Member LoginDividend CushionValue Trap |

Salesforce’s Growth Story Continues

publication date: Dec 7, 2020

|

author/source: Callum Turcan

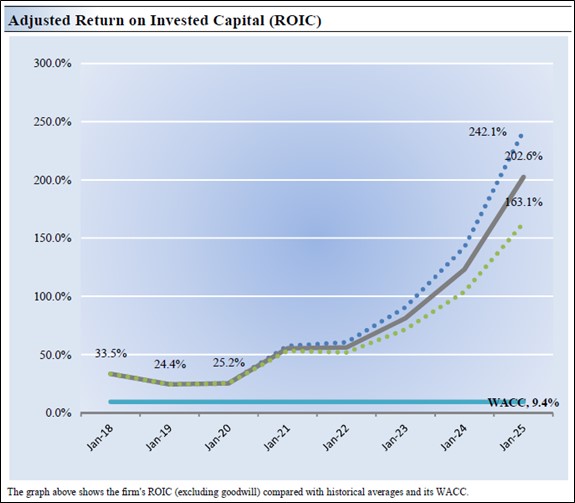

Image Shown: Salesforce Inc expects its impressive revenue growth story will continue at a brisk pace going forward. Image Source: Salesforce Inc – Company IR Presentation By Callum Turcan On December 1, Salesforce Inc (CRM) reported third quarter earnings for fiscal 2021 (period ended October 31, 2020) that saw the Software-as-a-Service (‘SaaS’) giant beat both consensus top- and bottom-line estimates. While Salesforce has historically focused on growing its core customer relationship management (‘CRM’) offerings, the firm more recently has been expanding into new and adjacent areas to extend its impressive growth runway. Acquisitions For instance, Salesforce announced it was acquiring Slack Technologies Inc (WORK) at the start of December for ~$27.7 billion in a cash-and-stock deal. This acquisition will significantly grow Salesforce’s collaboration offerings (particularly for workplace needs), an area it has had trouble expanding into in the past. Here is what management had to say regarding that acquisition during Salesforce’s latest earnings call: “And we see in Slack a once-in-a-generation company and platform, it’s the central nervous system of so many companies on this call and our company and so many of our great customers connecting everyone and everything and now we could go even bigger, better, more exciting and it brings all the companies, people, the data, the tools together and you can see all the CRM information, the sales, customer interactions, you probably saw Slack Connect, which extends the benefit of Slack’s employees can securely work collaboratively with partners, suppliers, but especially important for us, customers.” --- Marc Benioff, founder, Chairman and CEO of Salesforce In August 2019, Salesforce completed the acquisition of Tableau Software, which in turn significantly improved its analytics-oriented offerings and greatly grew Salesforce’s presence in this lucrative and fast-growing area. That all-stock deal had an enterprise value of ~$15.7 billion. Salesforce is a highly acquisitive company, and its strong stock price performance over the past several years helps its endeavors on this front. Financial Commentary Historically, Salesforce has done a tremendous job generating shareholder value (ROIC excluding goodwill > WACC). Going forward, we think this will continue being the case, as you can see in the upcoming graphic down below.

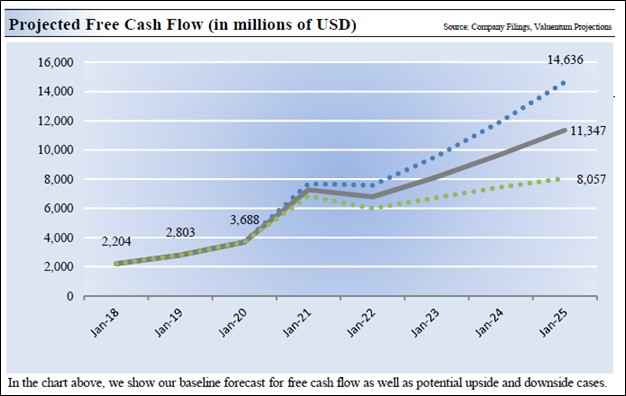

Image Shown: We forecast that Salesforce’s return on invested capital, excluding goodwill, will continue to significantly exceed its estimated weighted-average cost of capital over the coming fiscal years, as has been the case in the recent past. At the end of October 2020, Salesforce had $9.5 billion in cash, cash equivalents, and marketable securities on hand versus $2.7 billion in long-term debt with no short-term debt on the books. We are big fans of Salesforce’s pristine balance sheet, though the cash component of its pending acquisition of Slack will change this picture somewhat. Given that Salesforce does not currently pay out a common dividend and historically has not spent a significant amount buying back its stock, the company should be able to build its cash balance back up via organic free cash flows. During the first nine months of fiscal 2021, Salesforce generated almost $2.1 billion in free cash flow. Under our “base” case scenario, highlighted by the grey line in the upcoming graphic down below, we forecast that Salesforce’s free cash flows will roughly triple by the middle of this decade versus fiscal 2020 levels. Please note the blue dots highlight our “bull” case scenario while the green dots highlight our “bear” case scenario for Salesforce in the upcoming graphic down below. Under any reasonable scenario, we forecast Salesforce’s free cash flow growth will be explosive going forward.

Image Shown: Our enterprise cash flow models forecast that Salesforce will experience stellar free cash flow growth over the coming fiscal years. During the first nine months of fiscal 2021, Salesforce reported 26% year-over-year growth in its GAAP revenues though its GAAP operating income declined to $262 million versus $333 million in the same period the prior fiscal year due to significant operating expense increases (up 26% year-over-year) and moderate GAAP gross margin contraction (down over 100 basis points year-over-year). With that in mind, Salesforces’ GAAP gross margins remained impressive at ~74.4% during the first nine months of fiscal 2021. Given the highly scalable nature of Salesforce’s business model, the investments the company is making are worthwhile, though eventually its operating expense growth will need to come in significantly. Management is guiding for Salesforce to generate $21.1 billion - $21.11 billion in revenues in fiscal 2021. In fiscal 2022, management forecasts the firm’s revenues will grow to $25.45 billion - $25.55 billion. For reference, Salesforce generated $17.1 billion in GAAP revenues in fiscal 2020 (period ended January 31, 2020). Salesforce’s revenue growth trajectory is enhanced by its M&A activity, though we caution the firm has historically seen significant increases in its outstanding diluted share count. Concluding Thoughts Salesforce’s growth runway is promising, and its financials are impressive. As the SaaS company operates in an industry supported by secular growth tailwinds, there is ample room for multiple winners in this space, in our view (meaning Salesforce’s CRM, analytics, collaboration, and other offerings will still be able to generate materially high-margin revenue growth over the coming fiscal years even after taking into consideration the very competitive nature of the SaaS industry). Our fair value estimate for Salesforce sits at $221 per share (under our “base” case scenario) and the top end of our fair value estimate range sits at $265 per share (under our “bull” case scenario). As of this writing, shares of CRM appear fairly valued. We are not adding shares of CRM to the newsletter portfolios at this time given that we are already overweight high-quality tech positions, but we are keeping an eye on the name as its growth story continues to unfold. Salesforce's 16-Page Stock Report (pdf) >> Note: Salesforce owns a 9.9% passive stake in recent new issue Snowflake (SNOW). ----- Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN Also tickerized for WDAY, ORCL, IBM. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment