Image Source: Oracle Corporation – Oracle Database Update September 2019 Presentation

By Callum Turcan

On June 16, Oracle Corp (ORCL) reported fourth quarter fiscal 2020 earnings (period ended May 31, 2020) that beat consensus bottom-line estimates and missed consensus top-line estimates, though there is some noise given the turbulence created by the ongoing coronavirus (‘COVID-19’) pandemic. Additionally, Oracle declared a $0.24 per share quarterly dividend that is slated to get paid out in July, which was flat on a sequential basis. Shares of ORCL yield ~1.8% as of this writing, and we continue to like the idea as a holding in the Dividend Growth Newsletter portfolio. While shares of ORCL sold off on June 17, management painted a more optimistic outlook for the firm’s fiscal 2021 performance than initial trading action suggests.

Operational Update

During the fiscal fourth quarter, Oracle’s GAAP revenues dropped by 6% year-over-year, though that decline was a more modest 4% in constant-currency terms. This decline was felt across the board as enterprises delayed major IT projects in the face of the pandemic. Oracle’s ‘cloud license and on-premise license,’ ‘hardware,’ and ‘services’ segments all posted material year-over-year sales declines. However, we appreciate that Oracle’s ‘cloud services and license support’ segment posted 3% year-over-year sales growth on a constant-currency basis as that indicates its cloud computing offerings continued to win over new customers. For more information on the specifics of the operational activities of Oracle’s various business segments and its cloud computing ambitions, please check out our pre-earnings article covering Oracle here.

Here is what Oracle’s founder and current chief technology officer, Larry Ellison, had to say regarding some of the successes Oracle has had in the cloud computing realm recently during the firm’s latest quarterly conference call:

“Look, this quarter, we announced new customer relationships with Zoom [Video Communications] (ZM) and 8×8 (EGHT). They were great wins but there were many others. And before I start listing the additional wins, I want to explain why we’re winning. Oracle Cloud Infrastructure is the world’s only second-generation autonomous cloud. Autonomous software technology, the Oracle Autonomous Database, Oracle Autonomous Linux, autonomy is the defining technology that separates our Gen2 cloud from Amazon’s (AMZN), Microsoft’s (MSFT) and [Alphabet’s] Google’s (GOOG) (GOOGL) generation-one cloud.”

Mr. Ellison is known for being very competitive and that is the kind of mentality needed to win in the highly competitive world of IT. Oracle’s founder noted that demand for Zoom Video Communications’ telecommunications services had surged 20x since January which meant “Zoom needed additional cloud capacity immediately” and Oracle’s highly scalable offerings were there to meet the challenge. It did not take long for Oracle to begin supporting “hundreds of thousands of simultaneous meeting participants” which quickly grew to “millions of simultaneous meeting participants.” Oracle’s ability to win over Zoom Video Communications as a major client is not only is a big win on a financial standing but serves as a powerful advertisement to both potential and existing customers that Oracle Cloud Infrastructure is up to any challenge. Here’s additionally commentary from Mr. Ellison that ties into the excerpt up above (emphasis added):

“Another win, in addition to Zoom, 8×8, a great example of our sales process, the customer began by moving some services to OCI [Oracle Cloud Infrastructure] for performance enhancements. 8×8 was very surprised by the extent of their performance gains by moving out of AWS [Amazon Web Services], moving part of their system out of AWS and into OCI. They were so surprised by the performance gains they achieved and the cost savings they achieved, that they decided to move all of their services out of AWS and into Oracle.”

8×8 is a provider of telecommunication services for entities of all sizes, and according to its website, its customer base includes corporate giants like McDonald’s (MCD), the Japanese manufacturer Shimano (SMNNY), and other large enterprises. Oracle’s recent victories in the telecommunications space are promising signs, in our view.

Furthermore, Oracle provided an update on how its relatively new “Autonomous Database” offering performed. We covered the offering in our pre-earnings article, noting Oracle had experienced strong demand for the service though these are still early days. During the firm’s fiscal fourth quarter conference call, Oracle’s management team noted “the ACR [appears to be annualized consumption revenue] for Autonomous Database grew nearly 70% in Q4” after growing by triple-digits in the fiscal third quarter. Part of the selling point of Oracle’s Autonomous Database offering is that it helps eliminate human labor and ultimately helps eliminate human error for both mundane and crucial tasks (such as autonomous driving services) which cuts down on costs and bolsters uptime. Additionally, Oracle sees its Autonomous Database offering having high quality cybersecurity capabilities built into the system, which are crucial during these times as we are witnessing rising cyberattacks from malevolent parties. Here’s another excerpt from Mr. Ellison from Oracle’s latest quarterly conference call (emphasis added):

“The Oracle Autonomous Database provisions itself, configures itself, encrypts the data itself, patches itself and updates itself, automatically scales itself up and down and continuously tunes itself as the database grows and user access patterns change, and it does all of those things while the system is running. There’s no downtime required to patch. There’s no downtime required to installing new version. There’s no downtime required to double the number of processors that you’re currently using or reduce the number of processors to have.

It all happens while the system is running. Oracle Autonomous Linux is the world’s only autonomous operating system, which provides 99.95% [ph] availability while maintaining itself with continuous security and monitoring, continuous patching and remediation while the system is running.”

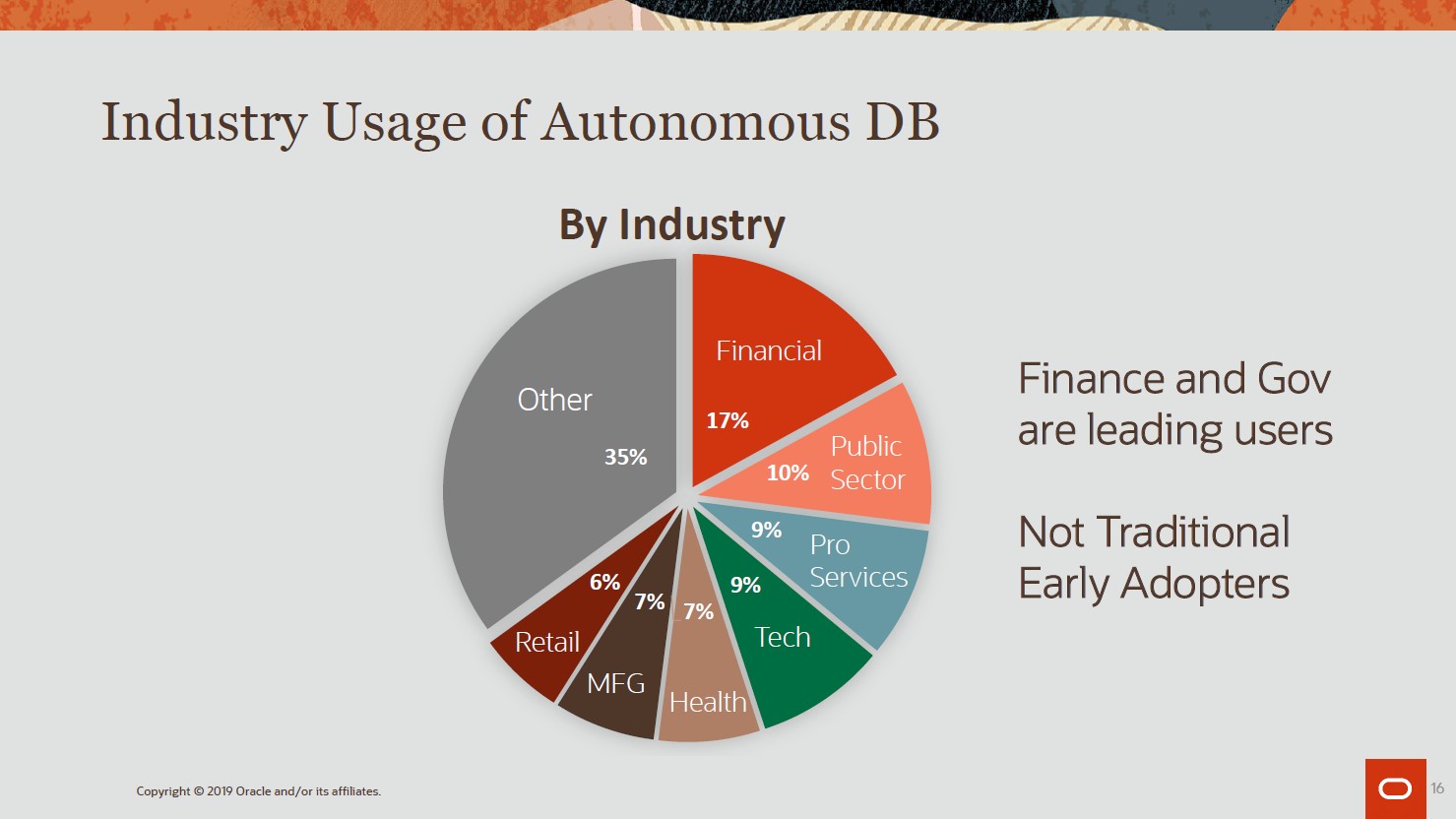

As of September 2019, users of autonomous databases came from all types of industries and sectors as you can see in the upcoming graphic down below. This indicates that Oracle’s growth runway on this front is quite large as customers with far different IT needs are turning to Oracle to bolster their operational uptime and improve their network security, all while reducing their costs. In other words, Oracle is not catering to a niche with a limited growth runway, but all types of customers.

Image Shown: Oracle is seeing demand for its Autonomous Database offering from customers in numerous industries. Image Source: Oracle Corporation – Oracle Database Update September 2019 Presentation

In the upcoming graphic down below, Oracle highlights the greater functionally of its database offerings relative to its major competitors, like Amazon. Management sees Oracle’s Autonomous Database as playing a key role in helping Oracle win market share in the incredibly competitive space of cloud computing.

Image Shown: Oracle sees its Autonomous Database offering as providing the firm with way to grow its market share in the hypercompetitive world of cloud computing. Image Source: Oracle Corporation – Oracle Database Update September 2019 Presentation

Safra Catz, Oracle’s CEO, noted that “industry analysts are universally recognizing our technology innovation and leadership in the cloud” which is expected to play a leading role in allowing for Oracle to “accelerate” its revenue growth going forward. Mrs. Catz noted that “it’s the continuation of leading technologies favorable mix shifts in our existing businesses and higher growth rates from our growing businesses that give me the confidence that our revenue growth will accelerate this [fiscal] year.”

Here, we would like to stress that pandemic-related headwinds aside, Oracle is signaling that the firm expects revenue growth will return this fiscal year (fiscal 2021). Though the firm did not provide guidance for fiscal 2021 given the ongoing pandemic and the inability to forecast with any reasonable accuracy Oracle’s future performance over an entire fiscal year, we appreciate that Oracle’s management team is communicating to investors the firm expects to return to its growth trajectory seen pre-pandemic.

In fiscal 2020, keeping headwinds in mind as it relates to its fiscal fourth quarter performance, Oracle posted a 1% year-over-year decline in its GAAP revenues (and flat performance on a constant-currency basis). For reference, Oracle’s GAAP revenues grew by roughly 5% from fiscal 2017 to fiscal 2019 after stagnating for several fiscal years.

Financial Update

Oracle ended May 2020 with $37.2 billion in cash and cash equivalents on hand along with $5.8 billion in marketable securities. Stacked up against $2.4 billion in short-term debt and $69.2 billion in long-term debt, Oracle’s liquidity position is incredibly strong, and we view its net debt load as manageable given the high quality nature of its cash flow profile.

In fiscal 2020, Oracle generated $7.4 billion in free cash flow and spent $3.0 billion covering its dividend obligations. The firm spent $19.4 billion repurchasing its common stock, a program that was largely funded by its balance sheet. Oracle’s management team seems share buybacks as one of the firm’s levers to reward investors via potential capital appreciation upside. Given that shares of ORCL are trading at a decent discount to our fair value estimate as of this writing, we view manageable share repurchases as a good use of Oracle’s capital. Mrs. Catz had this to say during the company’s latest quarterly conference call (emphasis added):

“As we’ve said before, we’re committed to returning value to our shareholder through technical innovation, strategic acquisitions, stock repurchases, prudent use of debt and a dividend. This quarter [fourth quarter of fiscal 2020], we repurchased nearly 107 million shares for a total of $5.2 billion. Over the last 12 months, we’ve repurchased 361 million shares for a total of $19.2 billion. Over the last 10 years, we have reduced the shares outstanding by nearly 40%. In addition, we have paid out dividends of $3.1 billion over the last 12 months, and the Board of Directors again declared a quarterly dividend of $0.24 per share.”

From fiscal 2019 to fiscal 2020, Oracle’s outstanding weighted-average diluted share count fell by approximately 12%. That helped grow the firm’s GAAP diluted EPS by 4% year-over-year in fiscal 2020, keeping in mind the pressures Oracle’s bottom-line faced during the last quarter of fiscal 2020. Oracle cut its ‘sales and marketing’ spend by $0.4 billion or 5% year-over-year last fiscal year while marginally growing its R&D spend year-over-year, largely to maintain its momentum in the cloud computing space and to support the rollout and expansion of its Autonomous Database offering. Additionally, Oracle’s G&A spend fell by $0.1 billion or 7% year-over-year in fiscal 2020. We appreciate Oracle’s cost control measures in the face of the pandemic.

Concluding Thoughts

Shares of ORCL moved moderately lower on June 17, but we continue to like the name as a holding in the Dividend Growth Newsletter portfolio as we view the initial reaction from investors as too focused on Oracle’s historical performance and not focused enough on the firm’s improving outlook. Oracle possess the financial strength to emerge on the other side of this pandemic with its current dividend payout intact, and management has communicated to investors that Oracle should be in a position to return to a trajectory of positive growth this fiscal year, keeping the ongoing pandemic in mind.

Our fair value estimate for shares of ORCL sits at $55 with room for upside as the top end of our fair value estimate range sits at $66 per share. Our Dividend Cushion ratio of 2.7 provides for a “GOOD” Dividend Safety rating and an “EXCELLENT” Dividend Growth rating as we are very optimistic on the growth trajectory of Oracle’s per share dividend payout over the coming fiscal years. Given Oracle’s strong liquidity position and high quality cash flow profile, the firm may push through a per share dividend increase this calendar year once the global health authorities get a better handle on COVID-19.

—–

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TECHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Related: EGHT, MCD, SMNNY, SPY, QQQ

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple Inc, Facebook Inc (FB), and Microsoft Corporation are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.