Image Shown: Best idea Korn Ferry posted a stellar fourth quarter of fiscal 2022 earnings report with several of its core financial metrics reaching all-time highs. The firm also issued out favorable near term guidance in conjunction with its latest earnings update. We continue to be huge fans of the global management consulting firm. Image Source: Korn Ferry – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On June 22, global management consulting firm Korn Ferry (KFY) reported fourth quarter earnings for fiscal 2022 (period ended April 30, 2022) that smashed past both consensus top- and bottom-line estimates. The firm also raised its dividend 15% sequentially to $0.15 per share or $0.60 on an annualized basis in conjunction with its earnings update, good for a forward-looking yield of ~1.1% as of this writing. Korn Ferry’s dividend growth story offers incremental upside to its substantial capital appreciation potential.

We include Korn Ferry as an idea in the Best Ideas Newsletter portfolio and our fair value estimate sits at $86 per share, with the lower end of our fair value estimate sitting at $69 per share. As of this writing, shares of KFY are trading well below the low end of our fair value estimate range.

In the wake of its latest earnings update, shares of KFY jumped higher. Several of the company’s key financial metrics achieved all-time highs in both the final quarter of fiscal 2022 and for all of fiscal 2022, and Korn Ferry provided favorable near term guidance that indicates its strong performance should continue going forward.

Earnings Update

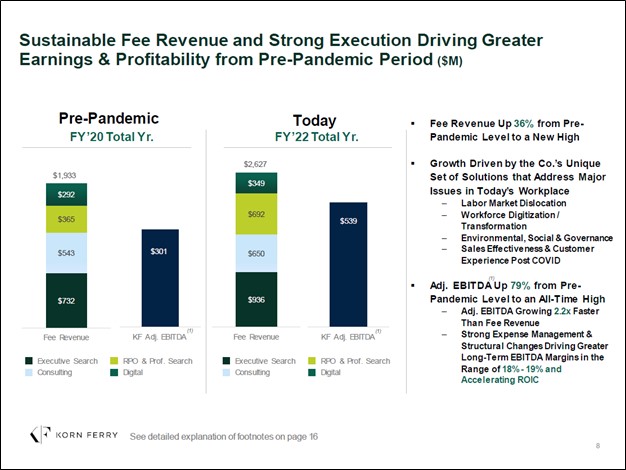

During the final quarter of fiscal 2022, Korn Ferry posted $721 million in fee revenue (a metric that closely resembles its underlying performance), which was a record high. That represented a 30% increase from the same period last fiscal year. Management noted within the earnings press release and during the firm’s latest earnings call that Korn Ferry benefited from shortages of skilled labor, its integrated go-to-market strategy and cross business referrals, and the strong relationship Korn Ferry has with its marque and regional accounts.

Korn Ferry’s sales growth last fiscal quarter was widespread with its ‘Consulting,’ ‘Digital,’ ‘Executive Search,’ and ‘RPO and Professional Search’ business segments all reporting year-over-year increases. On a GAAP basis, Korn Ferry’s revenue came in at $727 million (includes ‘reimbursed out-of-pocket engagement expenses’) in the fiscal fourth quarter, up 30% year-over-year.

Its GAAP operating income came in at $139 million in the fiscal fourth quarter (another all-time high), up 61% year-over-year. That was good for a GAAP operating margin of 19.1%, up ~360 basis points on a year-over-year basis. Korn Ferry has been steadily scaling up its workforce to meet increased demand for its services while also leaning on digital delivery solutions to boost productivity, and its efforts have panned out quite favorably so far. In the fiscal fourth quarter, Korn Ferry’s GAAP diluted EPS stood at $1.70 (another all-time high), up 40% year-over-year due to strong net income growth being aided by a 1% reduction in its outstanding diluted share count.

Korn Ferry’s fee revenue and GAAP diluted EPS in fiscal 2022 also reached all-time highs. Management stressed during the firm’s latest earnings call that this was not a one-off event but part of a bigger upward trend due to Korn Ferry’s position in an attractive space.

We are impressed with the company’s strong performance of late and see room for additional upside as Korn Ferry provided favorable guidance for the current fiscal quarter. Its near-term guidance calls for 19% year-over-year growth in its fee revenue and 9% year-over-year growth in its adjusted diluted EPS at the midpoint in the first quarter of fiscal 2023. In April 2022, Korn Ferry closed its acquisition of Patina Solutions Group which beefed up its executive solutions operations, and the deal should support its growth trajectory going forward. Financial terms were not disclosed.

Financial Strength Update

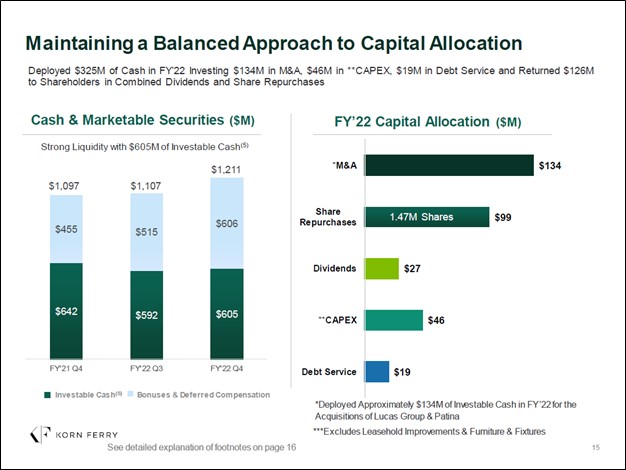

At the end of April 2022, Korn Ferry’s balance sheet remained pristine. The firm exited fiscal 2022 with $1.2 billion in cash, cash equivalents, current marketable securities, and noncurrent marketable securities on hand with no short-term debt and $0.4 billion in long-term debt on the books. Please note that Korn Ferry also had substantial bonuses and deferred compensation liabilities at the end of this period to be aware of, though even after taking that into account, it still exited April 2022 with a nice net cash position. We are big fans of Korn Ferry’s balance sheet health.

Image Shown: An overview of Korn Ferry’s investable cash position in recent fiscal quarters and its capital allocation decisions in fiscal 2022. Image Source: Korn Ferry – Fourth Quarter of Fiscal 2022 IR Earnings Presentation

Within its latest earnings press release, Korn Ferry did not provide a cash flow statement, and we will have more to say on the firm once its 10-K SEC filing covering fiscal 2022 is published. The company has historically been a stellar free cash flow generator due to its asset-light business model, which requires relatively little capital expenditures to maintain a given level of revenues. Its capital allocation priorities include investing in the business, bolt-on M&A activity, preserving and growing the dividend, and repurchasing its stock.

Concluding Thoughts

Korn Ferry’s growth outlook is bright as labor shortages are gripping industries across the board. Its ability to connect skilled workers with companies in need underpins its pricing power and represents a key reason why Korn Ferry has been able to grow its operating margins in the wake of the major inflationary pressures seen of late. We continue to like Korn Ferry as an idea in the Best Ideas Newsletter portfolio.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for KFY, ADP, DLX, EFX, JOBS, MAN, NSP, PAYX, RHI, HURN

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long DIS and META call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.