Member LoginDividend CushionValue Trap |

Realty Income Remains Resilient and Its Outlook is Improving

publication date: Nov 10, 2020

|

author/source: Callum Turcan

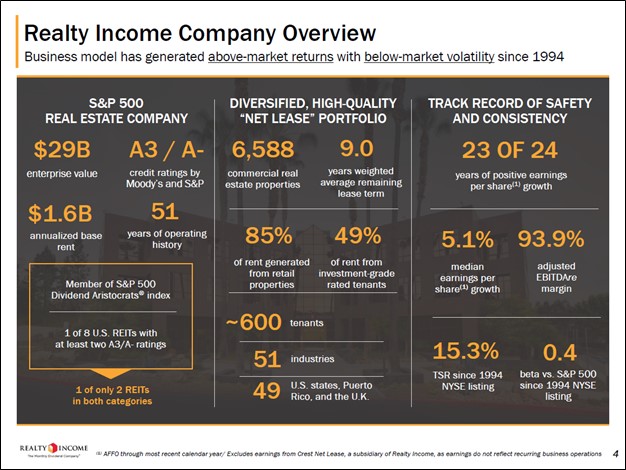

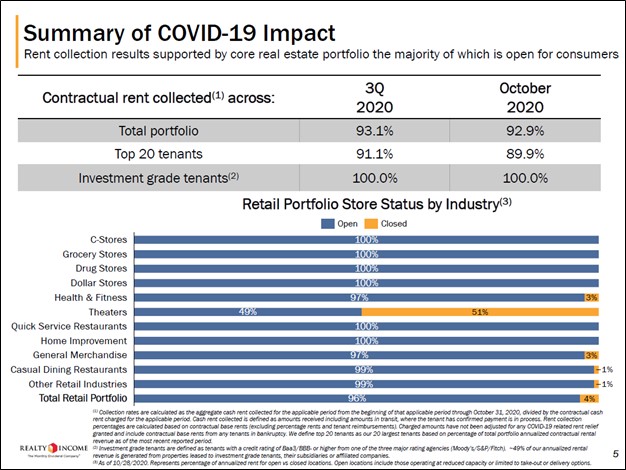

Image Shown: An overview of Realty Income Corporation’s asset base and historical financial performance. Image Source: Realty Income Corporation – Third Quarter of 2020 IR Earnings Presentation By Callum Turcan On November 2, Realty Income Corporation (O) posted third quarter earnings for 2020 that saw the real estate investment trust’s (‘REIT’) funds from operations (‘FFO’) come in flat year-over-year at $0.82 per share, while its adjusted funds from operations (‘AFFO’) declined by 2% year-over-year, hitting $0.81 per share. Realty Income invests in single-tenant commercial properties, and its business has faced headwinds from the ongoing coronavirus (‘COVID-19’) pandemic. However, things are starting to improve, though there is ample room for additional improvement. We like the relative resilience of Realty Income’s financials and continue to include shares of O at a modest weighting in our Dividend Growth Newsletter portfolio. As of this writing, shares of Realty Income yield ~4.4% and for reference, the REIT pays out a monthly dividend. Please note FFO and AFFO are heavily adjusted non-GAAP figures, though these metrics are useful for gauging the trajectory of a REIT’s financial performance. In September 2020, Realty Income pushed through its 108th dividend increase since going public back in 1994. The REIT’s monthly dividend now stands at $0.234. On an annualized basis based on its current monthly per share dividend and AFFO per share performance in the third quarter, Realty Income’s payout ratio stood at ~87% in the third quarter of 2020. Though we prefer payout ratios below 80%, we expect Realty Income’s financial performance will improve significantly over the coming months (which we will cover in just a moment). It is imperative that Realty Income retain constant access to capital markets at attractive rates to refinance its debt maturities, fund its growth investments, and to be able to continue meeting its payout obligations going forward. Realty Income retains solid “A-rated” investment grade credit ratings (A3/A-) which has helped the REIT tap debt markets at attractive rates in the recent past. In October 2020, Realty Income issued out £400 million in 1.625% senior unsecured notes due December 2030 at 99.191% of par. Quarterly Update During the third quarter, Realty Income collected on 93.1% of the contractual rent it is owed according to management commentary during the REIT’s latest earnings call. That figure dropped down to 92.9% for the month of October, with most of the trouble coming from its movie theater tenants given the immense financial stress facing that industry due to the COVID-19 pandemic. Management noted during Realty Income’s latest earnings call that “our confidence level associated with the collectability of a portion of our outstanding theater receivables has diminished” and additionally that “we believe it is prudent to establish a full reserve for the outstanding receivable balance for 37 of our 78 total theater assets, and to move to cash accounting for revenue recognition purposes, for these 37 assets going forward. We deemed the collectability of rents for these 37 theater assets to be less than probable, based on a variety of factors including the store level performance of these assets.” This weighed on Realty Income’s FFO and AFFO performance last quarter, though eventually there will be a resolution on this front. In the upcoming graphic down below, Realty Income highlights which type of tenants have been paying rent and where the REIT has had problems collecting rent. Most of Realty Income’s tenants have been able to keep paying rent during the pandemic, it is largely just tenants operating within the movie theater industry that have been weighing down its financial performance.

Image Shown: While the vast majority of Realty Income’s tenant base has continued to pay rent contractually owed to the REIT during the COVID-19 pandemic, a large chunk of its movie theater tenant base has not. Image Source: Realty Income – Third Quarter of 2020 IR Earnings Presentation As it concerns Realty Income’s non-rent paying tenants, the recent news that Pfizer Inc (PFE) and BioNTech (BNTX) are getting much closer to potentially receiving regulatory approval for their COVID-19 vaccine candidate (though nothing is for certain at this point) is a very promising sign that things could soon begin to “return to normal.” By that we mean movie theaters would be able to open back up at full capacity (eventually) and in theory, resume rent payments to Realty Income should a safe and viable COVID-19 vaccine get discovered. Management noted that the REIT’s “theater portfolio is one of very high-quality, and we estimate that 82% of theatres in our portfolio are in the top two quartile of each operator's portfolio in terms of store level performance.” With that in mind, management also mentioned that they expect there will be a “rationalization in the overall theatre industry, which may require repositioning some of our properties.” Whatever the outcome, we view Realty Income as eventually coming to a resolution on this front. Some of the other tenants Realty Income has had trouble collecting rent from, such as those operating in the ‘health & fitness’ and ‘general merchandising’ industries, would likely see their financial performance improve in the event the global economy starts to return to pre-pandemic activities.

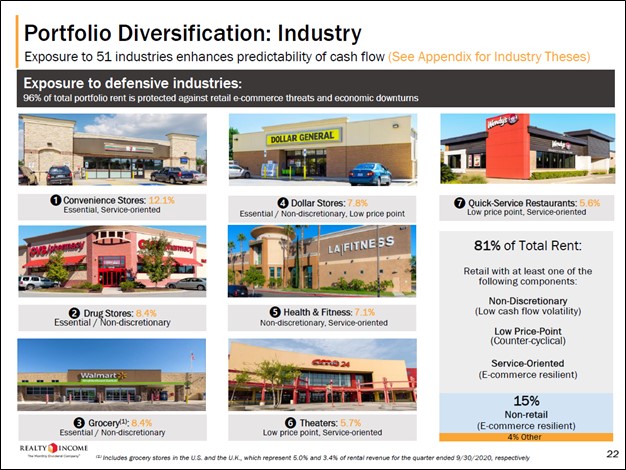

Realty Income was able to collect 100% of the contractually owed rent it was due in both the third quarter of 2020 and the month of October from its tenants with investment grade credit ratings. The REIT’s recent acquisitions have focused on adding investment grade tenants to its tenant base, which we appreciate. Additionally, Realty Income receives ~37% of its rental revenues from tenants that operate “convenience stores, drug stores, grocery stores and dollar stores” which sell “essential goods” according to the REIT’s management team’s recent commentary. Realty Income noted that “we have received nearly all of the contractual rent due to us from tenants in these industries since the pandemic began” during its latest earnings call.

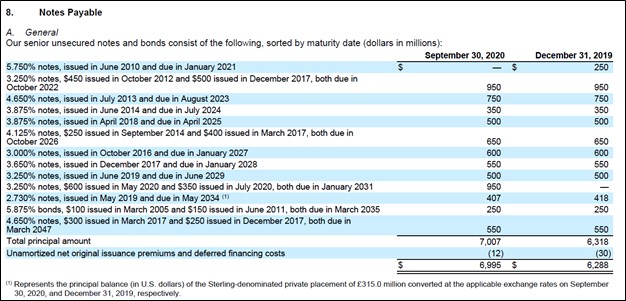

Image Shown: Many of Realty Income’s tenants sell essential goods and have been able to continue operating throughout the pandemic, enabling those tenants to keep making rent payments to Realty Income. Image Source: Realty Income – Third Quarter of 2020 IR Earnings Presentation Balance Sheet Update At the end of the third quarter of 2020, Realty Income had $8.4 billion in total debt (inclusive of short-term debt) and $0.7 billion in cash and cash equivalents on hand. Given its enormous growth-related capital expenditures, Realty Income generated negative free cash flows during the first nine months of 2020. As stated previously, the REIT’s access to capital markets needs to be monitored at all times, and part of that process involves keeping a close eye on Realty Income’s balance sheet. In the upcoming graphic down below, Realty Income provides an overview of its debt maturity schedule as of the end of September 2020 (specifically for its ‘notes payable’ balance, and there are other debt-like items to be aware of here). Please note that the firm issued out debt after the third quarter closed, as mentioned previously, with some of those proceeds going towards paying down its $3.0 billion revolving credit facility (which matures in March 2023, with two six-month extension options).

Image Shown: We appreciate the staggered nature of Realty Income’s debt maturity schedule. Image Source: Realty Income – 10-Q SEC filing covering the third quarter of 2020 Realty Income’s cash on hand, the access to liquidity provided by its revolving credit line, its apparent ability to tap capital markets at attractive rates, and the staggered nature of its debt maturity schedule should put Realty Income in a position to keep refinancing its debt load at reasonable rates going forward. We appreciate that Realty Income does not have a significant amount of debt coming due until 2022, though we caution its net debt load is sizable. As it concerns Realty Income’s ‘mortgages payable’ balance, it had a negligible amount due for the remainder of 2020 (less than $11 million in principal due) and 2021 (less than $70 million in principal due) at the end of the third quarter. In 2022, the REIT has approximately $112 million in principal due from its mortgages payable balance, though that is a relatively modest sum given Realty Income’s size (in total, the firm has roughly $335 million in principal due from its mortgages payable balance, as of the end of September 2020). On a final note here, Realty Income also has a $250 million term loan maturing in March 2024 to be aware of. We view Realty Income’s debt maturity schedule and financial needs at-large as manageable. In the third quarter of 2020, the REIT raised roughly $0.35 billion through its at-the-market (‘ATM’) equity issuance program. The REIT also issued $0.35 billion in 3.250% senior unsecured notes due 2031 at 108.241% of par in July 2020, raising north of $0.35 billion in gross proceeds. Realty Income will likely retain solid access to capital markets at attractive rates going forward. Concluding Thoughts Realty Income’s outlook is improving and we expect its FFO and AFFO performance will improve significant over the coming months as the REIT bulks up its tenant base with investment grade credit ratings and starts to move forward with a resolution regarding the rent it is owed from its movie theater tenants. Most of Realty Income’s tenant base has continued to pay rent during the pandemic, and we appreciate its exposure to retailer’s selling essential goods. Through future acquisition activities, Realty Income should be able to continue adding high quality tenants (those with investment grade credit ratings and/or those that operate in attractive industries) to its tenant base. ----- Retail REIT Industry – CONE DLR FRT O REG SPG WPC Discretionary Spending Industry - ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH Related: BIP, SPY, VDC, VNQ, MDY, PFE, BNTX ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Digital Realty Trust Inc (DLR), Health Care Select Sector SPDR ETF (XLV), Johnson & Johnson (JNJ) and Realty Income Corporation (O) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Dollar General Corporation (DG), Health Care Select Sector SPDR ETF, Johnson & Johnson and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust, CyrusOne Inc (CONE), Vanguard Consumer Staples ETF (VDC) and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment