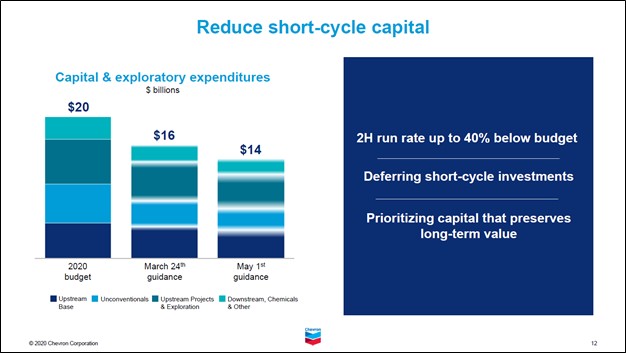

Image Shown: Chevron Corporation reduced its capital expenditure expectations a couple of times this year, though that still has not enabled the firm to generate meaningful free cash flows given the various headwinds facing its businesses. Image Source: Chevron Corporation – November 2020 IR Presentation

By Callum Turcan

On October 30, Chevron Corporation (CVX) reported third quarter earnings for 2020. As expected, it was a brutal report from Chevron. The ongoing coronavirus (‘COVID-19’) pandemic decimated global energy demand and severely weakened raw energy resources pricing at a time when refining margins are quite weak. This double whammy saw Chevron post a $0.2 billion GAAP net loss in the third quarter of 2020 as its revenues tanked.

Dividend Coverage Facing Serious Headwinds

Chevron’s ‘Upstream’ segment (responsible for the production of raw energy resources like crude oil, natural gas liquids, and natural gas from the ground) reported $0.2 billion in segment-level operating profit last quarter, down 91% year-over-year. The company’s ‘Downstream’ segment (responsible for its refining and petrochemical operations) reported $0.3 billion in segment-level operating profit last quarter, down 65% year-over-year. Additionally, Chevron’s ‘All Other’ segment reported a segment-level operating loss of $0.8 billion last quarter (however, that loss was 23% smaller than year-ago levels).

Pain is widespread. Low raw energy resources pricing played a leading role in dragging down its upstream performance, while lower sales volumes and weak refining margins were key in hampering Chevron’s downstream performance last quarter.

Even more troublesome, Chevron has so far refused to cut its dividend on conserve cash. The company generated almost $1.5 billion in free cash flow during the first nine months of 2020, though Chevron spent $7.2 billion on its dividend payments and another $1.5 billion repurchasing its shares on a net basis during this period (according to the firm’s latest 10-Q SEC filing). Considering Chevron exited September 2020 with a net debt position of $27.9 billion (inclusive of short-term debt), up from a net debt position of $21.2 billion (inclusive of short-term debt) at the end of 2019, it is clear that Chevron’s balance sheet is becoming stressed in order to keeping making good on its dividend obligations.

Management’s strategy, like those of some of Chevron’s peers, seems to be heavily rooted in the belief that raw energy resources pricing will improve come 2021. If that is not the case, then Chevron will need to make some touch choices. There is a limit to how much debt Chevron can take on to fund its cash flow outspend. Divestments are sometimes touted as a way to bring the gap, though there is a limit to how many assets Chevron can sell off before its cash flow generating abilities are negatively impacted in a big way. After the third quarter closed, Chevron entered into an agreement to sell its Appalachian natural gas-oriented assets for a little more than $0.7 billion to EQT Corporation (EQT), and management noted that Chevron aims to close the deal by the end of this year according to commentary given during the firm’s latest earnings call.

Chevron completed its all-stock acquisition of Noble Energy in early-October, and that deal will add to Chevron’s net debt load given Noble Energy had a net debt position as we covered in this article here. Additionally, Chevron will have a modestly larger outstanding diluted share count to make dividend payments to as roughly 58 million shares of CVX were issued to fund the Noble Energy deal. Noble Energy’s former midstream spin-off (which owns various energy infrastructure assets like gathering networks and processing facilities), Noble Midstream Partners LP (NBLX), also has a meaningful net debt load. Chevron now owns Noble Midstream Partners’ general partner and has a large economic stake in the midstream firm.

As of this writing, shares of CVX yield ~6.2% as investors are becoming increasingly worried Chevron will not be able to keep supporting its generous dividend payouts going forward, short of a significant increase in raw energy resources pricing materializing in the near-future. Chevron has a Dividend Cushion ratio of 0.7, though we still give the firm a “VERY POOR” Dividend Safety rating given that the company is very reliant on volatile commodity prices and carries a large (and growing) net debt load.

Concluding Thoughts

Many energy giants have so far refused to cut their dividend payments in the face of the ongoing COVID-19 pandemic, subdued raw energy resources pricing, and lackluster refining margins. Some areas of the petrochemical space have held up better, but ultimately, it is the upstream operations of these energy giants that generate the bulk of their cash flows (generally speaking). If raw energy resources pricing remains subdued, payouts are at risk across the board. Almost no energy firm’s dividend payouts are truly safe in this environment.

In our view, Magellan Midstream Partners L.P. (MMP) will be able to keep making good on its generous payout obligations going forward, which is why we include units of MMP in our High Yield Dividend Newsletter portfolio. To read why we like Magellan Midstream, please check out this article here.

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP

Related: XLE, XOP, BNO, USO, UNG, EQT, NBLX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares or units in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.