Member LoginDividend CushionValue Trap |

Our Bullish Thesis on Gilead Sciences

publication date: Aug 3, 2017

|

author/source: Alexander J. Poulos

We have become enamored with the potential of Gilead Sciences once again as the recent slide in the share price has in our view shaken out the speculative money that fueled the meteoric rise of the equity in 2015. As a value-based research publisher, we tend to focus on the sustainability of cash flow. In the case of Gilead, many believed that all hope had been lost as the continued decline in its Hepatitis C franchise would depress potential future gains. We are heartened by the recent earnings release and technical move, which have combined to give us comfort in adding Gilead Sciences to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. By Alexander J. Poulos Overview Gilead Sciences (GILD) remains a pioneer in the biotech industry thanks in large part to a dominant position built in infectious disease. Through elegant innovation and the need to simplify one of the most complex dosing regiments, Gilead vaulted past deep-pocketed well-entrenched players in the HIV space to gain a commanding position. In what has proven a masterstroke, Gilead focused on developing double and triple therapies that are combined into a single daily dose, the innovation directly led to enhanced compliance and ultimately a dominant market share. The lesson learned in the HIV battles were carried over into the quest for a cure in HCV (Hepatitis C) with Gilead introducing an impressive array of single daily dose regimens that can eradicate HCV. A functional cure was at hand, which unleashed a tremendous amount of pent up demand as patients flocked for treatment. The only drawback from an investment perspective has been the length of therapy, which is often 12 weeks or less. The rush for treatment led to a profound jump in revenue that is simply unsustainable, and the overall market for treatment continues to shrink with every patient that is cured. The decline in HCV revenue in 2016 crushed the share price with the management team looking rather inept in their attempt to arrest the stock price decline. A former Wall Street darling was now routinely mocked with sentiment reversing from euphoria to outright hate through 2016 and well into 2017 as the stock price kept probing new lows as the equity market seemingly made a daily new all-time high. The recent earnings report in our view marks an inflection point in the current downturn. Let’s examine the report in further detail which will help underscore our confidence in the name and hence the addition into our model portfolios. Second Quarter 2017: A Beat and Raise Quarter

Image Source: Gilead Sciences Q2 Earnings Slides

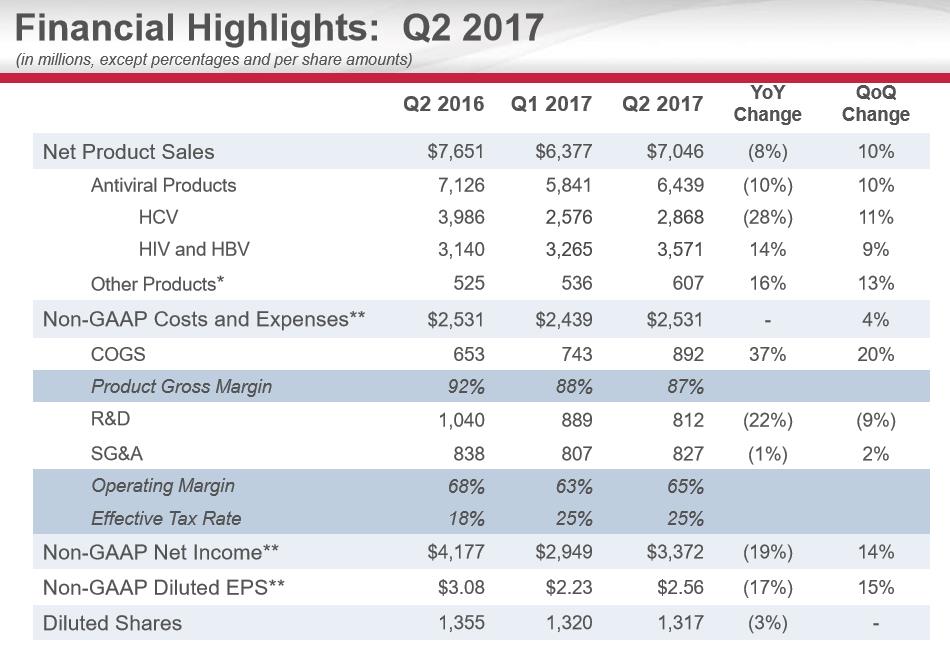

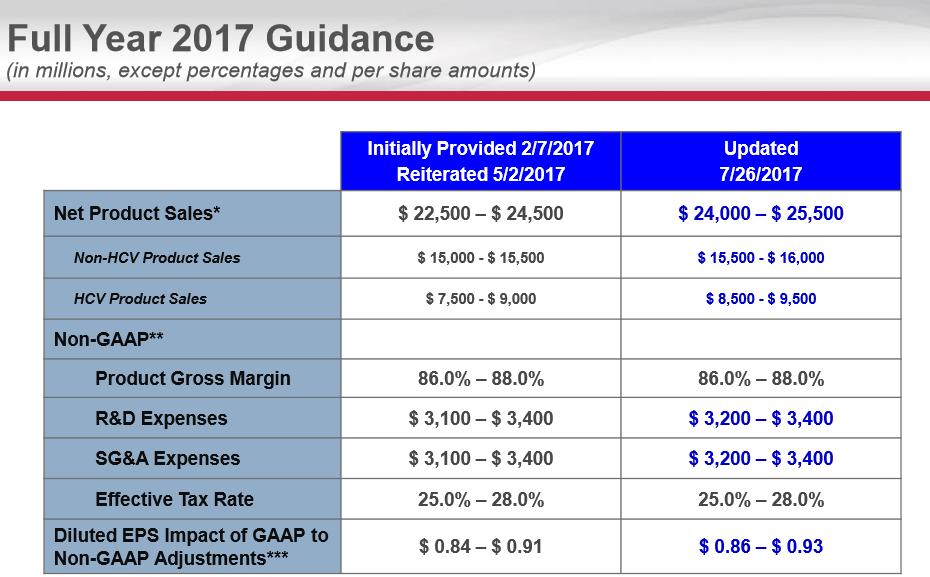

On July 26, Gilead posted second-quarter earnings that were met with a tad of enthusiasm by the investment community. Our renewed excitement for Gilead’s investment prospects is based on the continued growth of the HIV franchise coupled with a more favorable rate of decline in the HCV franchise (further, we’re starting to like the technical backdrop). We were also pleased that, in its second-quarter release, the company increased its annual revenue guidance (now $24-$25.5 billion; was $22.5-$24.5 billion) thanks in large part to a forecast of an additional $1 billion in HCV revenue. Let us be clear here though. We do not view the HCV franchise as an area of future growth. Instead, we similarly view HCV through the same lens as the revenue dynamics witnessed when a branded product loses patent protection. The caveat is the HCV franchise remains patent protected which should allow Gilead to generate multi-billions in revenue with minimal additional expenses devoted to further clinical research. The management team at Gilead mentioned on past conference calls it will not spend additional resources to develop other HCV properties. A quick scan of Gilead’s pipeline confirms this with the liver disease segment focus on NASH.

Image Source: Gilead Sciences Q2 Earnings Slides Balance Sheet The unique dynamics of the HCV marketplace remains a boon from a cash flow perspective for Gilead. We feel Gilead was miscast as a growth entity the past few years; it remains a cash flow story until additional compounds outside of HIV are brought to market. The surge in demand for treatment for those afflicted with HCV created unsustainable revenue expectations that could not be met. Naturally, once initial demand waned, year-over-year revenue growth declined along with the equity multiple. The executive team at Gilead decided to utilize the burgeoning pile of cash on the balance sheet to further reward shareholders in the form of a generous dividend coupled with a share repurchase plan. Thus far, the Accelerated Share Repurchase Plan (ASR) executed in early 2016 is an unmitigated failure with the equity trading well below the price paid. We would have preferred if the share repurchase plan had been carried out in equal quarterly installments as management was keenly aware of the expected revenue decline in 2016. Typically, as the top line contracts, the equity multiple has as well, a fact that might have been known by the management team. The relative inept execution of the share repurchase plan coupled with the decline in revenues has sapped investor enthusiasm (dare we say sentiment had transformed from unabashedly bullish to outright hatred). A quick scan of the balance sheet indicates Gilead is only moderately leveraged, and we feel the dividend is well covered assuming the team does not enter the debt market to fund another ill-timed ASR plan. We believe the cash flow profile coupled with a less-than-demanding multiple provide us the confidence to add Gilead to the Dividend Growth Newsletter portfolio. Clinical Pipeline From our perspective, Gilead needs to identify and bring to market additional compounds to grow the top line and fuel profit growth. We feel the company has a promising suite of molecules that, if successful, would offer considerable long-term fundamental upside. We have identified three areas of study that holds the most upside potential for Gilead. The first molecule worth mentioning is Bictegavir a non-boosted integrase inhibitor that will be combined with Emtricitabine and Tenofovir Alafenamide to form a combination therapy with a more benign side-effect profile. Gilead is taking direct aim at GlaxoSmithKline's (GSK) Triumeq. Its goal is to steal additional market share and ensure Gilead’s continued dominance in the HIV marketplace. The new combo therapy utilizing Bictegavir is expected to gain approval in 2018 which will help offset some of the declines in the HCV revenue stream. For Gilead to accelerate the top line, additional products outside infectious disease will need to be brought to market, in our view. The next molecule worth mentioning is the JAK-1 inhibitor Filgotinib. The JAK-1 class is an oral dosage form for the treatment of a host of inflammatory diseases. In a stroke of luck for Gilead, a competing product developed by Incyte (INCY) and Eli Lilly (LLY) sold under the trade name Olumiant was rejected by the FDA even though the European equivalent approved the product for marketing. The hold up is the potential side effect of an increase in blood clots above the number seen in the control arm. We were surprised by the FDA’s rejection, and we remain impressed with the efficacy in Rheumatoid Arthritis especially in comparison with industry leader Humira. The FDA requires additional clinical trials, which will take a minimum of 18 additional months to complete. The delay may be a boon for Gilead as Filgotinib thus far does not show a side-effect profile of an increase in the risk of forming blood clots. Gilead’s primary rival is Abbvie (ABBV) as it continues to develop its own internal JAK-1 discovered compound. Abbvie desperately needs a win in the JAK-1 space to offset the expected revenue decline in Humira as patent coverage begins to wane. Filgotinib is currently in phase 3 trials with an expected completion in 2018 for the indication of Rheumatoid Arthritis.

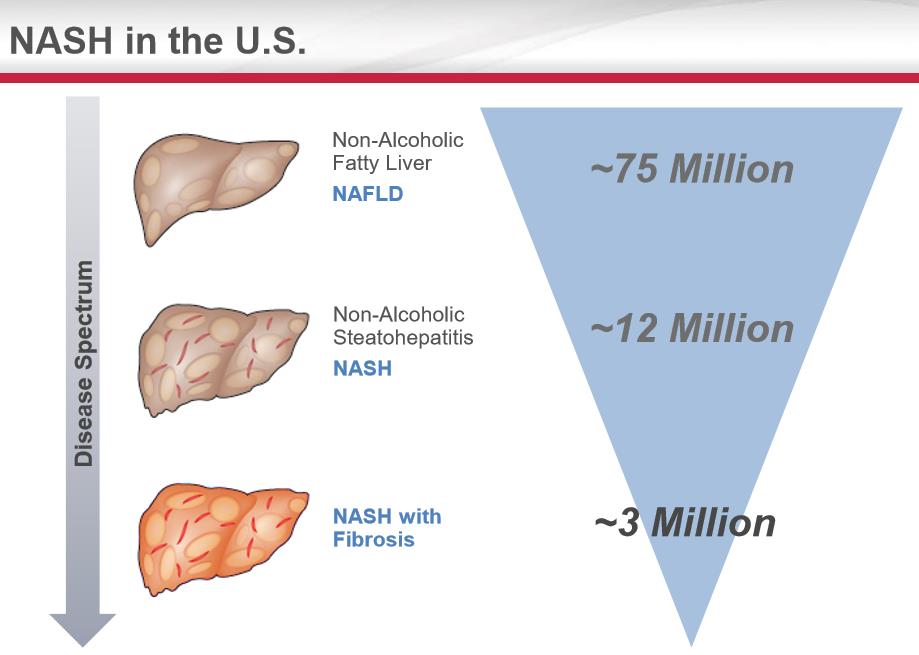

Image Source: Gilead Sciences Q2 Earnings Slides We also view the IP suite for the treatment of NASH as the area of study with potentially the greatest fundamental upside if a successful therapy can be brought to market. A treatment for NASH seamlessly blends with Gilead’s existing sales force that is promoting the HCV products. According to Gilead, the market for NASH with Fibrosis is approximately 3 million in the US, a very robust target market. The patient population afflicted with NASH with fibrosis is the sickest of the sick, which should eliminate payer resistance. We feel the marketplace will evolve in a similar fashion as the HCV market with the patient population with the highest risk prioritized for treatment. We view NASH as a treatable disease--hence an annuity-like revenue stream should evolve unlike the pricing dynamics of the HCV marketplace. Conclusion We felt embolden to add shares of Gilead to both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio, now that the share price has seemingly reversed the steady slide since the end of 2015. We believe the combination of weak sentiment, a robust cash flow profile coupled with a host of promising late-stage molecules offers an interesting combination. We will continue to monitor Gilead's progress carefully with timely updates when warranted. Healthcare and biotech contributor Alexander J Poulos is long Gilead Sciences. |