Member LoginDividend CushionValue Trap |

Oracle Beats Consensus Estimates and Raises Its Dividend By 33%

publication date: Mar 12, 2021

|

author/source: Callum Turcan

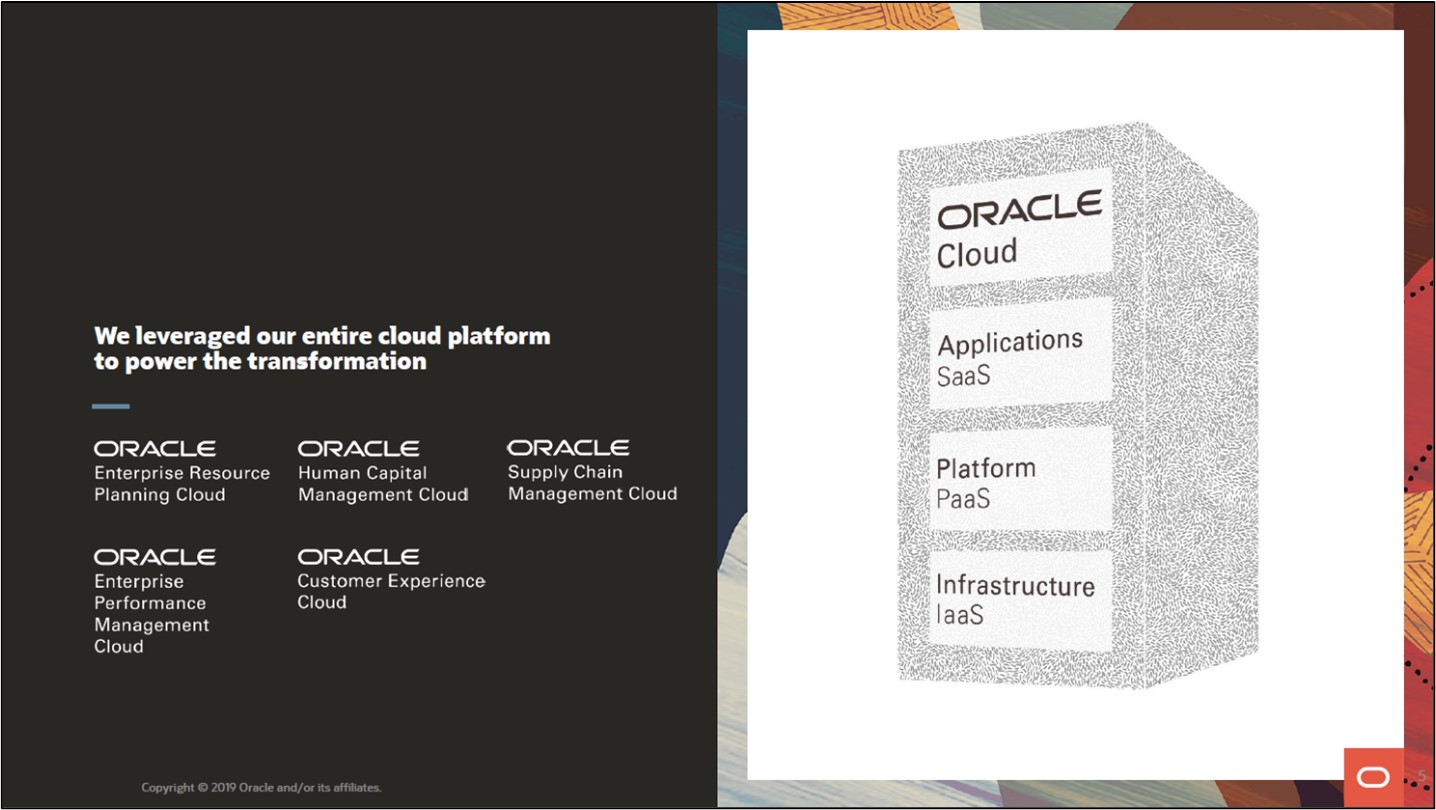

Image Source: Oracle Corporation – September 2019 Financial Analyst Meeting Presentation By Callum Turcan On March 10, Oracle Corporation (ORCL) reported third quarter earnings for fiscal 2021 (period ended February 28, 2021) that beat both consensus top- and bottom-line estimates. We include Oracle as an idea in the Dividend Growth Newsletter portfolio, and we are big fans of its impressive free cash flow generating abilities. The company’s Dividend Cushion ratio of 3.0 (a stellar ratio) earns Oracle an “EXCELLENT” Dividend Safety rating, and please note that these metrics incorporate our expectations that Oracle will push through meaningful payout increases over the coming fiscal years. We give Oracle an “EXCELLENT” Dividend Growth rating. In conjunction with its latest earnings report, Oracle boosted its quarterly dividend up to $0.32 per share, up 33% on a sequential basis. At the new payout level, shares of ORCL yield ~1.9% as of this writing. Management also recently increased Oracle’s share buyback authority by $20.0 billion. We continue to like exposure to Oracle in the Dividend Growth Newsletter portfolio and were impressed with the company’s latest earnings report and recent operational updates. Earnings Update On a GAAP basis, Oracle’s revenues were up 3% year-over-year in the fiscal third quarter with growth at its ‘cloud services and license support’ and ‘cloud license and on-premise license’ offsetting declines elsewhere. As we have noted in the past, Oracle is doing a solid job keeping a lid on its cost structure. In the fiscal third quarter, Oracle’s operating costs fell by 1% year-over-year, which combined with modest revenue growth allowed for nice operating margin expansion. Its GAAP operating margins were up over 240 basis points year-over-year and its GAAP operating income climbed higher by 10% year-over-year in the fiscal third quarter. Special items, namely a $2.3 billion net tax benefit due to the transfer of assets between certain subsidiaries, allowed for Oracle’s GAAP net income to surge higher by 95% year-over-year last fiscal quarter. Its diluted GAAP EPS more than doubled year-over-year in the fiscal third quarter, hitting $1.68, aided by Oracle’s strong underlying performance, the special tax item, and a sharp drop in its outstanding diluted share count (which was down more than 8% year-over-year). During the first nine months of fiscal 2021, Oracle generated $9.6 billion in free cash flow, up from $8.4 billion during the same period the prior fiscal year. Oracle’s CEO, Safra Catz, mentioned that “recurring revenue, as a percentage of total revenue now represents 72% of total company revenue and we anticipate this trend to continue as cloud services grow” during the firm’s latest earnings call which we appreciate. Recurring revenue streams provide for better cash flow profiles due to the highly visible nature of those sales. Oracle spent $2.4 billion covering its dividend obligations during the first nine months of fiscal 2021 and another $13.0 billion buying back its stock through its repurchase program. The company also spent another $0.6 billion on ‘shares repurchased for tax withholdings upon vesting of restricted stock-based awards’ though it raised $0.9 billion through common stock issuances during this period. Please note that a portion of Oracle’s share buybacks were partially funded by its balance sheet, which remains strong though there is room for improvement on this front. At the end of February 2021, Oracle had $35.9 billion in cash, cash equivalents, and marketable securities on hand versus $5.8 billion in short-term debt and $63.5 billion in long-term debt. We would like to see Oracle utilize its rock-solid cash flow profile to improve its balance sheet (i.e., reduce its net debt position), though this burden is manageable given Oracle’s strong cash flow profile and ample liquidity on hand. We are big fans of Oracle’s ability to generate sizable free cash flows in almost any environment. Over the past several fiscal quarters, Oracle’s free cash flow conversion rate (on a trailing twelve month basis) has been at or above 100% of its GAAP net income. Operational Update and Guidance In its latest earnings press release, Oracle noted that revenue at its cloud-based enterprise resource planning (‘ERP’) units Fusion Cloud ERP and NetSuite Cloud ERP were up 30% and 24%, respectively, last fiscal quarter on what appears to be a year-over-year basis. Oracle's Gen2 Cloud Infrastructure unit (includes the Autonomous Database component) posted over 100% revenue growth on what appears to be a year-over-year basis last fiscal quarter, highlighting the firm’s ability to continue growing one of its newer offerings. When Oracle’s Gen2 Cloud Infrastructure was launched back in 2018, the company touted the autonomous database component as being key to giving Oracle an edge over its competitors. The company has done a decent job growing its cloud-oriented businesses over the past few years as Oracle seeks to pivot away from its legacy businesses, though investors were apparently not impressed with its near-term guidance. Oracle provided guidance during its latest earnings call that calls for 5%-7% revenue growth in the fiscal fourth quarter on what appears to be a year-over-year basis, though that growth forecast includes a significant uplift from favorable foreign currency movements. The company noted that “cloud services and license support will grow faster than in Q3, as well as strategic back-office cloud applications” during the earnings call. Oracle aims to invest more towards businesses that are experiencing strong demand growth of late, and we view this strategy favorably. Should Oracle continue to grow its cloud-oriented operations at a decent clip going forward, that would go a long way to enhancing its cash flow growth outlook. Management noted these investments “will enable [Oracle] to continue to deliver double digit earnings growth, once again, in FY2022 for the fifth year in a row” during the firm’s latest earnings call. Here is additional management commentary concerning Oracle’s near-term forecasts: “As a result of the increased investment in the [current fiscal] quarter, non-GAAP EPS in USD is expected to grow 7% to 11% and be between a $1.28 and a $1.32 in USD. Non-GAAP EPS in constant currency is expected to be flat to up 4% and be between a $1.20 and a $1.24 in constant currency.” --- Safra Catz, CEO of Oracle Management noted that Oracle will significantly increase investments towards its Oracle Cloud Infrastructure (‘OCI’) business to better position the company to meet strong demand. During the earnings call, management noted: “[Oracle] experienced capacity constraints for OCI cloud services as customer workloads expanded dramatically. In addition, we continue to land many new customers, including ISVs [Independent Software Vendors], and we have some very large users coming online shortly that will require significant amounts of capacity. As a result, we're investing aggressively this quarter, this Q4, both OpEx and CapEx to prepare for this increase in cloud consumption and associated revenue in FY2022. As such, we are going to target a 49% operating margin for Q4.” --- CEO of Oracle The company’s growth outlook is bright. Oracle’s co-founder and CTO, Larry Ellison, noted within the earnings press release that Oracle continues to expand its presence geographically to meet demand. One recent move we found quite intriguing was the launch of Oracle Roving Edge Infrastructure in February 2021 which involves using portable and ruggedized server nodes to enable remote parts of the planet to utilize Oracle’s cloud-based offerings. Here is how a press release described this offering: Oracle Roving Edge Infrastructure delivers core infrastructure services, platform software, enterprise grade security, and applications to the edge and disconnected locations with Roving Edge Devices, ruggedized, portable, scalable server nodes. It enables customers to operate cloud applications and workloads in the field, including machine learning inference, real-time data integration and replication, augmented analytics, and query-intensive data warehouses. In addition, it delivers cloud computing and storage services at the edge of networks for government and enterprise organizations, enabling low-latency processing closer to the point of data generation and ingestion, which provides timely insights into data. Beyond expanding its geographical reach, Oracle has also been steadily rolling out material updates to its offerings. In January 2021, the firm announced that Oracle Database 21c was live. According to the press release “Oracle Database 21c contains more than 200 new innovations, including immutable blockchain tables, In-Database JavaScript, native JSON binary data type, AutoML for in-database machine learning (ML), and persistent memory store, as well as enhancements for in-memory, graph processing performance, sharding, multitenant, and security.” Another significant operational update involved Oracle developing a cloud-based National Electronic Health Records Database along with various management applications for health care needs, specifically to help combat the coronavirus (‘COVID-19’) pandemic. This IT infrastructure is marketed towards US public health agencies and health care providers, with an eye towards supporting vaccine-related activities among other things. In February 2021, Oracle announced that Northwell Health, a non-profit health care provider in New York state, was using Oracle’s IT offerings to meet patient needs during the COVID-19 pandemic. Northwell Health operates roughly two dozen hospitals and uses Oracle’s IT infrastructure to manage its nursing resources, staffing needs, and patient load. Concluding Thoughts Oracle does a tremendous job converting its GAAP net income into free cash flow, and its growth outlook is improving on the back of strong demand growth for its cloud-oriented operations. We continue to like exposure to Oracle in the Dividend Growth Newsletter portfolio. Vaccine distribution efforts should eventually enable public health authorities to contain the COVID-19 pandemic, something that should enable enterprises to resume major IT projects that were delayed by the COVID-19 pandemic, which in turn would support Oracle’s financial outlook. While shares of ORCL initially sold off after its latest earnings report, this latest update reinforces our optimistic view towards Oracle as a rock-solid income growth opportunity. When the dust settles, the market may begin to appreciate some of the understated positives in Oracle’s latest earnings report. Oracle's 16-page Stock Report (pdf) >> Oracle's Dividend Report (pdf) >> ----- Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI Related: NOW, CRM, HUBS, WDAY, WORK, DDOG Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment