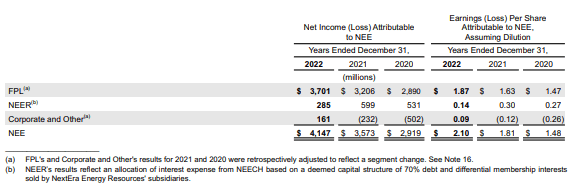

Image: FPL accounts for a large portion of Nextera Energy’s earnings. Image Source: Form 10-K

By Brian Nelson, CFA

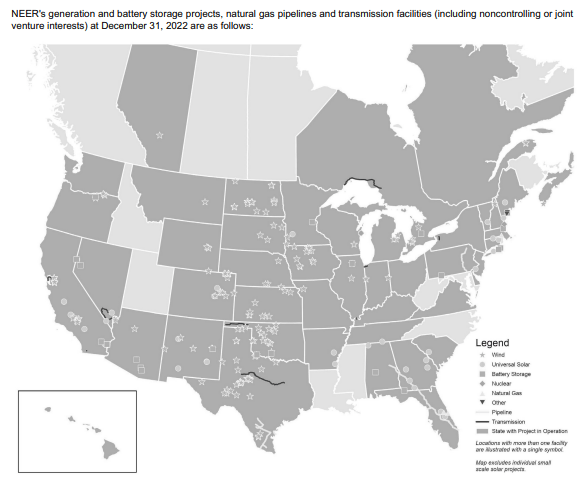

NextEra Energy (NEE) is one of our favorite utility ideas. The company operates two principal businesses, FPL, which is the biggest electric utility in Florida, and NEER, which is the world’s largest generator of wind and solar power and a global player in battery storage. FPL has approximately 32,100 MW of net generating capacity and is state regulated, serving more than 12 million people, with residential accounting for a little more than half of operating revenue. FPL operates four nuclear power plants. NEER has 27,400 MW of total net generating capacity and represents one of the largest wholesale generators of electric power in the U.S., with the majority of its electricity coming from renewables (Source: Form 10-K).

Image Source: NextEra Energy Form 10-K

Nextera Energy continues to pursue new clean-energy initiatives as well, with the company’s FPL unit planning to build 20 gigawatts of incremental low-cost solar generating capacity over the next decade. In April, NextEra Energy swung to a profit when it reported its first-quarter 2023 results, with first-quarter net income coming in at $2.09 billion compared to a loss of $451 million in the first quarter a year ago. On an adjusted basis, first-quarter 2023 earnings came in at $1.68 billion versus $1.46 billion in the year-ago period. The quarterly results were solid.

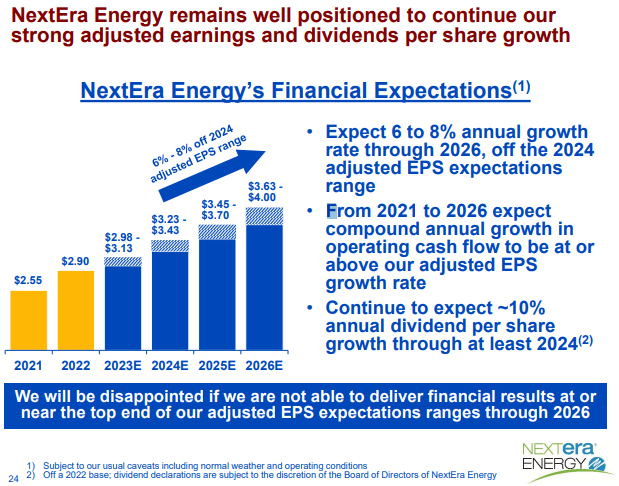

Image Source: Nextera Energy

Nextera Energy reiterated its long-term financial expectations in its first-quarter press release:

For 2023 and 2024, NextEra Energy continues to expect adjusted earnings per share to be in the ranges of $2.98 to $3.13 and $3.23 to $3.43, respectively. For 2025 and 2026, NextEra Energy expects to grow 6% to 8%, off the 2024 adjusted earnings per share range. This translates to a range of $3.45 to $3.70 for 2025 and $3.63 to $4.00 for 2026. NextEra Energy also continues to expect to grow its dividends per share at a roughly 10% rate per year through at least 2024, off a 2022 base.

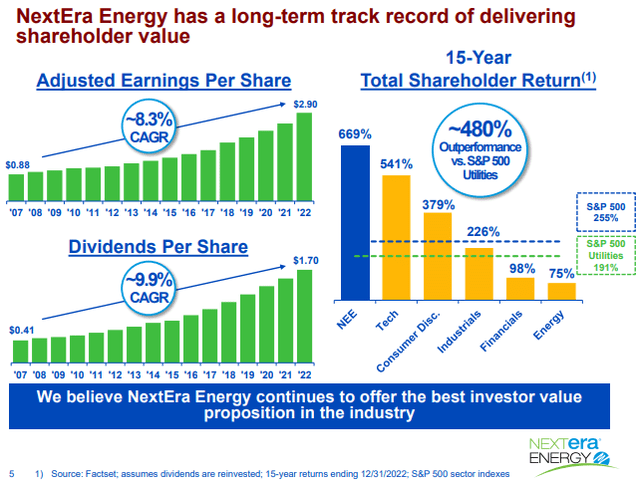

We think the utility sector is generally overrepresented in many dividend-oriented and income-producing portfolios, but we think NextEra Energy is a good fit for the well-diversified ESG Newsletter portfolio given its vast renewable resource assets. Shares of Nextera Energy have fallen more than 20% since the beginning of 2022, while the Utilities Select Sector SPDR Fund ETF (XLU) is down more than 8% over the same time period. Shares of Nextera Energy yield ~2.6%.

Image Source: Nextera Energy

Though the performance of the utility sector hasn’t been that great recently, we still think utilities can sometimes make sense within a well-diversified equity portfolio as they tend to provide some yield while generally holding up during difficult times. We like Nextera Energy, in particular, because of its exposure to important ESG-related considerations, but we don’t want readers to lose sight of the view that we generally don’t find much utility in utility exposure, especially when certificates of deposit are now yielding 4%-5% and sometimes more at the local bank.

NOW READ: Shocking?!?! Utility Dividends Aren’t Always Safe

———-

Tickerized for NEE, FSLR, SPWR, ENPH, RUN, SEDG, CSIQ, JKS, BE, AZER, NOVA, BEP, ORA, WNDW, DQ, SOL, MAXN, PCG, ED, D, DUK, AEP, EXC, ETR, LNT, EIX, ARRY, NRG, NEP, XLU

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.