|

|

Recent Articles

-

Meta Platforms’ Earnings Surge in Fourth Quarter

Meta Platforms’ Earnings Surge in Fourth Quarter

Jan 30, 2025

-

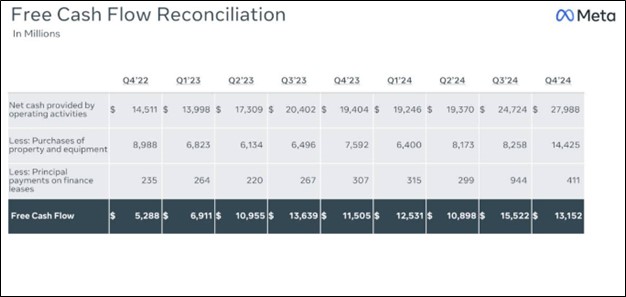

Image Source: Meta Platforms.

Meta Platforms’ earnings growth was phenomenal in the fourth quarter, and we like its ability to drive strong free cash flow, despite higher capital spending. Total dividend and dividend equivalent payments were $1.27 billion and $5.07 billion for the fourth quarter and full year 2024, respectively. Though Meta is not a big dividend payer, we like its dividend growth prospects and include shares in the Dividend Growth Newsletter portfolio.

-

Microsoft Issues Fiscal Second Quarter Results

Microsoft Issues Fiscal Second Quarter Results

Jan 30, 2025

-

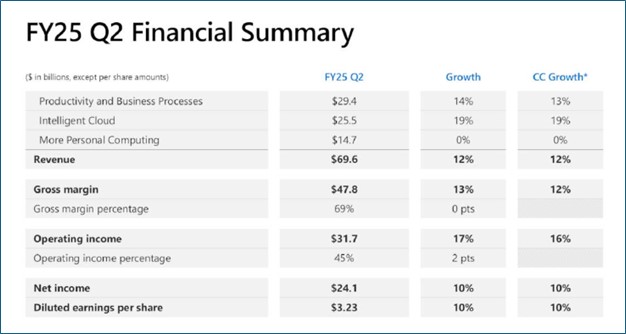

Image Source: Microsoft.

Looking to the fiscal third quarter, Microsoft expects Azure revenue growth to be between 31%-32% in constant currency. Revenue growth for the fiscal third quarter is expected in the range of $67.7-$68.7 billion, below the consensus forecast of $69.8 billion. For all of fiscal 2025, management expects total revenue to grow double digits, operating expenses to grow in the single-digits, and operating income to grow in the double digits. Operating margins are expected to be up slightly year-over-year. Though Azure revenue growth and fiscal third quarter guidance may have come in a little light of what the Street was looking for, we still like Microsoft as a core idea in the newsletter portfolios.

-

Lockheed Martin’s Earnings Impacted by Classified Program Losses

Lockheed Martin’s Earnings Impacted by Classified Program Losses

Jan 29, 2025

-

Image Source: Lockheed Martin.

Looking to 2025, Lockheed Martin expects revenue in the range of $73.75-$74.75 billion, in line with the consensus forecast of $74.1 billion, business segment operating profit of $8.1-$8.2 billion, while diluted earnings per share is targeted in the range of $27-$27.30, below the consensus forecast of $27.94. Cash flow from operations is expected in the range of $8.5-$8.7 billion in 2025, while free cash flow is expected in the range of $6.6-$6.8 billion, after roughly $1.9 billion in capital spending. Shares yield 2.9% at the time of this writing.

-

NextEra Energy Reaffirms Earnings Outlook for Next Couple Years

NextEra Energy Reaffirms Earnings Outlook for Next Couple Years

Jan 25, 2025

-

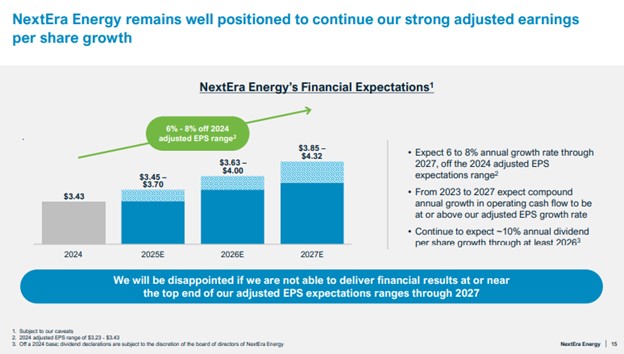

Image Source: NextEra Energy.

NextEra Energy reaffirmed its long-term financial expectations. For 2025, NextEra Energy continues to expect adjusted earnings per share to be in the range of $3.45-$3.70. For 2026 and 2027, NextEra Energy expects adjusted earnings per share to be in the ranges of $3.63-$4.00 and $3.85-$4.32, respectively. The company also continues to expect to grow its dividends per share at a roughly 10% annual clip through at least 2026, off a 2024 base. We continue to like NextEra Energy as a holding in the ESG Newsletter portfolio.

|