Member LoginDividend CushionValue Trap |

New Taxes? Trump’s Misstep and Seeming About-Face

publication date: Apr 4, 2017

|

author/source: Brian Nelson, CFA

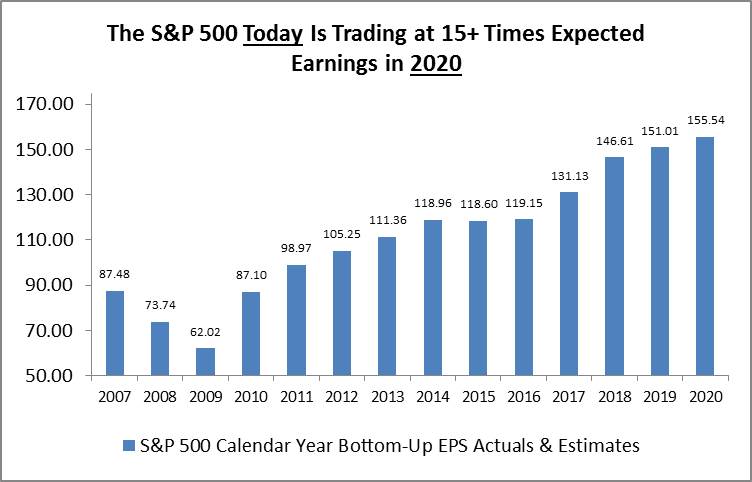

Image Source: FactSet and Valuentum estimates (2019, 2020) News that Trump was considering new taxes, his failure to repeal Obamacare, and the seeming about-face on for-profit education regulations have put the probability of corporate tax reform in jeopardy, from where we stand. If we’re right, the implications on the market could be considerable… and not in a good way. Let’s talk about this in the context of current market valuations. By Brian Nelson, CFA The shot across the bow has been fired. The news came and went, and many seemed to ignore its potential massive implications. What am I talking about? As you have read by now, Donald Trump’s first major move as President has resulted in failure--a divided Republican House pulled legislation March 24 that would have repealed the Affordable Care Act (“Obamacare”) from consideration. Obamacare appears to be here to stay for some time yet. But what’s the major investment takeaway from this--implications on healthcare (XLV) stocks, more of the same for them? Perhaps. But that’s not what we think is the major takeaway. In a market (SPY, DIA) that is effectively pricing in a major reduction in corporate tax rates that will drive earnings higher during the Trump administration, could this major legislative blow foreshadow disappointment in corporate tax reform, too? It might, and if so, it’s a huge deal. Here’s why: On March 31, the S&P 500 was trading at a forward price-to-earnings ratio of 17.6 times, above its 5-year average of 15 times and its 10-year average of 14.3 times. That’s not all that’s troubling though--the S&P 500 is trading at 16.1 times calendar 2018 earnings of $146.61, which implies growth of nearly 12% on top of double-digit growth expected in calendar 2017. If we apply a 3% bottom-line growth rate in earnings for 2019 and 2020, the S&P 500 today is trading at ~15 times 2020 earnings. Translation--the market is pulling forward years and years of growth in current prices. What’s more, it’s reasonable that many bottom-line forecasts for 2018 are factoring in--if not explicitly then implicitly--some probability that corporate tax reform will be successful. If more and more investors and analysts start to embrace the idea that corporate tax cuts won’t come easy, just like the failed repeal of Obamacare, earnings estimates are likely to come down considerably, and that alone may spark a broader market sell-off. Though many companies have been buying back their own stock hand over fist, we doubt it will be enough to stem the declines. Market valuations are just too frothy. But are we being too dire? After all, what’s one setback in repealing Obamacare in the whole of Trump’s ambitious political agenda. Can we really extrapolate just one failure to potential troubles in implementing corporate tax reform? Well, maybe because it’s not the only surprise thus far. Late last month, the Trump administration “offered a forceful defense of the so-called gainful employment rule.” The language appears to fly in the face of a recent March 6 announcement from the US Department of Education. The apparent about-face comes off the heels of Trump’s own personal troubles with his namesake Trump University, which recently paid out millions to settle long-running litigation. For-profit education stocks may find no refuge with Trump at the helm. Perhaps even more concerning have been reports of new taxes. The Washington Post noted that the Trump administration had been considering a carbon tax to increase revenue, a move that we find astonishing given that new taxes simply fly in the face of plans to grow tax revenue through economic growth, not by increasing the rate or via new levies. Even though the carbon tax may no longer be on the table according to a Trump administration spokesperson, it’s somewhat difficult to explain how a new tax could have even been considered when the big question for investors continues to rest on whether corporate tax reform is going to happen at all. The Washington Post may have it right that this “rapid reversal illustrates a Trump administration still in the initial stages of a plan to rework the tax code.” But how early? If corporate tax reform isn’t implemented before the end of 2017, my bet is that 2018 earnings numbers on the S&P 500 are probably too optimistic--and that may mean some profit taking as the market starts to price in analyst earnings adjustments several months in advance. In light of all the lobbying in Washington, modifying the tax code will be just as challenging--if not more so--than changing the healthcare laws rolled into Obamacare, something that has already failed. Is the market getting too far ahead of itself? Well, we will say this -- for this first time in Valuentum’s history, there isn’t one stock that registers a 9 or 10 on the Valuentum Buying Index. Yes, the market remains pricey by most measures. Our best ideas for consideration continue to reside in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, or within the Nelson Exclusive publication. The next edition of the Nelson Exclusive will be released Saturday, April 8, 2017. Related: HRB Solar: CSIQ, FSLR, JKS, SPWR, TSL Education (For-Profit): APOL, BPI, CECO, CPLA, DV, EDU, LOPE, LRN, STRA, UTI |