This note was emailed to members August 19. Alert >>

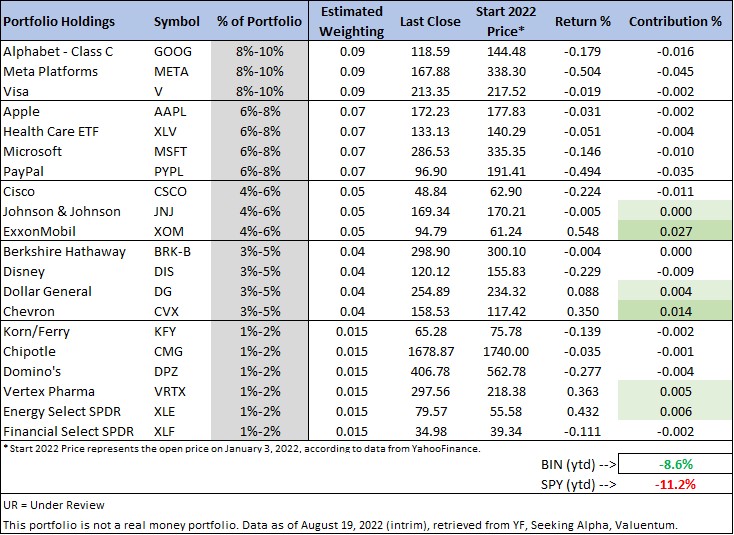

Image Shown: We are very happy with the overall “performance” of the simulated Best Ideas Newsletter portfolio, which is carving out 2.6 percentage points of relative outperformance so far in 2022 on a price-only basis, as shown in the table above. However, we’re making some big changes to the simulated newsletter portfolio today on some of our favorite names. Our best ideas continue to be in the simulated Best Ideas Newsletter portfolio, the simulated Dividend Growth Newsletter portfolio, the simulated High Yield Dividend Newsletter portfolio, the ESG Newsletter portfolio, and the Exclusive publication, as well as with our additional options commentary.

“So when it comes to using data, you can think of it that it’s not really apples-to-apples for us. And as a result, we believe Google Search ad business could have benefited relative to services like ours is based a different set of restrictions from Apple. And given that Apple continues to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue.” — Meta Platforms’ CFO David Wehner, February 2022

Summary of the Changes

PYPL: 6%-8% –> 0% (removed)

META: 8%-10% –> 3%-5% (trimmed)

GOOG: 8%-10% –> 10%-12% (increased)

V: 8%-10% –> 10%-12% (increased)

Cash: +8%-10% (approximate)

Hi everyone!

We’re making some big moves in the simulated Best Ideas Newsletter portfolio today! At the moment, the simulated Best Ideas Newsletter portfolio is carving out about 2.6 percentage points of relative outperformance so far in 2022, on a price-only basis relative to the SPDR S&P 500 Trust ETF (SPY). Overall, after some huge years, the simulated Best Ideas Newsletter portfolio is down a modest ~8.6% in 2022, by our estimates. Pretty good, all things considered.

That said, the SPDR S&P 500 Trust ETF has bounced right off its 200-day moving average (technical resistance), and we’re not going to sit by while the risks to the market this year increase. We remain bullish on stocks for the long haul, of course, but we think incremental alpha may be generated by removing/trimming/adding to some of our winners in the simulated Best Ideas Newsletter portfolio at this time. We’re changing our mind on a couple things, too, as any good investor does.

First, we’re removing PayPal (PYPL). The stock has simply been a darling since we inherited it from the eBay (EBAY) spin-off in 2015, with the stock up nearly 160% since that time, besting the SPY’s return by roughly 50 percentage points on a price-only basis, according to data from Morningstar. Things have been tough for PayPal since the middle of last year, however, and we’re more than disappointed by its fundamental performance and share-price action since then.

Consistent with the Valuentum methodology, we should have removed PayPal from the portfolio when it first started to break down in late 2021, but we liked and still like its long-term story and exposure to the payments space. It wasn’t until we re-evaluated PayPal’s long-term top-line and operating-margin potential following its recent quarterly disappointments, where challenges to our thesis on the firm started to arise.

PayPal became a “show-me” story several months ago as we had outlined in its latest stock report (pdf), and there’s a decent probability our future assumptions may still be optimistic. We’re removing the entire position of PayPal in the simulated Best Ideas Newsletter portfolio. We’re not happy about PayPal’s recent performance, but we’re not going to continue to “hope” for a turnaround in a very difficult market, a turnaround that may not fully materialize in the ways we would have liked.

Second, we’re reducing our position in long-time favorite Meta Platforms (META). We still love the company over the long haul, but there seems to be a “perfect storm” against the company right now. Almost everyone hates the stock, and while this may present opportunity, the sentiment, in our view, has started to impact the fundamentals of Meta’s business, and to us, that’s just not good. We’re also not too pleased with Meta raising debt, as we remain extremely debt averse when it comes to our very best ideas.

We’re still retaining Meta Platforms as one of our long-term favorite ideas, but we’re reducing the position to a 3%-5% “holding” in the simulated Best Ideas Newsletter portfolio from an 8%-10% one prior. We first added Facebook (now Meta Platforms) to the simulated Best Ideas Newsletter portfolio back in January 2016 at $112.10 per share, but its recent performance has been absolutely abysmal, and we’re far from happy about the market’s punishing of shares since they topped $380 per share in August of last year.

Absorbing some of the new cash “raised” from removing PayPal and trimming Meta Platforms is Alphabet. We’ve viewed our position on Meta Platforms and Alphabet as ‘combined exposure’ to online advertising trends, but we’re now tilting more toward Alphabet for continued heavy exposure to a very attractive trend. For starters, Alphabet is doing absolutely fantastic, “Shares of Best Idea Alphabet Remain Incredibly Undervalued,” doesn’t have “hair” like Meta Platforms, and isn’t exposed to the Apple (AAPL) privacy limitations as that of Facebook, which we talk about later in this note.

Image: Shares of Alphabet have more than doubled since it registered a 10 rating on the Valuentum Buying Index (VBI) in January 2019. Alphabet remains one of our top ideas. On a split-adjusted basis, Alphabet is trading at nearly $2,400 per share.

In hindsight and consistent with the Valuentum methodology, we should have made the move to trim Meta Platforms and add to Alphabet following Facebook’s fourth-quarter report, released in February 2022, but we liked and still like Meta Platforms’ long-term story. We can’t look back on PayPal and Meta Platforms, and we’re pushing forward. As mentioned earlier and further supporting the move to Alphabet, here’s how Alphabet’s Google isn’t as adversely impacted by Apple’s iOS14 changes, unlike Facebook, through the words of CFO David Wehner on Facebook’s fourth-quarter 2021 conference call:

“On iOS 14, we saw the revenue impact with iOS 14 — sorry, iOS just in general, in Q4, and that was in line with our expectations and similar to the Q3 headwind. But obviously, as we go into 2022, we’re going to be lapping a period in which in Q1 and Q2, those headwinds were not in place in the year ago period. So that definitely makes for a tough comp in the first half of the year. And we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind for our business…

And we’re seeing that impact in a number of verticals. E-commerce was an area where we saw a meaningful slowdown in growth in Q4. And similarly, we’ve seen other areas like gaming to be challenged. But on e-commerce, it’s quite noticeable — notable that Google called out, seeing strength in that very same vertical. And so given that we know that e-commerce is one of the most impacted verticals from iOS restrictions, it makes sense that those restrictions are probably part of the explanation for the difference between what they were seeing and what we were seeing…

And if you look at it, we believe those restrictions from Apple are designed in a way that carves out browsers from the tracking prompts Apple requires for apps. And so what that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours…

So when it comes to using data, you can think of it that it’s not really apples-to-apples for us. And as a result, we believe Google Search ad business could have benefited relative to services like ours is based a different set of restrictions from Apple. And given that Apple continue to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue.”

With Alphabet absorbing some of the new “cash” to retain solid exposure to secular online advertising trends without as much of the “hair” as Facebook, we’re similarly increasing our “exposure” to Visa (V) to absorb the “removal” of PayPal from the simulated Best Ideas Newsletter portfolio. This will help us retain solid exposure to e-commerce and stay ahead of the secular trend toward a cashless society.

Though we are apologetic for not doing as best we could with Meta Platforms and PayPal the past year or so, we know everyone understands that we view our methodology within a portfolio context, and the simulated Best Ideas Newsletter has done fantastic for years, even now carving out “relative outperformance” in 2022, despite weakness from Meta Platforms and PayPal. It’s great to see the methodology working, even as these high-profile names have worked against us so far this year.

The changes today should leave the simulated Best Ideas Newsletter portfolio with roughly an 8%-10% cash “weighting” as we expect the market to continue to sell off following the technical failure at the 200-day moving average. This could open the door for some fresh new ideas to be added to the simulated Best Ideas Newsletter portfolio, as we continue to work toward the goal of long-term capital appreciation. The changes today in the simulated Best Ideas Newsletter portfolio will be reflected upon the next update on September 15.

Down markets like that of 2022 are tough, but this is where the big money is made, in our view — via dollar-cost averaging through thick and thin. We may allocate the newly raised “cash” to some of the existing opportunities in the simulated Best Ideas Newsletter portfolio, too. We’re available for any questions, and please don’t forget to read “The 16 Most Steps to Understand the Market” here. My thoughts on the markets continue to evolve, and we hope all have profited immensely during these past 10+ years.

Congrats on sticking with it!

Kind regards,

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

brian@valuentum.com

–———

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.