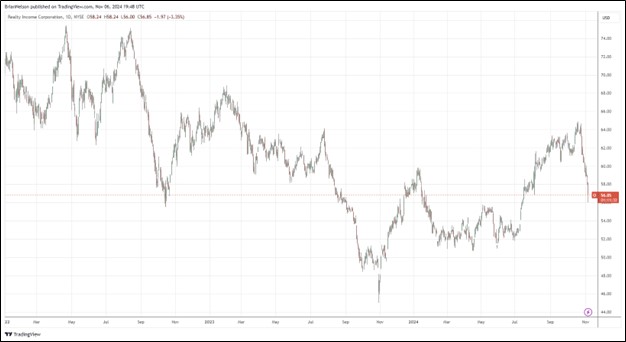

Image: Realty Income’s shares have seen better days.

By Brian Nelson, CFA

Realty Income (O) reported mixed third quarter results November 4 with revenue exceeding the consensus forecast but funds from operations coming up short. Revenue advanced 28.1% in the quarter on a year-over-year basis, with same store rental revenue up modestly (0.2%).

However, net income per share and FFO per share fell to $0.30 and $0.98, respectively, from $0.33 and $1.04 in the same period a year ago. Adjusted funds from operations (AFFO) came in at $1.05 per share in the period, up from $1.02 in last year’s quarter, and comfortably higher than dividends paid per share of $0.789 over the same time.

Management had the following to say in the press release:

Our third quarter results reflect disciplined execution of our strategy and the inherent benefits of our global platform. Supported by improvements in the investment environment and solid operating results, we see a robust pipeline of opportunities. As a result, we’re pleased to increase our 2024 investment volume guidance to approximately $3.5 billion and raise the low-end of our AFFO per share guidance to a range of $4.17 to $4.21 per share, reflecting a 4.8% growth at the mid-point of the range. Looking ahead, Realty Income is pursuing a wide range of growth opportunities, including capital diversification initiatives to further enhance the reach and scale of our proven platform.

During the quarter, Realty Income invested $740.1 million at an initial weighted average cash yield of 7.4% and ended the quarter with net debt to annualized pro forma adjusted EBITDAre of 5.4x. The REIT was active in the capital markets in the quarter, raising $271 million in common stock and issuing $500 million and £700 million in senior unsecured notes. The company also redeemed 6.9 million shares of its 6.000% Series A Cumulative Redeemable Preferred Stock in the quarter.

Realty Income achieved a rent recapture rate of 105% on properties re-leased in the quarter ($38.41 million versus $36.57 million). At the end of the quarter, portfolio occupancy was 98.7%, down modestly on a sequential and year-over-year basis. Though Realty Income has a large debt position, the firm has $5.2 billion of liquidity, consisting of cash equivalents of $397 million, unsettled ATM forward equity of $958.1 million, and $3.8 billion of availability under its unsecured revolving credit facility.

Looking to its guidance for 2024, Realty Income lowered the high end of its net income per share target to the range of $1.15-$1.20 from $1.21-$1.30. Normalized FFO per share was lowered to $4.16-$4.21 from $4.19-$4.28, but the low end of its AFFO per share guidance was raised to $4.17-$4.21 from $4.15-$4.21. Occupancy for the year is targeted north of 98%, and the company raised its investment volume guidance to ~$3.5 billion from ~$3 billion. Our fair value estimate for Realty Income stands at $61 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.