Tickerized for the DIA.

“This kind of trading activity could be setting the stage for a big quant fund blow up, if the kind of leverage it takes to move the markets to this magnitude was applied. All it may take is for the B/M “value” factor to continue to suffer in the coming 12-18 months–it’s possible we could see a few quant firms go belly up. My guess is that market participants are paying very close attention to this activity, and if they “smell blood,” things could get ugly.” – Brian Nelson, CFA

Earlier this week, the markets experienced significant internal “rotation,” as cyclicals and “value” stocks materially outperformed their defensive and “growth” counterparts, all the while the broader equity markets remained relatively quiet. Let’s pick up where we last left off in the latest Economic Roundtable, finishing our team’s views on “The Big Short” Michael Burry’s views on why index funds are like subprime CDOs, from Bloomberg:

Burry, who made a fortune betting against CDOs before the crisis, said index fund inflows are now distorting prices for stocks and bonds in much the same way that CDO purchases did for subprime mortgages more than a decade ago. The flows will reverse at some point, he said, and “it will be ugly” when they do.

“Like most bubbles, the longer it goes on, the worse the crash will be,” said Burry, who oversees about $340 million at Scion Asset Management in Cupertino, California. One reason he likes small-cap value stocks: they tend to be under-represented in passive funds.

“Central banks and Basel III have more or less removed price discovery from the credit markets, meaning risk does not have an accurate pricing mechanism in interest rates anymore. And now passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies — these do not require the security-level analysis that is required for true price discovery.

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

“The dirty secret of passive index funds — whether open-end, closed-end, or ETF — is the distribution of daily dollar value traded among the securities within the indexes they mimic.

“In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those — 456 stocks — traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different — the index contains the world’s largest stocks, but still, 266 stocks — over half — traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.”

Callum Turcan: Liquidity risk is something passive fund investors aren’t taking seriously and haven’t in a long time, if ever. There’s far more trading volume in these passive funds than in most of the underlying equities/commodities themselves which could create the liquidity squeeze of a lifetime if things go south. Burry’s example that the exit door is the same size as it always was but the crowd inside the theater is now much larger is perfect. If the theater catches fire, many will get burned as they can’t leave in time.

Additionally, there are a lot of mediocre funds out there that invest in lightly traded equities. Let’s say that the fund in question is facing a lot of redemptions as the market is tanking and investors want to sell out. The fund’s liquidity is quickly used up, forcing the fund to sell down its equity positions at meaningful discounts as the sudden surge in selling activity in lightly traded equities overwhelms the limited amount of buying activity. That in turn prompts more investors to seek redemptions as the value of the fund is eroding away at an even faster rate now, forcing the fund to further sell off its holdings to raise cash. This is all happening while the market is free falling, creating a snowball effect.

Matthew Warren: I think that is one of the causes of these large air pockets. If a particular stock or sector is sold down quickly because of flows at a particular point in time, it drives more action from the algos. If the comp trades down by 5-10%, the algo assumes something changed about the state of the future macro or cash flows. The comps then trade down in sympathy. That creates algo selling of still more comps. If the real-people investors pause because they are worried that the market knows something that they don’t, the irrational selling continues. Given career risk, it requires a ton of courage to start buying when all of the algos are selling into light volume. I think that’s what happened last December. Because the tail wags the dog and there is such a large confidence and wealth effect, a similar drawdown to December that stayed down could easily cause a recession in my opinion.

Callum: The wealth effect in America is thought to marginally enhance GDP growth when positive due to minor increases in consumer spending, but conversely can have a really adverse impact on consumption when negative. Factor in dynamic effects (a precipitous drop in the stock market leads to reduced consumption leads to reduced business investment, which was already hurting from subdued business confidence levels due to the trade war, which in turn further reduces consumption levels and leads to even sharper stock market declines and so forth) and I can see how a recession forms.

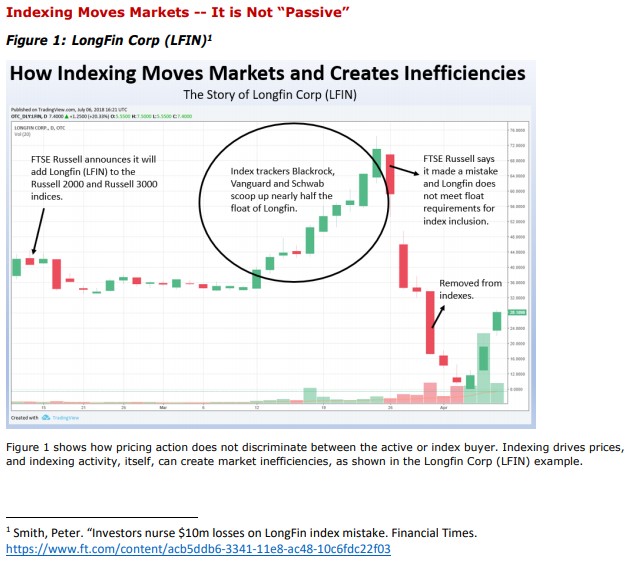

Brian Nelson: I think it is simply disingenuous to dismiss the sound reasoning behind “The Big Short” Michael Burry’s take on the passive bubble and the risks of lower volume, lower value-traded stocks. Here’s an excerpt from a piece I wrote last year (image as of July 2018, also published in Value Trap).

On February 14, 2018, FTSE Russell announced that it would add Longfin Corp (LFIN) to the Russell 2000 and 3000 indices. The news caused Blackrock and other index trackers to buy nearly half of the freely available float in Longfin, “pushing the shares up from their February low of $32 to above $71,” according to the Financial Times.

Once FTSE Russell noted they made a mistake, and that Longfin did not meet the 5% free-float requirement to be included in the Russell indices, the stock was removed from the indices after the close March 28, 2018, meaning Blackrock and other index tracking funds, including Vanguard and Charles Schwab, also had to sell their shares at a loss. The idea is not necessarily whether this “mistake” was material to index fund returns, but rather it’s important because it shows directly how indexing impacts pricing, causing inefficiencies.

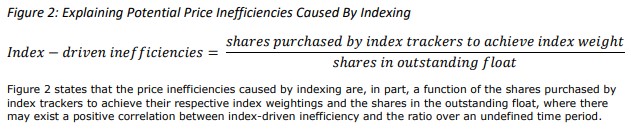

Though this is an extreme example that shows indexing drives prices and that indexing can create inefficiencies, it is no less important of an example, and perhaps its very existence has significant implications. We hypothesize, for example, that, given this empirical evidence, not only can inefficiencies exist in the marketplace, but that some inefficiencies are driven by index investing, itself, and might be explained, in part, as a function of the company’s weight in the index, and how many shares are required to be owned by index trackers versus the company’s outstanding float.

Should the weight of the company in an index cause a large percentage of the float to be purchased by index trackers, there may be greater potential for index-driven inefficiencies over an undefined time period (image as of July 2018, also published in Value Trap).

[Longfin is now a penny stock, trading for ~$0.70 per share at the time of this writing.]

Let’s talk about some names in particular. It’s really peculiar what is happening with Visa (V) and PayPal (PYPL), for example, and some of the profit taking in these names that is going on during this rotation.

Callum: Payment processing and financial technology names getting hurt might be due to a rotation out of growth and momentum stocks, and towards “value” plays (really blue chips and equities that are considered “safer”). I don’t quite get the reasoning behind others making this trade either, particularly given the strong fundamental performance of Visa and PayPal (in terms of their financial performance and strong free cash flows).

Matthew: Given the recession uncertainty, people had flocked to safety by seeking out secular growth (and bond proxies). Those short-hand valuation metrics are WAY higher than the cyclicals, which had de-rated. The past few days is a reversal of trend, exacerbated by short covering in cyclicals and weak conviction holders of high-quality secular growers. Whether it is a partial reversal of trend or something bigger I think depends on whether we get the green light of no recession probability. I personally don’t expect that. Even if the recession is 2-3 years away, I think we will worry ourselves all the way there given the 10-year bull market.

Callum: Price-agnostic trading creates these kinds of low-conviction long equity holders, namely “weak-hands” momentum buyers who are quick to flee equities on low single-digit down days. We will have to see if interest in secular growth picks up after the most recent sell off, but I suspect substantial volatility will continue until at least the upcoming FOMC meeting on September 17-18.

If there ever were an event that could play an outsize role in helping the US economy avoid recession, it might come down to whether we get a large preemptive interest rate cut or not from the US Federal Reserve. Not so much because lower interest rates would have a large positive effect on the economy (there will be positives from lower rates, of course, but the upside is limited when rates are already low), but because a material interest rate cut might soothe capital markets and spur greater business investment as US recession fears truly begin to recede. That might not represent the green light you mentioned Matt, indicating recession fears are completely unfounded, but the light might change from a sharp orange-red to a nice yellow instead.

Really, it’s a confidence game, and investors shifting into cyclicals indicates investor confidence is growing in the outlook of the global economy–oil (USO, OIL) and metals prices (XME) strengthening recently further reinforces this sentiment. Now, the US Federal Reserve needs to deliver, otherwise that paradigm shift might not last. For secular growth, those names should do well in a lower interest rate environment as their future free cash flows grow in relative value (due to the lower discount rate the market will apply to those future free cash flow streams), at least in theory, so I think caution is our best approach right now. If the US Fed doesn’t cut rates, and recession fears keep building, then it’s hard to say but investors would likely pile back into secular growth names.

Matthew: I don’t think we’ll ever be able to outguess the daily or weekly or monthly wiggles in the market marking up and down the probability of recession. To me, the best bet is to limit the fishing pond to high quality companies and then constantly sift for the best value for money being served up by Mr. Market. If SAAS valuations go nuts, you shift some money into high quality cyclicals that are beaten down, and vice versa. So–it’s up to us to have high quality identified in advance and be watching valuations. You tilt the portfolio towards and away from beta based on the opportunities the market serves up.

Callum: I like that approach. As it relates to Visa and PayPal, neither company appears overvalued right now based on our discounted free cash flow analysis (Visa trades near our fair value estimate, PayPal trades at the low end of our fair value estimate range), and both are high quality names playing secular growth trends. I think that short-term volatility aside, they should continue performing well going forward, and my only real concern relates to PayPal’s weak technical performance since July 2019 (Visa has shifted lower over the past few days but is still on a powerful upward trend).

Matthew: I agree that if you like the moat, the tailwind, the management and culture, the fundamental risk profile, and the valuation, then there is a lot to like and holding through volatility equals conviction in your analysis.

Brian: I get the sense that a few quant firms are making some huge leveraged bets.

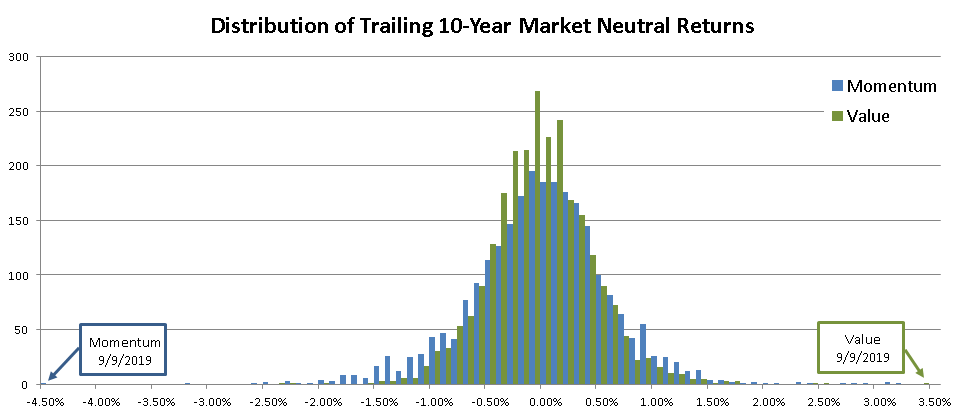

I don’t think this is rational buying, but more akin to what might best be described as the gambler’s fallacy, doubling down after decades of losing, trying to make it all back with leverage. The traditional price-to-book (book to market, B/M) “value” factor, for example, has been underperforming so much during the past 15 to 30-year stretch, that I think the quants are expecting or rather hoping for a massive “reversion to the mean.” The problem is that there’s been a structural shift in the data, and book value just isn’t as indicative of intrinsic value as it once was when banks and industrials ruled the S&P 500.

This kind of trading activity could be setting the stage for a big quant fund blow up, if the kind of leverage it takes to move the markets to this magnitude was applied. All it may take is for the B/M “value” factor to continue to suffer in the coming 12-18 months–it’s possible we could see a few quant firms go belly up. My guess is that market participants are paying very close attention to this activity, and if they “smell blood,” things could get ugly. I remember LTCM saying that when they tried to unwind their portfolio it was as if others had the same positions, were imitating them, or something like that. Seems like a very similar set up with just how popular the B/M “value” factor has become.

In any case, the dynamics of the past couple trading sessions seem to speak heavily to the considerable systemic risks caused by quants. Things are certainly interesting: Cross sectional dispersion of the daily standard deviation of single stock returns was near the 97th percentile, while distribution between value and momentum was phenomenal compared to baseline over the past 10 years.

Image Source: Josh Russell

Matthew: Very interesting hypothesis, Brian. As for why now or why the magnitude of the move, perhaps quant funds were piling on top of each other once it started?

I very much agree with you about B/M being less relevant than when banks and industrials used to be a larger part of the index. A lot of the value-creating tech and users of tech companies that have grown up over the years in fact deserve a lower B/M ratio to reflect the return on capital spread from value creation.

Brian: Thanks Matt. As we wrap up, let’s address a question from a member. Here’s the question:

Noticed in the new Dividend Growth Newsletter that you included the table entitled “Stocks with High Valuentum Buying Index Ratings and Strong Dividend Growth Prospects” in which AmerisourceBergen (ABC) was still listed with a VBI of 9.

Somewhat surprised, since the VBI of 9 was in the May 24 report on this stock (when its price was comparable), and in the last few weeks the opioid litigation developments in Oklahoma and Ohio have changed the outlook of liabilities for distributors like ABC. While the stock is back trading at the lower end of your fair value range, it does not have the offsetting breadth of JNJ in businesses nor its scale. Does your VBI incorporate the “one-time legal exposure”? I would consider buying this stock once its liabilities are more clarified, as the price may decline further before recovering.

Thanks for the question.

The Valuentum Buying Index is a multi-faceted process that considers enterprise valuation (including a margin of safety that implicitly considers exogenous developments such as unexpectedly large, one-time potential liabilities), relative valuation, and share-price momentum. We use the VBI as a source of idea generation (not as the only factor in considering adding an idea to a newsletter portfolio). We took a pass on adding AmerisourceBergen to any newsletter portfolio for now, but we’re still watching it.

Our best ideas are always included in the newsletter portfolios. Here is our latest update regarding the ‘Hierarchy of Idea Generation:’

/The_Hierarchy_of_Valuentum_Idea_Generation

Join the conversation. Post your thoughts below.