Member LoginDividend CushionValue Trap |

ICE’s Purchase of Ellie Mae Gives Us Pause

publication date: Nov 12, 2020

|

author/source: Brian Nelson, CFA

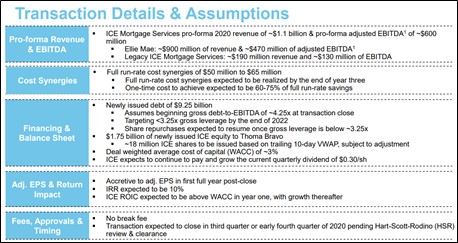

Image Source: IntercontinentalExchage Intercontinental Exchange’s acquisitive behavior and weakening balance sheet have given us pause. The company may have bitten off more than it can chew with its $11 billion cash and stock acquisition of Ellie Mae, a cloud-based provider in mortgage finance, and we question its new debt-funded strategic direction, which takes it further from its core bread-and-butter operations we liked so much. By Brian Nelson, CFA The exchanges industry consists of firms that deliver trading, clearing, exchange technology, and regulatory securities listing. Industry constituents include the NASDAQ (NDAQ), Chicago Board Options Exchange (CBOE), and the Chicago Mercantile Exchange (CME), among others. These firms carve out competitive advantages via scale (operating the largest market for a given financial instrument) and via technological superiority (transaction speeds and reliability). We like the industry’s structure a lot, and Intercontinental Exchange (ICE) has historically been one of our favorites. For those that may not be familiar with the company, Intercontinental Exchange is a leading operator of regulated global markets and clearing houses, including futures exchanges, over-the-counter markets, derivatives clearing houses and post-trade services. It holds interests in a variety of entities, including the Options Clearing Corp, and the company’s business generally breaks down into two reporting segments, both of which have been performing quite well in recent years: ‘Trading and Clearing’ and ‘Data and Listings.' The majority of its revenue in its ‘Trading and Clearing’ segment comes from collecting fees from trading and clearing services for futures and options in energy, agricultural, metals, financials, and fixed income/credit, as well as cash equities and options. Its ‘Data and Listing’ segment provides data and listing services such as pricing, analytics, and connectivity services, among other solutions. This segment may be its most attractive, as that part of its operation’s revenue model is mostly subscription-based and recurring in nature. In this division, the company has put up 43 consecutive quarters of year-over-year revenue growth. More recently, Intercontinental Exchange expanded into the mortgage services market with its full acquisitions of MERS (2018) and Simplifile (2019), and then further increased its exposure to this area with its September 2020 buyout of Ellie Mae, a cloud-based platform serving the mortgage finance industry. We’re not entirely excited about ICE’s new strategic direction, as it adds layers of integration and execution risk to its business model, not to mention the inherent risks in mortgage finance given the lessons of the Great Financial Crisis of 2007-2009. We think ICE’s buying of Ellie Mae could turn into an unforced error, and it paid a pretty penny for it, too (about 12x revenue). With that said, Intercontinental Exchange does have a good track record, and it has put up impressive GAAP operating margins consistently north of 50% in recent years. We also like the company’s free cash flow generating capacity. During its last fiscal year (2019), for example, the company hauled in $2.5 billion in traditional free cash flow, covering dividends paid of ~$621 million nearly 4x during the year, while revealing a remarkable free cash flow margin of ~48%. However, in light of its acquisition frenzy and move to acquire Ellie Mae, Intercontinental Exchange now has a meaningful leverage position, with $16.7 billion in net debt (inclusive of short-term debt) and an adjusted debt-to-EBITDA measure of 4.2x at the end of the third quarter of 2020. Concluding Thoughts Intercontinental Exchange has been a fantastic stock, up more than 330% during the past 10 years on a price-only basis. However, the company’s new strategic direction in the mortgage arena and newly-leveraged balance sheet make what was once a “clean” story far too convoluted, in our view. With so many other net cash rich, free-cash-flow generating powerhouses tied to strong secular tailwinds to choose from on the markets, ICE just doesn’t make the cut for inclusion in the newsletter portfolios at this time. We’re still keeping a very close eye on the name, however. --- Related: TW, RPAY, VIRT, AMTD, EQIX, SCHW, ETFC, IBKR, ELLI Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment