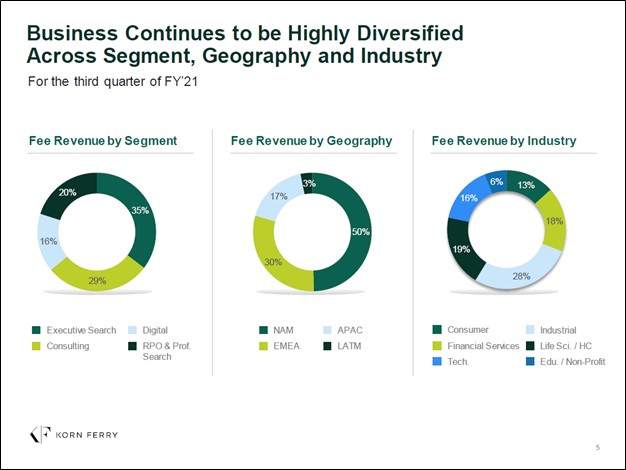

Image Shown: Korn Ferry’s revenue generation mix across business operating segments, geographies, and industries as of the third quarter of fiscal 2021. Image Source: Korn Ferry – Third Quarter of Fiscal 2021 Earnings IR Presentation

By Callum Turcan

The management consulting firm Korn Ferry (KFY) was added to the Best Ideas Newsletter portfolio on January 12, 2021 (link here) after the firm registered a 9 on the Valuentum Buying Index (‘VBI’). Shares of KFY have increased by 31% since then versus an 11% gain for the S&P 500 (SPY) as of the end of normal trading hours on June 18. The top end of our fair value estimate range sits $79 per share of KFY, well above where shares of Korn Ferry are trading as of this writing, and we see room for additional capital appreciation upside going forward. Though Korn Ferry’s business faced tremendous headwinds due to the coronavirus (‘COVID-19’) pandemic, ongoing vaccine distribution efforts are beginning to pick up steam worldwide and demand for the firm’s services is on the rebound.

Image Shown: Shares of Korn Ferry have surged higher year-to-date as of this writing.

Business Profile Overview

Korn Ferry operates through four business operating segments: Consulting, Digital, Executive Search, and RPO and Professional Search. At the end of fiscal 2020 (period ended April 30, 2020), Korn Ferry had 110+ offices across 50+ countries. The firm notes that over 70% of its revenues “comes from clients that utilize multiple lines of our business” according to its Fiscal 2020 Annual Report.

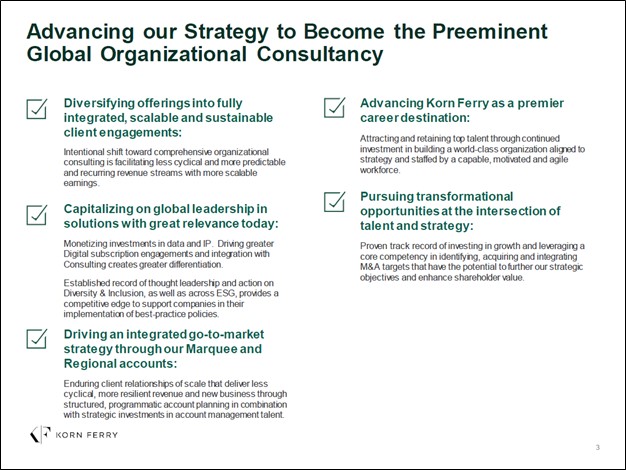

Over the past several years, Korn Ferry placed a great emphasis on its digital investments and building out a platform that would allow the firm to deliver services more effectively across its company-wide operations. Additionally, integrating recent acquisitions (Miller Heiman Group, AchieveForum and Strategy Execution) into Korn Ferry’s global business have further improved its ability to deliver services efficiently across a more expansive set of solutions.

Image Shown: An overview of Korn Ferry’s operational goals and past accomplishments. Image Source: Korn Ferry – Third Quarter of Fiscal 2021 Earnings IR Presentation

Financials

Before the market opens on June 22, Korn Ferry plans to announce its fourth quarter earnings for fiscal 2021 (period ended April 30, 2021) and will hold a conference call shortly thereafter. Korn Ferry’s financials took a hit from the COVID-19 pandemic, though by the third quarter of fiscal 2021 (period ended January 31, 2021), its business began to stage a meaningful turnaround on a sequential basis. During the first three quarters of fiscal 2021, Korn Ferry generated $31 million in free cash flow versus $23 million during the same period the previous fiscal year.

Korn Ferry spent $18 million covering its dividend obligations (including dividends paid to noncontrolling interests) and spent $30 million buying back its stock during the first three quarters of fiscal 2021. Its dividend obligations were fully covered by its free cash flows, though its share buyback program took advantage of Korn Ferry’s strong balance sheet.

At the end of April 2021, Korn Ferry had $740 million in cash, cash equivalents, and current marketable securities on hand along with $157 million in non-current marketable securities. Stacked up against $395 million in long-term debt on the books at the end of this period, with no short-term debt on the books, Korn Ferry’s ~$502 million net cash position (inclusive of non-current marketable securities) provides the firm with ample financial firepower.

We are supportive of Korn Ferry’s recent share repurchases given that during most of this period, shares of KFY were quite undervalued relative to their intrinsic value derived through enterprise cash flow analysis. Looking ahead, share repurchases still represent a good use of capital, in our view, as Korn Ferry is trading well below the top end of our fair value estimate range. Shares of KFY yield ~0.6% as of this writing, as its dividend is not a core focus on its capital allocation policy (though there is ample room for Korn Ferry to grow its payout going forward). The company’s payout offers incremental upside to its immense capital appreciation potential.

Management Commentary

During Korn Ferry’s fiscal third quarter earnings call, management had this to say regarding the firm’s business model (emphasis added, moderately edited):

“We’ve driving integrated solutions base go-to-market approach that facilitates growth and enduring partnerships with our marquee and regional accounts that are central to more scalable and durable levels… The focused execution of our strategy has transformed our business into a more efficient, profitable, growth oriented organization. We are far less economically cyclical today than in any point in our history. The time to recovery, much shorter, the trajectory of the recovery, much steeper, our revenues more visible and scalable, our client solutions more impactful, our people, the absolute best in the industry, in our data and IT, it’s deep, rich, in absolutely best in class…

Underpinning all of our offerings and solutions is our world class IP, putting us in an unparalleled position of strength… At the end of the third [fiscal] quarter, we hold rewards data for over 20 million people. Over 70 million assessments have been taken. We’ve got organizational benchmark data on 12,000 entities we have 3,900 individual success profiles covering almost 30,000 job titles. Our proprietary recruiting AI tool has compiled more than 550 million profiles of potential candidates across the globe. Every year, we train and develop nearly a million professionals. And certainly last but not least, each business hour, we place a candidate in a new job every three minutes.” — Gary Burnison, CEO of Korn Ferry

Management noted during the fiscal third quarter earnings call that Korn Ferry had been bulking up its workforce of late (with an eye towards highly skilled positions) as the recovery in demand for the firm’s services in the wake of COVID-19 pandemic-related lockdown measures easing has outstripped its capacity. The company intends to continue bulking up its workforce and ability to meet demand going forward as management appears confident the recovery has legs.

Image Shown: Korn Ferry faced tremendous headwinds from the COVID-19 pandemic though its outlook has improved considerably since then, and its growth trajectory is quite bright. The financial performance of Korn Ferry’s core business segments has been improving over the past few fiscal quarters. Image Source: Korn Ferry – Third Quarter of Fiscal 2021 Earnings IR Presentation

Concluding Thoughts

We are big fans of Korn Ferry’s business model and its numerous competitive advantages (such as its digital edge with an eye towards its IP portfolio, vast talent database, and AI tools). The company’s pristine balance sheet, impressive free cash flow generating abilities, and improving outlook highlight how Korn Ferry’s strong operational performance enables it to deliver. We continue to like Korn Ferry as an idea in the Best Ideas Newsletter portfolio and will have more to say on the firm after it reports its fiscal fourth quarter earnings.

Korn Ferry’s 16-page Stock Report (pdf) >>

Tickerized for KFY, ADP, DLX, EFX, JOBS, MAN, NSP, PAYX, RHI, HURN

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for KFY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.