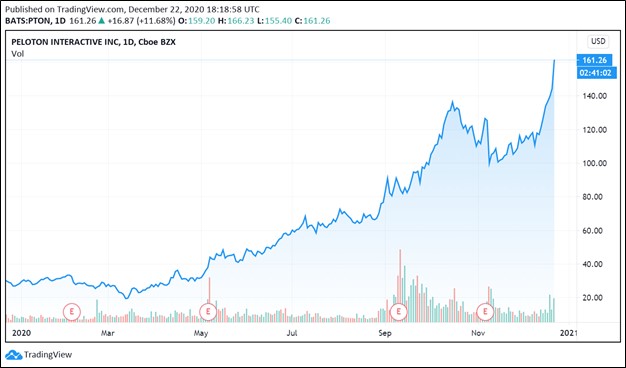

Image Shown: Shares of Peloton Interactive surged higher during 2020. The firm recently announced it would acquire an exercise equipment manufacturer based in the US. As demand for Peloton’s products has been incredibly strong of late, the firm has had trouble keeping up, which in turn has led to delayed deliveries of its “premium” exercise bikes. This acquisition is expected to help alleviate those concerns.

By Callum Turcan

The exercise bike and digitally-oriented exercise training service provider Peloton Interactive Inc (PTON) announced it was acquiring Precor, an exercise equipment manufacturer, for $420 million in cash (before closing adjustments) on December 21. Peloton aims to complete the transaction by early 2021 (calendar year), and by the end of 2021, the goal is to begin producing Peloton products in the US. This transaction will provide Peloton with 625,000 square feet of US manufacturing capacity split between a complex in Whitsett, North Carolina and Woodinville, Washington. Peloton aims to build up a US manufacturing base to better meet domestic demand while reducing its logistics costs, given that transporting heavy exercise equipment can be a difficult task.

Betting on US Manufacturing

The success of Peloton’s business model largely rests on effectively selling premium exercise equipment and then generating recurring revenue by adding digital subscription services. As of June 30, 2020, Peloton had a huge community of 3.1 million members. Most of the company’s current revenue is generated from Connected Fitness Products–its Peloton Bike (launched in 2014) and Bike+, Peloton Tread (launched in 2018) and Tread+, as well as recurring subscription revenue–with room for upside via on-demand personal training offerings. Peloton has doubled its revenue in each of the past 6 years, a pace of growth that has been augmented recently as a result of the work-from-home situation caused by the COVID-19 pandemic.

Image Source: The company’s revenue growth has been phenomenal during the past several years. Peloton’s Investor Day, September 15, 2020 (pdf).

Peloton doesn’t currently have its own manufacturing footprint in the US, however, and it has historically leaned heavily on third-party manufacturers to meet demand, though that is starting to change. Peloton leases corporate office space in Plano, Texas, New York City, NY, and London, UK for general corporate purposes, and for exercise video production and on-demand personal training activities. Peloton also leases space in several countries for its showrooms, warehouses and other activities. However, its only operated manufacturing facility is overseas according to information provided by Peloton’s fiscal 2020 Annual Report (period ended June 30, 2020). For reference, Peloton’s fiscal year ends on June 30.

When Peloton purchased Tonic Fitness Technology in October 2019 for $45 million in net cash considerations, it acquired a manufacturing facility in Taiwan. Additionally, Peloton has another facility under construction in Shin Ji, Taiwan that is expected to be completed by the end of calendar year 2020 according to management commentary during the firm’s latest earnings call. Peloton is doing what it can to bulk up its supply chain, but considerable near-term challenges remain.

Fixing Supply Chain Problems, Assisted by Ample Financial Firepower

At the end of the first quarter of fiscal 2021 (period ended September 30, 2020), Peloton had $2.0 billion in cash, cash equivalents, and marketable securities on hand with no debt on the books. However, Peloton’s operating lease liabilities are quite material and stood near $600 million (both short- and long-term combined) at the end of September 2020. With that said, Peloton’s net cash-rich balance sheet provides the company with the financial firepower required to boost its manufacturing capacity.

Peloton’s operating income turned positive in the first quarter of fiscal 2021, though historically it has generated large negative operating losses. In fiscal 2020, Peloton generated a little over $0.2 billion in free cash flow after generating negative free cash flows in fiscal 2019 and negligible positive free cash flows in fiscal 2018. The near-term trajectory of Peloton’s operating income and free cash flows is bright, in our view, though rising operating expenses and capital expenditure requirements need to be kept in mind. Peloton would be wise to maintain a net cash balance going forward.

During Peloton’s latest earnings call, management noted that “(it) will likely be operating under Bike+ supply constraints for the foreseeable future causing longer order to delivery time frames for Bike+ for a couple more quarters” as manufacturing capacity expansions will take time to complete and ramp up. The Peloton Bike+ is its newest exercise bike offering, though management noted that its traditional bike offering will remain in high demand in the near term.

Image Source: The company’s exercise bike has changed an industry. Peloton’s Investor Day, September 15, 2020 (pdf).

Peloton’s GAAP revenues more than tripled year-over-year in the first quarter of fiscal 2021, aided by strong exercise bike sales and its growing subscription revenues for its digitally-provided exercise and on-demand personal training offerings. During the first quarter of fiscal 2021, Peloton generated a tad under $0.3 billion in positive free cash flow and a little under $0.1 billion in GAAP operating income. Whether this performance can be sustained going forward remains to be seen, but Peloton’s growing digital subscriber base lends support to its outlook.

At the end of September 2020, Peloton had over 1.3 million ‘connected fitness subscriptions’ which was more than double year-ago levels. Being able to meet elevated consumer demand is about more than just hardware; it is about Peloton maintaining its strong digital subscriber growth. Though Peloton offers standalone subscription services, it is its installed exercise bike customer base that represents the company’s primary target. These revenue streams are likely to be “stickier” in nature, and these customers are likely to opt for the higher priced subscription services, in our view.

Concluding Thoughts

Management is focused on building up the firm’s manufacturing capacity, and given Peloton’s strong balance sheet, that appears like a good use of capital. Peloton could also highlight its domestic manufacturing base in future US advertising campaigns once the deal closes to bolster its corporate image (remember its advertising misstep?) and attempt to further grow its installed hardware base.

Having greater control of its supply chain is essential for a firm experiencing triple-digit revenue growth. Shares of PTON popped higher when its acquisition of Precor was announced, indicating investors are big fans of the news. We are keeping an eye on various industry disruptors and encourage our members to check out our ‘Disruptive Innovation Industry’ coverage in the upcoming link down below.

Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ESTY, DOCU, UBER, BYND, SFIX, CVNA, TER, GPN, PANW, VRSN, MELI, PRLB

Tickerized for PTON, LULU, NLS, CLUB, UA, UAA, PLNT, FIT, NKE, ADDYY, ADDDF, WFH

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.