Image Shown: Global Payments Inc is in the process of acquiring EVO Payments Inc. Image Source: Global Payments Inc – Second Quarter of 2022 IR Earnings Presentation

By Callum Turcan

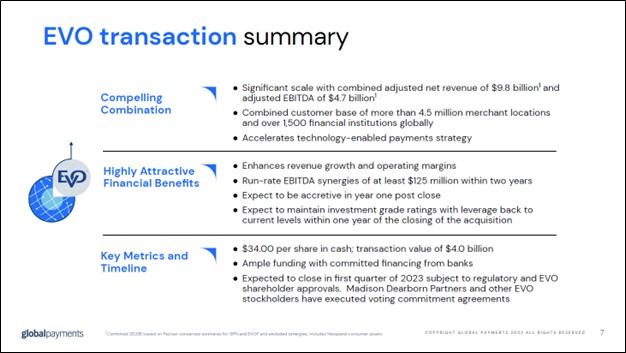

Global Payments Inc (GPN) announced it would acquire EVO Payments Inc (EVOP) for $34 per share through an all-cash deal worth ~$4.0 billion by enterprise value. As its name would suggest, Global Payments provides payment technology and software solutions to customers in over 100 countries. By acquiring EVO Payments, which focuses on providing payment technology and services to small and medium-sized businesses in over 50 markets worldwide, Global Payments will extend its reach into new markets (including Chile, Germany, Greece, and Poland) while enhancing its presence in existing markets (including Canada, the US, Mexico, the UK, Ireland, and Spain).

Deal Overview

Ample cost and revenue synergies are expected to be realized through this combination, aided by the operational overlap between Global Payments and EVO Payments. The combined company is targeting ~$125 million in run-rate synergies and Global Payments expects the deal will be accretive to its non-GAAP adjusted EPS per share performance within one year after closing. There is room for substantial margin expansion if everything proceeds as planned, made possible through a combination of this pending acquisition and a pending disposition that we will cover later in this article.

Image Shown: Global Payments expects pending M&A activity could significantly improve its margins over the long haul. Image Source: Global Payments – Second Quarter of 2022 IR Earnings Presentation

By joining forces with EVO Payments, Global Payments will be able to become a more integrated enterprise and a bigger player in the business-to-business (‘B2B’) payment solutions industry. Greater scale, cross-selling opportunities, geographical market expansion, and the ability to provide a more expansive array of offerings in new and existing markets represent some of the reasoning behind the deal, along with expected cost structure and related margin improvements.

Image Shown: By acquiring EVO Payments, Global Payments is targeting cross-selling opportunities, cost synergies, geographic market expansion, and new opportunities arising from being able to offer a wider array of offerings for payment solution needs. Image Source: Global Payments – Second Quarter of 2022 IR Earnings Presentation

Global Payments offered EVO Payments shareholders a premium of ~24% over its closing price on July 29 and a ~40% premium over its 60-day average price. To fund the deal, Global Payments intends to utilize its cash on hand, a committed bank facility, and a $1.5 billion strategic investment by the private equity firm Silver Lake in the form of a convertible note. At the end of June 2022, Global Payments had $1.9 billion in cash and cash equivalents on hand, though its total debt load of $12.6 billion (inclusive of short-term debt) requires the firm to maintain a level of cash-like assets on hand to meet its near-term funding needs. The deal is expected to close in the first quarter of 2023.

Financial Considerations

On August 1, Global Payments also reported its second-quarter earnings update that saw the firm beat consensus top- and bottom-line estimates. Additionally, the company reaffirmed its full-year guidance for 2022 that calls for 10%-11% adjusted non-GAAP net revenue growth and 17%-20% adjusted non-GAAP EPS growth on an annual and constant-currency basis. Global Payments expects its adjusted non-GAAP operating margin will expand up to 150 basis points this year versus 2021 levels, up 25 basis points from its previous forecast. We appreciate that Global Payments also expects to generate a ~100% adjusted free cash flow conversion rate this year.

Image Shown: Global Payments forecasts that it will grow its top- and bottom-line at a robust pace this year while generating sizable free cash flows. Image Source: Global Payments – Second Quarter of 2022 IR Earnings Presentation

The firm is in the process of selling the consumer portion of its prepaid debit card business Netspend for $1.0 billion to the private investment firm Searchlight Capital and the fintech firm Rev Worldwide through a deal expected to close in the first quarter of 2023, as announced during Global Payments’ latest earnings report. Global Payments will retain the B2B portion of its Netspend division and will integrate those operations with its ‘Issuer Solutions’ segment this quarter. Looking ahead, when these deals close, Global Payments expects its ‘Merchant Solutions’ segment will represent ~75% of its adjusted net revenue with its Issuer Solutions segment representing the remainder.

Global Payments’ GAAP revenues advanced 7% year-over-year in the second quarter, though it reported a sizable GAAP operating loss due to a goodwill impairment charge and a loss on business dispositions charge. However, the firm remains a solid cash flow generator. Global Payments generated $0.9 billion in free cash flow during the first half of 2022 while spending less than $0.2 billion covering its total payout obligations (dividends to common shareholders and distributions to noncontrolling interests) and more than $1.2 billion buying back its common stock via its buyback program during this period. Shares of GPN yield ~0.8% as of this writing.

The firm recently increased its share buyback authority up to a total of $1.5 billion. However, given Global Payments large existing net debt load and considering that its deal for EVO Payments will further grow that burden, we think it would be prudent for the firm to scale back the pace of its share repurchases in the medium term. This would allow Global Payments to utilize its “excess” free cash flows, after covering its total dividend obligations, to improve its balance sheet health in a timely manner. If Global Payments continues to stretch its balance sheet, that could create major problems for the company down the road, especially as interest rates are on the rise.

Annual financing expenses at heavily indebted firms can drain resources needed to fund future innovations. Global Payments operates in an incredibly competitive industry and will need to stay ahead of the curve if it wants to continue growing over the long haul.

On a non-GAAP basis, Global Payments’ adjusted net revenues grew 6% year-over-year and its adjusted operating income rose 11% in the second quarter of 2022. Strength at its Merchant Solutions (adjusted net revenues and operating income were up 11% and 15% year-over-year, respectively) and Issuer Solutions (adjusted net revenues and operating income were up 3% and 2% year-over-year, respectively) segments offset weakness at its ‘Business and Consumer Solutions’ segment. Global Payments’ underlying business is performing well, and looking ahead, it should benefit from the addition of EVO Payments to its portfolio while shedding less desirable operations (the consumer facing part of its Netspend operations).

Pivoting here, EVO Payments also reported its second quarter 2022 earnings update on August 1. The company generated a little under $0.1 billion in free cash flow during the first half of 2022 and exited June 2022 with a net debt load of ~$0.15 billion (inclusive of short-term debt). EVO Payments’ GAAP revenues were up 13% year-over-year in the second quarter of 2022 (up 18% on a constant currency basis) while its GAAP net income grew 66%. International revenues at EVO Payments were up 33% year-over-year last quarter on a constant currency basis with strength seen in European and Latin American markets. Overall, EVO Payments’ business has been trending in the right direction of late.

Concluding Thoughts

Unlocking expected synergies from the acquisition of EVO Payments will be key to ensuring Global Payments can stay on top of its net debt load and other financial obligations. This deal is arguably stretching Global Payments’ balance sheet health quite a bit given its existing net debt load. For now, Global Payments’ ability to generate ample “excess” free cash flows after covering its total dividend obligations along with its promising near term guidance should help the firm stay on top of its various financial obligations. We are keeping an eye on this deal as consolidation in the fintech industry would positively behoove the pricing power of the remaining players.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for GPN, EVOP, ACIW, EPAY, FDC, FIS, FISV, FLT, LPS, MA, MELI, PAY, PYPL, V, VRSK, WEX, WU, SQ, SOFI, COIN, UPST, LC, LSPD, NU, HOOD, AFRM, TREE, BLND, RPAY, NVEI, ADYEY, ADYYF, RKT, MQ, LDI, PSFE, PRG, GFOF, FINX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, V, and VRTX and is long put options on RDFN and RKT. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.