Image Shown: Visa Inc remained a free cash flow cow last fiscal quarter in the face of the pandemic. Image Source: Visa Inc – Third Quarter of Fiscal 2020 IR Earnings Presentation

By Callum Turcan

On July 29, Visa Inc (V) reported third quarter fiscal 2020 earnings (period ended June 30, 2020) that missed consensus top-line estimates and beat consensus bottom-line estimates. The ongoing coronavirus (‘COVID-19’) pandemic weighed on travel-related purchases across Visa’s cardholder base, a dynamic that held down cross-border transactions which tend to be more lucrative for the payment processor. Keeping pandemic-related headwinds in mind, the company noted its performance was improving in several key markets around the world. We continue to like Visa as a top-weighted holding in the Best Ideas Newsletter portfolio given its high quality cash flow profile, strong balance sheet, and very promising post-pandemic growth outlook. The top end of our fair value estimate range for Visa sits at $214 per share.

Earnings Overview

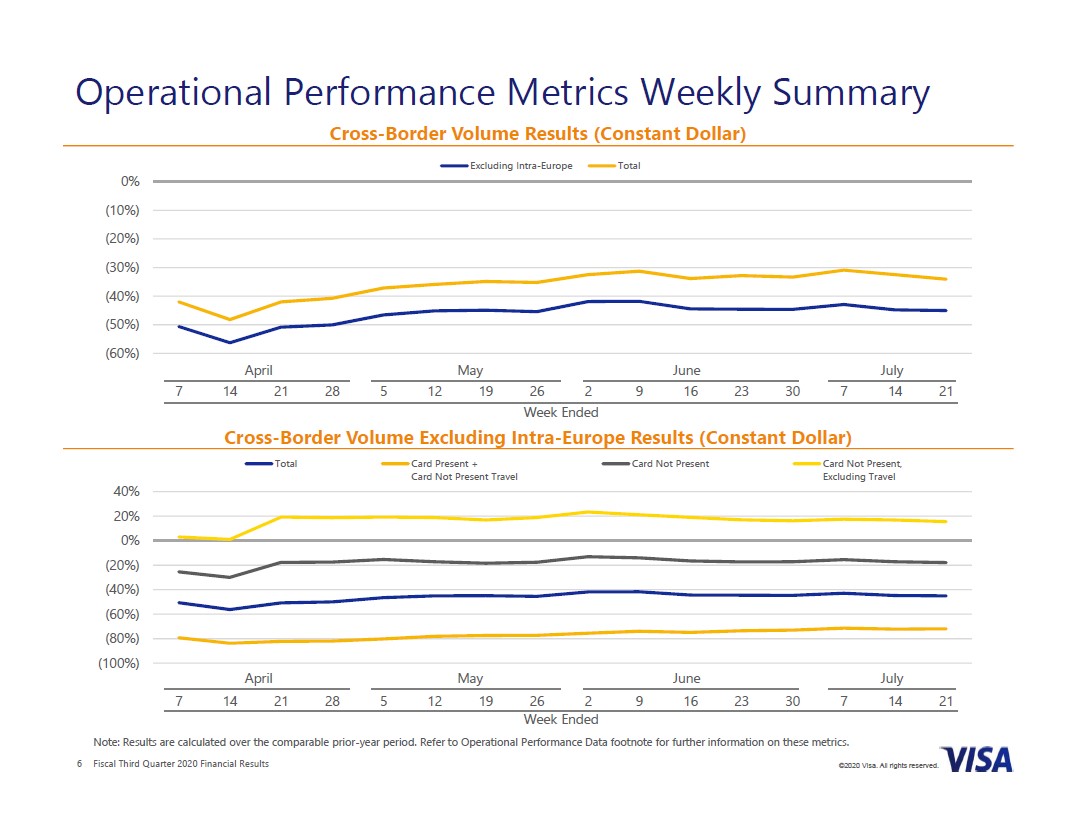

In the fiscal third quarter, Visa saw its GAAP net revenues fall by 17% year-over-year due the decline in payments volume (down 10%), processed transactions (down 13%), and cross-border transactions (down 37%). Visa reported that its cross-border transactions were down 47% excluding intra-European transactions last fiscal quarter. This highlights the uneven way the pandemic has impacted economies worldwide. Visa’s fiscal third-quarter report was rough, but this was expected given pandemic-related headwinds.

Management mentioned that Visa’s payment volumes in Poland, the Czech Republic, and Hungary “recovered rapidly to post positive growth in the quarter” which supported its relative strength in Europe. Visa also noted that the firm’s UK business staged a recovery late last fiscal quarter as its payment volumes in the country “returned to growth in June, driven by consistently strong card not present growth” as e-commerce demand continues to grow. Furthermore, Visa mentioned its business held up well in Russia and Central Asia last fiscal quarter due to client wins and a rapid recovery in payment processing volumes across Visa’s cardholder base in both regions after getting pummeled in April 2020.

Image Shown: Visa’s cross-border volumes continue to face significant headwinds due to the pandemic, as many of its cardholders are not travelling or vacationing and are instead “cocooning” at home. Image Source: Visa – Third Quarter of Fiscal 2020 IR Earnings Presentation

The modest decline in Visa’s operating expenses last fiscal quarter offset some of the losses from its smaller revenue streams. Visa reported that its GAAP operating income fell by 23% year-over-year in the fiscal third quarter, hitting $3.0 billion, while its GAAP net income also fell by 23% year-over-year, hitting $2.4 billion. Considering Visa generated $4.8 billion in GAAP revenues during this period, the company was still quite profitable. We appreciate the resilience of Visa’s business model, which has held up well in the face of the pandemic all things considered. As it relates to downside risks, please note that Visa mentioned its business in India (PIN) continues to face material headwinds.

Management is targeting long-term spending reductions at Visa’s marketing and G&A segments. The company continues to invest in its long-term opportunities but seeks to improve its cost structure along the margins which we appreciate. Considering the Summer Olympics, originally planned for 2020 in Tokyo, Japan, have been delayed until the Summer of 2021 at the latest, some of Visa’s marketing spend was pushed back into the next fiscal/calendar year.

Fiscal Strength

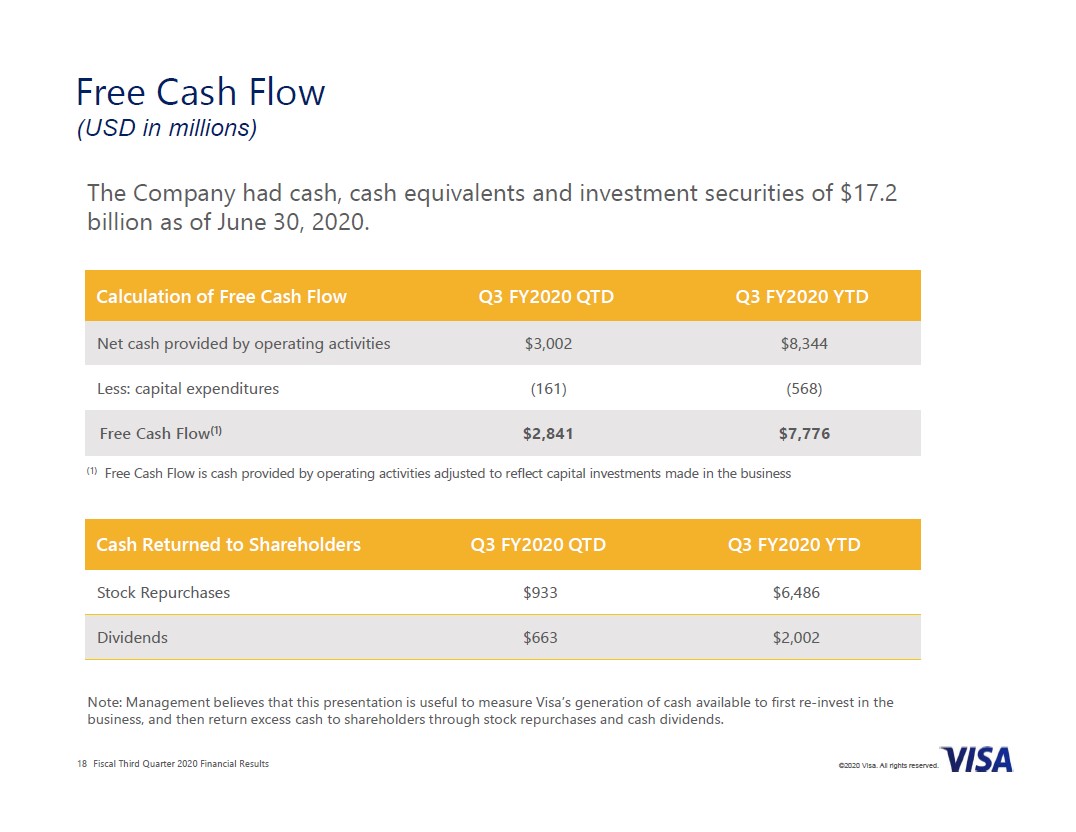

At the end of June 2020, Visa had $13.9 billion in cash and cash equivalents on hand versus $3.0 billion in short-term debt and $17.9 billion in long-term debt. The firm also had $3.3 billion in total short-term and long-term investment securities on the books at the end of this period (which includes marketable equity securities, US government-sponsored debt securities, and US Treasury securities). Visa’s modest net debt load is quite manageable, in our view, given its large cash-like position and the company’s ability to generate meaningful free cash flows.

During the first nine months of fiscal 2020, Visa generated $7.8 billion in free cash flow as the company spent less than $0.6 billion on capital expenditures during this period. Low capital expenditure requirements represent a key reason why we like the payment processing and financial tech industry (only modest capital expenditures are required to maintain large revenue streams). Visa paid out $2.0 billion in dividends during this period and spent $6.6 billion repurchasing its Class A common stock. Some of its share repurchases were funded by the balance sheet.

Ongoing US Recovery

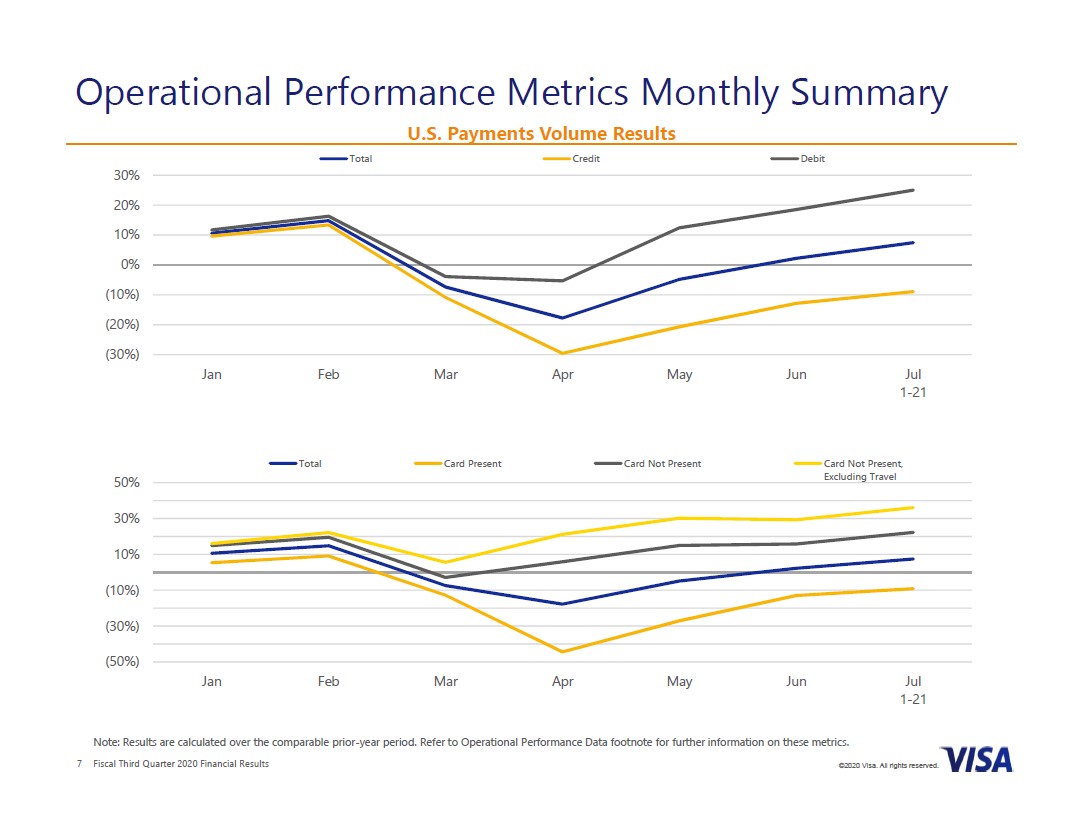

In the US, Visa reported a strong recovery in its payment volumes since bottoming in April 2020, as depicted in the upcoming graphic down below. Strong “card not present” growth helped enable this V-shaped recovery as e-commerce demand surged in the face of the pandemic in the US (and elsewhere). Management also cited the positive impact the CARES Act had on its domestic business which was passed in late-March 2020 (we will cover that in just a moment).

Image Shown: Visa is seeing a steady improvement in payment volumes at its US cardholder base. Image Source: Visa – Third Quarter of Fiscal 2020 IR Earnings Presentation

During Visa’s latest earnings call, management had this to say reading the firm’s US operations (lightly edited and emphasis added):

“For the quarter U.S. payments volume declined 7%, a sharp decline from mid-April was followed by a V-shaped domestic spending recovery. Volumes declined 18% in April, before returning to positive territory in June. July volumes through the 21st are up 7%. This recovery was jump-started by the economic impact payments and enhanced unemployment benefits, helped along by pent-up demand fulfillment and accelerated by the relaxation of shelter in place requirements.

Debit outperformed credit by almost 30 points. Debit spending was up 8% while credit spending declined 21% in the quarter… The outperformance of debit versus credit is driven by several factors… First, the government’s economic impact payments were directly deposited into consumers checking accounts benefiting debit. Second, in times of economic uncertainty, consumers have a propensity to shift spending from money they borrow to money they have in the bank.

Third… there has been a significant shift to online purchases… which favors debit. Fourth, affluent customers tend to use credit for discretionary spending in categories such as travel, entertainment and restaurants, which have been especially hard-hit by the pandemic.

Fifth, the last tranche of economic impact payments as well as unemployment benefits in over 20 states were distributed via Visa prepaid cards, which lifted debit growth by several points in May and June. Finally, in the U.S. Visa Direct was up over 75% this quarter, due to strong growth in a variety of use cases ranging from P2P [peer-to-peer], to insurance payouts, to payroll. The significant growth in debit demonstrates the acceleration of the secular shift away from cash to digital forms of payment as a result of the pandemic.”

Please note that some of the positive factors that helped improve Visa’s operational and financial performance in the US during the fiscal third quarter will be short-lived. For instance, the direct cash payments to US households and individuals. Though there are reports that another emergency fiscal spending package may get passed into law in the US, another round of direct cash payments (this has been seriously floated as being a key part of the potential final bill) would still not represent a recurring source of business for Visa. Enhanced federal unemployment benefits are not expected to continue in their current form for long (there may be a short-term extension to keep the program going past July 2020, but that would likely be limited in nature), which would hurt the spending power of US consumers if unemployment rates remain elevated. That in turn would weigh on the outlook for Visa’s domestic operations.

Keeping all of this in mind, we appreciate the steady improvement in Visa’s domestic payment processing volumes over the past few months. Another emergency spending package in the US would support Visa’s short-term outlook, though what matters most is the economy returning to some type of normal. However, that will require the COVID-19 pandemic to first be effectively contained before reopening activities can resume in earnest in many US states. We remain optimistic that a COVID-19 vaccine could get discovered in the coming quarters. Should travel and vacation activities resume, that would support the outlook for Visa’s credit card processing volumes which (generally speaking) are more lucrative than its debit card business. Here is another key excerpt from management during Visa’s latest earnings call (emphasis added):

“Finally, some perspectives on the [fiscal] fourth quarter. Forecasting revenues remains a challenge in this environment. It is difficult to predict when borders will reopen and what the trajectory of the cross-border travel recovery will be post re-openings. Domestic volumes have bounced back nicely in most countries and inevitably the rate of recovery will slow. Other uncertainties include the impact of the recent spike in infections and the economic impact of stimulus payments tapering off or ending altogether around the world.”

Concluding Thoughts

We continue to like Visa as a top-weighted holding in the Best Ideas Newsletter portfolio. Its financial performance held up well last fiscal quarter, and it seems the company is on the road to recovery as the trajectory of its payment processing volumes are steadily improving. On top of capital appreciation upside potential, shares of Visa also yield a modest ~0.6% as of this writing. Should a COVID-19 vaccine get discovered, Visa’s outlook would improve materially overnight as the outlook for cross-border transactions across its cardholder base would dramatically change.

On a final note, Visa’s ~$5.3 billion acquisition of Plaid is still pending regulatory approval according to Visa’s management team. Members interested in reading about that purchase are encouraged to check out this article here.

—–

Financial Tech Services Industry – MA MELI PYPL VRSK V

Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC

Related: DAL, IYG, IPAY, IYF, XLF, PIN, FLIN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.