Image Source: NextEra Energy

By Brian Nelson, CFA

On January 24, NextEra Energy (NEE) reported mixed fourth quarter results with revenue missing the consensus forecast, but non-GAAP earnings per share coming in line. For the fourth quarter, net income attributable to NextEra Energy came in at $1.203 billion, or $0.58 per share, compared to $1.21 billion, or $0.59 per share, for the fourth quarter of 2023. On an adjusted basis, NextEra reported fourth-quarter earnings of $1.095 billion, or $0.53 per share, compared to $1.067 billion, or $0.52 per share, in the same period last year.

Management had a lot to say about the quarter:

NextEra Energy had an excellent year of execution in 2024, growing full-year adjusted earnings per share by more than 8% over 2023 and once again achieving the top end of our adjusted earnings per share expectations range. Continuing our track record of providing long-term value for shareholders, we have delivered compound annual growth in adjusted earnings per share of more than 10% since 2021 and of approximately 10% over the past 10 years, both of which are the highest among all top-10 power companies. NextEra Energy generates more electricity and invests more in energy infrastructure than any other company in the U.S. and in 2024 placed into service roughly 8.7 gigawatts of new renewables and storage projects, expanding our leadership in power generation. With experience in every part of the energy value chain and a track record of delivering for our customers and shareholders, we believe NextEra Energy is well positioned to capitalize on the opportunity set that lies ahead and the increased power demand that is happening now in the U.S. Given the strength of both of our businesses, we will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges in each year through 2027, while maintaining our strong balance sheet and credit ratings.

Its FPL division reported fourth quarter 2024 net income on a GAAP basis of $845 million, or $0.41 per share, compared to $1.146 billion, or $0.56 per share, for the same period of 2023. On an adjusted basis, FPL’s 2024 fourth quarter earnings were $845 million, or $0.41 per share, compared to $846 million, or $0.41 per share, in last year’s quarter. NextEra Energy Resources reported fourth-quarter 2024 net loss on a GAAP basis of $442 million, or $0.21 per share, compared with net income of $885 million, or $0.43 per share, in the prior-year quarter. On an adjusted basis, NextEra Energy Resources’ earnings for the fourth quarter of 2024 were $446 million, or $0.22 per share, compared to $361 million, or $0.18 per share, for the fourth quarter of last year.

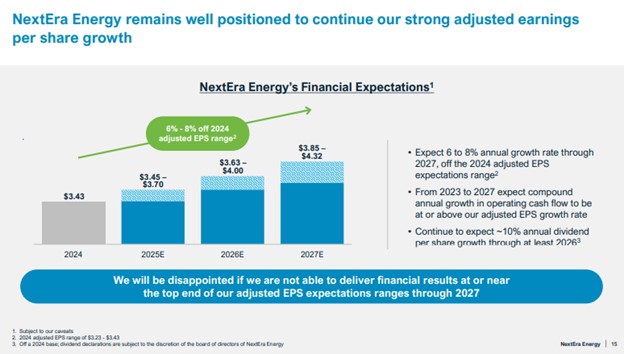

NextEra Energy reaffirmed its long-term financial expectations. For 2025, NextEra Energy continues to expect adjusted earnings per share to be in the range of $3.45-$3.70. For 2026 and 2027, NextEra Energy expects adjusted earnings per share to be in the ranges of $3.63-$4.00 and $3.85-$4.32, respectively. The company also continues to expect to grow its dividends per share at a roughly 10% annual clip through at least 2026, off a 2024 base. We continue to like NextEra Energy as a holding in the ESG Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.