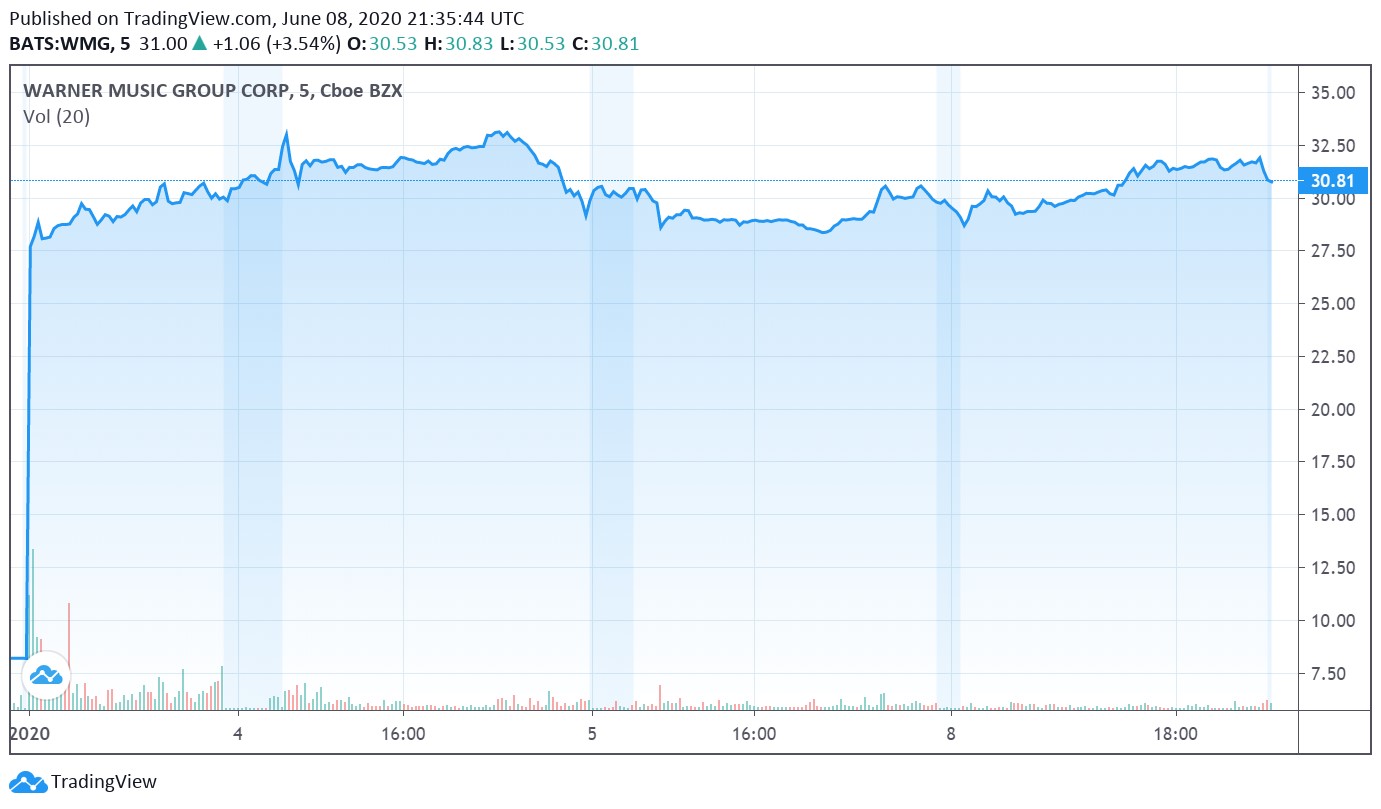

Image Shown: Shares of Warner Music Group Corp were trading comfortably above their initial public offering (‘IPO’) price of $25 per share at of the end of normal trading hours on June 8, after going public on June 3.

By Callum Turcan

Warner Music Group Corp (WMG) went public on June 3, though shares were sold by the company’s stockholders in the IPO and not the firm itself, meaning these proceeds are not expected to go to Warner Music Group. The company owns various record labels including Atlantic Records, Warner Records, Elektra Records and Parlophone Records along with its global music publishing business Warner Chappell Music.

For some background, please note Warner Music Group counts Ed Sheeran, Bruno Mars, and Cardi B as some of its recording artists and on the music publishing business side of things songwriters including Twenty One Pilots, Lizzo and Katy Perry are part of the firm’s team. In 2011, Access Industries purchased Warner Music Group and took the company private after the firm was previously publicly traded from 2005 to 2011.

Governance Structure

During the IPO, 77 million Class A shares (with the underwriters having the ability to purchase an additional 11.55 million Class A shares) are being sold by privately-held Access Industries and other parties. Access Industries is owned and run by multibillionaire Leonard “Len” Blavatnik who will effectively control Warner Music Group post-IPO due to the firm’s dual class structure (from the firm’s S-1/A SEC filing):

Access Industries is a privately-held industrial group with long-term holdings worldwide. [The company was] founded in 1986 by British-American industrialist and philanthropist Len Blavatnik…

Following the completion of this offering, Access will hold an aggregate of 440,000,000 shares of our [Warner Music Group’s] Class B common stock, representing approximately 99.2% of the total combined voting power of our outstanding common stock (or an aggregate of 429,500,000 shares of our Class B common stock, representing approximately 99.1% of the total combined voting power of our outstanding common stock if the underwriters exercise in full their option to purchase additional shares of our Class A common stock from the selling stockholders) and approximately 86.3% of the economic interest (or approximately 84.2% of the economic interest if the underwriters exercise in full their option to purchase additional shares of our Class A common stock from the selling stockholders).

Accordingly, Access will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. We believe that this voting structure aligns our interests in creating stockholder value.

While shareholders of Class A stock will have an economic interest in the company, they will not have any meaningful say in how the company is run as “each share of Class B common stock is entitled to 20 votes per share” while “each share of Class A common stock is entitled to one vote per share” and that’s unlikely to change anytime soon. Stephen Cooper is CEO of Warner Music Group, Max Lousada is CEO of the Recorded Music division of Warner Music Group, Michael Lynton is Chairman of the Board, and Len Blavatnik is Vice Chairman of the Board.

Business Landscape

Warner Music Group cites data from the International Federation of the Phonographic Industry (‘IFPI’) when it noted that “the recorded music industry generated $20.2 billion in global revenue in 2019 and has consistently grown since 2015” with digital leading the way. Streaming revenues accounted for 88% of the industry’s digital sales in 2019, and digital sales accounted for 64% or $12.9 billion of the recorded music industry’s total revenues that year. Furthermore, digital sales rose by 18% in 2019, with streaming revenues up 24%. Warner Music Group, citing IFPI data, noted that the global recorded music industry’s revenues grew by 9% CAGR since 2015 (apparently through 2019).

Streaming services appear to have fundamentally altered the trajectory of the recorded music industry’s financials in a very positive way. Many companies including Apple Inc (AAPL), Alphabet Inc (GOOG) (GOOGL), Amazon Inc (AMZN), iHeartMedia Inc (IHRT), Spotify Technology SA (SPOT), and others offer some form of music streaming services. What makes streaming appealing for the recorded music industry is that piracy becomes far less of a concern. For established businesses that play music in-store, generally speaking (especially for corporate chains), those entities prefer to have lawfully acquired in-store music options due to the legal implications of not doing so (generally under commercial music streaming agreements). For consumers, many prefer the streaming music experience due to the ability to find new bands, songs, genres, and the wide selection of content available.

Citing IFPI data once again, Warner Music Group notes that there were 341 million global paid music streaming service subscribers at the end of 2019, up from 255 million at the end of 2018, with room to grow given that there are over 3 billion smartphone users in the world, according to data from Statista cited by Warner Music Group.

Financial Overview

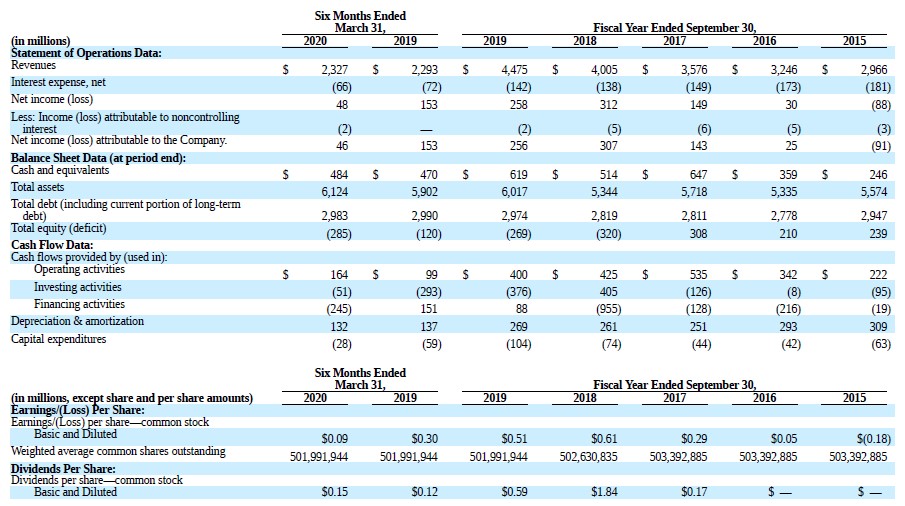

Please note Warner Music Group’s fiscal year ends in September. From fiscal 2015 to fiscal 2019, Warner Music Group grew its GAAP revenues 51%, which hit $4.5 billion in fiscal 2019 (period ended September 30, 2019). Over this period, Warner Music Group’s GAAP net income flipped from approximately -$0.1 billion (negative $0.1 billion) to approximately positive $0.3 billion. The uplift from rising streaming revenues was key to turning the firm’s financial performance around.

Image Shown: Warner Music Group’s financials have improved over the past several years. Image Source: Warner Music Group – S-1/A SEC Filing

During the first half of fiscal 2020 (six month period ended March 31, 2020), Warner Music Group’s GAAP revenues were up a little over 1% year-over-year, keeping in mind the coronavirus (‘COVID-19’) pandemic likely negatively influenced its financials during the second half of this period as it spread worldwide. While Warner Music Group’s physical sales dropped by 23% year-over-year in the first half of fiscal 2020, its digital sales rose by 9% year-over-year.

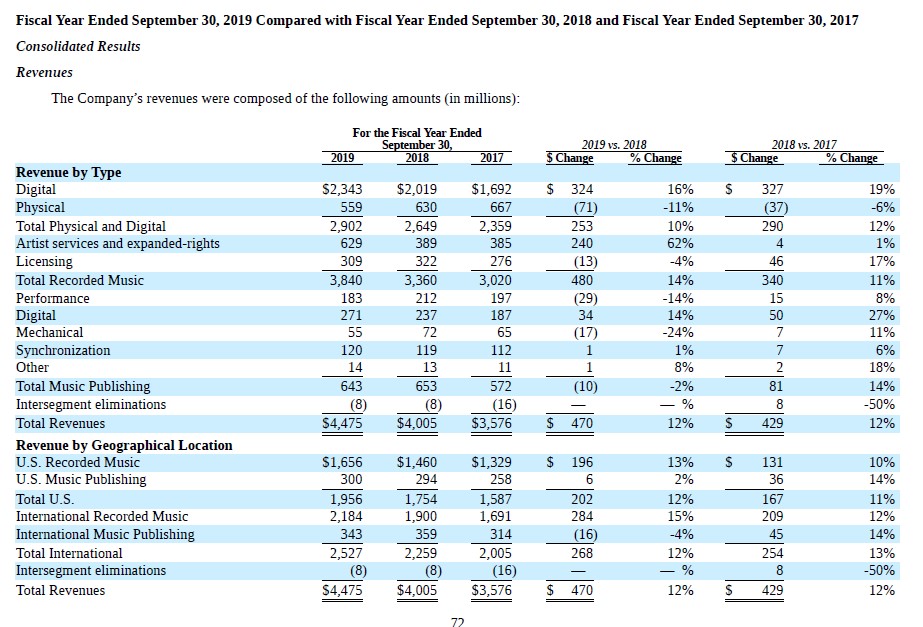

Image Shown: Digital sales are a crucial part of Warner Music Group’s total revenues and its main source of growth going forward, with an eye on rising global demand for paid music streaming services. Image Source: Warner Music Group – S-1/A SEC Filing

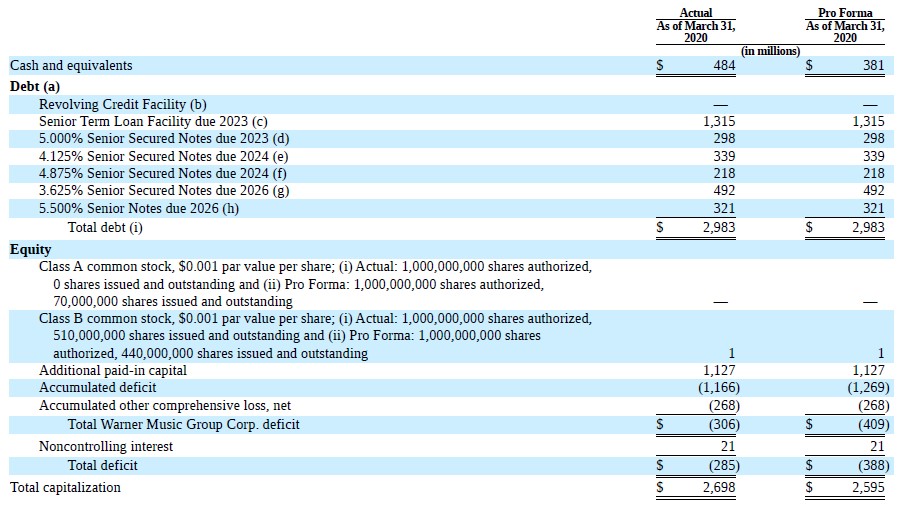

As of March 31, 2020, Warner Music Group carried $3.0 billion in total debt versus $0.5 billion in cash and cash equivalents. The firm’s debt maturity schedule is staggered and manageable, though having a relatively large net debt position could create hurdles in the future.

Image Shown: An overview of Warner Music Group’s balance sheet. Image Source: Warner Music Group – S-1/A SEC Filing

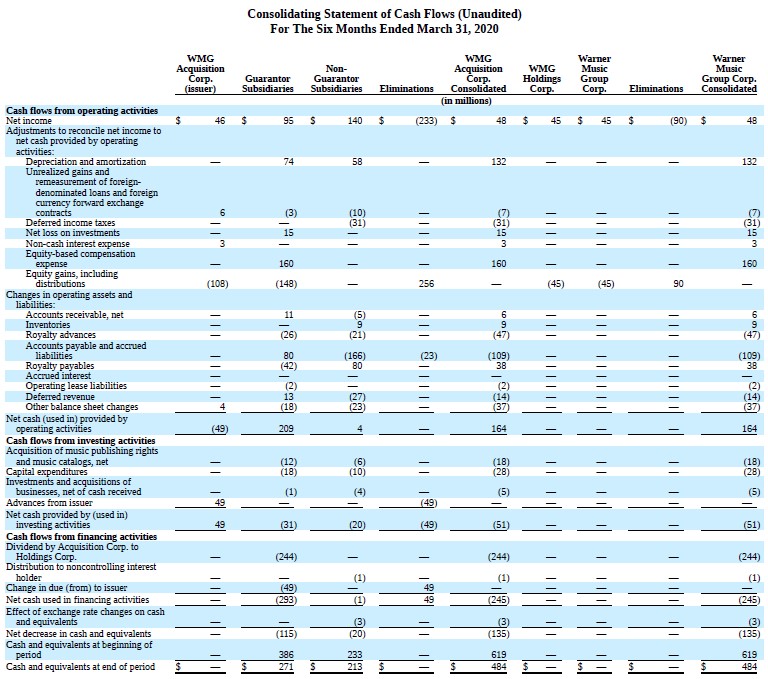

During the first half of fiscal 2020, Warner Music Group generated over $0.1 billion in free cash flow as you can see in the upcoming graphic down below.

Image Shown: Warner Music Group is comfortably free cash flow positive. Image Source: Warner Music Group – S-1/A SEC Filing

Please note Warner Music Group intends on paying out a regular dividend according to its S-1/A SEC Filing (emphasis added):

The Company intends to institute a regular quarterly dividend to holders of our Class A common stock and Class B common stock whereby we intend to pay quarterly cash dividends of $0.12 per share. We expect to pay the first dividend under this policy in September 2020. The declaration of each dividend will continue to be at the discretion of our board of directors and will depend on our financial condition, earnings, liquidity and capital requirements, level of indebtedness, contractual restrictions with respect to payment of dividends, restrictions imposed by Delaware law, general business conditions and any other factors that our board of directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the amount of any such dividends.

Concluding Thoughts

Warner Music Group’s financials are steadily improving, and its growth outlook looks promising due to rising paid streaming subscribers worldwide, though its net debt load is a concern. The company’s services will likely remain in high demand during the pandemic as they are primarily provided digitally. This is an interesting company to keep on your radar, though shares aren’t cheap after exploding past their IPO price of $25 per share in the initial few days of trading.

—–

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TECHY TWTR

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Related: IHRT, SPOT, WMG

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Alphabet Inc (GOOG) Class C shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.