Member LoginDividend CushionValue Trap |

American Express Carries Meaningful Credit Risk

publication date: May 26, 2020

|

author/source: Callum Turcan

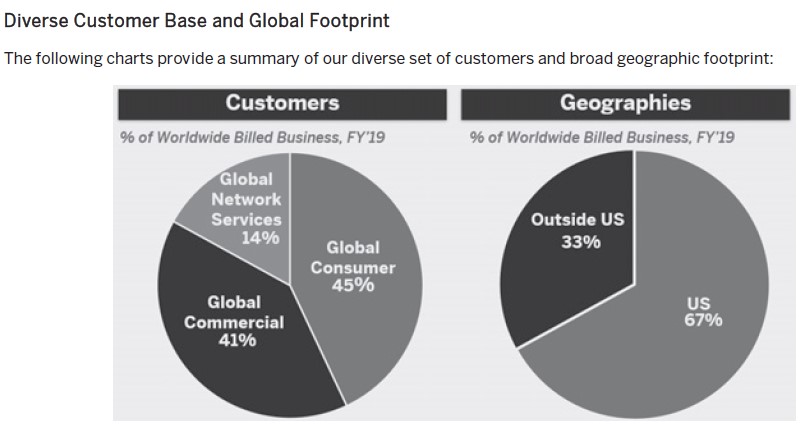

Image Source: American Express Company – First Quarter of 2020 Earnings IR Presentation By Callum Turcan At Valuentum, we are very bullish on the growth trajectory of high-quality payment processing, payment solutions, and financial technology firms. That’s why we include PayPal Holdings Inc (PYPL) and Visa Inc (V) as top-weighted holdings in our Best Ideas Newsletter portfolio. However, please note that what makes those firms appealing is the limited or lack of exposure to credit risk. Visa carries no credit risk and generates revenues through fees collected on transactions conducted with Visa-branded cards, and while PayPal possesses some credit risk, that risk is rather small relative to its overall business. Both firms enable investors to capitalize on the shift to a “cashless” society, a trend occurring both offline and online. Pivoting now to American Express Company (AXP), the focus of this piece, American Express carries a lot of credit risk. While, generally speaking, American Express tends to cater to relatively more affluent clientele than say, Discover Financial Services (DFS), that doesn’t mean American Express isn’t exposed in a very meaningful way to a sharp downturn in US and global economic activity. That downturn is a result of the ongoing coronavirus (‘COVID-19’) pandemic and the negative dynamic effects the virus has had on economic activity across the globe. Credit Risk American Express Company and its principal operating subsidiary, American Express Travel Related Services Company Inc (‘TRS’), are bank holding companies. In 2019, 67% of American Express’ billed businesses were in the US according to its 2019 Annual Report as the firm is primarily US-focused, though it also has meaningful international exposure.

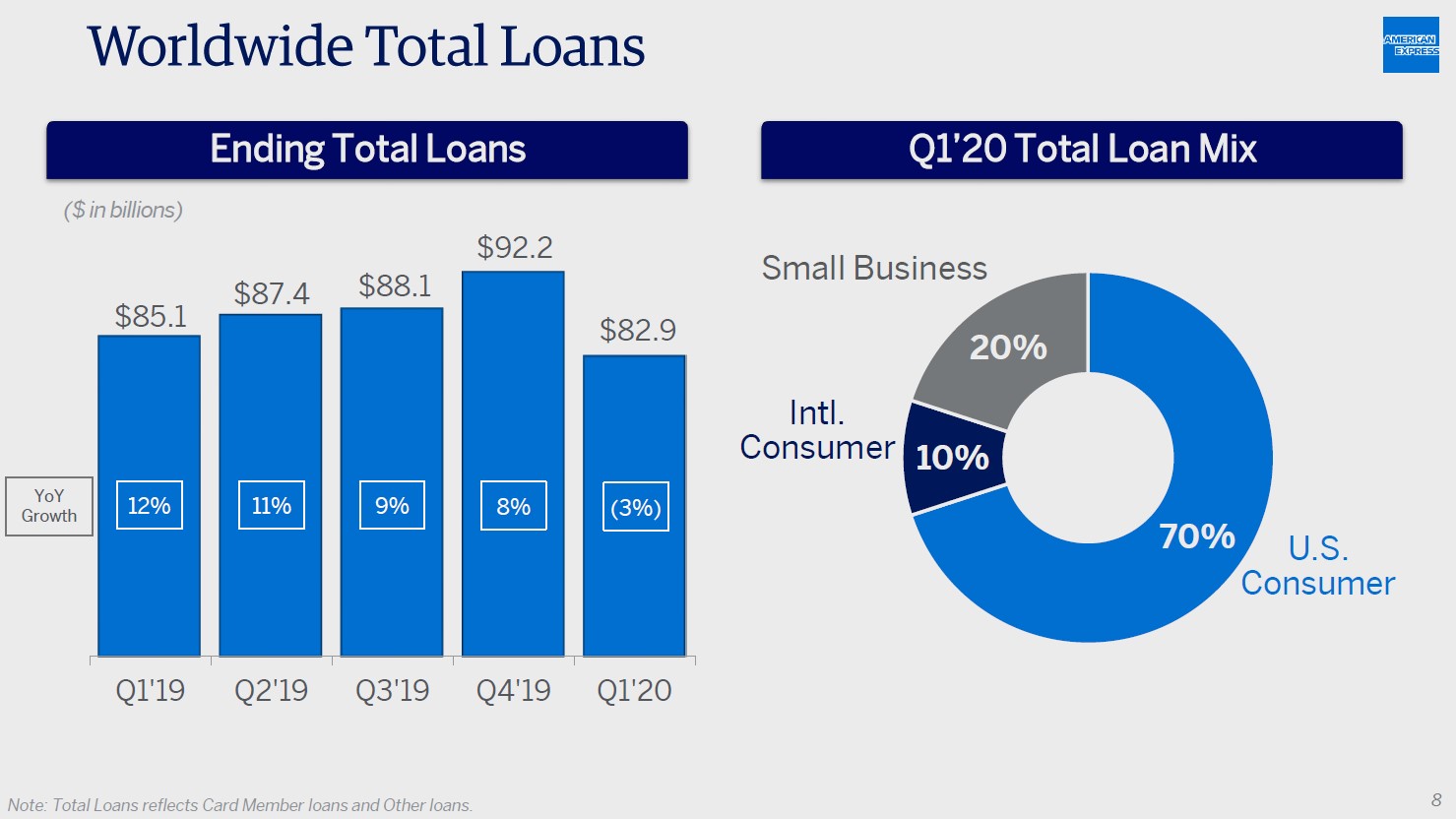

Image Shown: American Express is a US-centric financial services and banking enterprise. Image Source: American Express – 2019 Annual Report Most of American Express’ loans are for US consumers as you can see in the upcoming graphic down below.

