Image: Visa is a free cash flow generating powerhouse and is insulated from rising delinquency and charge offs, unlike others in the credit card space. Image Source: Visa

By Brian Nelson, CFA

On January 26, Best Ideas Newsletter portfolio holding Visa (V) reported excellent first-quarter fiscal 2023 results. Net revenues advanced 12% in the quarter, and Visa leveraged that top-line expansion into 17% growth in non-GAAP net income. The company’s operating margin for the period came in at an impressive 64.1%, a decline from last year’s quarter but still a sight to see. Non-GAAP earnings per share leapt 21%, to $2.18, which came in better than the consensus estimate. Shares of Visa have jumped more than 11% so far in 2023, and while the company’s share price has eclipsed our fair value estimate, we could see shares run to the high end of our fair value estimate range of $259 per share.

Visa doesn’t take on credit risk like other credit-card companies, so while delinquencies and charge offs are expected to rise materially at Discover Financial (DFS) and Capital One Financial (COF), Visa is insulated from credit risk in this regard, as it gets paid every time someone swipes a Visa card, not on the interest charged on the card itself. During the first quarter of fiscal 2023, payments volume increased 7%, total cross-border volume increased 22%, and processed transactions increased 10%. Visa is in a sweet spot as the company benefits from the trend toward a cashless society and e-commerce proliferation.

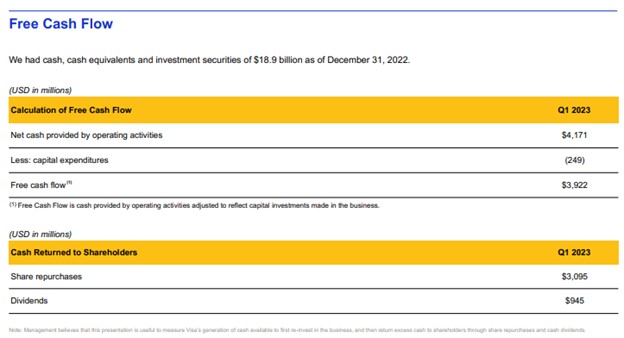

Visa is a capital-light entity, meaning that its capital expenditures are quite small relative to its revenue and cash flow from operations. We love these types of companies as they are able to generate a significant amount of free cash flow, which for Visa, came in at $3.92 billion during the quarter, about 49% of total revenue. Visa’s business model is so cash-rich that for every $1 generated in revenue, roughly half of that turns into free cash flow. Very few companies have the operating margin and free cash flow profile as that of Visa, and we remain huge fans of this Best Ideas Newsletter portfolio holding. Shares yield 0.8%.

Visa’s 16-page Stock Report (pdf) >>

Visa’s Dividend Report (pdf) >>

Tickerized for V, DFS, COF, AXP, JPM, MA, SYF, BFH, C, BAC

NOW READ: What So-Called Statistical “Value Premium?”

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.