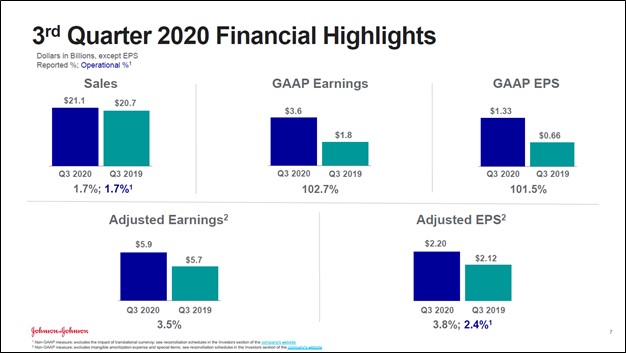

Image Shown: An overview of Johnson & Johnson’s financial performance during the third quarter of fiscal 2020. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2020 IR Earnings Presentation

By Callum Turcan

On October 13, Johnson & Johnson (JNJ) reported third quarter fiscal 2020 earnings (period ended September 27, 2020) that beat consensus non-GAAP EPS estimates and consensus GAAP revenue estimates, though its GAAP EPS fell short of consensus estimates likely due to turbulence created by the ongoing coronavirus (‘COVID-19’) pandemic. Johnson & Johnson’s GAAP revenues were up 2% year-over-year last fiscal quarter while its GAAP gross margin stayed broadly flat at 66.9%. A sharp reduction in other expenses resulted in Johnson & Johnson’s GAAP net income more than doubling year-over-year in the fiscal third quarter.

The company once again raised its full-year guidance for fiscal 2020 (boosting both its top- and bottom-line forecasts) during its latest earnings report, just as it did back during its fiscal second quarter earnings report (which we covered in detail here). Stronger than expected performance at Johnson & Johnson’s ‘Medical Devices’ business operating segment was largely responsible for the guidance increase according to management commentary during the firm’s latest earnings call. We continue to include shares of Johnson & Johnson in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

Image Shown: Johnson & Johnson raised its full-year guidance for fiscal 2020 during its latest earnings report. Image Source: Johnson & Johnson – 8-K SEC filing covering the third quarter of fiscal 2020

Quarterly Overview

Johnson & Johnson reported decent sales growth on a year-over-year basis at its ‘Consumer Health’ and ‘Pharmaceutical’ business operating segments last fiscal quarter. Its Consumer Health segment was supported by strong growth at its ‘OTC’ unit as its Tylenol offering gained market share and at its ‘Oral Care’ unit as Johnson & Johnson launched new Listerine products in the Asia-Pacific region. Johnson & Johnson continues to push forward with its Consumer Health SKU (stock keeping unit) rationalization program which management expects will improve the company’s margins over time.

Its Pharmaceutical segment was supported by strong growth at its ‘Oncology’ unit as Johnson & Johnson reported its DARZALEX drug sold well, which is used to treat multiple myeloma in adult patients. More broadly, many of Johnson & Johnson’s core pharmaceutical offerings have sold very well of late. During Johnson & Johnson’s latest earnings call, management mentioned that (emphasis added):

“…our Pharmaceuticals business grew 4.6% operationally in the third quarter, and we delivered our 10th consecutive quarter with sales that exceeded $10 billion and our second quarter with sales exceeding $11 billion. 7 of our key brands grew at double-digit rates, including our oncology brands, ERLEADA, DARZALEX and IMBRUVICA; our immunology brands, STELARA and TREMFYA; and our pulmonary hypertension brands OPSUMIT and UPTRAVI. And despite the pressures that COVID-19 placed on our business, our growth year-to-date is roughly 6%, definitely above market growth.” — Jennifer Taubert, Executive Vice President, Worldwide Chairwomen, Pharmaceuticals at Johnson & Johnson

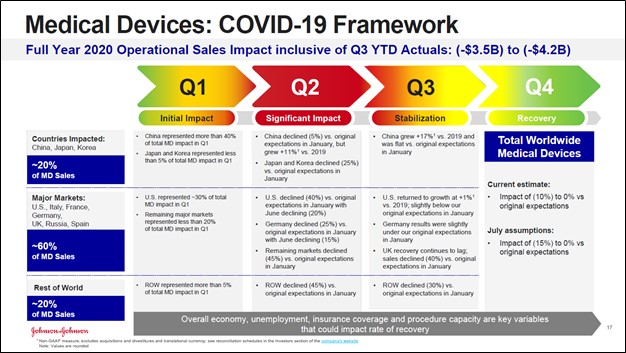

As it concerns Johnson & Johnson’s Medical Devices segment, that segment continued to face significant headwinds from delayed elective surgeries due to the COVID-19 pandemic. However, management noted that its outlook on this front was improving supported by strong performance in the US and China last fiscal quarter, though its performance in Germany and the UK continued to be a drag. When a COVID-19 vaccine that is both safe and effective is discovered, and we are confident such a vaccine will be discovered (though nothing is for certain), Johnson & Johnson’s Medical Devices segment should experience a strong rebound, especially as delayed elective surgeries resume in earnest in Western Europe.

Image Shown: Johnson & Johnson’s Medical Devices segment was hit hard by delayed elective surgeries due to the COVID-19 pandemic, especially in Western Europe, though things are beginning to improve especially in China and the US. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2020 IR Earnings Presentation

Please note that Johnson & Johnson has historically not released its 10-Q SEC filing concurrently with its earnings report. The company provided an update on its balance sheet position as of the end of the fiscal third quarter, noting that its net debt position (apparently inclusive of short-term debt) had shrunk to $7.0 billion at the end of the fiscal third quarter from $11.3 billion at the end of the fiscal second quarter (period ended June 28, 2020).

We appreciate that Johnson & Johnson apparently reduced its net debt load and apparently remained very free cash flow positive in the fiscal third quarter, which helped the firm fund a key acquisition that closed early on in the fiscal fourth quarter (we will cover that in just a moment). In August, Johnson & Johnson also tapped debt markets at attractive rates to help fund that deal. According to management, Johnson & Johnson generated $13.0 billion in free cash flow during the first three quarters of fiscal 2020.

Image Shown: According to management, Johnson & Johnson remained very free cash flow positive last fiscal quarter. Management used those free cash flows to cover the firm’s dividend obligations, invest in R&D activities, and reduce the company’s net debt load ahead of a key acquisition which we really appreciate. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2020 IR Earnings Presentation

Looking Ahead

Management intends to place a greater focus on e-commerce/digital operations and health/hygiene-focused products going forward, particularly as it concerns its Consumer Health segment. As noted previously, Johnson & Johnson is expecting that a recovery in elective medical procedures will underpin a turnaround at its Medical Devices segment next fiscal year. Its Pharmaceutical segment should benefit over the long haul from its $6.5 billion acquisition of Momenta Pharmaceuticals which closed on October 1, as that deal gave Johnson & Johnson access to nipocalimab (a therapeutic candidate currently undergoing clinical trials that seeks to treat immune-mediated diseases). We covered that acquisition in detail here.

Image Shown: An overview of Johnson & Johnson’s strategy for fiscal 2021. Image Source: Johnson & Johnson – Third Quarter of Fiscal 2020 IR Earnings Presentation

COVID-19 Vaccine Candidate Update

On a side note, Johnson & Johnson recently suspended its Phase 3 clinical trials for its COVID-19 vaccine candidate reportedly due to an unexplained illness experience at one of its volunteers. The clinical trial was suspended out of an abundance of caution, and there is reason to believe that the clinical trial will resume once the situation has been properly examined. Here is what management had to say during Johnson & Johnson’s latest earnings call (lightly edited, emphasis added):

“First, some context. It’s not at all unusual for unexpected illnesses that occur in large studies over their duration. In some cases, they’re called serious adverse events or SAEs, and may have something or nothing to do with the drug or vaccine being investigated. However, as a company that always puts safety first, we take each and every case seriously…

First, preliminary information is sent to an independent data and safety monitoring board or DSMB. DSMB, as you know, are very commonly part of trials in the pharmaceutical industry. This board is comprised of outside experts who evaluate the information and then make a recommendation to us.

In our case here, we were informed of an unexpected illness on Sunday evening October 11, and we followed our process exactly and quickly and posted a statement on our website the following day on Monday, October 12 pausing enrollment.The DSMB was informed immediately on Sunday, and they’ve requested additional information. We’re now awaiting further medical information and evaluation, which we will then forward to the DSMB for their independent recommendation.” — Mathai Mammen, Global Head of Janssen Research and Development (which is Johnson & Johnson’s main pharmaceutical subsidiary)

Please note that we do not expect Johnson & Johnson will generate needle-moving revenues or profits from its COVID-19 vaccine candidate given that the vaccine is expected to be sold on a not-for-profit basis (as statement explicitly by management), though discovering such a vaccine would earn the firm goodwill worldwide. Here is another key comment from management during Johnson & Johnson’s latest earnings call (emphasis added):

“Our team continues to be hard at work pursuing a vaccine candidate to help combat the COVID-19 pandemic, and we are proud of the progress that has been made thus far. On September 23, we announced that the first participants were dosed in our pivotal multi-country Phase 3 trial ENSEMBLE, which will evaluate a single dose of our COVID-19 vaccine candidate in up to 60,000 people worldwide, including representation from high-risk populations and underrepresented communities. This follows positive interim results from our Phase 1/2a study, which showed the safety profile and immunogenicity after a single vaccination with our candidates supported for the development.

These findings demonstrated that a single dose resulted in immunogenicity in all age groups with similar responses, including older adults. A single dose of a safe and effective vaccine could offer a significant advantage during a global pandemic. We also appreciate that a 2-dose regimen may have the potential for enhanced durability in some participants. Therefore, we plan to run a Phase 3 clinical trial with a 2-dose regimen beginning later this year.

Simultaneously, we have scaled up manufacturing capacity and are on track to meet our goal of providing over 1 billion doses of a vaccine per year. We have committed to the public to provide the vaccine once approved on a not-for-profit basis for emergency pandemic use.” — Joe Wolk, Executive Vice President and Chief Financial Officer for Johnson & Johnson

Concluding Thoughts

We continue to be big fans of Johnson & Johnson and shares of JNJ offer investors a combination of capital appreciation and income generation upside, in our view. Shares of JNJ yield ~2.7% as of this writing. The company increased its quarterly dividend back in April 2020, highlighting management’s confidence in Johnson & Johnson’s free cash flow generating abilities even when facing significant exogenous headwinds. In the near-term, we await the resumption of the clinical trials regarding Johnson & Johnson’s COVID-19 vaccine candidate.

—–

Medical Devices Industry – EW ISRG MDT VAR WAT ZBH

Health Care Services Industry – DVA EHC HCA UNH UHS

Pharmaceuticals (Big) Industry – ABT ABBV AMGN AZN BMY LLY GSK MRK NVS NVO PFE SNY

Pharmaceuticals (Biotech/Generic) Industry – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS

Household Products Industry – CHD CLX CL ENR HELE JNJ KMB PG

Related: XLV, STT, MNK, ENDP, CAH, MCK, ABC, WMT, RAD, CVS, IBB, MCO, CSLLY, MNTA

Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE, SFOSF, SPY, CTLT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Health Care Select Sector SPDR ETF (XLV) and Johnson & Johnson (JNJ) are both included in Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.