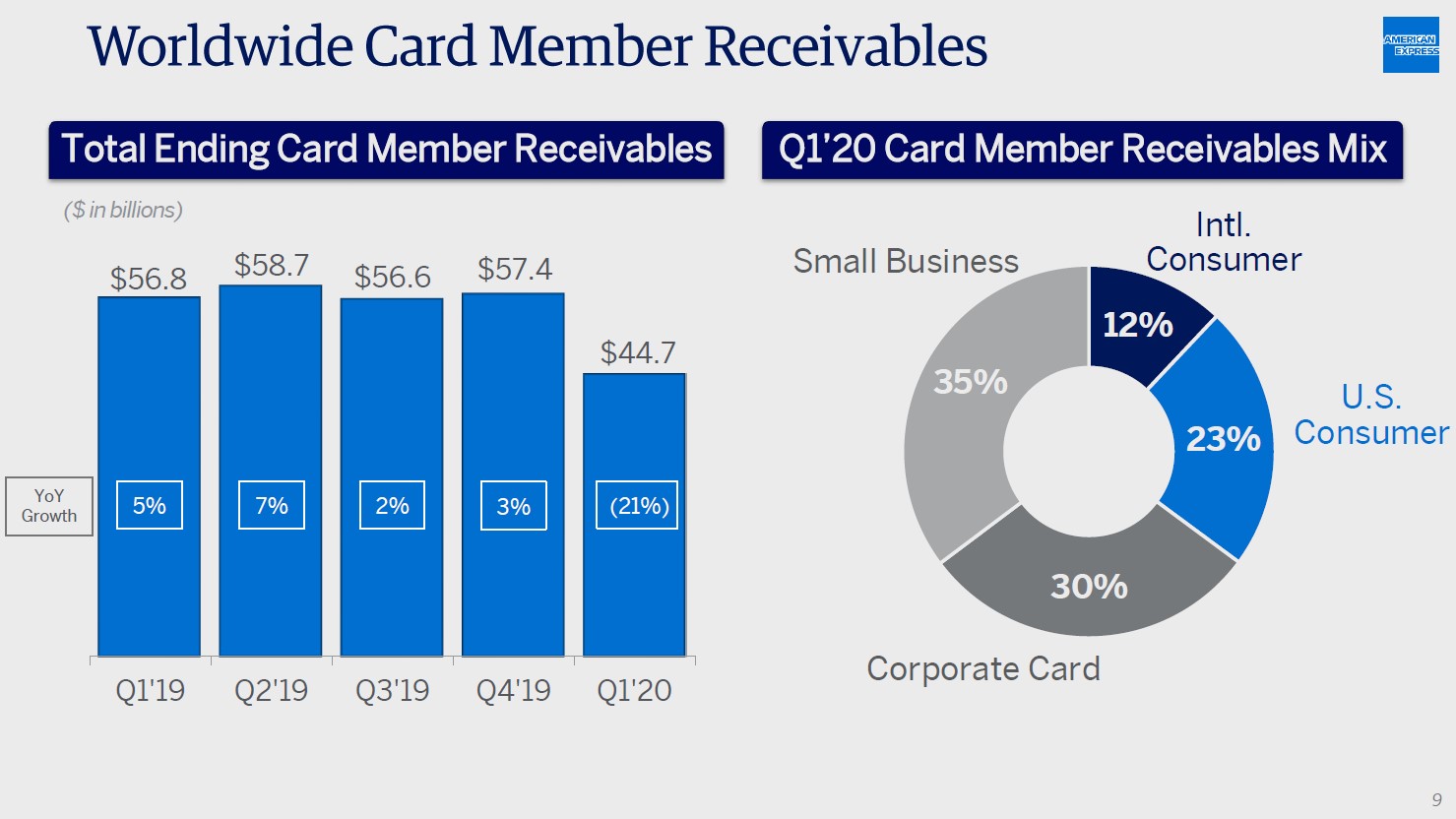

Image Shown: American Express’ credit risk is heavily influenced by the state of the US economy and the US consumer. Image Source: American Express – First Quarter of 2020 Earnings IR Presentation As it relates to American Express’ credit card business, that is modestly more diversified in terms of its customer mix, keeping in mind that a large portion of the transactions conducted through this system are done in the US.

Image Shown: An overview of American Express’ credit exposure from its card holders. Image Source: American Express – First Quarter of 2020 Earnings IR Presentation

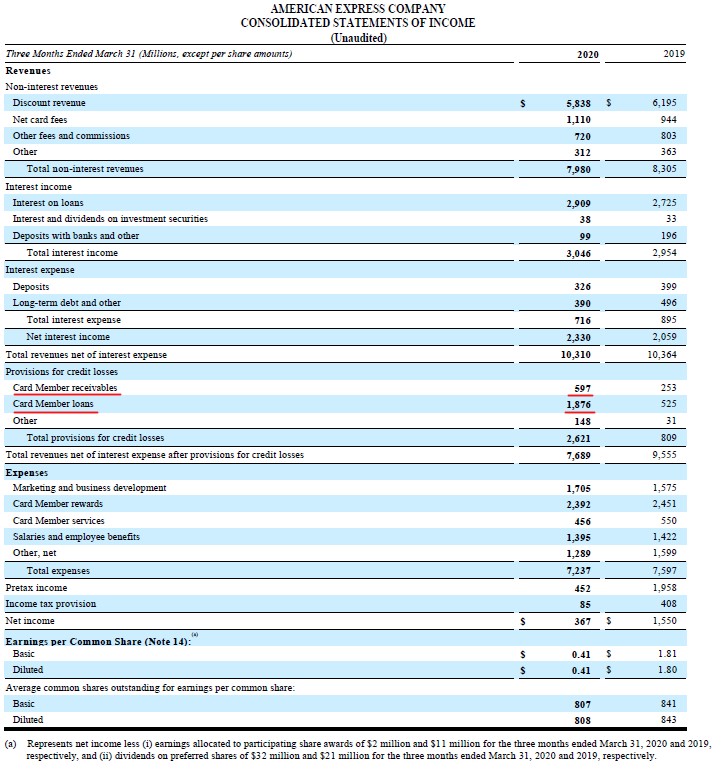

American Express’ credit risk is highlighted in part in the upcoming graphic down below. The firm set aside a meaningful provision for credit losses in the first quarter of 2020, $2.6 billion in total, up sharply from $0.8 billion in the same quarter the prior year. Given that the US economy has slowed down considerably since the end of March 2020, American Express will likely have to set aside additional funds for credit losses.

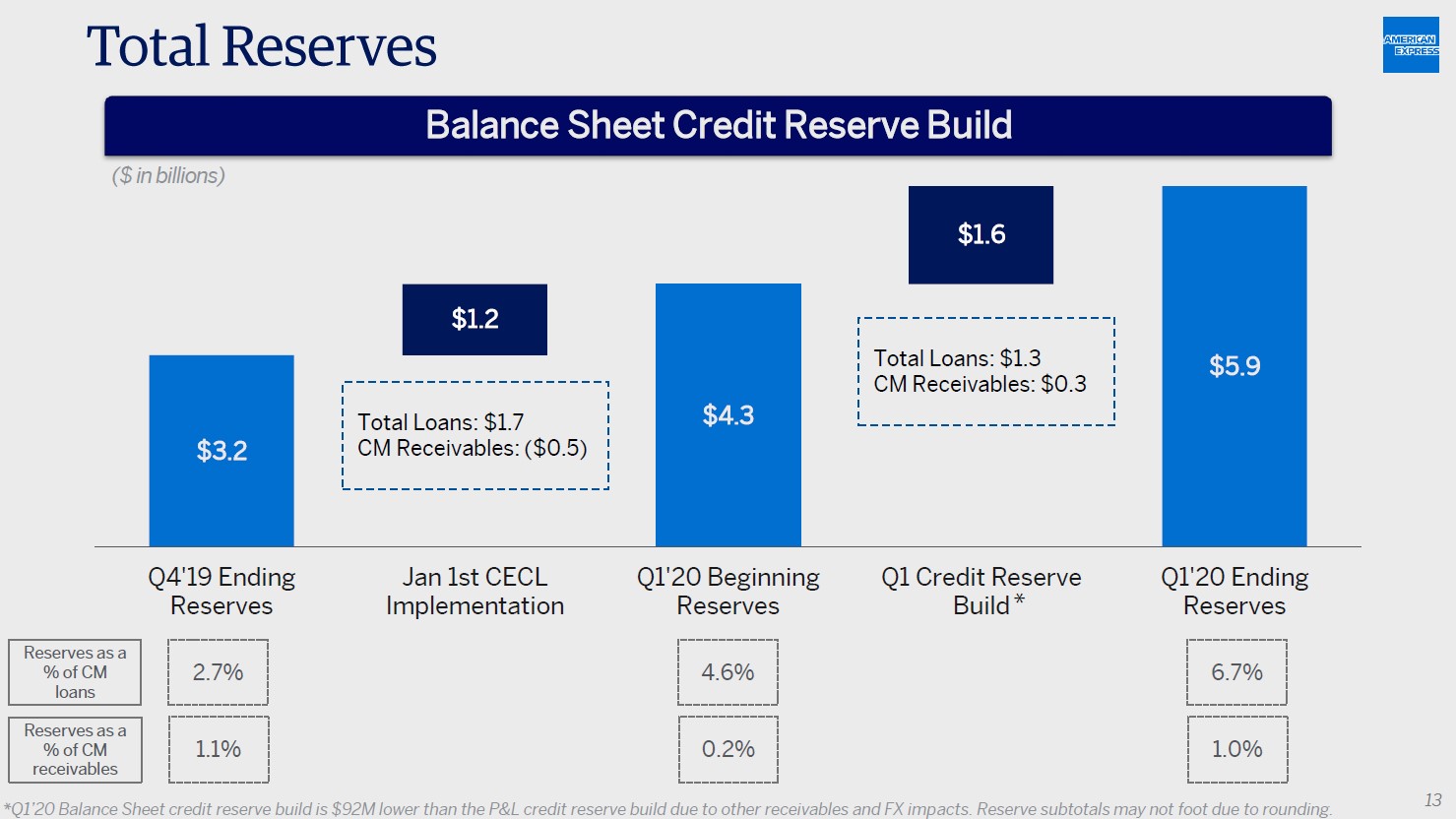

Image Shown: American Express incurred significant provisions for credit losses in the first quarter of 2020, with those line-items underlined in red in the graphic up above. Image Source: American Express – 10-Q filing covering the first quarter of 2020 with additions from the author In American Express’ first quarter of 2020 earnings press release the company noted: Consolidated provisions for losses were $2.6 billion, up from $809 million a year ago. The increase was driven primarily by significant reserve builds of $1.7 billion, which reflect deterioration of the global estimated macroeconomic outlook as a result of COVID-19 impacts. As of January 1, 2020, the company adopted the new Financial Instruments - Current Expected Credit Losses (CECL) standard. Growth in provisions for credit losses were material at both its ‘Global Consumer Services Group’ and its ‘Global Commercial Services’ divisions. To adjust, American Express launched several financial assistance programs that are targeted towards consumer and small business ‘Card Members’ that are both short- and long-term in duration. The upcoming graphic down below highlights the build in American Express’ reserves for credit losses. It is possible that its reserves will need to grow further given that ‘reserves as a % of CM receivables’ remained low at the end of the first quarter of 2020 at just 1.0%, below the 1.1% at the end of 2019 before the pandemic hit.

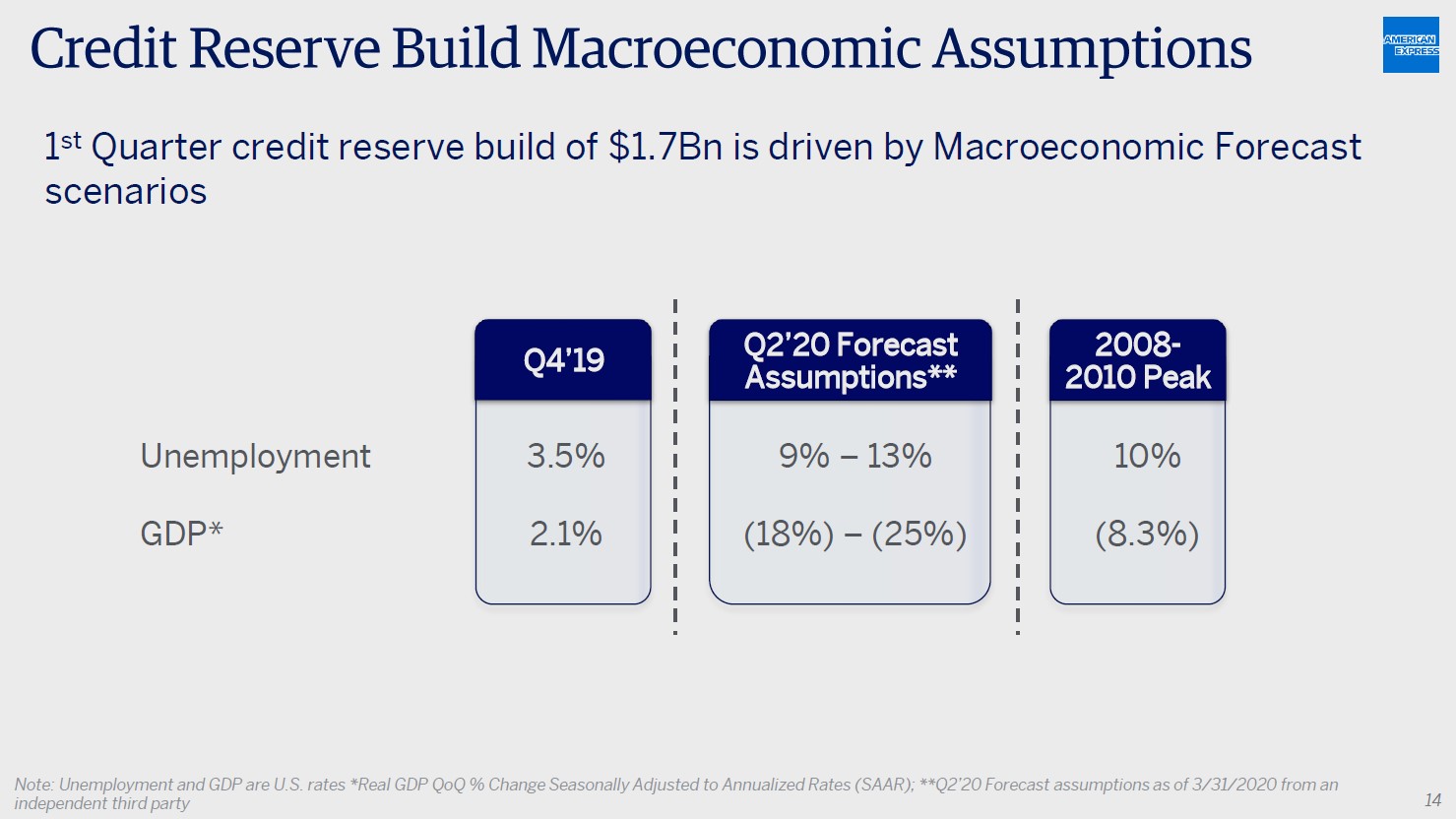

Image Shown: American Express may have to further increase its reserves for credit losses in a meaningful way going forward. Image Source: American Express – First Quarter of 2020 Earnings IR Presentation In the upcoming graphic down below, American Express highlights the assumptions used to gauge its provision for credit losses. The company assumes unemployment in the US will hit 9-13% and that US GDP will contract 18-25% quarter-over-quarter on an adjusted basis in the second quarter of 2020. Please note that the official unemployment rate in the US hit 14.7% in April 2020 according to the US Bureau of Labor Statistics (‘BLS’) and the Congressional Budget Office (‘CBO’) forecasts second quarter US GDP will contract by 38% on an annualized basis. Expanding on that, American Express may be too optimistic in its macroeconomic forecasts, which underpins our reasoning behind why there’s a good chance the firm’s provision for credit losses will stay elevated going forward (until its reserves for credit losses builds up to a level we would deem more appropriate given the harrowing times we are currently experiencing).

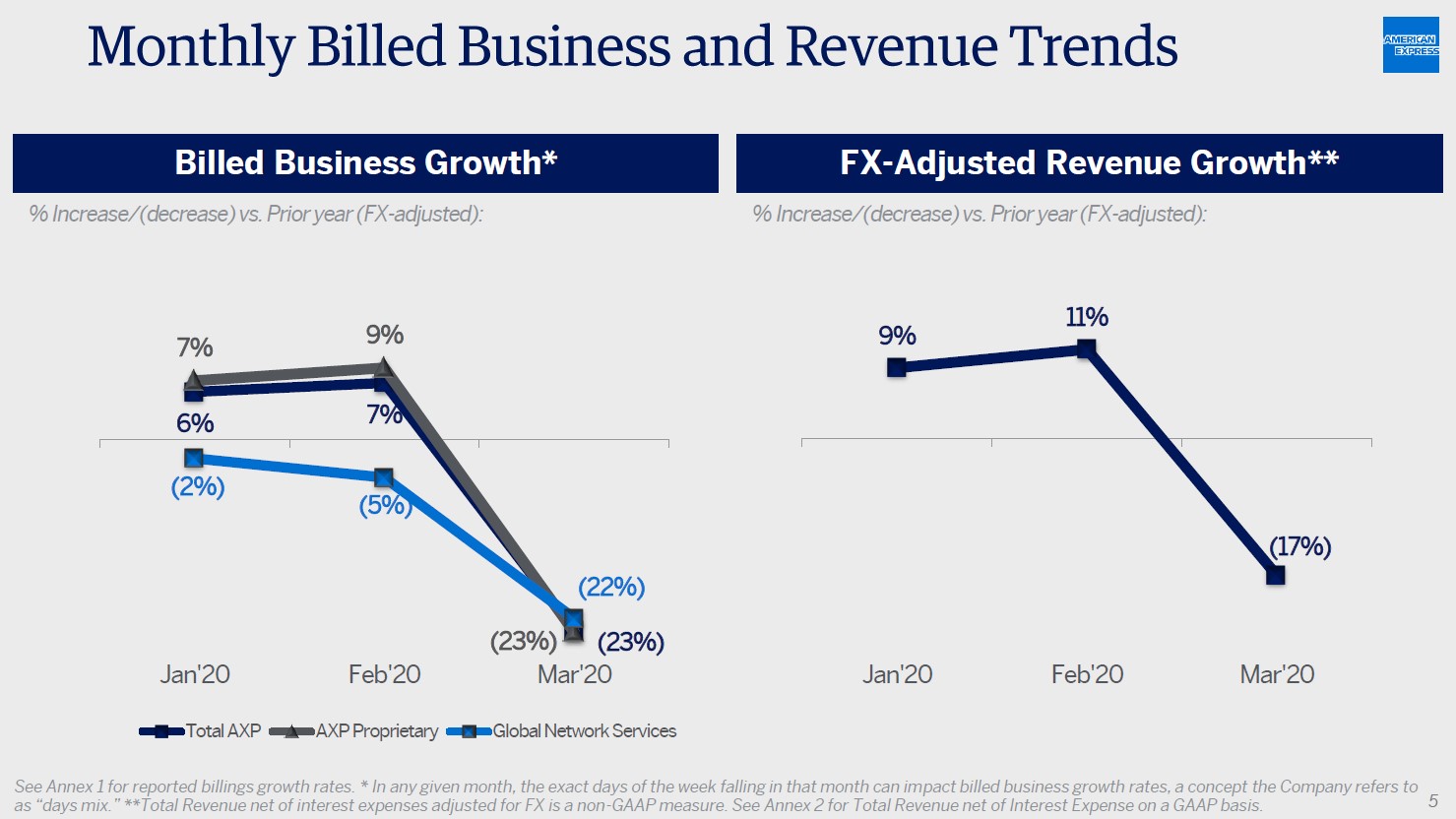

Image Shown: American Express’ assumptions used to determine its credit reserve builds in the first quarter of 2020 appear too optimistic, in our view. Image Source: American Express – First Quarter of 2020 Earnings IR Presentation Spend-Centric Model American Express bills its business model as one that is “spend-centric” which will take a beating during the current downturn as consumers spend less for a variety of reasons. Part of that dynamic involves the “cocooning” of households indoors to ride out the pandemic, part involves the negative impact elevated unemployment rates have on consumer spending power, and part involves the aversion to big vacations as consumers and households shun air travel in favor of smaller vacations in local regions. In the upcoming graphic down below, American Express highlights the drop off in transaction activity that occurred late in the first quarter. While management noted that this trend began to stabilize in April during the firm’s latest quarterly conference call, the outlook for spending activity in the near-term remains dour.

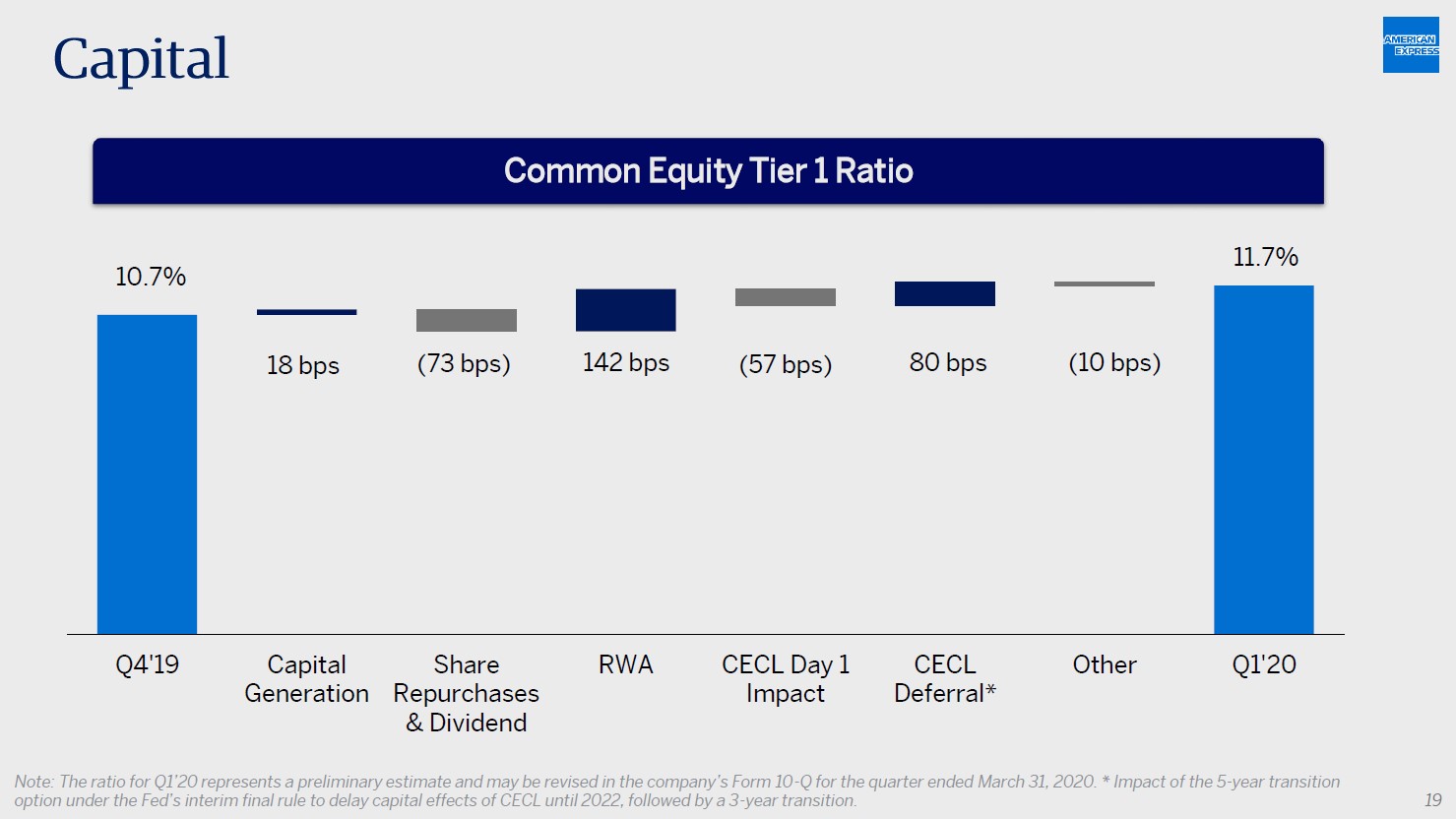

Image Shown: The pandemic aggressively reduced payment transaction activity in American Express’ network and pressured the firm’s revenues in the first quarter, and that weakness will likely persist going forward. Image Source: American Express – First Quarter of 2020 Earnings IR Presentation The company seeks to generate revenues primarily by attempting to increase spending on its cards (a strategy that is normally supported by secular growth tailwinds due to the shift to a cashless society), with finance charges and fees representing a secondary source of revenues in terms of operational focus. American Express seeks to woe over high-value and more affluent consumers with generous rewards programs, made possible through the higher annual fees (relative to its competitors) it charges its clients. For American Express’ merchant partners, the value proposition boils down to American Express offering those partners a potential way to funnel a vast group of affluent consumers through targeting marketing and promotional programs towards their products and services. For instance, American Express’ main strategic partner is Delta Air Lines Inc (DAL) and a key part of the value proposition American Express offers its card holders is travel rewards. However, those apparently aren’t in high demand right now. While many US states are starting to relax stay-at-home orders, resulting in a slow and uneven return in economic and daily activities, there’s a long way to go before things return to pre-pandemic levels. According to US Transportation Security Administration (‘TSA’) data cited by CNBC, the number of people passing through security checkpoints at US airports was down 92% year-over-year during the first 18 days of May 2020. Furthermore, international payment processing and payment solutions offerings tends to be far more lucrative as compared to handling domestic payment transactions. Here’s a key excerpt from American Express’ 2019 Annual Report (emphasis added): Delta Air Lines is our largest strategic partner. Our relationships with, and revenues and expenses related to, Delta are significant and represent a significant source of value for our Card Members. We issue cards under cobrand arrangements with Delta and the Delta cobrand portfolio represented approximately 8 percent of our worldwide billed business and approximately 22 percent of worldwide Card Member loans as of December 31, 2019. The Delta cobrand portfolio generates fee revenue and interest income from Card Members and discount revenue from Delta and other merchants for spending on Delta cobrand cards. During 2019, we signed an 11-year renewal extending the Delta cobrand relationship through the end of 2029 and expect to continue to make significant investments in this partnership going forward. Among other things, Delta is also a key participant in our Membership Rewards program, provides travel-related benefits and services, including airport lounge access for certain American Express Card Members, accepts American Express cards as a merchant and is a corporate payments customer. That relationship has worked well in the past, but going forward, is less likely to generate the kind of value proposition it once did for American Express’ ‘Card Members’ or its merchant partners. As an aside, the decline in international travel will weigh negatively on American Express’ financial performance. Financial Overview From 2017 to 2019, American Express generated $10.7 billion in free cash flow on average per year, defining free cash flow as net operating cash flows less ‘purchase of premises and equipment, net of sales’ which we would classify as its capital expenditures. During this period, the firm’s annual dividend obligations averaged $1.3 billion (for reference, that figure came in at $1.4 billion in 2019) and additionally, American Express spent $3.6 billion on average per year repurchasing its common stock from 2017-2019. Historically speaking, American Express’ cash flow profile has been quite strong, though this was supported by the benign macroeconomic backdrop in the US. The emergence of a Black Swan event like COVID-19 tends to stress the financial performance of firms with large amounts of credit risk. American Express exited March 2020 with $36.1 billion in cash, cash equivalents, and short-term investments on hand on top of $5.0 billion in investment securities versus $3.5 billion in borrowings maturing with a year and $52.6 billion in long-term debt. The company carries a meaningful but manageable amount of net debt. However, please note that American Express also carries $44.3 billion in ‘Card Member receivables’ and $72.5 billion in ‘Card Member loans’ on a net basis (‘less reserves for credit losses’) on top of an additional $5.0 billion in ‘Other loans’ on a net basis (‘less reserves for credit losses’), which is where its credit risk lays. On a positive note, American Express remains well capitalized as you can see in the upcoming graphic down below. The firm exited the first quarter of 2020 with a Common Equity Tier 1 Ratio of 11.7%, above its long-term target.

Image Shown: American Express remains well capitalized. Image Source: American Express Company – First Quarter of 2020 Earnings IR Presentation Here’s what American Express’ management team had to say regarding the firm’s targeted capital structure during its latest quarterly conference call (emphasis added): “Our CET1 Ratio was 11.7% at the end of the first quarter, above our 10% to 11% CET1 target range. The sequential growth in our CET1 ratio was driven by the counter cyclical nature of our balance sheet. As our balance sheet shrinks, with declining AR and loan balances in the current environment, our risk weighted assets drop according. I would also note that our first quarter CET1 ratio includes a roughly 80 basis point impact from the five year transition option made available under the fed rules delay any capital effects of CECL until 2022. We repurchased $0.9 billion worth – $900 million worth of shares in the first quarter, that have suspended our share repurchase program as of mid-March and we do not expect to resume share repurchases for the time being given the current environment. However, with our strong capital position, we have the capacity and intend to continue to pay our dividend in the second quarter.” --- Jeffrey Campbell, CFO of American Express since 2013 On May 7, American Express declared a quarterly dividend of $0.43 per share for shareholders of record on June 2 that’s payable August 10. That payout is flat compared to its previous quarterly dividend and indicates management remains confident enough in American Express’ capital structure and outlook to maintain those payments, at least for the time being. As of this writing, shares of AXP yield ~1.9% on a forward-looking basis. This strategy is assisted by American Express holding off on its share repurchases, which we think is a prudent move given the macroeconomic environment the firm is now facing and considering shares of AXP trade well above the top end of our fair value estimate range. We give American Express a fair value estimate of $69.30 per share and the top end of our fair value estimate range stands at $83.16 per share. Given that AXP is trading just below $91.00 per share as of the end of normal trading activity on May 20, it appears investors may not be fully factoring in American Express’ credit risk, in our view. Concluding Thoughts During times of consistent and stable economic growth, particularly in the US, American Express tends to perform quite well and carries a quality cash flow profile. However, during times of great economic upheaval, having a lot of credit risk on the books creates downside risks that we would prefer to steer clear from as we see better ways to play the payment processing space (in particular, PayPal and Visa are high quality names as we mentioned previously). Manageable credit risk is one thing, but American Express has yet to truly build up the credit reserves that will be required given the sharp increase in US unemployment rates of late and the growing risk that a wave of small businesses will collapse over the coming months. American Express’ net debt position, as of the end of the first quarter of 2020, is another concern. ----- Financial Tech Services Industry – MA MELI PYPL VRSK V Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC Related: DAL, IYG, IPAY, IYF, XLF ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Bank of America (BAC) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment