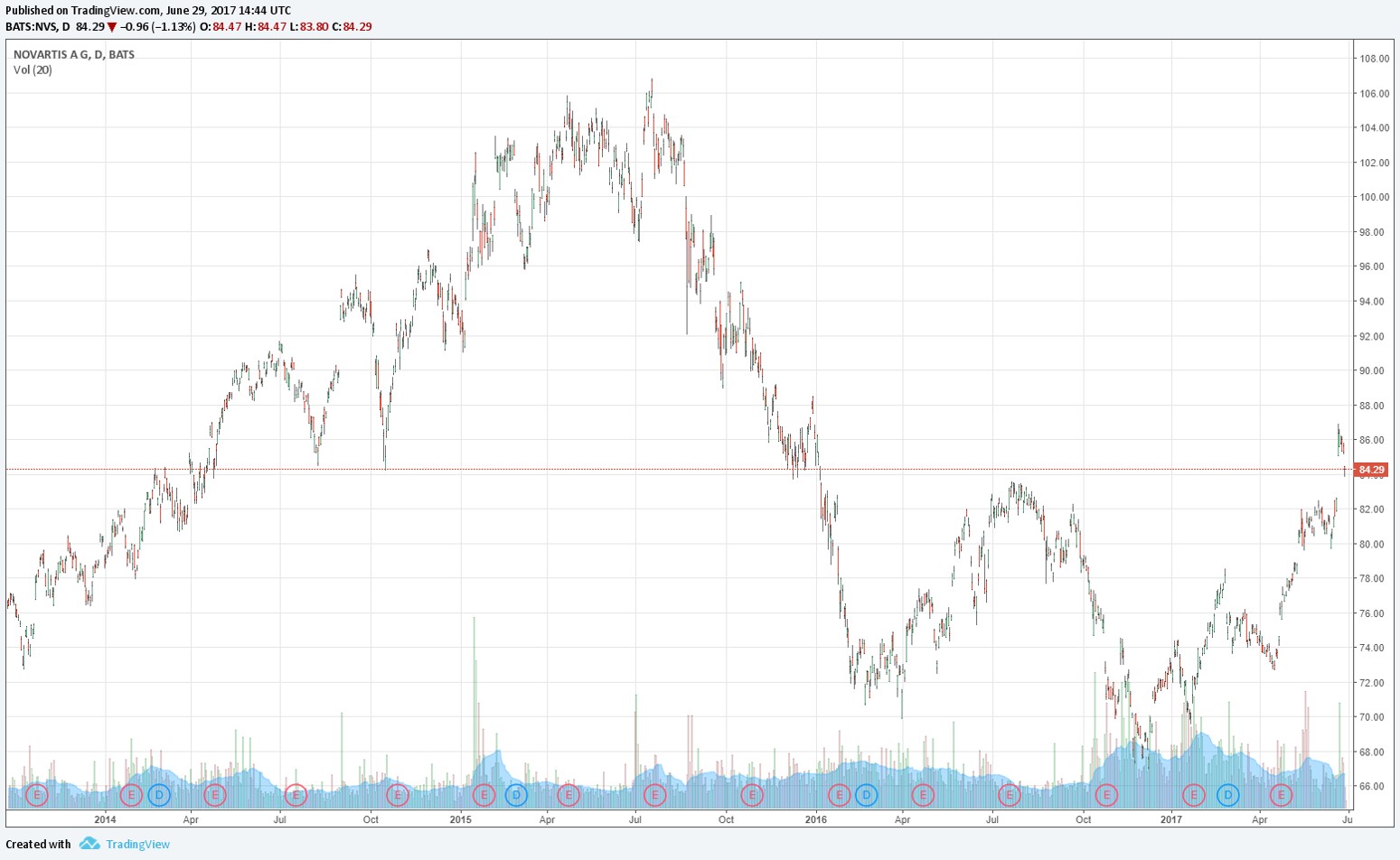

Image shown: The performance of Novartis since the beginning of 2014.

One of the more interest times to consider speculating in the biotech/pharmaceutical space is in advance of the identification of the full potential of the clinical pipeline. Once investors recognize the full “value” of an entity’s pipeline, they often bid the company’s equity price higher well in advance of what traditional near-term fundamental metrics might indicate. The results recently released by Novartis have significantly solidified its clinical pipeline, in our view. Let’s take a look.

By Alexander J. Poulos

Canakinumab

The path a molecule follows moving from the realm of theory through the various phases of clinical trials is often fraught with peril. Often, as the molecule is tested on humans, unwanted side effects will develop that will scuttle the commercial potential of the product. The process of drug discovery remains a boom-bust endeavor.

Novartis (NVS) maintains a robust portfolio of molecules in various stages of clinical development. Often, a molecule will be “forgotten” as the clinical trials will encompass a significant period of time. We have noticed the longer the clinical trial–the investment community begins to doubt the commercial potential of the product well in advance of actual results.

We are very pleased to report the stunning preliminary results of the CANTOS trial, released June 22, which spanned six years worth of data accumulation. To say the least, the length of the clinical trial is very extensive—we applaud Novartis for having the foresight to fund such an endeavor. We feel the results may signal a shift in the treatment of heart disease.

The CANTOS study met the primary endpoint, demonstrating that when used in combination with standard of care ACZ885 (Canakinumab) reduces the risk of major adverse cardiovascular events (MACE), a composite of cardiovascular death, non-fatal myocardial infarction and non-fatal stroke, in patients with a prior heart attack and inflammatory atherosclerosis.

“Despite current treatment, about 25 percent of heart attack survivors will have another cardiovascular event within five years, making the outcome of the CANTOS study a promising new development for patients,” said Vas Narasimhan, Global Head, Drug Development and Chief Medical Officer, Novartis. “ACZ885 is the first and only investigational agent which has shown that selectively targeting inflammation reduces cardiovascular risk. Our priority now is to thoroughly analyze these important data and discuss them with regulatory agencies.”

We would like to highlight the commentary on the reduction of inflammatory disease. Subscribers may recall a recent post on Amgen (AMGN) titled “Analyzing Amgen’s Sudden Fall” where we discussed the full results of the Fourier trial.

Repatha registered a 15% decrease in MACE, its primary endpoint, with a 20% drop in MACE to meet its secondary endpoints. The key portion of the secondary outcome is the inclusion of a statin therapy in addition to Repatha. The unfortunate outcome is the use of Repatha did not have a positive impact in lowering cardiac death versus statin alone, in our view a negative for the future prospects of the entire class.

The lowering of LDL-C, as shown by the Fourier trial does have a positive impact, but the goal of reducing cardiac death remains elusive. The ability to drop LDL-C is a significant step in lowering the overall risk but remains just part of the process. Additional work will need to be conducted with other mechanisms to produce the desired outcome.

Quote attributed to Alexander J Poulos

We remain negative on the prospects of the entire PCSK9 class with Repatha and Praluent as the two approved products that headline the therapeutic class. We feel the results posted by Repatha which missed its secondary endpoint of a reduction in MACE dooms the commercial appeal of the product. We are receptive to the line of reasoning that atherosclerosis is an inflammatory disease which may help explain why certain patient populations have absurdly high total cholesterol numbers yet have an absence of heart disease.

We feel the marketplace will soon have a product in Canakinumab that is proven to reduce inflammatory atherosclerosis and lessen the incidence of MACE which should reduce the commercial prospects of the PCSK9 class further. Armed with superior outcomes data, we feel payers will be willing to pay up for Canakinumab. The new entrance by Novartis, in our view, further hamstrings the rather uninspiring clinical pipeline boasted by Amgen. Amgen pointed to the potential of its emerging Cardiovascular franchise headlined by Repatha with the expectation the group would drive sales. Thus far, the group is a tremendous disappointment. At this juncture, in light of the results from the Fourier trial in conjunction with the results from Canakinumab, we remain unenthusiastic over the prospects for Amgen.

Enter Regeneron Pharmaceuticals

At first glance, the Canakinumab news should be viewed as a negative for the outlook of Praluent, Regeneron Pharmaceuticals (REGN) PCSK9 product. Regeneron initially expected to pair its blockbuster macular degeneration product Eylea with Praluent and recently approved Dupixent to form the nucleus of its ascent into the pantheon of biotech heavyweights. The path forward for Praluent remains less-than-inspiring with sales of Praluent continuing to underperform.

In a rather deft marketing move, Regeneron had the foresight to issue a media release detailing its royalty rate on Canakinumab. Novartis did not discover the molecule. Instead, it formed a royalty deal with Regeneron which now appears to be win-win for both parties. Novartis will pay a tiered royalty of 4% of sales with a maximum payout of 15% when worldwide sales exceed $1.5 billion. We feel based on the preliminary data read–the maximum 15% royalty will be paid netting Regeneron a nice new income stream.

Novartis has guided to a patient population class of approximately 4 million patients worldwide–a huge overall group which should have no problem ramping to a multi-billion dollar product. We feel the initial hype for the PCSK9 class was misplaced yet the proclamations of it being one of the costliest therapeutic class should shift to Canakinumab.

Equity Reaction to the News

The share price of Novartis reacted favorably to the news. The decent move higher can be viewed as somewhat out of character for Novartis, too—the company should be viewed as a blue chip, low-volatility performer that pays a generous dividend. Though we feel it is prudent to take a longer-term view, the movement in both Novartis and Regeneron is still worth highlighting.

At this juncture, Regeneron’s share price has exceeded the top end of our fair value range, and we just can’t get comfy adding shares to the newsletter portfolios at these heights. As for Novartis, we remain intrigued, we will wait for the full-data reveal expected later this year before updating our fair value projections. Novartis is not a candidate for inclusion in the portfolio of the Best Ideas Newsletter, though it does have merit for consideration in the portfolio of the Dividend Growth Newsletter.

Disclosures: Alexander J Poulos is long Novartis and Regeneron Pharmaceuticals.