Member LoginDividend CushionValue Trap |

Banks Holding Up Well, Some Feel Pain from Archegos Capital Collapse

publication date: Apr 20, 2021

|

author/source: Callum Turcan

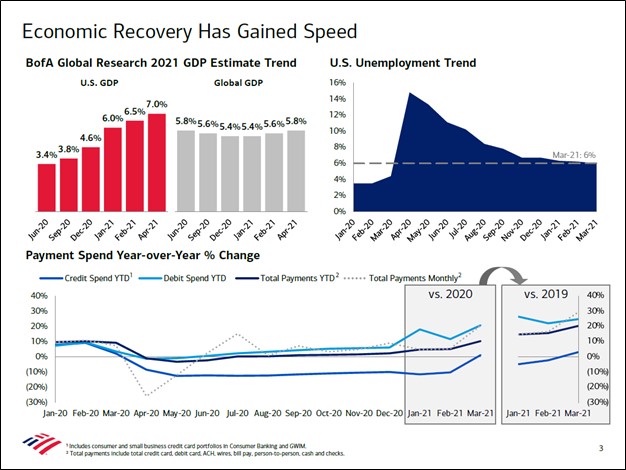

Image Shown: Bank of America Corporation has an optimistic view towards the ongoing US economic recovery. Image Source: Bank of America Corporation – First Quarter of 2021 IR Earnings Presentation By Callum Turcan Earnings season is now underway! In this article, we cover the performance of two large US banks and the problems facing one major European bank in light of losses stemming from Archegos Capital Management blowing up. Large reserve releases last quarter--due to the US economy holding up better than expected--during the coronavirus (‘COVID-19’) pandemic played an outsized role in bolstering the financial performance of key US banks after these institutions recorded large reserve builds in 2020. Net interest margins (‘NIM’) continue to face headwinds from the low interest rate environment, though noninterest related income (such as income generated from wealth management, investing banking, and other activities) at several banks has come in strong (aided by favorable capital market conditions). The surge in special purpose acquisition companies (‘SPACs’) going public in the US has been a boon for investment banking operations, though as we noted in a recent article (link here), many of these SPACs are not great for investors. In the Best Ideas Newsletter portfolio, we include the Financial Select Sector SPDR Fund ETF (XLF) to gain broad exposure to the financial services sector. As the US economy continues to recover, aided by ongoing COVID-19 vaccine distribution efforts and the easing of social distancing restrictions (along with the uplift provided by massive fiscal stimulus packages), the outlook for interest rates should improve, though in the near term, rates are likely to remain subdued according to commentary from Fed chairman Jerome Powell. Bank of America Bank of America Corp (BAC) reported first quarter 2021 earnings on April 15 that beat both consensus top- and bottom-line estimates. The bank generated $0.87 in GAAP EPS last quarter, more than double year-ago levels though there is a lot of noise in the numbers. Net interest margins continued to face headwinds from the low interest rate environment in the first quarter, though strength at its wealth management and investment banking business bolstered Bank of America’s performance. Please note Bank of America’s bottom-line benefited from a large reserve released in the first quarter of 2021 as the company set aside more than it needed in 2020 to cover potential losses (in the first quarter of 2020, Bank of America’s profit took a hit from a large reserve build). As the outlook for the domestic economy continues to improve, the bank now expects its loan losses will be smaller than originally feared.

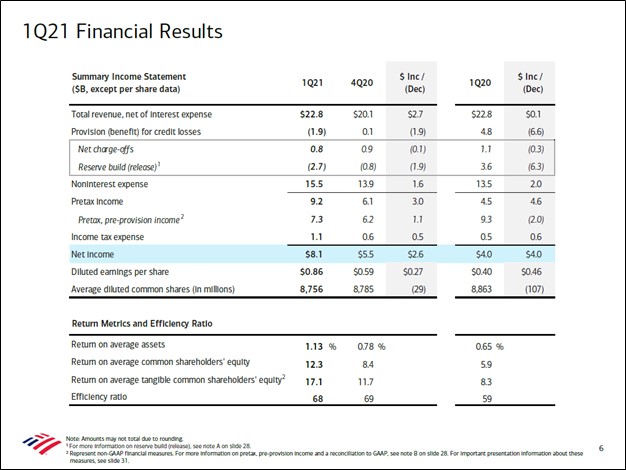

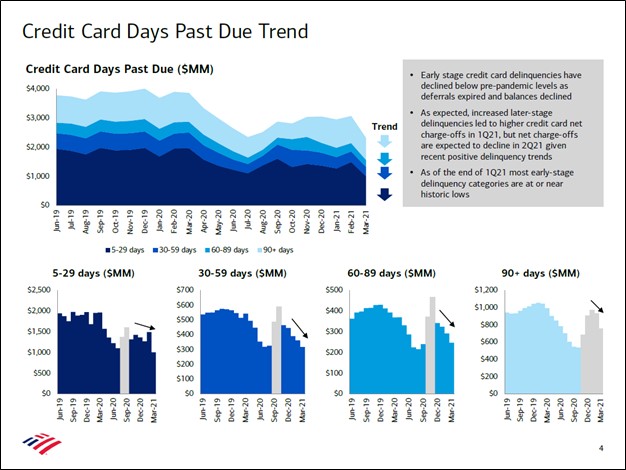

Image Shown: Bank of America’s bottom-line received a massive boost in the first quarter of 2021 due primarily to a large reserve release, money previously set aside for potential loan losses. The US economy has fared better than initially expected so far during the COVID-19 pandemic and with vaccine distribution efforts now well underway, there is room to keep the momentum going in the right direction. Image Source: Bank of America – First Quarter of 2021 IR Earnings Presentation According to its latest earnings presentation, Bank of America is experiencing a steady decline in “early stage credit card delinquencies” which relates to accounts that are 89 days (or fewer) past due. The bank communicated to investors that if current trends hold, its net charge offs from its credit card business should move lower in the near-term. Savings built up by many households and corporations during the pandemic saw Bank of America’s deposits surge higher last quarter versus year-ago levels.

Image Shown: Bank of America’s credit card delinquency rates are trending in a positive direction. Image Source: Bank of America – First Quarter of 2021 IR Earnings Presentation Bank of America’s digital operations continue to see growing levels of user engagement. From the first quarter of 2018 to the first quarter of 2021, its digital household adoption percentage grew from 61% to 70%. The bank’s virtual financial assistant, known as Erica, has surged in popularity over the past couple of years. On April 15, Bank of America also announced that it had authorized $25.0 billion in share repurchases, though in the near-term, Bank of America will need to comply with pandemic-related regulations set by the Fed regarding capital allocation decisions. At the end of March 2021, Bank of America had a common tier one equity (‘CET1’) ratio of 11.8%, well above the 9.5% requirement. We continue to view Bank of America as one of the best banks out there. As of this writing, shares of BAC yield ~1.8%. On a final note, as it concerns the collapse of Archegos Capital Management, Bank of America appears to have largely dodged that bullet. Credit Suisse Group The Switzerland-based bank Credit Suisse Group AG (CS) has not yet released its earnings report for the first quarter of 2021 (which is due to be published on April 22, though it will be a brutal report). However, we want to highlight that Credit Suisse expects to take a CHF$4.4 billion charge (approximately USD$4.8 billion based on exchange rates seen in the middle of April 2021) from the collapse of Archegos Capital Management which is largely why the bank is guiding to post a pre-tax loss in the first quarter of 2021 of approximately CHF$0.9 billion (roughly USD$1.0 billion). Counterparty risk in the financial services sector always needs to be monitored. Credit Suisse suspended its share buyback program at the end of March 2021 in light of the massive charge and also intends to reduce its dividend. On a final note, Credit Suisse is dealing with problems related to certain supply chain finance funds and Greensill Capital, which recently filed for bankruptcy. Though Credit Suisse changed portions of its corporate structure and management team in the wake of these crises, more will likely need to be done to stabilize the ship. We continue to view the banking landscape in the US much more favorably than the banking landscape in Europe. JPMorgan On April 14, JPMorgan Chase & Co. (JPM) reported first quarter 2021 earnings that beat both consensus top- and bottom-line estimates. As was the case with Bank of America, JPMorgan recorded a large reserve release last quarter which played an outsized role in its GAAP net income rising many-fold over year-ago levels (when its performance was weighed down by large reserve builds). JPMorgan’s home lending business performed quite well last quarter as the number of loan originations grew ~40% year-over-year, and this segment of its business also benefited from a reserve release.

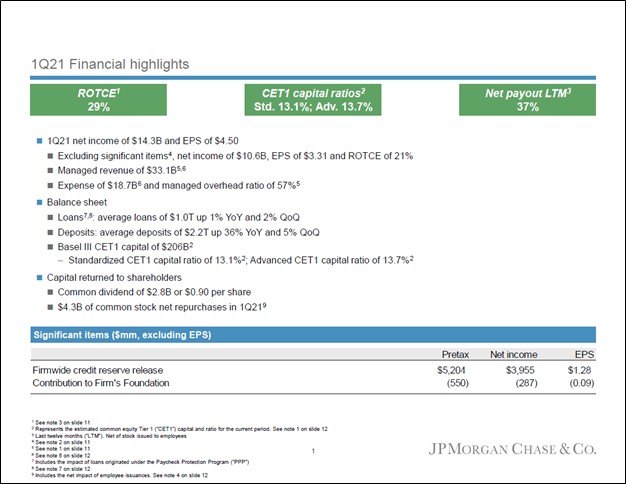

Image Shown: A snapshot of JPMorgan’s performance during the first quarter of 2021. Image Source: JPMorgan – First Quarter of 2021 IR Earnings Presentation JPMorgan’s NIM continued to face headwinds from the low interest rate environment last quarter, though strength at its investment banking and wealth management business helped offset those headwinds (similar to Bank of America’s performance in the first quarter). At the end of March 2021, JPMorgan had a standardized CET1 ratio of 13.1% and during its latest earnings call, management communicated to investors that additional share buybacks were on the horizon. JPMorgan’s management team also noted that the bank’s digital platform performed quite well last quarter during the company’s latest earnings call as “approximately 50% of new checking and savings accounts were opened digitally--that's up more than 10 percentage points year-on-year.” Looking ahead, JPMorgan has a positive view towards the US economic outlook as consumer sentiment and credit/debit card activity is starting to return to pre-pandemic levels according to the bank. Commentary from major US banks underpins our view that the US economic recovery is on a positive trajectory, and we continue to view JPMorgan as one of the best banks out there alongside Bank of America. Shares of JPM yield ~2.4% as of this writing. Final Thoughts Earnings season is getting underway as companies work towards putting 2020, and all of the problems that arose last year, in the rearview mirror. We continue to like the XLF ETF in the Best Ideas Newsletter portfolio as a way to gain broad exposure to the financial services sector. Bank of America and JPMorgan are the second and third largest holdings in the XLF ETF, as of April 16, with the ETF’s largest holding being Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares (ticker: BRK.B). Combined, those three firms represent about a third of the XLF ETF’s total holdings. We continue to like Berkshire Hathaway and include Berkshire Hathaway Class B shares in the Best Ideas Newsletter portfolio. ----- Related: BRK.A, BRK.B, CS, KBE, KRE, XLF, VFH, IYG, KBWB Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B) and the Financial Select Sector SPDR Fund ETF (XLF) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment