Member LoginDividend CushionValue Trap |

Cantel Medical Surges Higher

publication date: Dec 8, 2020

|

author/source: Callum Turcan

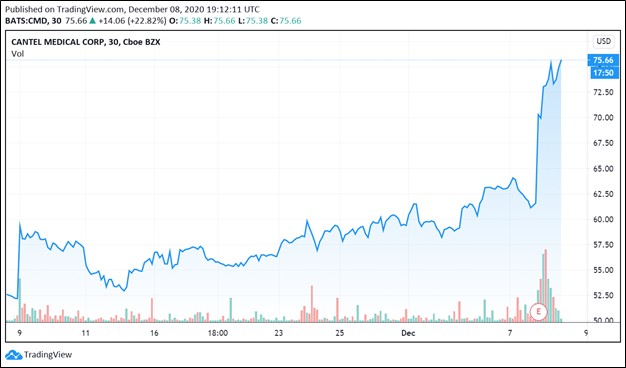

Image Shown: Shares of Cantel Medical Corporation popped higher during normal trading hours on December 8 after the firm’s latest earnings report indicated its recovery was well underway. By Callum Turcan On December 8, Cantel Medical Corporation (CMD) reported first quarter earnings for fiscal 2021 (period ended October 31, 2020) that beat both top- and bottom-line consensus estimates. Furthermore, Cantel Medical’s $297 million in GAAP revenues last fiscal quarter exceeded the top end of its forecast that was published on October 22, which had been raised above the revenue guidance range management put forward during the firm’s fourth quarter of fiscal 2020 earnings call that was held on September 17. Cantel Medical focuses on designing, developing, manufacturing, installing, and marketing a comprehensive portfolio of medical devices and instruments (including products for the dental industry), along with a slate of related services. The coronavirus (‘COVID-19’) pandemic has weighed quite negatively on its operational and financial performance, particularly during the second half of fiscal 2020 (period ended July 31, 2020), due to the widespread delays of elective surgeries. As elective surgery activities have started to recover over the past several months--particularly in the US where Cantel Medical has historically generated most of its revenues--that has gone a long way in improving the company’s outlook. We published a note back on December 2 (link here) highlighting that “we think Cantel Medical is one for the radar of a risk-seeking investor” on the back of its improving near-term revenue outlook. In that article, we mentioned that it was crucial for Cantel Medical to show signs that its margins were moving in the right direction after deteriorating over the past couple of fiscal years. During its latest earnings report, Cantel Medical’s financial performance clearly indicated that a recovery was well underway. Improving Outlook Economies of scale combined with operating expense reductions (synergies from its Hu-Friedy acquisition are running ahead of schedule) led to Cantel Medical reporting significant margin expansion last fiscal quarter. Cantel Medical’s GAAP gross margins expanded by almost 460 basis points year-over-year while its GAAP operating margins expanded by over 1,130 basis points year-over-year in the first quarter of fiscal 2021. The resumption of elective surgeries drove demand higher for Cantel Medical’s products and services, resulting in its GAAP revenues growing over 15% year-over-year last fiscal quarter. Its GAAP operating income more than tripled year-over-year, hitting $50 million, and Cantel Medical’s free cash flows came in at $57 million in the third quarter of fiscal 2021 (in the same quarter last fiscal year, Cantel Medical generated negative free cash flows). Shares of Cantel Medical surged higher by double-digits during normal trading hours on December 8, and we can understand why. Cantel Medical paid down $75 million of the borrowings on its revolving credit line in September and management noted in the firm’s earnings press release that the company paid down another $50 million in November after the end of the fiscal first quarter. Additional deleveraging activities are under consideration. At the end of October 2020, Cantel Medical had $258 million in cash and cash equivalents on hand to meet its future liquidity needs and to assist in future deleveraging activities. Though Cantel Medical still carried a meaningful amount of total debt on hand (~$1.0 billion inclusive of short-term debt and convertible debt) at the end of October 2020, things are moving in the right direction. Looking ahead, management sees Cantel Medical’s recent margin-expansion gains as having legs and had this to say during the firm’s latest earnings call (emphasis added, lightly edited): “Turning to consolidated margins our GAAP gross margin increased by 460 basis points to 49.6% [in the fiscal quarter of fiscal 2021] versus 45% in [the first quarter of fiscal 2020], while non-GAAP gross margins increased by 280 basis points year-over-year to 51.1%. The expansion was driven by the return of volumes combined with our more disciplined approach in managing manufacturing costs as well as favorable mix due to the higher sales of consumable products. More importantly, at this volume we believe we should sustain gross margin expansion going forward.” --- Shaun Blakeman, CFO and Senior Vice President of Cantel Medical Additionally, Cantel Medical’s management team noted that (emphasis added, moderately edited): “Our assessment of procedures during [the first quarter of fiscal 2021] place dental procedures in the range of 80% to 85% of pre-COVID levels [while] medical procedures were approximately 90% to 95% of pre-COVID levels. While this is positive news, we do expect patient’s safety concerns to be higher over the next several weeks regardless of any potential near-term impact due to COVID. We are bullish on what we believe the market environment for our products and solutions will look like in the spring with or without a COVID vaccine. It is worth noting that through November, our daily order intake rates have continued to outpace sales in both medical and dental. This trend along with the operating enhancements that we've made over the past nine months bolsters our confidence in the future. While there is much to do, we know how to manage what is in our control including our cost structure, discretionary spending, working capital, debt service and taking care of our employees during challenging times.” --- Peter Clifford, COO and President of Cantel Medical On a final note, the synergies from Cantel Medical’s acquisition of Hu-Friedy, which manufactures instruments and instrument reprocessing workflow systems for the dental industry, are running ahead of schedule according to recent management commentary. Cantel Medical’s management team highlighted a combination of cost control measures and rising demand as a sign that the acquisition of Hu-Friedy was the right call, with room for sustained margin expansion in the coming fiscal years. Concluding Thoughts As global health authorities work toward bringing an end to the COVID-19 pandemic, Cantel Medical’s outlook should continue to get brighter as elective surgeries slowly return to pre-pandemic levels. Though there are still meaningful short-term headwinds to consider, longer term, Cantel Medical’s cash flow growth trajectory looks quite promising. We are reiterating our prior view that Cantel Medical should continue to be on the radar of a risk-seeking investor. ----- Also tickerized for STE, OCPNF, OCPNY, BSX, FTV, ECL, GNGBF, GNGBY, BAX, FMS, XRAY, AMCR, DVA, HSIC, PDCO

----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment