Dividend Growth Newsletter portfolio idea Novartis continues to grow its free cash flow stream while producing a string of products still in the infancy of their respective growth curves. The pharma/biotech realm remains bedeviled with patent issues that can disrupt cash flow generation once protection is lost, causing us to look for companies positioned for a fresh leg of growth. To that end, let’s take a look at Novartis’ pipeline, near-term potential, and how it relates to its dividend health.

By Alexander J Poulos

Alcon Division

In Novartis’ (NVS) third quarter of 2017, results released October 24, its Alcon division posted an impressive constant-currency revenue jump of 7% from the year-ago period and a 23% year-over-year increase in core operating income, reversing the lackluster trend in which the division has been stuck over the past few quarters. The Alcon division has significantly underperformed expectations since becoming part of Novartis, and the underperformance has led to calls for a cleaving off of the group as expected synergies have failed to materialize.

Alcon’s underachievement thus far should serve as a cautionary tale of the risks associated with the growth-by-acquisition model. Investors should be cognizant of the achievability of synergy targets management teams sometimes use to rationalize debt-fueled acquisitions, which can be a major source of shareholder capital erosion. Not only can these deals represent poor investments on an individual basis on the part of the company, but they can also bloat a firm’s balance sheet, reducing management’s ability to navigate potentially changing market conditions.

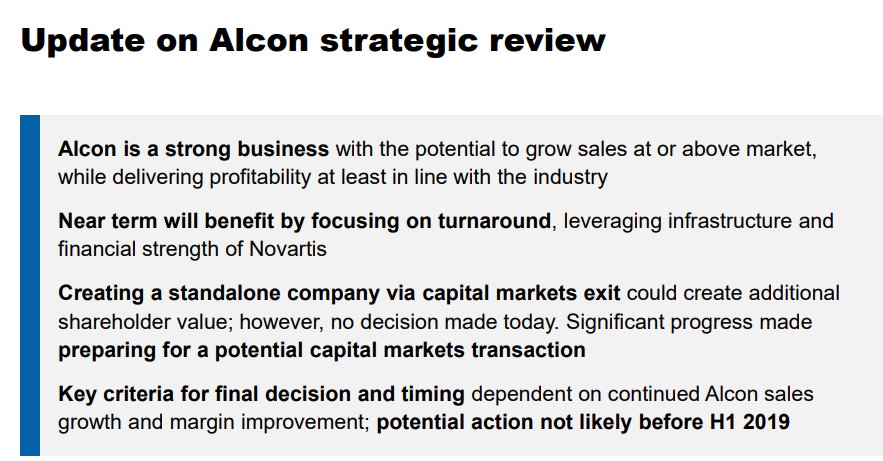

Image Source: Novartis Earnings Presentation

Novartis has floated the idea of spinning off the Alcon division to shareholders as a way of unlocking what it believes to be hidden value in the assets, a view we share as the eye-care marketplace does not mesh well with the heavy emphasis on immunology and oncology that Novartis’ business contains. From a sales force perspective, there is minimal potential overlap thus requiring Novartis to maintain a separate sales force, reducing the productivity of the reps, and increasing operating costs.

Though Novartis emphasized that a final decision has not been reached regarding the ultimate fate of Alcon, it has laid out a credible path towards a split-off of the Alcon division with the first half of 2019 being the earliest time frame such a transaction may take place. We support the potential move as the Alcon division does not hold the strategic purpose it once did. The continued growth of Regeneron’s (REGN) retina disease treatment Eylea coupled with a generic launch of Roche Holding’s (RHHBY) Avastin has taken the wind out of Lucentis’ sails, thus leaving Novartis with fewer reasons for holding on to the ophthalmology division.

New Product Growth

The continued growth of Cosentyx has been nothing short of impressive–the molecule has now morphed into one of Novartis’ top-selling products with sales of $1.5 billion through the first three quarters in 2017. Cosentyx is firmly entrenched in its growth trajectory, and we fully expect the treatment to remain one of the top-selling products in Novartis’ product line-up for many years to come.

On the conference call, management indicated Cosentyx’s share of the rheumatology market has now surpassed the long-established behemoths in Humira and Enbrel while gaining share in the psoriasis market as well. Such an outcome should not come as a surprise as Cosentyx has a cleaner side effect profile coupled with superior clinical and real-world data. The IL-17 class, which is headlined by Cosentyx, is able to clear the skin of psoriasis sufferers more effectively than Humira, suggesting additional share will be ceeded by Humira to the more efficacious treatments. The growth of Cosentyx has been directly related to the stunning sell-off in the shares of Celgene (CELG), where sales of Otezla have failed to live up to expectations.

However, the excellent results posted by Cosentyx have not been matched by Entresto, which has gotten off to a sluggish start. The product came with high intial expectations, but a Cosentyx-like sales ramp continues to evade Entresto as prescribers continue to prefer a litany of generic remedies. Sales of Entresto have increased to $322 million through the first three quarters of 2017, up from $102 million through three quarters of 2016, and we are cautiously optimistic the product will evolve into a blockbuster product (sales north of $1 billion per year). However, patient resistance to paying a premium co-payment may continue to limit sales growth.

Novartis recently launched two new innovative oncology treatments that complement already existing product lines to help form the backbone of Novartis’ key franchise. The first product is Kisqali, a novel therapy for a specific form of metastatic breast cancer. The drug is still in the very early stages of its potential growth trajectory, but it enters into a crowded field that includes Pfizer’s (PFE) Ibrance as the established entity along with Eli Lilly’s (LLY) recently approved Verzenio.

Not to be outdone, Novartis remains on the forefront of the CAR-T field with its recently approved Kymriah for the treatment of patients up to 25 years of age with B-cell precursor acute lymphoblastic leukemia (ALL) that is refractory or that have failed previous therapy. The CAR-T field remains in its infancy, but the results posted are nothing short of stunning, as evidenced by Kite Pharma’s stellar clinical data in the area, which led to its acquisition at a material premium by Gilead Sciences (GILD). Kymriah is first to market, but the approval for ALL is a small overall market. Gilead Sciences has a significant first-mover advantage here with a much broader label, an advanteage that justifies the price tag for Kite Pharma.

Novartis’ strength in oncology is due in part to its “multiple shots on goal” approach via strategic partnerships with innovative biotechs such as Incyte (INCY) for the marketing rights to Jakafi outside the US and the oncology assets acquired in an asset swap with Glaxo SmithKline (GSK). The oncology franchise as a whole is weathering the patent loss of its key product Gleevec very well, and the patent cliff is nearing completion with growth expected to resume in 2018 thanks to the performance of Novartis’ innovative pipeline of newly released products in conjuncture with the maturation of asstes such as Cosentyx.

Outlook

We remain impressed with the pace of innovation that continues to spring forth from Novartis as the promise of its clinical pipeline becomes reality. The returns on capital generated from the latest batch of innovation should allow for a series of annual dividend hikes as Novartis’ free cash flow continues to expand. We will continue to monitor the progress made towards a potential spin off of the Alcon division, and the concept of a pure-play ophthalmology firm is an intriguing one as the renewed focus the business would receive after being set free from the parent could prove to be exactly what it needs.

Image Source: Novartis Earnings Presentation

All things considered, Novartis will remain an idea in the Dividend Growth Newsletter portfolio as we feel the dividend is solid. Through the first three quarters of 2017, free cash flow came in at nearly $8 billion, up from ~$6.5 billion in the comparable period of 2016, while cash dividend obligations came in just under $6.5 billion for the nine-month period. It registers a Dividend Cushion of 1.7 at last check to go along with a yield of nearly 3.4% as of this writing.

Disclosure: Independent Healthcare and Biotech contributor Alexander J. Poulos is long Gilead Sciences and Celgene.