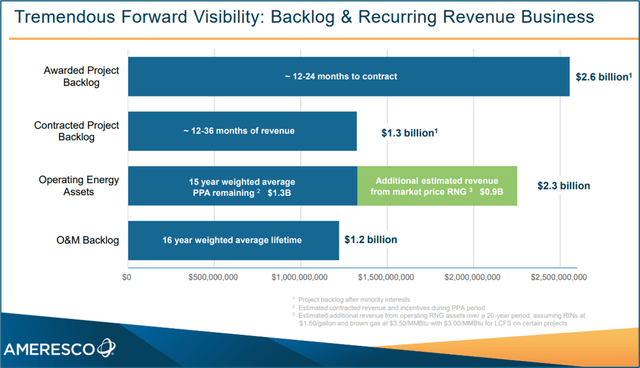

Image Source: Ameresco’s backlog of opportunities remains robust.

By Valuentum Analysts

The rise of ESG investing and the political shift towards encouraging developments within the realm of green energy–from renewable energy projects to efforts to reduce water consumption and much more–has created numerous opportunities for investors. Ameresco Inc (AMRC) offers energy efficiency solutions, infrastructure upgrades, and renewable energy solutions to its customers. The company also operates some of the renewable energy facilities it helps develop such as solar farms and biogas plants.

Ameresco provides its services all over the globe though the U.S. remains its most important market (and the source of over 90% of its revenues). In the U.S., Ameresco will often help its clients secure the financing needed to fund relevant projects, particularly for its federal government customers.

We include Ameresco as an idea in the ESG Newsletter portfolio. Due to Ameresco utilizing energy savings performance contracts (‘ESPC’), its financials can be a messy read. ESPCs enable its governmental customers in the U.S. to finance infrastructure upgrades without needing to tap their capital budgets by taking advantage of the expected future energy cost savings. The company generally experiences large working capital builds on an annual basis due to growth in its federal ESPC receivables asset, a product of Ameresco’s overall business growing, making gauging its underlying free cash flows a more difficult task.

On February 28, Ameresco reported better-than-expected fourth-quarter results, with revenue increasing 33% and the company generating strong performance across its four lines of business. Its Projects business generated 40% revenue growth in the quarter, Energy Asset revenue leapt 12.3%, O&M sales increased 13.2%, while Other revenue advanced 11.4%. Profitability also looked very healthy in the period. Adjusted EBITDA increased 33%, to $54.9 million, while non-GAAP earnings per share nearly doubled. Management’s commentary was positive in the press release:

Fourth quarter results represented a strong finish to a challenging year, demonstrating positive momentum that supports Ameresco’s long term growth trajectory. In addition to the considerable revenue and Adjusted EBITDA growth achieved in the quarter, we grew total project backlog nearly 50%, ending 2023 with a record $3.9 billion. We also grew our assets in development 35% to 717 MWe at the end of the year. Both of which provide a pathway for continued growth over the next several years.

Ameresco’s record backlog and asset pipeline metrics underscore the strength of our market positioning and our ability to continue to achieve substantial long-term growth in revenues and profitability. New awards in 2023 were approximately $2.2 billion, double last year’s $1.1 billion, and proposal activity remained at an all-time high. In 2023, our Energy Asset business continued to add high return assets to our development pipeline. During the year, we increased Ameresco-owned Assets in development by 199 MWe to 669 MWe, while also bringing 118 MWe into operation during the year.

Shares of Ameresco have been under pressure as of late due to supply chain issues and “administrative bottlenecks that caused the push-out of project revenues,” but management is working hard to get things back on track. Fourth quarter operating cash flow was a burn of $29.6 million, but adjusted operating cash flow, including proceeds from federal ESPC projects, was $17.5 million. Ameresco ended the quarter with $73.9 million in cash and total corporate debt of $279.9 million, resulting in a corporate leverage ratio of 3.3x (its bank covenant level is 3.75x).

Looking to fiscal 2024, revenue is targeted in the range of $1.6-$1.7 billion (up 20% at the midpoint), with gross margin in the range of 17.5%-18.5%. Adjusted EBITDA is targeted at $210-$240 million (up 38% at the midpoint), with non-GAAP earnings per share expected in the range of $1.30-$1.50. We like the trajectory of Ameresco’s backlog, its order momentum as well as commentary that “proposal activity (remains) at an all-time high.” The company’s track record and technical know-how suggest to us that win rates will likely continue to be healthy.

That said, we continue to monitor Ameresco’s debt position and adjusted operating cash flow trends closely, and while the firm remains an idea in the ESG Newsletter portfolio, we’re viewing it as a source of cash should another ESG idea present a better risk-reward opportunity.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.