Image Shown: Visa Inc remains a tremendous free cash flow generator, aided by its asset-light business model. We continue to be big fans of Visa and include the company as a top-weighted idea in our Best Ideas Newsletter portfolio. Image Source: Visa Inc – Second Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

On April 27, Visa Inc (V) reported second quarter fiscal 2021 earnings (period ended March 31, 2021) that beat both consensus top- and bottom-line estimates. Visa’s GAAP revenues and GAAP operating income were down 2% and 9% year-over-year, respectively, last fiscal quarter as its cross-border business remains subdued. On the flip side, Visa’s total payment volumes and processed transaction were up 8% and 11% year-over-year, respectively, in constant currency terms. Coronavirus (‘COVID-19’) vaccine distribution efforts should help global health authorities eventually bring the pandemic to an end, though the return of international travel and related activities to pre-pandemic levels is likely a way off. During its latest earnings report, Visa’s business showcased serious signs that a recovery was already well underway, and we continue to be huge fans of the name. We include Visa as a top-weighted idea in the simulated Best Ideas Newsletter portfolio.

On the Rebound

Visa’s long-term growth outlook remains bright due to its booming e-commerce business and the secular trend away from cash seen worldwide. Additionally, the company is already seeing signs that consumer spending habits are returning to their pre-pandemic levels while its e-commerce business, part of its ‘Card Not Present’ performance metric, remains strong. This speaks very favorably towards Visa’s near-term outlook. To adapt to the changing landscape, Visa has made a major effort to improve its contactless payment offerings when consumers are at physical stores (as compared to online shopping). Tap to pay offerings are one such way Visa is enabling consumers and businesses to socially distance while still being able to do normal everyday tasks.

In the upcoming graphic down below, Visa highlights the trajectory of its payment volumes in the US since the start of 2020. Please note the surge in domestic ‘Card Present’ payment volumes (instances where Visa-branded cards are used at physical locations) seen during the February-April 2021 period in the graph on the righthand side of the picture down below. Part of this is due to the latest major fiscal stimulus bill in the US which included another round of direct cash payments to qualified households, though there is more to the story here. By April 2021, the US had administered over 200 million doses of COVID-19 vaccines and it seems that consumers are starting to resume some pre-pandemic activities in earnest. Furthermore, Visa’s domestic ‘Card Not Present’ payment volumes continue to come in strong, indicating its e-commerce growth story remains intact as the US economy slowly opens up.

Image Shown: Visa’s domestic payment volumes started to really perk up around the February-April 2021 period, which speaks favorably towards its outlook. Image Source: Visa – Second Quarter of Fiscal 2021 IR Earnings Presentation

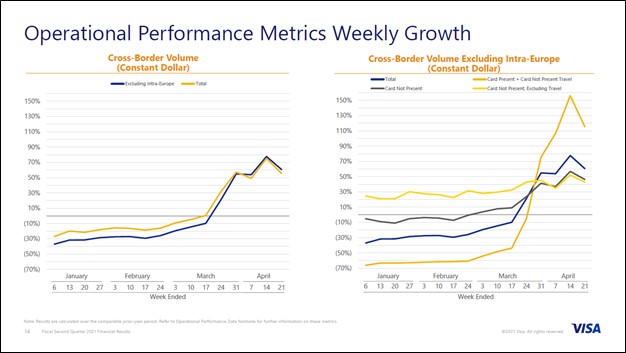

Visa also noted during its latest earnings update that its lucrative cross-border business was starting to recover, as one can see in the upcoming graphic down below. This recovery, like the ongoing bounce in its US payment processing volumes, should be reflected in Visa’s future financial performance as the recovery did not really pick up steam until the middle of its fiscal second quarter or later, meaning its latest earnings report only captured part of this uptick.

Image Shown: Visa’s lucrative cross-border transactions business is also starting to recover. Image Source: Visa – Second Quarter of Fiscal 2021 IR Earnings Presentation

The company did not provide an outlook for fiscal 2021 due to ongoing headwinds from the COVID-19 pandemic making it difficult to predict its future financial and operational performance. However, management did have this to say during Visa’s latest earnings call (emphasis added)

“As we look ahead, with COVID recovery underway, a few key important realities. Mainly, the way consumers feel about e-commerce, cash, and travel will particularly impact Visa. The pandemic has accelerated e-commerce.

Global card-not-present credentials excluding travel grew over 20% in the quarter versus last year. Our growth in card-not-present payments volume excluding travel has averaged at least 30% in the United States, Canada, Brazil, United Kingdom, Italy, Germany, India and Singapore over the last three quarters, and in global cross-border excluding intra-Europe, it’s averaged 20% growth.

We believe this shift is likely to persist as the convenience of e-commerce is indisputable and its growth continues to be robust even as card-present begins to return. In March, in the United States, as some states loosened transactions, card-present as a percentage of 2019 spend improved 11 points versus February. While at the same time, card-not-present excluding travel still expanded 8 points.

If you look at that in Japan, where restrictions were also lifted, card-present improved 6 points, and card-not present excluding travel still improved 4 points in that same comparison between March and February. The pandemic has accelerated the digitization of cash, and we see the impact in debit and tap-to-pay.” — Alfred Kelly, Chairman and CEO of Visa

Financial Update and Other Commentary

During the first half of fiscal 2021, Visa generated $6.5 billion in free cash flow, up from $4.9 billion in the same period last fiscal year. Visa spent $1.4 billion covering its dividend obligations and another $3.5 billion buying back its Class A common stock in the first half of fiscal 2021, activities that were fully covered by its free cash flows. The company has relatively modest capital expenditure requirements to maintain a certain level of revenues due to its asset-light business model, which bolsters Visa’s free cash flow generating abilities.

Visa had a net debt load of ~$2.3 billion at the end of March 2021 (excluding restricted cash and including its short- and long-term investment securities holdings) with no short-term debt on the books. Given Visa’s impressive cash flow generating abilities, that net debt load is quite manageable, in our view.

We covered the initial announcement back in January 2020 that Visa intended to acquire fintech firm Plaid (link here), a deal that has since been terminated due to antitrust concerns and other considerations which we covered here. Visa is facing an inquiry from the US Department of Justice (‘DoJ’) as the DoJ is probing Visa’s debit card business, though this news does not change our optimistic view towards Visa and its bright outlook. Even if Visa is forced to modify the business practices around its debit card operations down the road, any potential changes would likely only have a modest impact on its intrinsic value.

Please note that Visa does not take on credit risk as it operates a payments network, one that greatly benefits from the “network effect” as a growing cardholder base encourages a greater number of merchants to accept Visa-branded cards which in turn encourages growth at its cardholder base and so forth. Visa-branded cards are issued by banks and other financial entities, the entities that are actually taking on the credit risk (particularly as it concerns credit cards), and this is one of the reasons why we are such big fans of Visa. In many ways, Visa is a “pure play” on the secular shift away from cash and towards card/online/other payment transaction methods.

On a final note, Visa recently partnered with Airbnb Inc (ABNB) to allow “hosts” on Airbnb to get paid faster via Visa Direct, Visa’s real-time payments platform. In our view, Visa remains as innovative as ever and its growth outlook is impressive.

Concluding Thoughts

Visa is included as a top-weighted idea in the Best Ideas Newsletter portfolio, and we continue to be huge fans of its capital appreciation potential. The top end of our fair value estimate range sits at $272 per share of V, and the strong technical performance seen at shares of Visa of late indicates investors are increasingly warming up to its improving near-term outlook, rock-solid long-term growth outlook, and stellar free cash flow generating abilities. Additionally, shares of V yield ~0.6% as of this writing, offering incremental income generation upside. Visa operates a great business that is on the rebound, and we are excited for its future.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for V, ABNB, AXP, SQ, MA, DFS

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.