Member LoginDividend CushionValue Trap |

What Really Is the ”S” in ESG Investing

publication date: Dec 10, 2021

|

author/source: Valuentum Analysts

By Valuentum Analysts Back in October, we explored “Putting the Environmental in ESG” investing. In this article, let’s dig deep into the second consideration of ESG (Environmental, Social, and Governance) investing -- “Social.” While there has been greater attention paid to the social impact of companies in recent years--from the industries they operate in to the ways they impact their communities--this concept is definitely not a new trend. Investors have always cared about the impact of the companies they invest in. In the past, this idea has been encapsulated in the phrase Socially Responsible Investing (SRI), which is essentially the practice of seeking out companies that have a positive social impact on society. Some even put the earliest origins of SRI as far back as the first books of the Bible called the Pentateuch and the Jewish concept of Tzedek governing investing, meaning equity and justice. Within ESG investing, this concept has grown and evolved over the many centuries from its religious roots to become the S, or social aspect, of ESG investing, which is expected by Bloomberg Intelligence to reach as much as $53 trillion by 2025, or a whopping one third of global assets under management. What Is “Social” in the Modern Definition of ESG? “Social” in the context of today’s ESG investors covers a lot of ground. It not only includes the way a company treats its customers and employees, but it also considers how a company interacts with the community and how it responds to larger social issues, including diversity, equity, and inclusion. According to the CFA Institute, the term “Social” includes all the considerations of “people and relationships.” This is the way the company interacts with the world. Important issues to consider are “customer satisfaction, data protection and privacy, gender and diversity, employee engagement, community relations, human rights, labor standards,” and more. Additionally, this is the category where investors will want to consider the broader industry in which the company operates. Along with other considerations, this is generally where the concept of “sin stocks” is addressed. "Sin stocks" are companies that are engaged in unethical or immoral activities. Bringing ethical (rather than legal) judgements into the conversation makes this a much murkier area (and a challenge for regulators), but in general companies involved in alcohol, tobacco, weapons, gambling, and adult entertainment fall into this category. Companies such as Altria Group (MO) that sells cigarettes, or company such as Smith & Wesson Brands, Inc. (SWBI) that sells firearms, or Churchill Downs (CHDN) that is involved in gambling activities, or RCI Hospitality (RICK) that operates adult nightclubs or Playboy parent PLBY Group (PLBY) are a few examples. Since these organizations don’t meet the threshold for what is generally defined as a positive social impact--primarily by virtue of the industry they operate in--they aren’t considered a great fit under the criteria of ESG investing, even if they may be great investments by other more traditional financial measures such as net cash and future expected free cash flow (e.g. the cash-based sources of intrinsic value).

The bull market during the past many years and the very brief bear market during the COVID-19 meltdown, which happened in conjunction with the proliferation of ESG investing, socially-responsible ETF products and ESG rating systems, may have misconstrued ESG investing as a great strategy and a replacement for other strategies given the high returns. However, a company that may not register highly on an ESG rating system could potentially be a great investment consideration, too. This concept is illustrated more fully in the example below, as it relates to an income idea.

