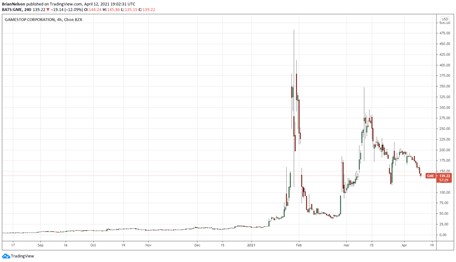

Image: GameStop’s shares are falling like a rock after hitting euphoric levels in the mid-$400s earlier this year. Our fair value estimate stands below $10 per share.

By Brian Nelson, CFA

GameStop (GME) will be trading in the double digits soon enough, in our opinion. The stock’s rise caught Wall Street by surprise, putting hedge fund Melvin Capital’s back against the wall. Earlier this year, the Reddit/Robinhood (r/WallStreetBets) community aggressively bought the quant factor “short interest as a percentage of float” to drive shares of GameStop, AMC Entertainment (AMC) and others like it into a relentless short squeeze.

According to reports, Melvin Capital generated a 49% first-quarter loss, which for any institution should be an unfathomable possibility in a market that advanced ~8% during the first quarter (as measured by the S&P 500)–and with all the risk-management tools at their disposal. My goodness — if you’re shorting stocks, know your exposures. Know your vulnerabilities. Know how you can be wrong.

For 99.9% of people, you should never ever short stocks.

Now having said that, we’re doing an excellent job with short idea considerations in the Exclusive publication, but this publication is for the ultra-sophisticated investor. In the newsletter portfolios, we prefer put option considerations to cap any potential “losses” at the premium “paid,” and we generally only use put options sparingly. We added put options to the newsletter portfolios right before the COVID-19 crash, for example.

The reality is that hedge fund Melvin Capital is lucky to still be around. Were it not for a $2 billion bailout from Citadel and another $750 capital infusion from Point72, the fund would have likely gone belly-up. For most hedge funds, they shouldn’t expect investors to keep backing their bad ideas, especially when they’ve lost half of their capital!

The concept of being wiped out on just one bad bet is a valuable lesson for aspiring hedge fund managers. It reminds me of a quote from the 1998 movie starring Matt Damon, Edward Norton, Gretchen Mol, and John Malkovich about a misguided law school student that learns about the hard-knocks of life through the game of poker. Many of you may have seen the movie Rounders:

…you don’t hear much about guys who take their shot and miss…I had a picture in my head of me sitting at the big table Doyle sitting to my left Amarillo Slim to my right, playing in The World Series Of Poker and I let that vision blind me at the table against KGB; now the closest I get to Vegas is West New York, driving down this lousy route from Knish to rounders who forgot the cardinal…rule: always leave yourself outs.

I have been talking about how the 60/40 stock/bond portfolio has underperformed active stock managers that charge 2% per year during the past 30 years, but please understand that this is not a ding against the concept of diversification. Quite the contrary. My big problem is with something called “diworsification.” An example of “diworsification” would have been adding midstream pipeline MLPs in mid-2015 to smooth returns when really doing so only hurt performance.

Here’s what I write about diversification in Value Trap:

At the very least, I think the equity portion of someone’s entire portfolio should consist of no less than 15-25 securities. If you’re holding less than 15-25 securities that span sectors of the economy, I don’t think you’re adequately diversified. The work of Surz and Price, The Truth About Diversification by the Numbers, talked about how the common view that 90% of diversification is achieved with a 16-stock portfolio and 95% with a 32-stock portfolio may be somewhat imprecise, but they are still good rules of thumb. Surz and Price used r-squared and tracking error, instead of standard deviation, and still found that a 30-stock portfolio achieves approximately 86% of possible diversification.

Adding more companies than 30-60+ in the equity portion of one’s portfolio may lead to something that is commonly described as “diworsification.” For example, even a rather large investment team probably can’t know the sixty-first best idea in the portfolio as well as the very best idea, and the potential cost of allocating capital to the sixty-first best idea instead of overweighting the top ten ideas may only hurt expected return in the long run, while doing very little to improve overall diversification. An equity portfolio of 30-60+ stocks is probably heavily diversified, or at least sufficiently diversified. If you’re only holding a few stocks in an equity portfolio, however, you’re taking on a tremendous amount of risk, and that almost always doesn’t end well.

At Valuentum, we like to limit the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to about 15-25 ideas. We’re looking to capture alpha by overweighting our favorite ideas in the Best Ideas Newsletter portfolio, not diversify away alpha by adding more and more securities to the portfolios. With each new idea, the potential alpha contribution of our top ideas to overall portfolio returns is reduced.

The Dividend Growth Newsletter portfolio seeks to capture our favorite long-term dividend growth considerations within a diversified portfolio context. As you may have noticed, there’s a lot of overlap between these two strategies at the moment, with Apple (AAPL) and Microsoft (MSFT) likely to be the best dividend growth stocks in the coming decade.

Both newsletter portfolios use put option considerations (at times) to hedge against downside risks.

Concluding Thoughts

Day trading GameStop is gambling. Resist the urge.

The 60/40 stock bond portfolio may have cost investors a bundle during the past 30 years relative to active stock managers charging 2% per annum, but that doesn’t mean you shouldn’t diversify appropriately within the equity component of your asset mix.

Use common sense, and don’t get too aggressive on your favorite ideas either. We generally like to limit new ideas to 8%-10% of the newsletter portfolios at “cost” and generally don’t like them to run higher than 15% of the newsletter portfolio after appreciation.

From my perspective, only ultra-sophisticated investors should ever consider shorting, and please don’t gamble too aggressively on options. Know the unlimited loss potential of selling options contracts. Options is not a fun game to lose.

Investing is a long game–and know the difference between diversification across your favorite ideas and “diworsification” by buying overpriced assets just because they “seem” uncorrelated. Adding pipeline MLPs to your portfolio in mid-2015, for example, may have smoothed your returns the past five years, but only by hurting them.

Leave gambling on multiples such as the P/S ratio to the quants. See through the illusion of “factor” investing. Be smart, and don’t get stuck thinking “inside the box.” Markets are inefficient, unless of course, you think GameStop was appropriately priced at both $180 and $350 on the same day (March 10) on no news.

Finally, unless you have a few friends that can lend you a few billion in a pinch, don’t ever forget the cardinal rule–and even if you have a few billionaires next store: Always leave yourself outs.

Stocks for the long run.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson’s household owns shares in HON. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.