Image Source: J&J

By Brian Nelson, CFA

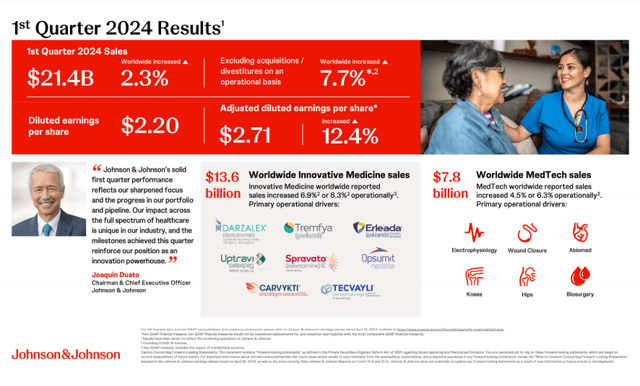

Johnson & Johnson (JNJ) reported mixed first-quarter 2024 results on April 16 with adjusted operational growth of 4%. Excluding its COVID-19 vaccine sales, revenue growth was 7.7% in the period. First quarter adjusted earnings per share advanced 12.4%, to $2.71, which was slightly better than the consensus forecast. Management was upbeat in the press release:

Johnson & Johnson’s solid first quarter performance reflects our sharpened focus and the progress in our portfolio and pipeline. Our impact across the full spectrum of healthcare is unique in our industry, and the milestones achieved this quarter reinforce our position as an innovation powerhouse.

J&J’s adjusted operational sales for its Innovative Medicine division increased 2.5%, while adjusted operational sales increased 6.5% in its MedTech division. Excluding COVID-19 related revenue, its Innovative Medicine division experienced sales growth of 8.3%. Management pointed to growth in DARZALEX, ERLEADA, CARVYKTI, TECVAYLI, UPTRAVI, OPSUMIT, TREMFYA, and SPRAVATO. The company also noted that electrophysiology products and Abiomed (cardiovascular) helped drive MedTech sales higher.

Image Source: J&J

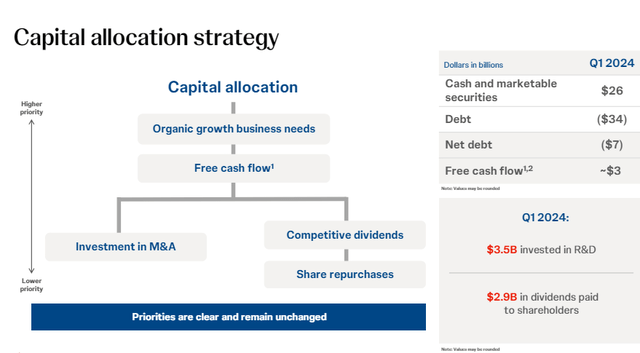

Looking to 2024, J&J expects adjusted operational sales growth in the range of 5.5%-6%, the midpoint of which is up from the prior range of 5%-6%. Adjusted operational diluted earnings per share is targeted in the range of $10.60-$10.75 per share, the midpoint also up from the range of $10.55-$10.75 previously. Management also upped its dividend 4.2%, to a quarterly payout of $1.24 per share, implying a forward estimated dividend yield of 3.4%. We like J&J, but we won’t be adding it back to any newsletter portfolio anytime soon.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.