Member LoginDividend CushionValue Trap |

Best Ideas PayPal and Visa Have Ample Capital Appreciation Upside Potential

publication date: Jun 18, 2021

|

author/source: Callum Turcan

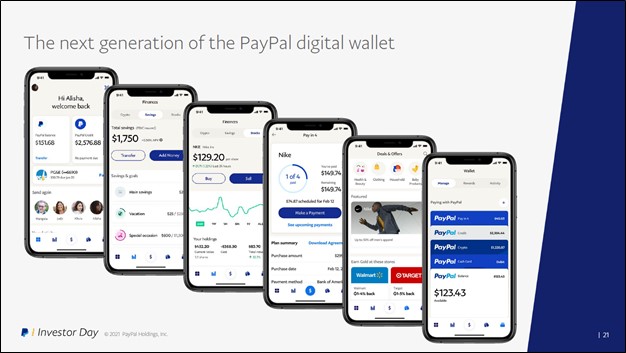

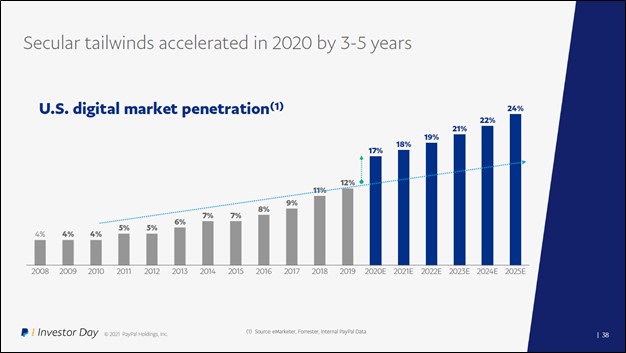

Image Shown: PayPal Holdings Inc’s digital wallet offers the firm multiple sources of upside. Image Source: PayPal Holdings Inc – February 2021 Investor Day Presentation By Callum Turcan The payment processing and fintech industries are incredibly lucrative and supported by powerful secular growth tailwinds such as the proliferation of e-commerce and the global shift away from cash (towards card, tap to pay, QR code, online, and other payment methods). PayPal Holdings Inc (PYPL) and Visa Inc (V) are two of our favorites in the space, and we include both firms as ideas in the Best Ideas Newsletter portfolio. PayPal's Long Term Growth Prospects Are Immense PayPal offers an expansive slate of services for consumers and merchants including checkout and point-of-sale solutions, shopping and marketing tools, various financing solutions, peer-to-peer money transfer services, and more. The popular peer-to-peer money transfer app Venmo is owned by PayPal, and in 2020, PayPal launched its first Venmo Credit Card in 2020. PayPal has only recently attempted to seriously monetize its vast Venmo user base. Management aims for Venmo to generate around $0.9 billion in revenue this year, and the firm reiterated that guidance during a June 2021 investor event. In January 2020, PayPal completed its ~$4 billion acquisition of Honey Science Corporation. This deal added the popular Honey browser extension, a suite of shopping tools, and Honey’s sizable user base to PayPal’s operations. Additionally, PayPal now has greater insight into consumer shopping trends which supports the value proposition of its marketing tools for merchants. According to PayPal, the company views its total addressable market (‘TAM’) sitting at a whopping ~$110 trillion when looking at online and in-store retail, business-to-consumer, peer-to-peer, remittances, bill pay, digital services, and other opportunities. PayPal also has indirect exposure to cryptocurrencies via its digital wallet offerings, though this represents a small part of its overall business. PayPal’s growth runway is immense. Here is what management had to say regarding the secular tailwinds supporting PayPal’s outlook during the company’s February 2021 Investor Day event (moderately edited, emphasis added): “2020 changed everything. Black swan events tend to result in permanent changes in consumer behavior, and this one is no different. The changes in consumer behavior that we're seeing now, though, create an opportunity for PayPal that is unlike anything that we've seen before. Merchants are adopting digital first strategies. It's no longer a nice to have. It's become a necessity. Consumers are habituating to eCommerce and digital first experiences, because they're simpler.There's less friction. There's more convenience. They're doing so without sacrificing quality or choice, or in some cases even speed of delivery. Most estimate that eCommerce has been pulled forward three to five years… It took almost two decades to get to 12% U.S. digital market penetration. Estimates today are that we will get the next 12% in just the next five years… We've added things like Simility and Hyperwallet and iZettle and Honey, Zoom, other platforms that have provided more experiences, more capabilities in the wallet for our customers.” --- John Rainey, PayPal’s CFO and EVP of Global Customer Operations The upcoming graphic down below highlights the secular tailwinds PayPal’s CFO and EVP of Global Customer Operations mentioned in the above excerpt.

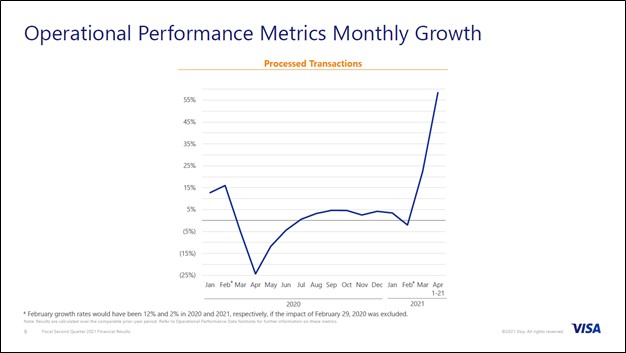

Image Shown: As the proliferation of e-commerce continues in the US, PayPal views itself as being well-position to capitalize on those secular tailwinds which supports its growth outlook. Image Source: PayPal – February 2021 Investor Day Presentation In the fourth quarter of 2020, PayPal launched its ‘Buy Now, Pay Later’ offering in three markets (the US, the UK, and France). During the final quarter of 2020, this offering had ~$0.75 billion in payment volumes with 3 million unique customers shopping at 250,000 merchants. Some of those merchants have been receptive to placing PayPal’s payment options in convenient “upstream” locations for consumers to improve visibility according to recent management commentary. So far, PayPal’s sales team has had a lot of success rolling out this service with larger merchants, and the firm is “excited” about its pipeline on this front in 2021. Here is what management had to say regarding the Buy Now, Pay Later offering during PayPal’s February 2021 Investor Day event (emphasis added): “Where we see upstream presentment, though, very importantly, we see a 10% lift in our branded share of checkout. It's very important for us, very important for our merchants as well. When we look at customers that have adopted Buy Now, Pay Later, there's a 12% increase in the weekly TPV [total payment volumes] in transactions. If you look at the U.S., 40% of customers that have used Buy Now, Pay Later have come back subsequently for two more transactions during that period of time. It's a relatively low risk experience that we provide, as 80% of the funding of this is done around debit. I'm excited about this. This is one of the best product launches that we've ever had.” --- PayPal’s CFO and EVP of Global Customer Operations By 2025, PayPal aims to generate $50.0+ billion in revenues and $10.0+ billion in free cash flow according to forecasts laid out at its February 2021 Investor Day event. In 2020, PayPal generated $21.5 billion in GAAP revenues and $5.0 billion in free cash flows, highlighting the firm’s confidence in its medium-term growth trajectory. The company expects its operating margins will expand through 2025 versus 2020 levels, aided by economies of scale (operating leverage). PayPal aims to allocate 30%-40% of its free cash flows towards share repurchases going forward, and it does not pay out a common dividend at this time. The top end of our fair value estimate for PayPal sits at $334 per share, and we view PayPal’s share repurchase strategy as reasonable. At the end of March 2021, PayPal had a net cash position of $4.1 billion with no short-term debt on the books. However, within PayPal’s $6.0 billion ‘long-term investments’ line item, there are $3.1 billion in cash-like items (time deposits and available-for-sale debt securities), with the balance represented by strategic assets. Taking those cash-like positions into account indicates PayPal’s net cash position is stronger than it first appears. We appreciate PayPal’s pristine balance sheet, promising growth runway, and stellar free cash flow generating abilities. Our May 2021 article PayPal Reports Strongest First Quarter Results in History can be viewed here. PayPal’s capital appreciation upside is immense, in our view, and shares of PYPL are on a nice upward climb of late. Visa Boasts an Impenetrable Economic Moat Visa is a leader in the payment processing and payment solutions space, and the firm has been steadily growing its fintech business over the past several years as well. The company’s payment ecosystem offers a wide slate of solutions to facilitate transactions between financial institutions, merchants, and consumers all over the globe. Visa also provides value added offerings such as fraud management and security services, along with consulting services provided via its Visa Consulting & Analytics unit. Business-to-business (‘B2B’) payment solutions represent a key growth opportunity for the company. Visa’s Visa B2B Connect offering operates separately from VisaNet, its proprietary network, and Visa B2B Connect facilitates direct cross-border transactions from the originating bank to the recipient bank. According to its Fiscal 2020 Annual Report, Visa B2B Connect was available in 80 markets and the goal is to expand the service into 30 additional markets in the near term (Visa is aiming for this business to achieve scale by 2022). Here is what Visa’s management had to say on the issue in response to an analyst’s question during a June 2021 investor event (emphasis added): “We often talk about B2B, just the overwhelming size of the opportunity. It is about $185 trillion with a payment volume opportunity. So pretty darn hard to ignore. Now if you start parsing it apart, about $65 trillion of that $185 trillion are things like P2P, B2C, government to consumer, and so I'm going to set those aside because they're really not the core big B2B type payments, about $120 trillion of the $185 trillion is core B2B. And then that further breaks down into three components that we look at. One is carded or Cardinal. The payments that get circulated on cards today. I think D&E cards and procurement cards and virtual cards, that's about $20 trillion worth of volume. So huge market. $10 trillion is cross border. These are large value, low frequency, information-rich transactions between companies and cross borders. That's about $10 trillion, relatively strong yields in that segment, by the way. And then there's $90 trillion in non-carded domestic accounts payable receivable volume, which has a somewhat lower yield. So we think of it in those three buckets. On the first bucket, the card opportunity, $20 trillion, that's our bread and butter. We have incredibly strong traction there. We continue to focus on growth. We've got about 20% more commercial issuers today than we did four years ago. So we continue to add more and more and more issuers on the commercial side. For the $10 trillion in cross-border opportunity, that's a place where we focused a lot recently on product development, and you heard us talk about B2B Connect, which is a platform that we think addresses major pain points in cross-border around speed, reliability, efficiency, data transparency, flexibility. And we're excited about it.” --- Jack Forestell, Visa’s EVP and Chief Product Officer As with PayPal, the company’s growth runway is quite impressive. In May 2019, Visa acquired control of Earthport for a little over $0.3 billion after outbidding its key rival Mastercard Inc (MA). Earthport “provides cross-border payment services to banks, money transfer service providers and businesses via the world’s largest independent ACH network” according to the press release. Visa integrated Earthport with VisaDirect, a global real-time push payments platform, which significantly extended the reach of VisaDirect by enabling Visa to push payments to an additional 1.5 billion bank accounts. What VisaDirect offers smaller businesses and sellers is faster access to funds, better enabling these entities to manage their cash flows. Visa continues to innovate, which supports its long-term growth outlook. In fiscal 2020 (period ended September 30, 2020), Visa Direct enabled 2.35 million US small businesses and sellers to access their funds faster. At the end of the second quarter of fiscal 2021 (period ended March 31, 2020), Visa had a modest net debt position of $2.3 billion (inclusive of short- and long-term ‘investment securities’) with no short-term debt on the books. Visa generated $6.5 billion in free cash flow during the first half of fiscal 2021 while spending $1.4 billion covering its dividend obligations and $3.5 billion buying back Class A common stock during this period. Visa’s business took a beating over the past several fiscal quarters due to the sharp reduction in cross-border travel and related activities in the wake of the coronavirus (‘COVID-19’) pandemic, though enormous growth in its e-commerce transactions has helped offset those headwinds to a degree. Additionally, when the global economy eventually opens up in the wake of vaccine distribution efforts, Visa’s cross-border business should rebound in earnest. When combined with sustained growth in its e-commerce business, Visa’s outlook is quite bright. As one can see in the upcoming graphic down below, Visa’s processed transactions performance started to rebound sharply in the early months of calendar year 2021.

Image Shown: Visa’s business is on the rebound. Image Source: Visa – Second Quarter of Fiscal 2021 Earnings IR Presentation We covered these topics and Visa’s outlook in detail in our April 2021 article Visa’s Business Is on the Rebound which can be viewed here. The top end of our fair value estimate range for Visa sits at $272 per share. Though the US Department of Justice (‘DOJ’) is probing Visa’s debit card business, that does not shake our confidence in the company. We continue to view Visa’s capital appreciation upside quite favorably. Shares of V yield a modest ~0.6% as of this writing with its dividend offering incremental upside to its capital appreciation potential. Additionally, shares of V are on a nice upward climb of late as investors are apparently warming back up to the company’s improving outlook. Concluding Thoughts We continue to like PayPal and Visa as ideas in the Best Ideas Newsletter portfolio. PayPal is almost a top-weighted idea and Visa is a top weighted idea. We want the Best Ideas Newsletter portfolio to have significant exposure to high-quality industries with promising outlooks. Given both firms have substantial pricing power, in the event sustained cost inflation headwinds materialize, PayPal and Visa should be able to easily pass those cost increases and then some along to their customers. ----- Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI Tickerized for PYPL, SQ, V, MA, COIN, FIS, BILL, GPN, FISV, GBTC Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment