Member LoginDividend CushionValue Trap |

Korn Ferry Is Ridiculously Underpriced, A Huge Market Inefficiency Exposed

publication date: Dec 23, 2020

|

author/source: Callum Turcan

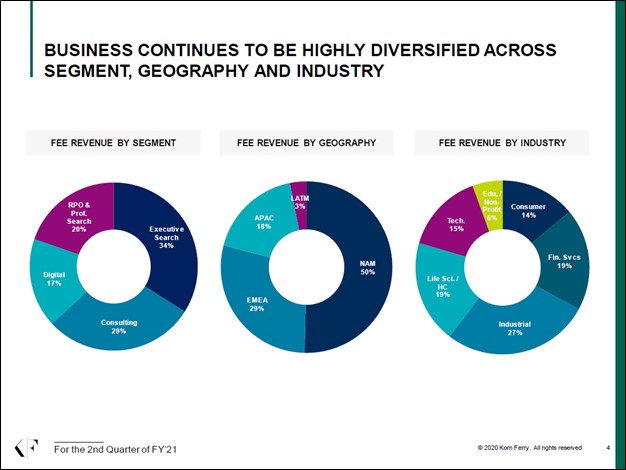

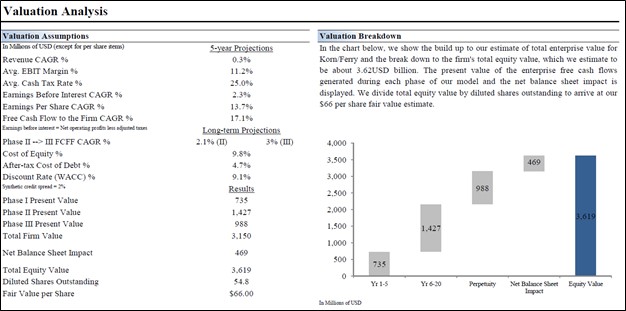

Image Shown: Korn Ferry has meaningful global reach and caters to a wide variety of end industries. Image Source: Korn Ferry – Second Quarter of Fiscal 2021 IR Earnings Presentation By Callum Turcan Korn Ferry (KFY) is a global organizational consulting firm that provides recruiting solutions, research offerings, various consulting services and other solutions to a wide array of industries. The firm has meaningful global reach. By investing in its digital capabilities and talent acquisition (growing its highly-skilled workforce) while expanding its worldwide footprint, Korn Ferry aims to differentiate itself from its peers including Ernst & Young, McKinsey, Willis Towers Watson PLC (WLTW) and Deloitte. We see Korn Ferry as having substantial capital appreciation upside as our fair value estimate of $66 per share of KFY is well above where shares are trading as of this writing (currently KFY is trading in the mid-$40s). Additionally, shares of KFY yield ~0.9%, and the firm offers incremental dividend growth upside as well. The company is highly-rated on the Valuentum Buying Index, with a rating of 9 (as of December 23, 2020). Improving Outlook During the first half of fiscal 2021 (period ended October 31, 2020), Korn Ferry’s financials took a beating due to headwinds created by the coronavirus (‘COVID-19’) pandemic. However, Korn Ferry’s outlook has become significantly brighter of late. COVID-19 vaccines are currently being distributed in the US and elsewhere, which should help global health authorities bring the pandemic under control sooner than previously expected. Korn Ferry did not provide full-year guidance for fiscal 2021 during its latest earnings report, but shares of KFY have moved sharply higher over the past few months as the market views the firm’s outlook as one that is improving. More likely, however, is that the market is working to "correct" a substantial mispricing in shares. Our fair value estimate is bolstered by the company's strong financials, which we'll dig into. Strong Balance Sheet At the end of the second quarter of fiscal 2021, Korn Ferry had $353 million in net cash on hand (inclusive of non-current marketable securities) with no short-term debt on the books. The firm’s pristine balance sheet has been an immense source of strength during these turbulent times and highlights one of the reasons why we like the name. Korn Ferry had $219 million in operating lease liabilities (short- and long-term combined) on the books at the end of October 2020, though even when adjusting the firm’s total debt load to include operating lease liabilities, Korn Ferry’s financial position remains rock-solid. Strong Normalized Free Cash Flow Generation Korn Ferry’s cash flow performance during the first half of fiscal 2021 hasn't been representative of the company's normalized free cash flow generating capacity, and along with risks related to COVID-19, this might be why the market has punished shares unfairly (the firm generated $92 million in negative net operating cash flows during this period). Historically, however, the firm has realized large working capital builds during the first half of its fiscal year, which is then drawn down during the second half of its fiscal year. Using fiscal 2020 (period ended April 30, 2020) as an example, Korn Ferry generated $104 million in negative net operating cash flow during the first half of the fiscal year, though it generated $236 million in positive net operating cash flow for the full fiscal year. Similar story in fiscal 2019 (period ended April 30, 2019), when Korn Ferry generated $32 million in negative net operating cash flow during the first half of the fiscal year, though for the full fiscal year, the firm posted $259 million in positive net operating cash flow. Korn Ferry’s negative net operating cash flows during the first half of fiscal 2021 are consistent with this trend, and we expect that the company should be able to generate meaningful positive net operating cash flows during the second half of this fiscal year. Given that Korn Ferry’s capital-expenditure requirements to maintain a certain level of revenues are relatively modest, the company has historically been comfortably free cash flow positive on an annual basis. The company generated $195 million in free cash flow in fiscal 2020 and spent $25 million covering its dividend obligations to shareholders and noncontrolling interests during this period. Korn Ferry also spent $92 million buying back its stock in fiscal 2020. Valuation Analysis Through our discounted free cash flow analysis (enterprise valuation) process, we assign a fair value estimate of $66 per share of Korn Ferry under our “base” case scenario. Note that the key valuation assumptions used in our cash flow model to arrive at our fair value estimate of Korn Ferry assume it only grows modestly, relatively speaking, in the coming years, meaning Korn Ferry doesn't have to do much but hold the line for shares to be considered ridiculously underpriced, in our view. For example, we're modeling in just 0.3% compound annual revenue growth over the next five years, which we think is easily achievable. Our assumptions for earnings before interest growth are also modest over this time period (a 2.3% CAGR over the next five years). EPS growth is targeted at a ~13.7% 5-year CAGR, a pace that is augmented by share repurchases, which have been common in recent years. Korn Ferry's buyback program should be viewed positively in light of its valuation mispricing. Should Korn Ferry outperform these assumptions, the high end of our fair value estimate range sits at $79 per share of Korn Ferry. We're talking about substantial valuation upside potential on the basis of very reasonable and achievable assumptions, given that the company is trading in the mid-$40s at the time of this writing.

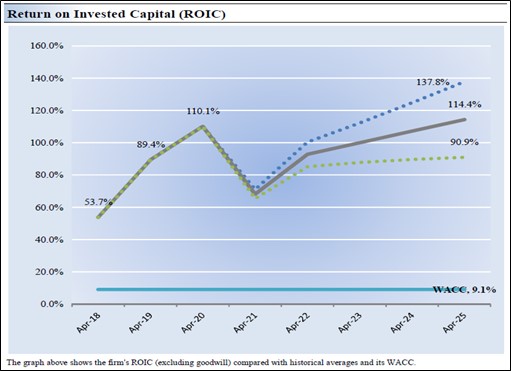

Image Shown: Under our “base” case scenario, Korn Ferry has a fair value estimate of $66 per share. Historically, Korn Ferry has done a tremendous job generating shareholder value (ROIC ex-goodwill > estimated WACC), and we expect that to continue being the case going forward (forecasted ROIC ex-goodwill > estimated WACC) as one can see in the upcoming graphic down below. While the company’s forecasted ROIC ex-goodwill is expected to take a hit in fiscal 2021, we expect the company’s performance on this front to quickly bounce back. Korn Ferry has a “VERY ATTRACTIVE” Economic Castle rating and is generating strong economic profits for shareholders, in part because of its capital-light business model and strong annual free cash flow performance.

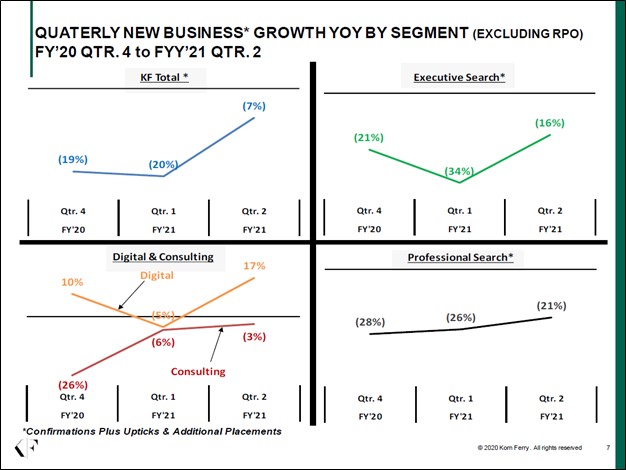

Image Shown: We forecast that Korn Ferry will continue to generate substantial shareholder value going forward, seen through the large cumulative difference between its estimated WACC and its forecasted ROIC ex-goodwill over the next five full fiscal years. Management Commentary During Korn Ferry’s second quarter of fiscal 2021 earnings call, management noted that its subscription-based revenues advanced both on a year-over-year and sequential basis. Though it's a relatively modest portion of its business at the moment, management sees this part of Korn Ferry’s operations as well-positioned to grow going forward. Rising subscription-based revenues would further enhance the company’s cash flow profile given the greater visibility provided by recurring revenues. Growing subscriptions to its digital offerings is key, and Korn Ferry has made expanding and improving its portfolio of digital talent acquisition solutions a priority.

Image Shown: Korn Ferry’s digitally-oriented solutions business has posted strong performance of late. This performance is made even more impressive considering the company has faced significant headwinds due to the COVID-19 pandemic. Image Source: Korn Ferry – Second Quarter of Fiscal 2021 IR Earnings Presentation On a company-wide basis, management highlighted the sequential improvement in the company’s revenue during its fiscal second quarter earnings call while noting Korn Ferry’s non-GAAP adjusted EBITDA performance was holding up well. Please note that November and December are seasonally slow months for Korn Ferry due to this period covering the holiday season. As enterprises slowly return to pre-pandemic activities, assisted by the widespread distribution of COVID-19 vaccines, Korn Ferry’s financial performance should continue to rebound over the medium-term. However, the pace of this recovery will likely be uneven as global health authorities work to contain flareups of the COVID-19 pandemic. Concluding Thoughts Korn Ferry scores a strong VBI rating of 9, and we are keeping a close eye on the stock given that its stock price is rebounding (strong technical performance of late) and considering shares of KFY are trading well below a very reasonably-derived fair value estimate. As of this writing, shares of KFY are even trading below the lowest bound of our fair value estimate range (which sits at $53 per share), indicating that Korn Ferry is ridiculously undervalued based on our systematic valuation processes. Korn Ferry is a company that investors seeking capital appreciation upside should keep on their radar, and it may make it into the Best Ideas Newsletter portfolio sooner than later. Korn Ferry’s 16-Page Stock Report (pdf) >> ----- Consulting, Staffing, and/or Employment Services Related: HSII, KFRC, KFY, NSP, RHI, WLTW Also related: BAH, CXW, CRAI, FCN, G, HURN, RGP, JOBS, DLX, EFX, MAN, PAYX ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment