Image Source: ASML Holding NV – Fourth Quarter and Full-Year 2020 Earnings IR Presentation

By Callum Turcan

Shares of Netherlands-based ASML Holding NV (ASML), which supplies lithography systems and services to the semiconductor industry, have done incredibly well since we published our ASML Holding Is an Impressive Enterprise with a Pristine Balance Sheet and Rock-Solid Growth Trajectory article back on April 8, 2020 (link here). From April 8 to January 22, shares of ASML more than doubled. We strongly encourage members that have not done so to check out that article, as we laid out how ASML Holding’s lithography systems are an essential part of the semiconductor industry along with our reasoning behind why we view the company’s long-term outlook favorably.

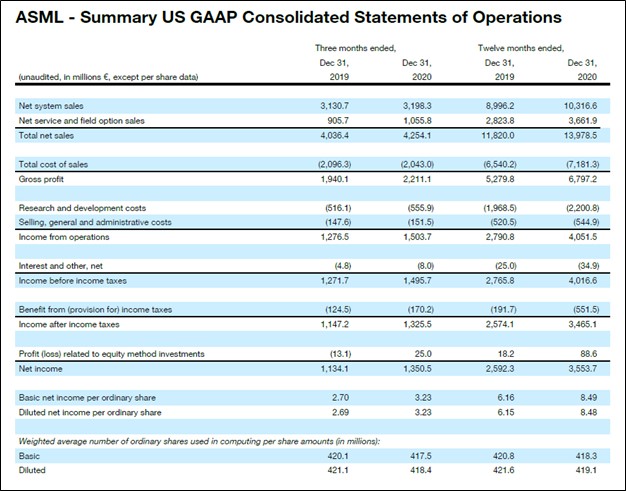

Resilient Financials

The company’s operational and financial performance proved to be incredibly resilient during the coronavirus (‘COVID-19’) pandemic. ASML Holding reported annual revenue growth at both its ‘net system sales’ and ‘net service and field option sales’ in 2020 which highlighted the firm’s ability to continue meeting strong customer demand even in the face of serious exogenous headwinds. Last year, ASML Holding’s GAAP revenues grew by 18% and its GAAP gross margin surged higher by almost 400 basis points year-over-year. The company’s GAAP operating income jumped higher by 45% year-over-year in 2020, aided by economies of scale, gross margin expansion and significant revenue growth. Management cited strength at its deep ultraviolet (‘DUV’) lithography offerings, extreme ultraviolet (‘EUV’) lithography offerings and ‘upgrade business’ as being key during ASML Holding’s fourth quarter of 2020 earnings call.

Image Shown: ASML Holding put up tremendous financial performance in 2020. Image Source: ASML Holding – Fourth Quarter and Full-Year 2020 Earnings Report

In 2020, ASML Holding generated $3.7 billion in free cash flow, up from $2.5 billion in 2019 due to its impressive net operating cash flow growth (which more than covered growth seen at its capital expenditures). The company spent $1.2 billion buying back its stock and another $1.1 billion covering its dividend obligations during this period. Please note that ASML Holding pays out a modest dividend in euros, and there are foreign currency movement considerations to be aware of.

At the end of 2020, ASML Holding had $7.4 billion in cash, cash equivalents, and short-term investments on hand versus $4.7 billion in long-term debt (the firm did not break down its current liabilities line-item in the financial packages provided at the time of this writing). Nontheless, we appreciate ASML Holding’s pristine balance sheet.

Looking ahead, ASML Holding intends to continue rewarding shareholders via dividend increases (in euro terms) and additional share repurchases. The proposed total dividend payout covering the 2020 period represents a 15% increase from the total dividend payout covering the 2019 period (ASML Holding historically has paid out an interim and final dividend). During the company’s latest earnings call, management noted that “we expect to execute a significant share buyback in Q1 2021” which can be funded by a combination of its cash on hand and ability to generate significant free cash flows in almost any environment.

Image Shown: ASML Holding is committed to returning cash to its shareholders via dividend increases (in Euro terms) and share repurchases. Image Source: ASML Holding – Fourth Quarter and Full-Year 2020 Earnings IR Presentation

Export Control Concerns

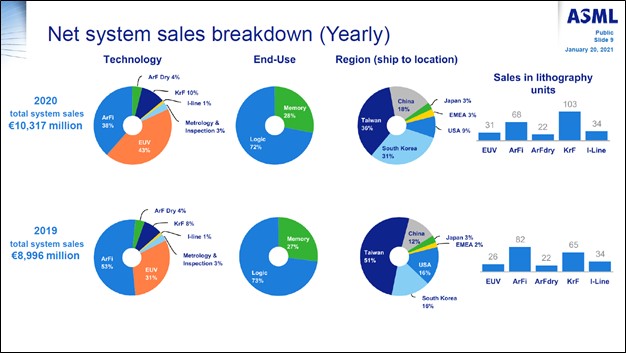

ASML Holding generates the vast majority of its revenue from East Asian markets, namely Taiwan, South Korea, and China. We caution that the state of US-China trade and geopolitical relations more broadly can have a powerful impact on ASML Holding’s financial performance due to the various roadblocks export controls can create (e.g., tariffs and prohibitions of technology transfers). While ASML Holding generates only a moderate amount of its revenue in the US and China, and is based in the Netherlands, the company is still very exposed to Western-imposed export controls and export controls imposed by China. For now, ASML Holding appears well-equipped to navigate these hurdles (export controls currently in place and export controls that may come into being down the road) given its strong financial position and its status as an industry leader in a technically complex space.

Image Shown: ASML Holding generates most of its revenues from a handful of East Asian countries. This is where a large chunk of the global semiconductor business is located as it concerns manufacturing activities. Image Source: ASML Holding – Fourth Quarter and Full-Year 2020 Earnings IR Presentation

Export controls were brought up during ASML Holding’s latest earnings call, though management did not have much to say directly on the issue beyond noting the firm was monitoring the situation and being conservative in its planning. Over the coming months, we will get a better idea of how the new administration in the White House plans to proceed regarding US-China trade relations.

Outlook

ASML Holding expects its growth trajectory will continue in earnest going forward. During the company’s latest conference call, management noted (emphasis added):

“In summary, 2020 was another great year despite the challenges presented by the pandemic. For 2021, taking into account that we are coming off a higher 2020 revenue base, we still expect a year of double-digit growth. This is driven by strong demand in Logic and continued recovery in Memory with potential upside to these numbers when we can disregard any further impact of export control regulations.

The build out of the digital infrastructure across multiple markets drives demand for both advanced, as well as mature process nodes. This is expected to fuel demand across our entire product portfolio. Although there are of course still some near-term macro and geopolitical uncertainties, the long-term demand drivers only increase our confidence in our future growth outlook towards 2025.” — Peter Wennink, President and CEO of ASML Holding

Underpinning ASML’s favorable outlook is expectations that demand for 5G, artificial intelligence, high-performance computing, data centers, cloud-computing and other technologies supported by secular tailwinds will continue to grow going forward. During ASML Holding’s fourth quarter earnings call, management alluded to there being potential upside to its 2021 growth assumptions should the export-control situation (i.e., US-China trade relations) calm down and become more predictable.

Taiwan Semiconductor Manufacturing Company Limited (TSM) [abbreviated as ‘TSMC’], the world’s largest contract “chip” manufacturer, plans to aggressively boost its capital expenditures in 2021 versus 2020 levels to bolster its ability to produce next generation semiconductors. For reference, TSMC operates foundries that produce semiconductors for third-parties (the firm does not design the semiconductor components). TSMC is one of ASML Holding’s big customers and in order for TSMC to grow its ability to produce next-generation chips, it needs ASML Holding’s most advanced lithography systems. ASML Holdings places a greater emphasis on R&D to stay a leader in its industry and to keep up with the ever-changing demands of the semiconductor industry and IT sector more broadly. Here is what TSMC had to say on the issue during its fourth quarter of 2020 earnings call (emphasis added):

“Every year, our CapEx is invested in anticipation of the growth that will follow in the next few years. Our capital investment decisions are based on four disciplines, technology leadership, flexible and responsive manufacturing, retaining customers trust and earning the proper return.

In 2020, we spent US$17.2 billion to capture the strong demand for our advanced technologies and support our customer’s capacity needs. In order to meet the increasing demand for our advanced and specialty technologies, and further support our customer’s capacity needs, our 2021 capital budget is expected to be between US$25 and US$28 billion.

Out of the US$25 to US$28 billion CapEx for 2021, about 80% of the capital budget will be allocated for advanced process technologies, including 3 nanometer, 5 nanometer and 7 nanometer. About 10% will be spent for advanced packaging and mask making and about 10% will be spent for specialty technologies.

Next, let me talk about our capital intensity outlook. As we have said previously, our long-term capital intensity is in the mid-30s percentage range. However, when we enter a period of higher growth, our CapEx needs to be spent ahead of the revenue growth that will follow. So our capital intensity will be higher.” — Wendell Huang, CFO of TSMC

During ASML Holding’s latest earnings call, analysts brought up that the guidance ASML Holding put out appeared conservative in nature given the sharp increases in TSMC’s expected capital expenditures. Here is what ASML Holding had to say in response to one of those questions during its latest earnings call (emphasis added):

“Yeah, you know, I think TSMC gave a range, 25 billion to 28 billion, hey great. We plan our business based on what they ask us, and as you know, you know, TSMC has been asking us, you know, in 2020, on several occasions to ship very different numbers for 2021. So, this is what I’m saying is it’s in constant flux. So what they are asking us and telling us that they would, you know, like, from their point of view, has a, you know, range, and we need to be able to respond to that.

So, I don’t think you can draw any direct conclusion from the TSMC CapEx numbers. Directionally, yes, but not in absolute terms. Now, having said that, I also said that I do believe that we see upsides to the Euro calculated 12%. And an upside is clearly there. But I think that upside that comes out of the Logic space in China. And of course, you know, that will happen if the current export control regulations stay as is. Now, you could argue, so why do you – why are you so conservative?

Well, simply because what we’ve seen over the last two months in terms of regulations that we had to deal with, and that basically were issued, rather suddenly, you know, there is a level of conservatism on our side, I said, we’re not going to add that upside yet to your 12%. Because, you know, we’ve been – we’ve got hurt but I mean, we’ve been surprised on a regular basis by all these new regulations that do have an impact on our business. So, nothing changes and stays as is. There’s a significant upside to what we told you today. But then everything needs to stay as is, and I think we made it clear in our prepared remarks.” — Roger Dassen, CFO of ASML Holding

In our view, ASML Holding is “playing it safe” and putting forth guidance that leaves room for upside should global trade tensions cool down a bit instead of putting out guidance that could be hard to achieve should the direction of geopolitical winds abruptly change once again.

Concluding Thoughts

We continue to be fans of ASML Holding’s business model. As a leader in an industry supported by numerous secular growth tailwinds (secular trends, such as the rise of AI and cloud-computing, support the outlook for semiconductor demand which in turn supports the outlook for the cutting edge lithography systems used to make these semiconductors), ASML Holding is poised to continue to generate strong revenue growth while maintaining its pricing power.

ASML Holding forecasts it will generate $3.9-$4.1 billion in revenue and have a gross margin of 50-51% in the first quarter of 2021. For reference, ASML Holding generated an impressive GAAP gross margin of ~48.6% in 2020. Management noted during the company’s latest earnings call that the firm expected its profitability levels to improve and its revenues to climb higher going forward.

ASML Holding generates enormous amounts of free cash flow and its balance sheet is pristine. Though we caution that export controls remain a concern, ASML Holding’s long-term growth outlook is bright, and its near-term outlook indicates the company is well-positioned to ride out the storm caused by COVID-19 and elevated global trade tensions. Members seeking an intriguing way to play the semiconductor space should take a close look at ASML Holding. It could end up in the Best Ideas Newsletter portfolio at the right price.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT

Related: ASML

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc Class C shares (GOOG), Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Qualcomm Inc (QCOM) and Oracle Corporation (ORCL) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.