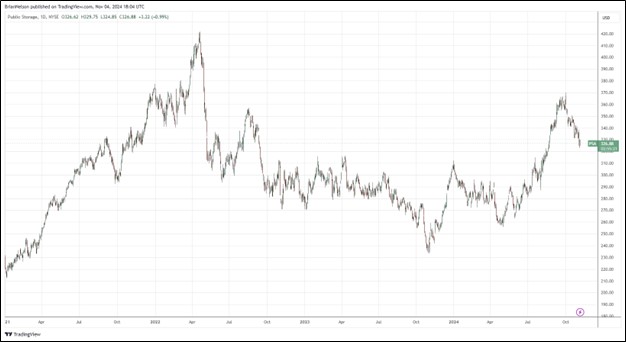

Image: Public Storage is bouncing off lows hit in late 2023.

By Brian Nelson, CFA

Public Storage (PSA) reported mixed third quarter results October 30 with revenue coming in-line with expectations and funds from operations missing the consensus forecast slightly. Revenue was up 3.8%, to $1.19 billion, while net income allocable to common shareholders came in at $2.16 per share, down from $3.20 per share in the same period in 2023 due to an increase in foreign currency losses, an increase in depreciation and amortization expense, and an increase in interest expense, offset in part by an increase of $11.7 million in self-storage net operating income.

Management had the following to say about the quarter:

Performance is stabilizing across our portfolio. With formidable competitive advantages and our distinctive operating model transformation ahead of schedule, we are very well-positioned for growth in an environment of improving fundamentals and increasing transaction market activity.

The increase in self-storage net operating income in the quarter was the result of a $29.8 million increase in its non-same store facilities, which was primarily driven by facilities acquired in 2023. Net operating income for its same-store facilities decreased $18 million during the quarter as a result of lower realized annual rent per occupied foot and a decline in occupancy. The cost of operations for its same store facilities also increased due to higher direct property costs, repairs and maintenance expense and marketing expense, partially offset by decreased on-site property manager payroll.

Public Storage’s core FFO allocable to common shareholders in the quarter came in at $4.20, down 3% on a year-over-year basis, but in excess of its regular common quarterly dividend of $3.00. Looking to 2024, management is targeting revenue to fall 0.5%-1.3%, with expense growth in the range of 2%-3.5%, and net operating income to fall 1.3%-2.7%. Non-same store operating income is targeted in the range of $480-$495 million, while core FFO per share for 2024 is expected in the range of $16.50-$16.85, down 0.2%-2.3% from last year but comfortably above the $12.00 annual dividend per share run rate. Shares yield 3.7% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.