Image Source: Cantel Medical Corporation – Fourth Quarter and Full Year Earnings for Fiscal 2020 IR Presentation

Executive Summary: Medical device and instrument maker Cantel Medical will be a major beneficiary of recent news regarding the growing chances that a safe and viable COVID-19 vaccine will potentially get approved soon. Though the company’s financial performance has deteriorated in recent fiscal years and organic revenue has faced headwinds, the firm’s upwardly-revised guidance (particularly its sales guidance) for the first quarter of fiscal 2021 was a highly encouraging sign, and Cantel noted that the level of elective medical procedures are starting to stabilize. Its recent October 2019 acquisition of Hu-Friedy’s dental operations will put the company in a better position to compete for business as well, though we note rising confirmed COVID-19 hospitalizations around the world continue to pose a threat to the pace of elective surgeries/procedures. Cantel’s near-term outlook is looking up, in our view, but high financial leverage (net debt to adjusted EBITDA), weak organic growth trends, rising expected operating expenses and capital spending, stronger and larger rivals that compete through bundling partnerships across the medical device/instrument arena, moderate customer concentration risk, and recent capital-spending cutbacks (coupled with a suspended dividend) to shore up capital put this idea firmly in the high-risk/speculative category. Nonetheless, given signs of a turnaround based on the recent guidance raise, we think Cantel Medical is one for the radar of a risk-seeking investor. We’ll be paying close attention to its revenue and margin performance when it reports fiscal first-quarter 2021 earnings December 8.

By Callum Turcan

Elective medical procedures were delayed in most parts of the world in 2020 to make room for patients recovering from the coronavirus (‘COVID-19’), with the delays often being the most pronounced during the worst parts of the ongoing pandemic. This dynamic also impacted elective medical procedures in the dental industry. Whether elective surgeries will be able to resume in earnest depends largely on the trajectory of COVID-19 hospitalizations and similar factors.

Cantel Medical Corporation (CMD) is a company that specializes in developing, manufacturing, and selling a comprehensive portfolio of medical devices and instruments, along with related services. The company should be a major beneficiary of recent news regarding the growing chances that a safe and viable COVID-19 vaccine will potentially get approved soon, though serious headwinds remain.

In fiscal 2020 (period ended July 31, 2020), Cantel Medical generated almost three quarters of its net sales in the US. Additionally, ~46% of its net sales this fiscal year were generated by its ‘Medical’ segment (includes offerings such as automated endoscope reprocessing systems, high-level disinfectants and sterilants, and leak testing and manual cleaning products), and ~32% of its net sales were generated by its ‘Dental’ segment (includes offerings such as dental hand instruments, powered dental instrumentation and accessories, and instrument reprocessing and sterility assurance products).

The company also a ‘Life Sciences’ segment (includes offerings such as hollow fiber filters and other filtration and separation products) and a ‘Dialysis’ segment (includes offerings such hemodialysis concentrates and other ancillary supplies) which generated its remaining net sales in fiscal 2020. With an enterprise value of ~$3.0-$3.5 billion, Cantel Medical is a relatively small player in the medical instruments space as of this writing.

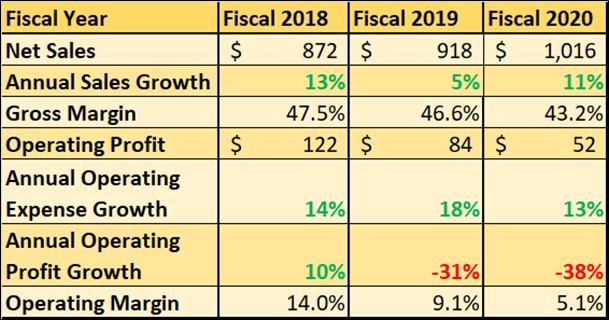

Historical Financials Show Significant Weakness

Cantel Medical’s financial performance has deteriorated during the past few fiscal years. In the upcoming graphic down below, we highlight Cantel Medical’s financial performance from fiscal 2018 to fiscal 2020 (its fiscal year has historically ended in July). Though the company’s GAAP revenues have steadily climbed higher during this period, its GAAP operating income and GAAP operating margin fell sharply due to Cantel Medical experiencing declining GAAP gross margins while contending with rising operating expenses. Shares of CMD have steadily drifted lower since peaking back in May 2018, which in our view, was largely due to its deteriorating financial performance and how that has impacted the market’s view of its long-term outlook.