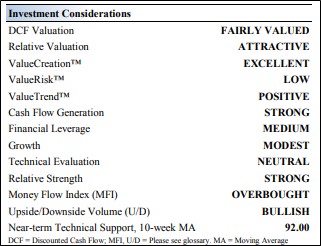

Image: Excerpt from Philip Morris’ 16-page stock report. The image above is from one of Valuentum’s 16-page stock reports showing the investment considerations of a company. The stock details shown above reveal that we think the stock is fairly valued, with strong cash flow generation and an attractive relative valuation versus peers. However, the company represented in the example is Philip Morris (PM), owner of several of the top-selling cigarette brands worldwide including the Marlboro, L&M, Chesterfield, and Parliament brands. The risk of PM’s products to the safety of consumers puts this investment consideration into the “sin stock” category, and also brings down Valuentum’s proprietary ESG rating on the firm, even if the stock may still be included as an idea in the simulated High Yield Dividend Newsletter portfolio for its lofty and arguably very resilient income potential. Just as in the case with companies that score poorly on the “Environmental” considerations, companies that score poorly on the “Social” considerations may also find themselves at increased legal and compliance risk. There is a very real risk of financial impact if there are new laws or lawsuits that lead to increased legal costs and/or a settlement. In this case, it is easy to imagine the types of situations that could occur since tobacco has had a long history. Laws limit the market of potential consumers and require warnings on packaging, consumers file lawsuits, and the list goes on and on. These established risks are well-known, but social trends are driven by changing habits and interests of consumers, and what is accepted today can fall out of favor tomorrow, making the risks more difficult to predict and account for. That’s why paying attention to the ESG rating of companies in the simulated ESG Newsletter portfolio is so important. Within that portfolio, you’re not only getting great ideas, but also great ideas with high ESG ratings. For example, one of the highest-rated ESG companies in Oracle (ORCL) that has a proprietary Valuentum ESG rating of 96 (100 is best) has performed fantastically of late, advancing almost 40% year-to-date. The stock was highlighted in the inaugural edition of the ESG Newsletter--select here (pdf) to download a sample edition. ESG investing is one of the fastest-growing areas in all of finance--make sure you have research exposure to this area to better serve your clients and impress your prospects. Subscribe to receive the ESG Newsletter. But why? Well, aside from the huge opportunity with respect to assets-under-management potential growth, many investors may not want to take an advisor’s word for his or her opinion about how a company stacks up with an ESG assessment (given the vast subjectivty of ESG ratings these days). The Securities & Exchange Commission (SEC) recently released an announcement regarding the creation of a Climate and ESG Task Force in the Division of Enforcement. Even if you don’t choose Valuentum, make sure that you have the independent perspective on ESG ratings of companies in your tool kit. Valuentum’s ESG Newsletter helps to aid advisors with their due diligence with respect to our independently-derived ESG rating system, while combining some of the best forward-looking thinking in equity valuation and fundamental analysis--the best of both worlds! How Valuentum Looks at “Social”

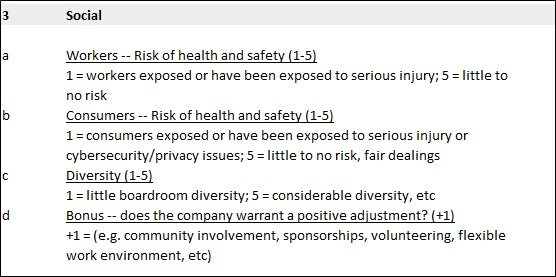

Image: The Valuentum Environmental, Social and Governance (ESG) Scoring System shows how “Social” considerations are analyzed. Valuentum looks at four primary categories when evaluating the “Social” rating of a company within the context of ESG investing. The first two considerations within this analytical subsegment of “Social” (a and b in the above image) are related to the health and safety of people. This could be related to the potential for physical harm or safety risks, but it could also be related to privacy or cybersecurity since that is another way people can be harmed. Valuentum looks at rating stocks in this area from the perspective of their employees, as well as the perspective of their consumers, because both groups face different risks from a company’s operations or products. Data breaches these days have unfortunately become commonplace. The September 2017 Equifax (EFX) data breach that exposed the personal information of ~150 million people is the one particular breach that really put into the public’s eye the importance of protecting customer information because it not only exposed names, dates of birth, and addresses, but also Social Security numbers. Yahoo, now owned by Apollo Global Management (APO), experienced a high-profile breach early last decade that exposed the information of billions of user accounts. Hackers also proved successful in stealing information from nearly 80 million accounts at Anthem (ANTM) in 2015, while high-profile breaches at Target (TGT) in 2013, eBay (EBAY) in 2014, and JPMorgan Chase (JPM) in 2014 showed that even the strongest retailers and fortress banks aren’t immune to the hacking community. The Importance of Diversity The third consideration in the “Social” category of ESG investing is diversity. Though it may be difficult to get a read on diversity across a company’s workforce, one area where it is simpler to take the temperature is in the boardroom. If the board of directors is comprised of people from diverse backgrounds and identities, that points to the company’s ability to consider a variety of views and experiences. It also impacts the values implicit in the way the organization is run. Diversity includes a wide range of characteristics, including age, gender, race and ethnicity, but it also includes things like sexual orientation, gender identity, and abilities. For example, companies such as Facebook (FB), an idea in the ESG Newsletter portfolio, and Autodesk (ADSK), as another example, have 44% and 50% of their board members as women, respectively, better than the S&P 500 average of ~30%. Other companies such as Stitch Fix (SFIX) and Hewlett-Packard (HPQ) also have an above-average percentage representation of women on their boards. A recent Harvard Business Review article points out that the true purpose of diversity is to add different perspectives to the conversation, not just vary the demographics. Board rooms that consider the importance of both cognitive diversity and demographic diversity have served investors well. In the following article, “The Investment Case for More Gender Diversity,” we showed not only why more gender diversity is just the right thing to do, but also how it can generate better returns, particularly against very tired quantitative analysis that doesn’t necessarily pay attention to the social good. A 2004 report from Catalyst also shows that increased gender diversity among top management (i.e., more women) correlated to better financial performance (measured by both total return to shareholders as well as return on equity) over companies with less diversity. This increased diversity is a big boon to investors, but it is important to remember that demographic diversity isn’t enough. Starbucks (SBUX), whose stock price has advanced more than 5-fold during the past 10 years, is a great example of the benefits of putting more diversity in the boardroom, as shown in the image below. The company has excellent board independence, a fantastic distribution of director tenure, good age distribution, as well as significant diversity with 42% of board directors as female, 25% bringing national diversity to the table and 50% bringing ethnic diversity (3 Asian, 2 Black, 1 Hispanic, and 6 White). Image: Starbucks Schedule 14A, January 22, 2021 The final subsegment of the “Social” component in the Valuentum ESG rating system is a catch-all, bonus adjustment. The first three subsegments in "Social" cover a lot of ground and can help investors understand how a company values some of these social aspects of their operations, but there are also many other ways a company can demonstrate a commitment to social issues. If a company is doing positive things in their community or in how it interacts with outside stakeholders, then this is a place where extra points can be earned on our proprietary ESG rating system. Concluding Thoughts Social considerations tend to ebb and flow and reflect the values of society. Renewed interest in diversity, inclusion, and equity, for example, have made these areas a greater focus for companies and investors. As we have evolved as a society over decades and generations, the types of social considerations that may have primacy will change over time, so it’s important to make sure social considerations are just one part of your research. In addition to looking at how a company scores on the Valuentum ESG rating system and how it aligns with your own values, be sure to also look at whether such an idea is in the simulated newsletter portfolios, how it rates on the Valuentum Buying Index (VBI), its Dividend Cushion ratio for dividend-paying stocks, and much more. It’s extremely important to reward those companies doing the social good, but equity prices and returns will always be driven in part by a company’s cash-based sources of intrinsic value: net cash on the balance sheet and future expected free cash flow. ---------- Tickerized for PM, CG, VDC, VEGPF, MO, JAPAY, BTI, SWM, TPB, VGR, IMBBY, OGI, RLX, BCS, RGR, SWBI, OLN, VSTO, POWW, NPK, AOUT, BGFV, SWBI, BJK, BYD, CHDN, HLT, LVS, MAR, MGM, PENN, PNK, SHFL, WMS, WYNN, RICK, PLBY, ORCL, EFX, APO, TGT, EBAY, JPM, FB, ADSK, SFIX, HPQ, SBUX, LRGE, WOMN, NACP Also tickerized for holdings in the IHAK. ---------- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment