Image Source: Meta Platforms

By Brian Nelson, CFA

On January 29, Meta Platforms (META) reported better than expected fourth quarter results with revenue and GAAP earnings per share outpacing the consensus forecasts. Revenue increased 21% in the quarter on a year-over-year basis, and the company was able to leverage the higher sales into a 43% increase in income from operations. Its fourth-quarter operating margin expanded 7 percentage points, to 48%. Net income increased 49%, to $20.8 billion, while diluted earnings per share advanced 50%, to $8.02.

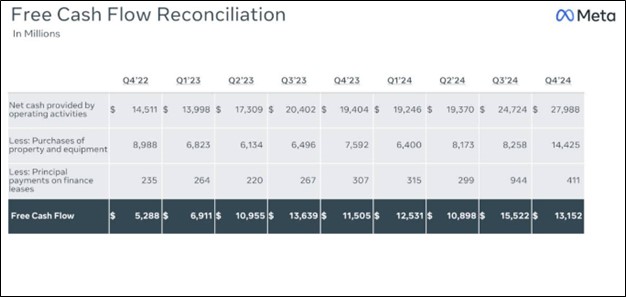

Its family daily active people (DAP) was 3.35 billion on average for December 2024, an increase of 5% on a year-over-year basis. Ad impressions across its Family of Apps increased 6% in the fourth quarter, while average price per ad increased 14%. At the end of the year, cash and marketable securities were $77.8 billion versus long-term debt of $28.8 billion. Free cash flow was $13.15 billion for the fourth quarter of 2024, up from $11.5 billion in last year’s quarter, while capital expenditures, including principal payments on finance leases, were $14.84 billion in the quarter, up from $7.6 billion in last year’s quarter.

Looking to the first quarter of 2025, Meta Platforms expects total revenue in the range of $39.5-$41.8 billion (versus consensus of $41.6 billion), reflecting 8%-15% year-over-year growth, or 11%-18% growth on a constant currency basis. Meta fell short of providing a full year 2025 revenue outlook but noted that the investments it’s making this year will drive strong revenue growth throughout 2025. Meta now anticipates its full year 2025 capital expenditures to be in the range of $60-$65 billion to support both its generative artificial intelligence efforts and core business, up from an expected $52 billion.

Meta Platforms’ earnings growth was phenomenal in the fourth quarter, and we like its ability to drive strong free cash flow, despite higher capital spending. Total dividend and dividend equivalent payments were $1.27 billion and $5.07 billion for the fourth quarter and full year 2024, respectively. Though Meta is not a big dividend payer, we like its dividend growth prospects and include shares in the Dividend Growth Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.