Member LoginDividend CushionValue Trap |

Apple’s 'Vision Pro' Not in Our Valuation Model; Expect Upside

publication date: Jun 7, 2023

|

author/source: Brian Nelson, CFA

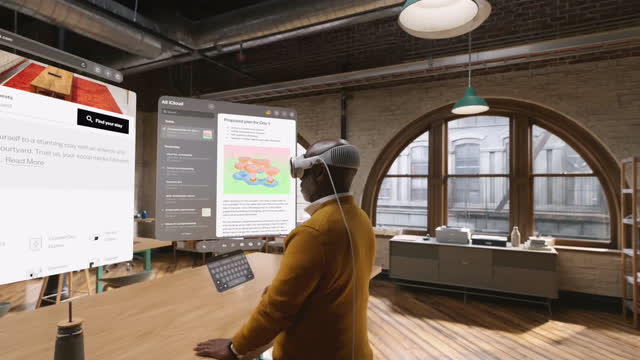

Image: Apple released its first major product since the Apple Watch in the Vision Pro on June 5. The device opens the door to the era of spatial computing and is priced at $3,499. By Brian Nelson, CFA

Apple (AAPL) unveiled its Vision Pro at the company’s Worldwide Developers Conference on June 5. We were impressed with the new major product launch, its first since the release of the Apple Watch nearly a decade ago but estimating the total market opportunity for a $3,499 device is a difficult one. The Vision Pro will be available in early 2024 and will compete in many areas with the Meta (META) Quest, and we expect Apple’s annual numbers come next year to be impressive. The market for high-end consumer devices is a large one, and from what we can tell, the number of possible applications of the Vision Pro are many. We’re not making any changes to our valuation of Apple until we get a better feel for just how big of a needle-mover the Vision Pro will be, but we expect to raise our fair value estimate of Apple. The company has another winner on its hands, in our view. ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |