|

|

Recent Articles

-

Albemarle Pursues Efficiency in the Wake of Lower Lithium Prices

Albemarle Pursues Efficiency in the Wake of Lower Lithium Prices

Nov 7, 2024

-

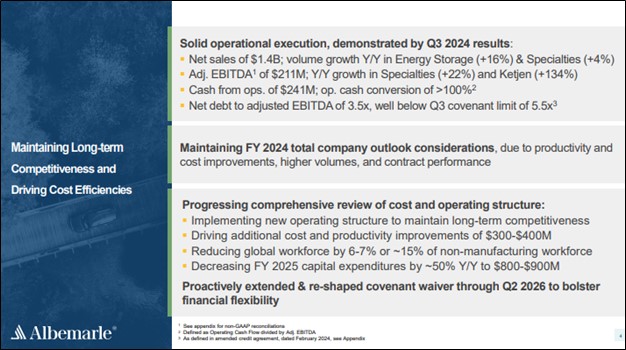

Image Source: Albemarle.

Albemarle is working hard in the face of weak lithium pricing, and the firm is driving cost and productivity improvements across its business. The firm noted that it is reducing its workforce by 6%-7%, which will help the company cut costs in the range of $300-$400 million, and it plans to decrease its fiscal 2025 capital spending by roughly half versus fiscal 2024 ($1.7-$1.8 billion), to an expected range of $800-$900 million. Total liquidity was $3.4 billion at the end of the quarter, including $1.7 billion in cash equivalents, while total debt was $3.6 billion. We continue to include Albemarle in the ESG Newsletter portfolio.

-

Realty Income’s AFFO Covers Dividends Paid in Third Quarter

Realty Income’s AFFO Covers Dividends Paid in Third Quarter

Nov 6, 2024

-

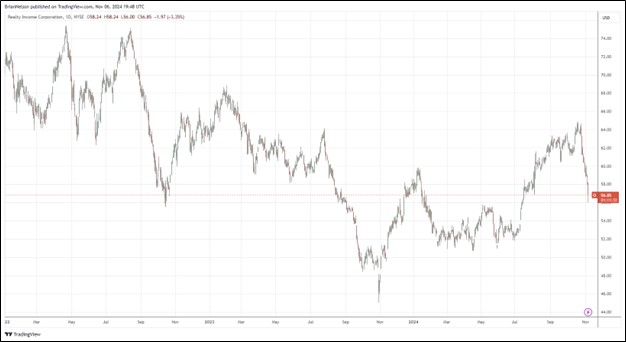

Image: Realty Income’s shares have seen better days.

Realty Income reported mixed third quarter results November 4 with revenue exceeding the consensus forecast but funds from operations coming up short. Revenue advanced 28.1% in the quarter on a year-over-year basis, with same store rental revenue up modestly (0.2%). However, net income per share and FFO per share fell to $0.30 and $0.98, respectively, from $0.33 and $1.04 in the same period a year ago. Adjusted funds from operations (AFFO) came in at $1.05 per share in the period, up from $1.02 in last year’s quarter, and comfortably higher than dividends paid per share of $0.789 over the same time. Our fair value estimate for Realty Income stands at $61 per share.

-

Cash-Rich Vertex Pharma Raises 2024 Product Revenue Guidance

Cash-Rich Vertex Pharma Raises 2024 Product Revenue Guidance

Nov 6, 2024

-

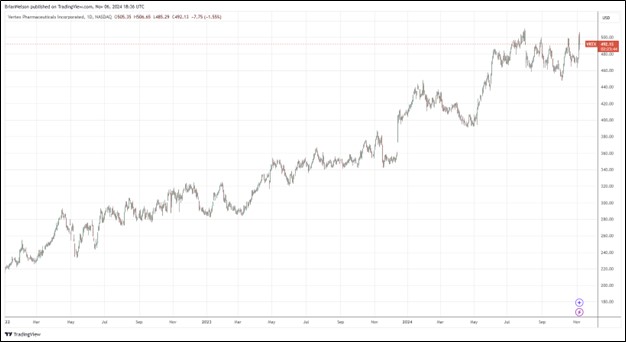

Image: Vertex Pharma’s shares have done quite well the past couple years.

We continue to like Vertex’s established position in cystic fibrosis and its opportunity in gene-editing therapies as well as a new class of medicine for acute pain (VX-548) that’s without the limitations of opioids. The company’s pipeline is also progressing nicely with three additional programs advancing to Phase 3 – suzetrigine in painful diabetic peripheral neuropathy (DPN), povetacicept in immunoglobulin A nephropathy (IgAN), and VX-880 in Type 1 diabetes (T1D). The high end of our fair value estimate range for Vertex stands at $640 per share.

-

Public Storage’s Core FFO Comfortably Covers Its Dividend

Public Storage’s Core FFO Comfortably Covers Its Dividend

Nov 4, 2024

-

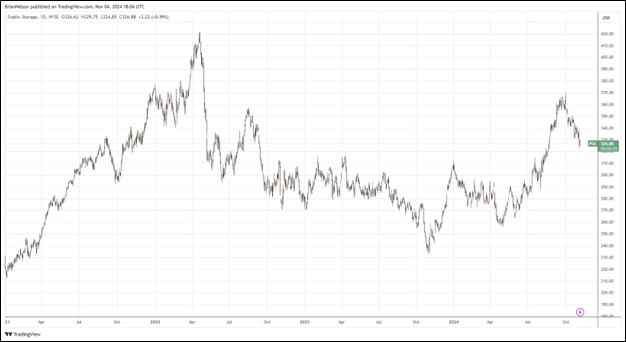

Image: Public Storage is bouncing off lows hit in late 2023.

Public Storage’s core FFO allocable to common shareholders in the quarter came in at $4.20, down 3% on a year-over-year basis, but in excess of its regular common quarterly dividend of $3.00. Looking to 2024, management is targeting revenue to fall 0.5%-1.3%, with expense growth in the range of 2%-3.5%, and net operating income to fall 1.3%-2.7%. Non-same store operating income is targeted in the range of $480-$495 million, while core FFO per share for 2024 is expected in the range of $16.50-$16.85, down 0.2%-2.3% from last year but comfortably above the $12.00 annual dividend per share run rate. Shares yield 3.7% at the time of this writing.

|