Member LoginDividend CushionValue Trap |

This Chart Changes Everything Quant

publication date: Apr 11, 2019

|

author/source: Brian Nelson, CFA

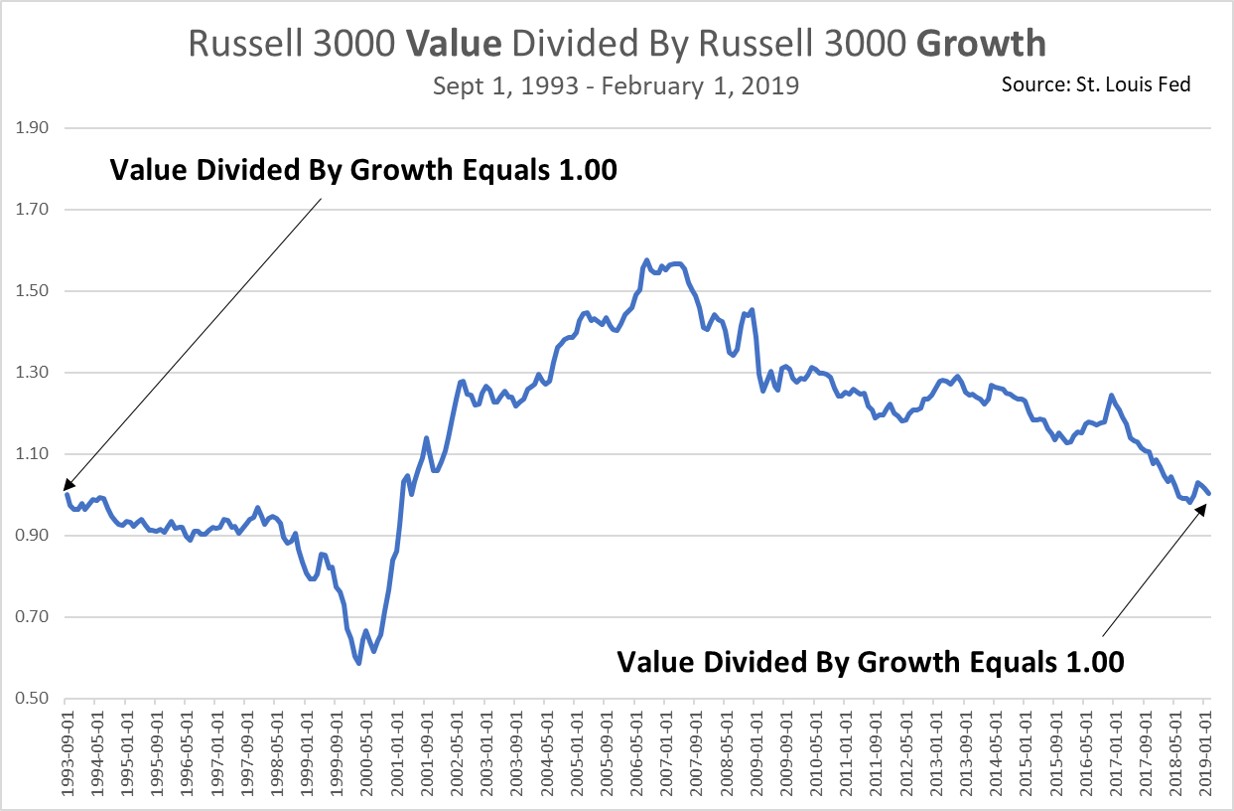

Image shown: Russell 3000 Value Divided by Russell 3000 Growth since September 1993, roughly one year after the publishing of the influential three-factor model. By Brian Nelson, CFA Recently, I wrote up my views on whether quant value is giving value investing a bad name. You can read that note here. The chart above changes everything quant. The chart is not so much about value and growth as it is about highlighting the hazards of extrapolating anything quantitative finance into the future. For those that don't know why this chart is important, let me provide some background. The entire field of factor investing has been built on the idea that ambiguous and sometimes impractical metrics and data can be used to carve out risk-adjusted premia to exploit so-called market "anomolies." Let's talk value. Though I believe the ongoing arbitrage of price-to-fair value assessments can be continuously arbitraged with a momentum overlay, I don't believe at all that the quant value metric makes much sense, it being based on price-observed multiples, as in the book-to-market (B/M) ratio in most academic literature. The chart above shows that since roughly the inception of the three-factor model (early 1990s)--a model that considers a market factor, a value factor in the book-to-market ratio, and a size factor--that how many are measuring value just isn't stacking up. The Capital Asset Pricing Model (CAPM) has already been shown to be ineffective, and the size factor has been shown to be sporadic with many suggesting there really isn't a size factor, and now the traditional quant value factor, as measured by book-to-market looks to largely be failing. The problem at hand with today's quantitative finance is rather easy to get energized about. Here goes my "What Are We to Believe" Speech? What Are We to Believe? Are we to believe that not only can finance divide stocks between "growth" and "value," but that it can do so using ambiguous and impractical metrics and multiples such as book-to-market (B/M)? Are we to believe that what we have witnessed since the "discovery" of the traditional quant value factor in the early 1990s hasn't been random? The image above may very well be the authentic walk-forward statistical assessment of significance, which excludes its pre-selected backtest. What is randomness if it does not include significant stretches of underperformance and significant stretches of outperformance only to come back to original value as in the chart above? What are we to believe? Are we to believe after the failures of the CAPM, of the traditional quant value factor, of the size factor that yet adding more and more ambiguous and impractical factors will somehow "fix" the issue? Or, is there something else that's going on? Perhaps there are not "growth" and "value" stocks. Perhaps Warren Buffett was on to something when he said: "Growth is always a component of value [and] the very term "value investing" is redundant." Are we to believe that somehow the same stocks are both "growth" and "value," as they are in the Russell 3000 indices? See images below.

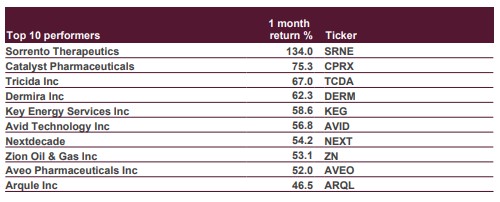

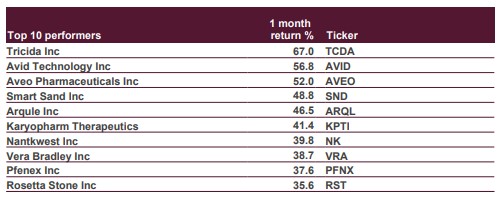

Images shown: Top performers of Russell 3000 Growth and Russell 3000 Value last month, respectively. Are we to believe that some of the most undervalued stocks on the market today are better classified as "growth" stocks than "value" stocks, as the Russell 3000 index implies? What are we to believe? See image below.

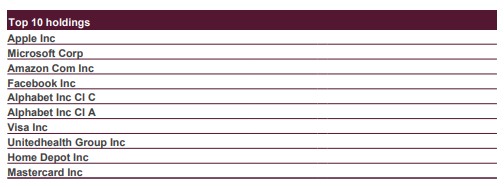

Image shown: Top 10 holdings in the Russell 3000 Growth. Has the conversation already been lost as soon as we mention "value" or "growth?" Isn't the right conversation price versus estimated intrinsic value? What are WE to believe? Even if the traditional quant value factor recovers, there is no reason to believe that it is still not randomness. Book equity does not pass muster as an adequate value-oriented metric among operating entities. Isn't a bet on impractical and ambiguous data and multiples backed by historical backtests that have not stood the rigors of walk-forward performance more like gambling than investing? What do YOU believe? I know what I believe. I've built an entire company on what I believe to be the right way to perform stock analysis. There may be nothing more to say. Related ETFs: IWV, SPTM, VTHR ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |