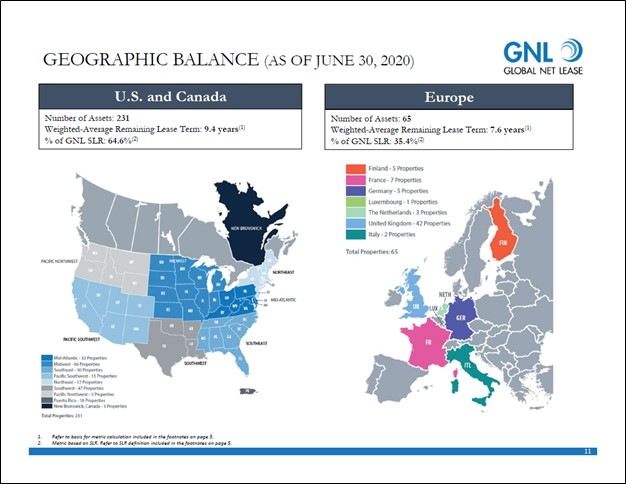

Image Shown: An overview of Global Net Lease’s asset base. Image Source: Global Net Lease – Second Quarter of 2020 IR Earnings Presentation

By Callum Turcan

Global Net Lease (GNL) is a real estate investment trust (‘REIT’) focused on single tenant net-leased commercial properties in the US, Canada, and Europe. Sale and leaseback transactions are a common way the REIT grows its business. At the end of June 2020, a little less than two thirds of its annualized rental income came from properties in the US and Canada. Global Net Lease generated a little less than half of its annualized rental income from both office properties and industrial/distribution properties, with the remainder coming from retail properties. Shares of GNL yield ~10.2% on a forward-looking basis as of this writing after the REIT cut its quarterly payout in early-2020.

Financial Overview

Like most REITs, Global Net Lease carries a significant net debt load which we will get into later. From 2017 to 2019, Global Net Lease generated ~$141 million in annual net operating cash flows on average while spending just ~$7 million per year on average covering its capital expenditures during this period. However, the REIT also spent ~$380 million per year on average on activities classified as ‘investment in real estate and real estate related assets’ and another ~$147 million per year on average covering its dividend obligations (including preferred and common dividend obligations) during this period. There are also modest ‘distributions to non-controlling interest holders’ to consider as well.

Its dividend obligations are primarily funded by its ability to tap capital markets for funds, ideally at attractive rates. Historically, Global Net Lease has preferred to tap both debt and equity markets for funds. The REIT has an at-the-market (‘ATM’) equity issuance program and a revolving credit facility. As a capital market dependent entity, should Global Net Lease lose access to debt and/or equity markets, not only would the REIT have to seriously consider suspending its payout but its core operations would also likely be severely impacted given that only a portion of its growth-related expenditures have historically been covered by internally generated funds (i.e. net operating cash flow).

Elevated Payout Ratio

With that in mind, the ongoing coronavirus (‘COVID-19’) pandemic has weakened investor confidence in Global Net Lease’s ability to keep making good on its dividend obligations going forward. That is reflected in the relatively high yield shares of GNL have as of this writing. Part of that comes from its adjusted funds from operations (‘AFFO’) slipping in 2020 versus last year’s levels.

In the second quarter of 2020, Global Net Lease’s AFFO per share dropped by 6% year-over-year hitting $0.44 per share. Though an imperfect industry-specific metric, AFFO is a useful tool for getting an idea of the REIT’s ability to maintain its payout. Currently, the firm’s quarterly payout sits at $0.40 per share, indicating its AFFO payout ratio (dividends per share divided by AFFO per share) is quite high at 91% based on its second quarter performance. Payout ratios below 80% are preferred, and ratios over 85% are a red flag.

Rent Collection Efforts

On October 8, Global Net Lease put out a press release that noted it had collected “97% of the original cash rent due for the third quarter of 2020 has been received as of October 2, 2020” including 99% of the rent due concerning its properties in the UK and other European countries. For reference, Global Net Lease collected “over 98%” of the rent it was due in the second quarter of 2020 according to management commentary during its second quarter earnings call. The REIT may receive additional rent payments before announcing its third quarter earnings, but it is worth noting that its rent collection performance likely stagnated from the second to the third quarter of this year.

Investors may also be concerned that Global Net Lease’s ability to push through organic rental rate increases in the future will be diminished by the acceleration of certain trends. If the working from home trend continues, and there are plenty of signs it will for workers in certain sectors/industries (especially tech), it may become tough to push through rental rate increases if occupancies rise down the road. Global Net Lease has deferred rent payments for a portion of its tenants in light of the headwinds created by the COVID-19 pandemic.

At the end of June 2020, 99.6% of Global Net Lease’s portfolio by square leasable feet was leased, and contractual rent increases are built into the vast majority of those agreements, though these are extenuating times. As contracts come up for renewal, Global Net Lease may find it hard to continue including meaningful rental rate increases at some of its properties, specifically office properties.

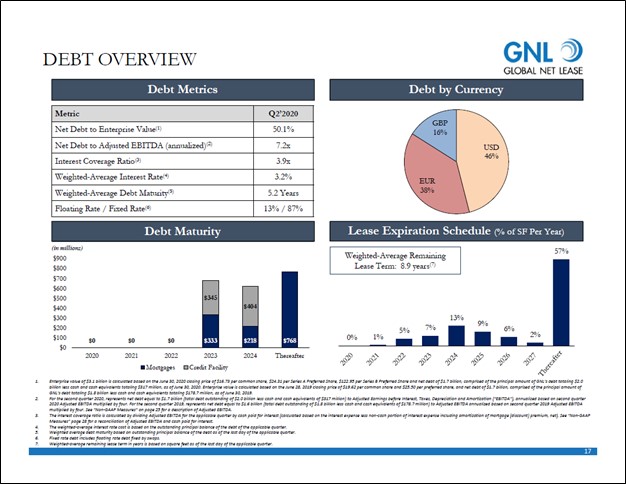

Highly Levered

Global Net Lease had $0.3 billion in cash and cash equivalents on hand at the end of June 2020. Though dwarfed by $1.3 billion in net mortgage notes payable, $0.3 billion drawn on its revolving credit facility, and $0.4 billion in net term loans at the end of this period, Global Net Lease has a decent amount of liquidity to meet its near-term needs.

Its revolving credit facility and term loan combined have $1.235 billion is total borrowing capacity (according to its second quarter of 2020 10-Q SEC filing), with the revolving credit facility maturing in August 2023 (there is the option for two six-month extensions) and its term loan maturing in August 2024. However, its borrowing capacity under the revolving credit facility “is based on the value of a pool of eligible unencumbered real estate assets” owned by Global Net Lease along with the borrowing capacity limit. The firm had just $14 million in available borrowing capacity under its revolving credit line as of the end of June 2020.

As of the second quarter of 2020, Global Net Lease’s annualized net debt to adjusted EBITDA ratio stood at a whopping ~7.2x, which is incredibly high. The company does not have a significant amount of debt coming due until 2023, which gives the REIT some time to adjust, but we are not fans of its balance sheet. Even for a REIT, that leverage ratio is simply far too high.

Image Shown: Global Net Lease’s balance sheet is highly levered. Image Source: Global Net Lease – Second Quarter of 2020 IR Earnings Presentation

Concluding Thoughts

Global Net Lease’s AFFO payout ratio is rather high, and its balance sheet is highly levered. The REIT’s rent collection performance appears to be stagnating as the fallout from the ongoing COVID-19 pandemic continues. We think there is a good chance Global Net Lease will be forced to cut its dividend again, and that is at least partially why shares of the REIT carry a lofty yield as investors appear to be pricing in a potential payout cut as likely. We prefer REITs that operate in the self-storage and data center space (more on that subject here).

—–

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: CUBE, GNL, PSA, VNQ

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.