Member LoginDividend CushionValue Trap |

High Yielding Idea CyrusOne Beats Estimates and Raises Guidance

publication date: Aug 9, 2021

|

author/source: Callum Turcan

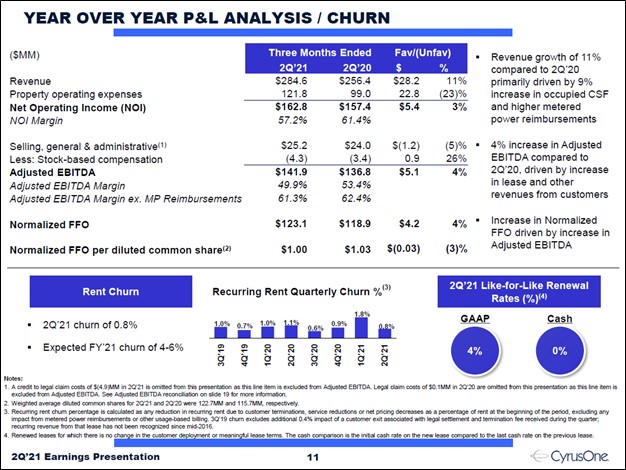

Image Source: CyrusOne Inc – Second Quarter of 2021 IR Earnings Presentation By Callum Turcan The data center and colocation service provider CyrusOne Inc (CONE) is a real estate investment trust (‘REIT’) that is included as an idea in the High Yield Dividend Newsletter portfolio (more on that here). CyrusOne reported second quarter 2021 earnings July 28 that beat both consensus top- and bottom-line estimates, and CyrusOne also increased its full-year guidance in conjunction with its latest earnings update. We liked what we saw in CyrusOne’s latest earnings report. Earnings Update Last quarter, CyrusOne’s GAAP revenues advanced 11% year-over-year while its non-GAAP normalized funds from operations (‘FFO’) increased 4% year-over-year, though on a per-share basis, its normalized FFO per share dropped modestly during this period as CyrusOne worked through headwinds stemming from the coronavirus (‘COVID-19’) pandemic. New leasing activity and reduced rent churn versus year-ago levels supported CyrusOne’s performance last quarter, though management noted during the REIT’s latest earnings call that some of its expected churn activity had been pushed into this quarter for various reasons. The REIT had leased out 86% of the colocation square feet (‘CSF’) of its stabilized properties and 83% of its total CSF at the end of the second quarter of 2021.

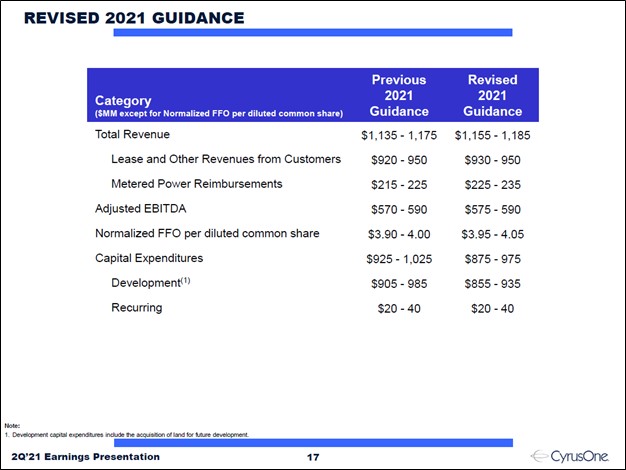

Image Shown: An overview of CyrusOne’s financial performance last quarter. Image Source: CyrusOne – Second Quarter of 2021 IR Earnings Presentation CyrusOne raised its full-year guidance in conjunction with its second-quarter earnings report, boosting both its revenue and normalized FFO per share forecast, among other items, for 2021. In the upcoming graphic down below, CyrusOne highlights its updated forecasts for 2021 versus its previous guidance. Timing effects are primarily responsible for the adjustment in the REIT’s capital expenditure expectations this year, which shifted moderately lower versus previous forecasts (as some of its capital investments were pushed into early-2022 according to recent management commentary).

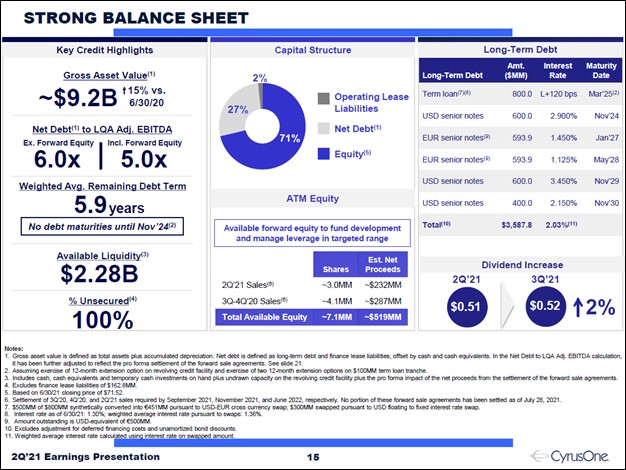

Image Shown: An overview of CyrusOne’s updated full-year guidance for 2021, which saw its revenue and normalized FFO per share forecast shift higher versus previous expectations, a welcome sign. Image Source: CyrusOne – Second Quarter of 2021 IR Earnings Presentation CyrusOne also announced on July 28 that its then-CEO and President, Bruce Duncan, was leaving the company and that CyrusOne’s co-founder and former CEO, David Ferdman, was taking over as interim President and CEO when CyrusOne files its 10-Q SEC filing covering the second quarter of 2021. That occurred on July 29. Not much else was said in the press release regarding the former President and CEO or the reasons for the departure. The chairwoman of the board of directors, Lynn Wentworth, offered praise to the new interim President and CEO within the press release announcing the management change. We are monitoring the situation as this was an unexpected announcement. Pivoting here, in conjunction with its second quarter earnings update, CyrusOne announced that it was increasing its quarterly dividend to $0.52 per share from $0.51 per share previously starting in the third quarter of 2021. We appreciate the modest payout bump as CyrusOne’s business continues to recover from the COVID-19 pandemic. CyrusOne does not have any significant debt tranches coming due until 2024 as its debt maturity schedule remained well-staggered at the end of June 2021, providing it with ample financial flexibility.

Image Shown: CyrusOne had ample liquidity and access to liquidity at the end of June 2021, and in our view, retains solid access to capital markets at attractive rates. Image Source: CyrusOne – Second Quarter of 2021 IR Earnings Presentation In the second quarter of 2021, CyrusOne raised EUR€500 million via 1.125% green senior notes due 2028 and an additional USD$0.2 billion via an at-the-market (‘ATM’) equity issuance program. CyrusOne, in our view, retains solid access to capital markets at attractive rates and should be able to continue meeting its dividend obligations, refinancing obligations, and investment needs going forward. The REIT completed construction on new facilities in Dublin, London, San Antonio, and Northern Virginia last quarter that had 146,000 in combined CSF and 45 megawatts (‘MW’) of power capacity. Additionally, CyrusOne had projects underway in Frankfurt, London, Paris, Phoenix, Northern Virginia, the New York Metro area, and Cincinnati at the end of the second quarter of 2021. During CyrusOne’s second-quarter earnings call, management mentioned that the REIT was “now in six markets in Europe, up from two, when (it) entered in late 2018. Upon completion of the projects in our development pipeline, (it has) more than 200 megawatts of power capacity in Europe, representing approximately 20% of our total portfolio.” We view CyrusOne’s growth outlook quite favorably as it continues to grow its position in Europe while maintaining its strength in the US. Concluding Thoughts CyrusOne’s financial and operational performance is moving in the right direction, and we continue to like the data center REIT as an idea in the High Yield Dividend Newsletter portfolio. Shares of CONE yield ~2.8% as of this writing on a forward-looking basis, and we expect the REIT will steadily grow its payout over the coming years. Our fair value estimate for CyrusOne sits at $78 per share, comfortably above where shares of CONE are trading as of this writing. The REIT’s adjusted (taking the REIT’s access to capital markets into account) Dividend Cushion ratio sits at 1.9, earning CyrusOne a “GOOD” Dividend Safety rating. Please note our Dividend Cushion metric incorporates our expectations that CyrusOne will steadily grow its payout going forward as the REIT has a “GOOD” Dividend Growth rating as well. Downloads CyrusOne’s 16-page Stock Report>> CyrusOne’s Two-page Dividend Report>> ----- Real Estate Investment Trust Industry - CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM Related: VNQ Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. CubeSmart (CUBE), CyrusOne Inc (CONE), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust Inc and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment