Image Source: Enterprise Products Partners L.P. – August 2021 IR Presentation

In our High Yield Dividend Newsletter portfolio (more on that here), we include Enterprise Products Partners L.P. (EPD)—8.1% yield—and Magellan Midstream Partners L.P. (MMP)—8.7% yield—as ideas with modest “weightings” as these are our two favorite midstream master limited partnerships (‘MLPs’). The global economy is steadily recovering from the worst of the coronavirus (‘COVID-19’) pandemic, though variants of the virus remain a concern. Enterprise Products and Magellan Midstream are well-positioned to capitalize on this recovery while continuing to make good on their “generous” payout obligations.

Enterprise Products

When Enterprise Products reported its second quarter 2021 earnings in late-July 2021, the midstream MLP showcased the positive impact the ongoing recovery in global refined petroleum product demand and oil & gas development activities in North America are having on its financial performance. For instance, its ‘NGL [natural gas liquid], crude oil, refined products & petrochemical pipeline volumes’ were up 3% year-over-year, its ‘natural gas pipeline volumes’ were up 9% year-over-year, and its ‘propylene plant production volumes’ were up 57% year-over-year in the second quarter.

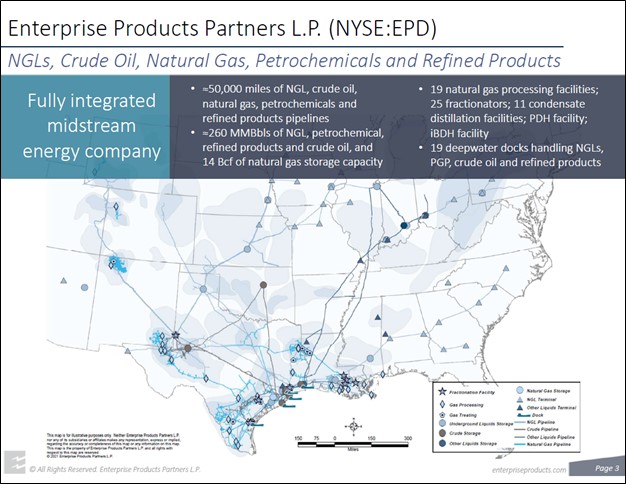

Image Shown: Enterprise Products’ expansive midstream asset base covers a lot of ground in the energy infrastructure space. Image Source: Enterprise Products – August 2021 IR Presentation

In recent quarters, Enterprise Products has started placing a much greater emphasis on free cash flow instead of the industry-specific “distributable cash flow” metric which does not fully capture the capital expenditure requirements of the firm in question. Distributable cash flow, or DCF, is a poor way to gauge a company’s ability to keep making good on its payout obligations.

Enterprise Products now prominently showcases its free cash flow performance in its earnings press releases, which we really appreciate. During the first half of 2021, Enterprise Products generated $2.7 billion in free cash flow (up from $1.2 billion during the same period last year) while spending $2.0 billion covering its payout obligations and a negligible amount buying back its common units.

At the end of June 2021, Enterprise Products had a net debt load of $2.81 billion (inclusive of short-term debt, exclusive of restricted cash). As part of its business model, Enterprise Products needs to retain constant access to capital markets to refinance its debt load, make good on its payout obligations, and to fund its growth endeavors. That appears to be the case as Enterprise Products’ operating subsidiary, Enterprise Products Operating (‘EPO’), was able to issue $1.0 billion in senior notes due 2053 with a fixed interest rate of 3.3% that were sold at just under par in September 2021. According to the press release, these funds will be used to retire some of its debt, for general corporate purposes, and to cover its growth endeavors.

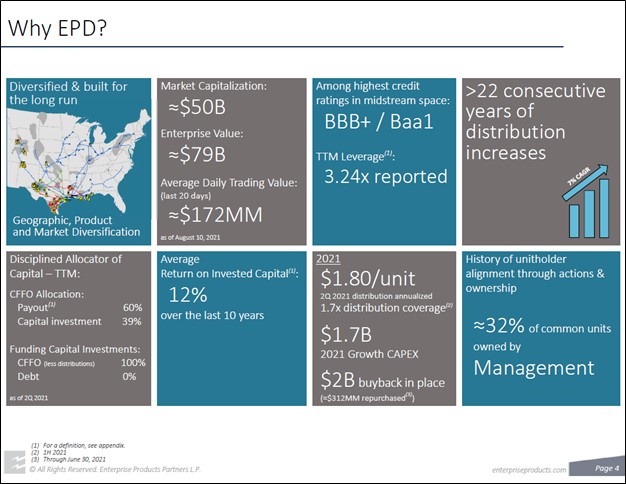

We appreciate Enterprise Products’ apparent ability to tap debt markets at attractive rates, a process aided by its investment grade credit rating (Baa1/BBB+/BBB+). Over the past 20+ consecutive years, Enterprise Products has grown its annual distribution.

Image Shown: An overview of Enterprise Products’ financial metrics and equity ownership. Image Source: Enterprise Products – August 2021 IR Presentation

Enterprise Products and Chevron Corporation (CVX) announced in September 2021 that they were joining forces to evaluate potential carbon capture and storage opportunities in the US. Growing pressures from governments, activists, and investors are compelling oil & gas firms to do more in the realm of green energy. The duo noted that “the initial phase of the study in which they will evaluate specific business opportunities to last about six months” in the press release announcing the venture.

While such projects are unlikely to generate meaningful revenues in the near term, in our view, Enterprise Products and Chevron are positioning themselves for the possibility that such endeavors will be encouraged by government policy over the coming years. Enterprise Products and Chevron are looking at opportunities in the US Midcontinent and Gulf Coast region, an area where both firms have sizable oil & gas operations.

Magellan Midstream

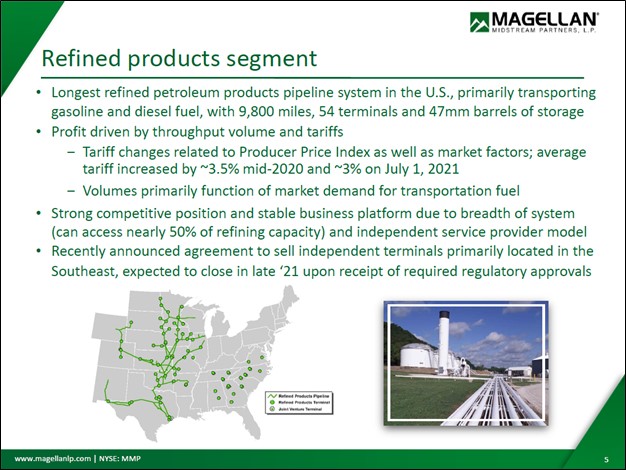

Magellan Midstream is also experiencing a powerful rebound in its financial performance as the global economy steadily recovers from the worst of the COVID-19 pandemic. After a series of divestments (including large portions of its marine terminal business that was sold off through multiple deals along with all of its inland independent terminal assets) in recent years, Magellan Midstream now generates the bulk of its cash flows from refined petroleum product pipelines and related assets (namely terminals that were not divested). The company notes that over 70% of its operating margin during the first half of 2021 came from its ‘Refined Products’ business operating segment and just under 30% came from its ‘Crude Oil’ segment.

Image Shown: Magellan Midstream owns and operates an expansive network of refined petroleum product pipelines in the US, keeping in mind it is in the process of divesting a large portion of its terminals business. Image Source: Magellan Midstream – September 2021 IR Presentation

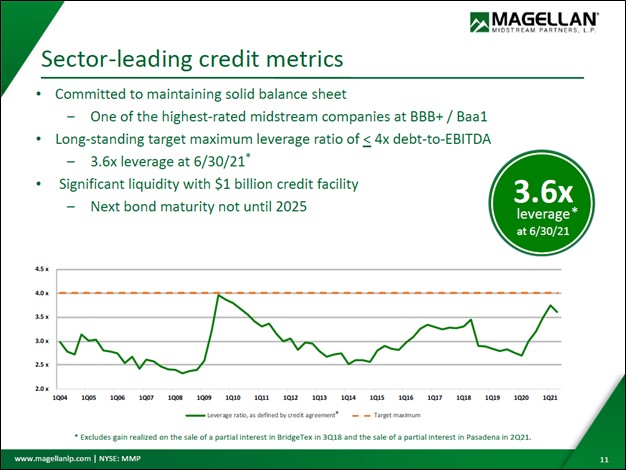

During the first half of 2021, Magellan Midstream generated just over $0.5 billion in free cash flow (up from $0.3 billion during the same period in 2020) while spending a tad under $0.5 billion covering its payout obligations along with a bit under $0.1 billion repurchasing its common units. At the end of June 2021, Magellan Midstream had $4.7 billion in net debt (exclusive of restricted cash) with no short-term debt on the books. Magellan Midstream’s debt maturity schedule at the end of June 2021 was well-staggered, with its next tranche of bonds not maturing until 2025. As with Enterprise Products, Magellan Midstream needs to retain constant access to capital markets.

The midstream MLP’s investment grade credit rating (Baa1/BBB+) and manageable leverage ratio should enable Magellan Midstream to continue tapping debt markets at attractive rates going forward. Its $1.0 billion revolving credit line that matures in May 2024 provides the firm with access to liquidity to meet its immediate funding needs, and its efforts here are supported by its $1.0 billion commercial paper program.

Image Source: Magellan Midstream – September 2021 IR Presentation

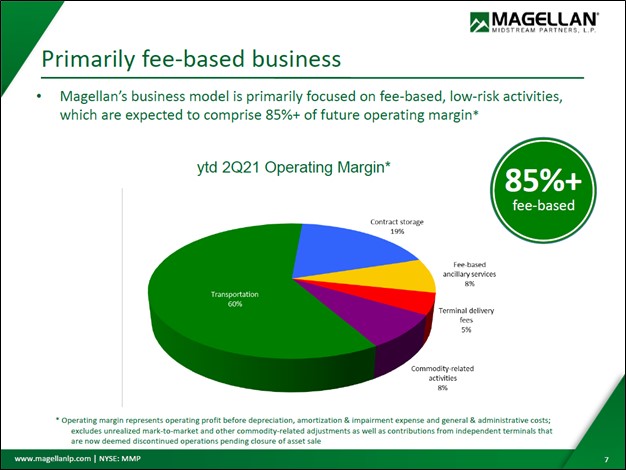

As noted previously, most of Magellan Midstream’s business is now primarily geared towards providing transportation services. Over 85% of the company’s operating margin comes from fee-based activities, providing for an incredibly stable cash flow profile. Recent tariff increases seen across its refined petroleum product pipeline operations support Magellan Midstream’s growth outlook.

Image Shown: Magellan Midstream’s pivot towards providing transportation services along its vast pipeline networks has significantly improved its cash flow profile. Image Source: Magellan Midstream – September 2021 IR Presentation

Concluding Thoughts

We continue to like Enterprise Products and Magellan Midstream in our High Yield Dividend Newsletter portfolio to gain exposure to the recovering global energy complex. Both companies, for midstream MLPs, have rock-sold financials and we expect both firms will continue making good on their generous payout obligations going forward.

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Tickerized for EPD, MMP, KMI, ET, PAA, ENB, CVX, AMLP, AMZA, RDS.A, RDS.B, USO, XLE, XOP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.