Image Shown: The dollar amounts are in millions of USD. An overview of Cantel Medical’s financial performance in fiscal 2018, fiscal 2019 and fiscal 2020, which includes data from fiscal 2017 as it concerns annual growth rates for certain items in fiscal 2018. Please note that these financial figures are all on a GAAP basis. Image Source: Valuentum, with data from Cantel Medical’s Fiscal 2020 Annual Report and data from Cantel Medical’s Fiscal 2019 Annual Report

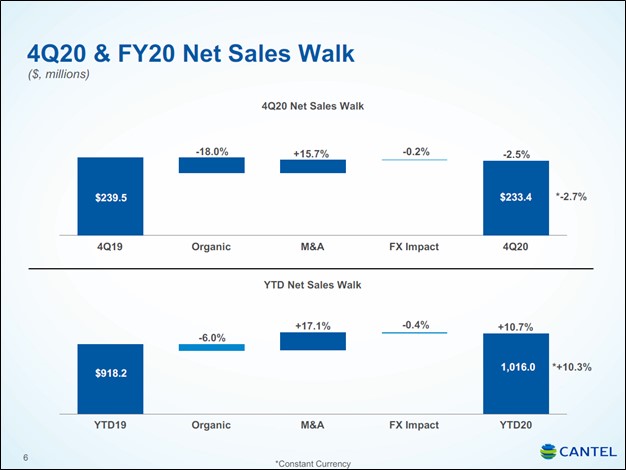

Due to a recent acquisition that we will cover later in this article, Cantel Medical’s fiscal 2020 financial performance appeared stronger than it really was, in our view. The upcoming graphic down below highlights that Cantel Medical’s “organic” revenues, a non-GAAP metric, moved lower year-over-year in fiscal 2020. In the fourth quarter of fiscal 2020, for example, the company’s organic revenue fell 18%, while year-to-date in the fiscal year, organic net sales have dropped 6%.

Image Shown: When excluding the favorable impact recent M&A activity has had on Cantel Medical’s financial performance, its recent net sales performance appears much weaker than first appearances suggest. Image Source: Cantel Medical – Fourth Quarter and Full Year Earnings for Fiscal 2020 IR Presentation

Near-Term Outlook Improving

Looking ahead, Cantel Medical is going to need to prove that the worst is behind it and that the firm will be able to hold the line as it concerns its margins. When Cantel Medical reported fourth quarter earnings for fiscal 2020 (period ended July 31, 2020) on September 17, the company beat consensus estimates on both and top- and bottom-lines. The firm’s guidance at the time (particularly its sales guidance) for the first quarter of fiscal 2021 was also stronger than consensus estimates. Cantel Medical guided that its revenues would come in at $250-$260 million in the fiscal first quarter of 2021 due to management expecting that the level of elective medical procedures were beginning to stabilize.

However, on October 22, the firm raised its revenue guidance for the first quarter of fiscal 2021 (period ended October 31, 2020) that called for its sales to come in at $290-$295 million. Considering this is significantly above what Cantel Medical was targeting back in September 2020, investors were apparently quite pleased with this update (shares of CMD have been moving higher of late). Within that press release management commented that Cantel Medical’s current revenue guidance represents an “increase of approximately 25% sequentially from the prior quarter, a year over year increase of approximately 14% on a reported basis and a decrease of approximately 3% on an organic basis.” However, rising confirmed COVID-19 cases and COVID-19 hospitalizations in the US and elsewhere continue to threaten Cantel Medical’s outlook for the fiscal second quarter.

Recent Acquisition

Pease note Cantel Medical completed its acquisition of Hu-Friedy, which is billed as “leading manufacturer of instruments and instrument reprocessing workflow systems serving the dental industry,” in October 2019. That was a cash-and-stock deal worth approximately $717 million, net of cash acquired (the deal primarily consisted of cash considerations), and the acquisition also included contingent payments, up to $50 million if certain milestones are met.

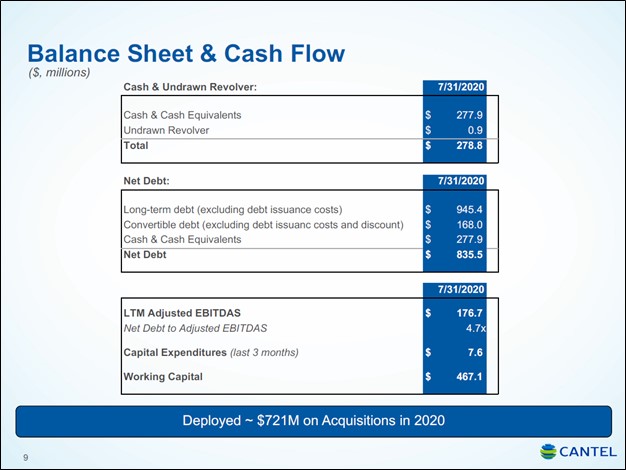

From the end of fiscal 2019 to the end of fiscal 2020, Cantel Medicals’ net debt load grew by ~$0.6 billion (inclusive of short-term debt and convertible debt) reaching ~$0.8 billion at the end of July 31, 2020. Cantel Medical also has operating lease liabilities on the books to be aware of (~$0.05 billion when including short- and long-term operating lease liabilities).

Combing Hu-Friedy’s dental operations with its own should help improve Cantel Medical’s market position, which is crucial given that the firm is often competing against significantly larger peers. On a final note, Cantel Medical’s revenues will benefit from this deal on a comparative basis, which is why it is important to note that the company expects its organic revenues will decline by ~3% year-over-year in the fiscal first quarter.

We appreciate the company’s improving near-term outlook, but we would like to see sustained improvement in Cantel Medical’s margin performance before getting excited. When Cantel Medical reports its fiscal first quarter earnings before the market opens on December 8, we will be paying close attention to its operating expenses and gross margins.

Financial Position

Subsequent to the end of September 2020, management noted that Cantel Medical had paid down $75 million of its revolving credit line during the company’s fourth quarter of fiscal 2020 earnings call. In May 2020, the company amended that facility, and its creditors gave Cantel Medical additional financial flexibility in return for meeting certain terms (such as maintaining a certain amount of liquidity). Paying down debt represents a good use of capital, in our view, as Cantel Medical needs to focus on fiscal prudence to ride out the storm caused by the COVID-19 pandemic. The company’s leverage remains elevated, in our view, and is a meaningful risk to Cantel Medical’s long-term financial flexibility.

Image Shown: A snapshot of Cantel Medical’s balance sheet and leverage ratio at the end of fiscal 2020. Please note that EBITDAS, earnings before interest, taxes, depreciation, amortization, loss on disposal of fixed assets, and stock-based compensation expense, is a non-GAAP metric. Image Source: Cantel Medical – Fourth Quarter and Full Year Earnings for Fiscal 2020 IR Presentation

The firm generated $103 million in free cash flow in fiscal 2020 while spending less than $9 million combined covering its dividend obligations and share repurchases during this period (roughly even split between the two). Cantel Medical’s dividend is currently suspended through October 2021 (this was announced back in March 2020), and the firm is deferring all non-essential capital expenditures as best it can. The company is also embarking on various cost saving measures as well (in the near-term, reducing travel expenses, decreasing executive salaries and bonuses, and furloughing employees, and longer term, rationalizing its headcount and focusing on efficiency and sales growth initiatives).

Cantel Medical generated $137 million in net operating cash flow in fiscal 2020, which was up significantly from the $67 million generated in fiscal 2019 though only up modestly from the $126 million generated in fiscal 2018. Please note that the firm incurred $95 million in capital expenditures in fiscal 2019, which fell down to just $34 million in fiscal 2020, indicating that Cantel Medical’s seemingly strong free cash flows in fiscal 2020 may not be quite as strong as first appears (given the eventual need to increase capital expenditures to complete deferred projects, and due to its net operating cash flows being subdued in fiscal 2019 as a result of unfavorable working capital movements).

It is not clear how Cantel Medical plans to proceed with its share repurchasing strategy going forward, though the firm is limited by recent changes to the covenants included in its revolving credit line. During the firm’s fourth quarter of fiscal 2020 earnings call, management had this to say regarding Cantel Medical’s outlook for the first half of fiscal 2021 (emphasis added):

“Although, we feel the environment is still too uncertain to provide specific guidance for the full year, I’d like to provide some color on our approach for the next two quarters regarding revenue. First of all, we expect first quarter ’21 revenue to increase sequentially to approximately $250 million to $260 million [this guidance was later revised upwards, as noted previously], given that we see external procedures stabilizing in the 80% to 85% range for the entire quarter, versus a Q4 that included a May with procedures in the 60% range.

We expect the recovery to continue into our second quarter, though not at the same rate as we saw in Q4. However, it’s worth remembering that we have four fewer shipping days in our Q2, due to the winter holiday season. So even with sequential day rate improvements, I would not expect a drastically improved total revenue number from Q1 to Q2.

Operating expense in Q1 will see a sequential increase from the fourth quarter as we enter our new fiscal year, stabilizing in the $85 million to $90 million range. With volumes recovering, we are opting to gradually cut back on employee furloughs and salary reductions in place through August. I estimate that normalization of items, such as sales commissions, bonus accruals and the cessation of salaried furloughs results in approximately a $15 million increase in our operating expense, in Q1 relative to Q4.

However, we are also taking cost actions driven by removing the equivalent of 125 headcount and structural cost, which is expected to result in approximately $13 million of savings on an annualized basis. In Q1, that equates to a savings of approximately $2 million, and Q2 will ramp up an additional $1 million for $3 million in savings relative to Q4, 2020. We believe these cost actions set us up well to react to volume changes as we progress through the year, and to improve sequentially each quarter.” — Shaun Blakeman, CFO of Cantel Medical

Cantel Medical’s near-term revenue outlook is improving, though we caution that its near-term operating expenses are expected to increase as well. Headcount rationalization efforts will put downward pressure on the incremental operating expense growth that Cantel Medical expects to incur as it positions itself for a rebound in demand (which includes cutting back on employee furloughs). In the upcoming graphic down below, Cantel Medical provides an overview of its “Cantel 2.0” strategy, which ultimately seeks to boost sales and improve the company’s efficiency while putting downward pressure on its expenses.

Image Shown: An overview of the company’s Cantel 2.0 strategy. Image Source: Cantel Medical – Fourth Quarter and Full Year Earnings for Fiscal 2020 IR Presentation

Other Considerations

When looking through Cantel Medical’s Fiscal 2020 Annual Report this key excerpt caught our eye (emphasis added):

From time to time, we ship certain of our products to Iran, and conduct related activities, in accordance with licenses issued by the Office of Foreign Assets Control (“OFAC”) of the U.S. Department of the Treasury. The Iranian sales were generally conducted through distributors, some of whose customers may include public hospitals owned or controlled directly or indirectly by the Iranian government.

Please be aware that there are certain risks involved with US firms doing business with Iran. The US has placed numerous sanctions on various Iranian entities and many of those sanctions are likely to remain in place for some time given rising geopolitical tensions between the two countries (regardless of which US political party controls the White House). Cantel Medical must be very careful and fully comply with all relevant regulations and regulatory bodies when doing business with Iran. However, it does not appear that Cantel Medical generates a sizable amount of revenue in Iran.

Cantel Medical also has a significant amount of customer concentration risk. Just under 42% of the revenues generated by its Life Sciences segment were generated by two customers in fiscal 2020, and about 42% of its Dental segment’s revenues were generated by three customers in fiscal 2020. Combined, these two business operating segments generated about half of Cantel Medical’s total revenues in fiscal 2020. Should any of these customers change the nature of their relationship with Cantel Medical, that could have a significant impact on its financial performance.

Concluding Thoughts

Medical device and instrument maker Cantel Medical will be a major beneficiary of recent news regarding the growing chances that a safe and viable COVID-19 vaccine will potentially get approved soon. Though the company’s financial performance has deteriorated in recent fiscal years and organic revenue has faced headwinds, the firm’s upwardly-revised guidance (particularly its sales guidance) for the first quarter of fiscal 2021 was a highly encouraging sign, and Cantel noted that the level of elective medical procedures are starting to stabilize. Its recent October 2019 acquisition of Hu-Friedy’s dental operations will put the company in a better position to compete for business as well, though we note rising confirmed COVID-19 hospitalizations around the world continue to pose a threat to the pace of elective surgeries/procedures. Cantel’s near-term outlook is looking up, in our view, but high financial leverage (net debt to adjusted EBITDA), weak organic growth trends, rising expected operating expenses and capital spending, stronger and larger rivals that compete through bundling partnerships across the medical device/instrument arena, moderate customer concentration risk, and recent capital-spending cutbacks (coupled with a suspended dividend) to shore up capital put this idea firmly in the high-risk/speculative category. Nonetheless, given signs of a turnaround based on the recent guidance raise, Categories Member Articles