Member LoginDividend CushionValue Trap |

Kroger Raises Guidance After Solid Earnings Report

publication date: Jun 22, 2021

|

author/source: Callum Turcan

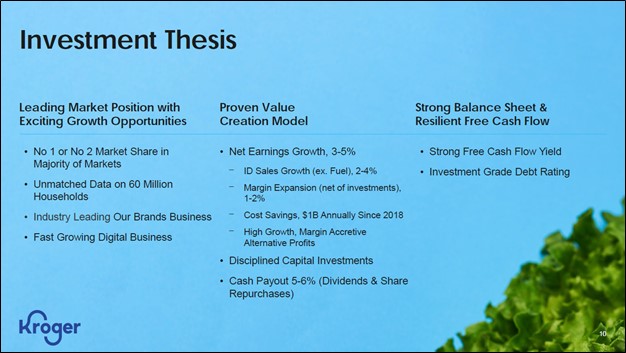

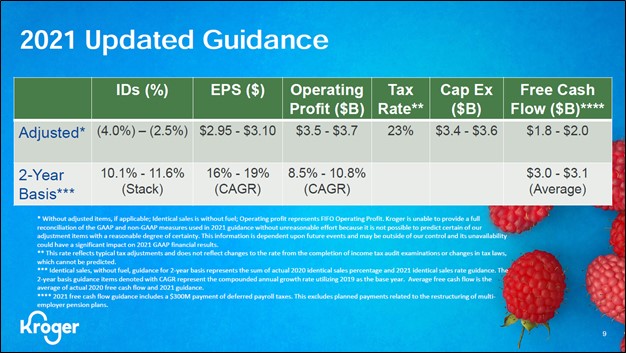

Image Source: Kroger Co – First Quarter of Fiscal 2021 IR Earnings Presentation By Callum Turcan Grocers are facing tough year-over-year comparisons due to the pantry stockpiling dynamic seen in 2020 in the wake of the coronavirus (‘COVID-19’) pandemic, though demand for consumer staples products remains healthy. On June 17, Kroger Co (KR) reported first quarter earnings for fiscal 2021 (period ended May 22, 2021) that beat both consensus top- and bottom-line estimates. Kroger’s management team also noted how the grocer views the current inflationary landscape, which we will cover in this note. Earnings Update and Guidance Boost Though Kroger’s same-store sales fell by 4.1% in the fiscal first quarter, on a two-year stack basis (the sum of its same-store sales growth in the first quarter of fiscal 2020 and fiscal 2021) its same-store sales were up 14.9%. Kroger’s digital sales were up 16% last fiscal quarter and more than doubled on a two-year stack basis. The company’s digital strategy is starting to bear fruit. Kroger boosted its full-year guidance for fiscal 2021 in conjunction with its latest earnings report. Now Kroger expects its same-store sales will decline by less-than-previously-forecasted this fiscal year, which in turn enabled Kroger to raise its full fiscal year guidance concerning its expected free cash flow, operating income, and EPS performance. Kroger’s capital expenditure budget was kept the same. The company’s guidance for fiscal 2021 is depicted in the upcoming graphic down below.

Image Shown: Kroger boosted its full-year guidance for fiscal 2021 during its latest earnings report. Image Source: Kroger – First Quarter of Fiscal 2021 IR Earnings Presentation Omni-channel selling capabilities are key to remaining relevant in the digital age as the ongoing proliferation of e-commerce has seen the sales of consumer staples and other products shift online, a trajectory that accelerated in the wake of COVID-19. Kroger opened two Kroger Delivery facilities, one in Florida and one in Ohio, in the fiscal first quarter to support these efforts. These facilities are powered by technology provided by Ocado Group PLC (OCDGF), which develops software, robotics, and automated systems for online retailing operations. Kroger’s first Ocado powered Kroger Delivery facility came online in the fiscal first quarter, and the firm plans to build out 20 of these facilities. We are intrigued by the potential upside these innovative facilities could generate over the long haul, though these are still early days. Kroger noted that it now offers pickup fulfillment services (buy online, pickup in-store) at over 2,200 locations and delivery fulfillment services at almost 2,500 locations, covering 98% of Kroger households, within its earnings press release. Due to Kroger’s momentum as it concerns its digital sales and strong free cash flow performance, the firm approved a new $1.0 billion share buyback program (announced in conjunction with its latest earnings report) after its previous program expired. Kroger’s net debt to adjusted EBITDA ratio stood at 1.79x after the fiscal first quarter, well below its long-term target of 2.30x-2.50x. While Kroger’s net debt load is sizable, the firm has ample liquidity to manage its near-term funding needs. In the fiscal first quarter, Kroger generated $1.4 billion in free cash flow and spent $0.1 billion covering its dividend obligations along with $0.4 billion buying back its stock. Kroger’s “alternative” businesses include its retail media segment, Kroger Precision Marketing, and its Kroger Personal Finance segment. Strong performance at these businesses enabled Kroger to post “record alternative profit business growth” in the fiscal first quarter. Kroger Precision Marketing works with 84.51, a subsidiary of Kroger, to provide advertising and marketing services with an emphasis on utilizing data and analytics to improve advertising campaigns (Kroger has plenty of in-house data on shopping trends and consumer habits). That includes solutions that involve advertising on Kroger properties as well as third-party properties. Kroger is not alone as it concerns building up an advertising business with Walmart Inc (WMT), Amazon Inc (AMZN) and others seeking to utilize their troves of data to create sizable new profit streams. Inflation Kroger’s management team was asked how the firm views the current situation regarding inflation and the ability to pass along price increases to consumers during the firm’s latest earnings call. Here is what Kroger had to say (emphasis added): “…Kroger has been able to successfully operate in high inflationary environments and low inflationary environments. If you look at the details of inflation during the quarter, if you look in the fresh departments, inflation has continued to increase during the quarter. Part of that is driven because of -- if you look at it, a lot of supply disruptions a year ago because of COVID. So, it’s going to be hard to tell, but we would expect overall to be able to successfully operate in whatever the environment is, and we would expect to be able to pass those costs to customers as you look at things that are permanent in nature. The other thing I think it’s always important to remind each of us, including our internal team is if you look, typically, our business operates the best when inflation is about 3% to 4%, and we have a meaningful amount of fixed costs. And when inflation is at 3% to 4%, that gives you leverage on those costs, and the inflation at 3% to 4%, customers don’t overly react to that inflationary environment either.” --- Rodney McMullen, CEO of Kroger Additionally, Kroger’s management team went on to highlight how the firm’s private-label brands can in some ways benefit from inflation, particularly when Kroger owns the manufacturing facilities. Management recently noted that when price increases are “not driven by true cost changes” Kroger’s private-label brands can “gain significant share at the expense of some of those national brand players.” The company is keeping an eye on inflation regarding produce and meat prices. As an aside, Kroger’s management team noted that the firm was having some problems filling open roles, though a recent hybrid hiring event yielded favorable results. Concluding Thoughts In our view, Kroger’s latest earnings update highlights the ongoing strength of the US consumer and that certain trends, which accelerated during the COVID-19 pandemic, are here to stay. Those trends include households cooking at home more often and consumers utilizing e-commerce platforms (supported by home delivery and order online, pickup in-store fulfillment options) to meet their grocery needs on a consistent basis. We are not interested in adding Kroger as an idea to any of the newsletter portfolios at this time. Shares of KR yield ~1.9% as of this writing, though we caution that Kroger’s large net debt load and competing capital allocation priorities (such as its share repurchases) limit its ability to grow its payout. The company’s cash flow profile is quite stable, and its outlook is improving, but it operates in an incredibly competitive market. As firms like Amazon are beginning to disrupt the pharmacy industry, Kroger is now facing even greater headwinds. ----- Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT Tickerized for WMT, TGT, COST, AMZN, KR, ACI, SFM, CHEF, USFD, SYY, UNFI, GO, WMK, VLGEA, IMKTA, SEGR, OCDGF, VDC Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment