|

Let’s talk about this hierarchy of idea generation in this note.

—

A version of this article was sent to members previously. New content has been added.

—

Note: We continue to work to optimize the signal-to-noise ratio in our work, and we are evaluating expanding our update cycle to half-year periods to better bolster the signaling aspects of the Valuentum Buying Index (VBI). In our widely-read case study (see here), the VBI showed its ability to rank equity returns over a forward 12-month period, and we think a migration to less-frequent updating may make the most sense to better capture the forward-looking dynamics of the system. We think this will help weed out false breakouts and other noise that could be harmful. You shouldn’t think of our reports as stale. Remember, if you are only paying attention to the update cycle, you are missing the forest for the trees. Our goals are to do extremely well in using the tools and metrics we create, the fair value estimate, the Valuentum Buying Index (VBI), the Dividend Cushion ratio, among others, and to highlight the best ideas for consideration in the newsletter portfolios.

—

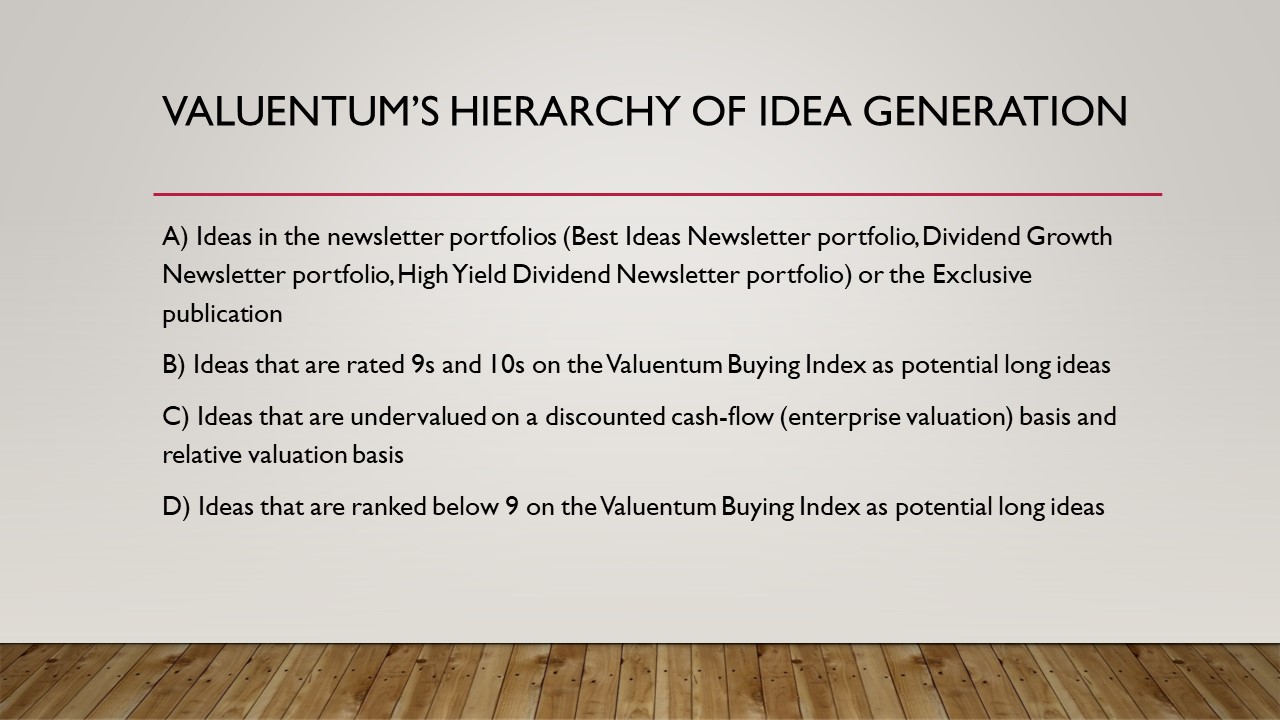

Hierarchy of Idea Generation

A) Ideas in the newsletter portfolios (Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio) or the Exclusive publication

B) Ideas that are rated 9s and 10s on the Valuentum Buying Index as potential long ideas

C) Ideas that are undervalued on a discounted cash-flow (enterprise valuation) basis and relative valuation basis

D) Ideas that are ranked below 9 on the Valuentum Buying Index as potential long ideas

If you are only considering the estimated fair value of stocks, you could fall into value traps! Use momentum as another check and balance to assess what the market thinks is the true intrinsic value of the company. Using enterprise valuation (free cash flow to the firm) and momentum together could shield your portfolio from painful value traps. Simply put, there may be no logical basis for buying stocks immediately as they fall and on the way down. Here’s an excerpt from Value Trap: Theory of Universal Valuation.

—

Image: Excerpt from Value Trap: Theory of Universal Valuation, page 241

—

————————-

—

Let’s get started!

Image: Chipotle (CMG) was one of our best calls in 2019.

Image: Verint (VRNT) was a controversial idea in the Best Ideas Newsletter portfolio that worked out great for members this year.

Image: Visa (V) has been the top-weighted idea in the Best Ideas Newsletter for as long as we can remember. In December 2017, when we migrated to weighting ranges for ideas in the newsletter portfolio, the company’s “weight” was 8.6%. The image above shows its performance relative to the S&P 500 (SPY) since then. Source (pdf).

—

Which Valuentum Buying Index (VBI) Ratings Are Material?

—  Image — Excerpt Value Trap: Theory of Universal Valuation, page 244. — By Brian Nelson, CFA —

I love it when I get questions because it shows the engagement of our members. I appreciate that very much. Though there are other considerations, of course, the Valuentum methodology is really quite simple: dividend growth considerations aside, we like undervalued ideas that are going up, and we generally won’t remove ideas that are overvalued until their technical/momentum indicators turn over. At times, however, I receive questions that worry me a bit that I may not be doing a good job communicating how we think about our service.

—

I’ve written consistently about how our favorite ideas are included in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, or for those seeking high yield, the High Yield Dividend Newsletter portfolio. The Exclusive publication is what I describe to be a “back-against-the-wall” publication where we “force” ourselves to highlight three new ideas each month: an income idea, a capital appreciation idea, and a short-idea consideration. The ideas in the three newsletter portfolios, per each strategy, or highlighted in the Exclusive publication are our favorites for consideration.

—

Though the ideas in the newsletter portfolios have done well, the Exclusive ideas have done extremely well, in my opinion. Through March 2019, for capital appreciation ideas highlighted in the Exclusive publication, the success rate is nearly 82% (81.8%). For short-idea considerations highlighted in the Exclusive publication, the success rate is nearly 79% (78.8%). Adjusted for currency, not one income idea has cut its payout either. That’s after 33 monthly editions!!! The Exclusive is purely incremental and highlights ideas that fall outside our vast coverage universe (and that may not fit as well into the existing newsletter portfolios). It is a great add-on publication if you may be interested. See here.

—

For new members, Valuentum is a financial information publisher, so we don’t provide personal advice or personal recommendations. That’s not the area that we operate in. Only your personal financial advisor knows what is right for you. That means we can’t tell you to buy or sell anything or what you should do if you own a stock. Financial advisors build you a personal financial plan and select the stocks that may fit best to achieve your personal goals in the context of your personal risk tolerances. Be sure to ask your financial advisor if any move is right for you. We don’t operate in this area. We provide financial information and data. With that said, as we publish studies on the market, here is how we think about our Valuentum Buying Index ratings.

—

Image: The guidelines for how we think about the Valuentum Buying Index rating. This table is provided on our website and in each 16-page company report. Valuentum is not a broker, financial advisor or money manager. Valuentum is a financial information provider.

—

Let’s assume that you are interested in a stock rated 8 on the Valuentum Buying Index, and it is not in the newsletter portfolios. What do we think of it? In the context of the hierarchy of idea generation and in light of what an 8 indicates on the Valuentum Buying Index (as shown in the table immediately above), a company rated 8, by itself, probably wouldn’t be highest on one’s list of considerations. It may be a consideration, of course, but only after many, many others. For starters, we view only the 9s and 10s as material considerations on the long side, but even then, we still prefer ideas in the newsletter portfolios, first. Said another way, after scouring the ideas in our newsletter portfolios, then the 9s and 10s on the Valuentum Buying Index, then those that are undervalued on a discounted cash-flow basis (“DCF Undervalued”), one might then start to look at ideas that are lower on the Valuentum Buying Index.

—

Hierarchy of Idea Generation

A) Ideas in the newsletter portfolios (Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio) or the Exclusive publication

B) Ideas that are rated 9s and 10s on the Valuentum Buying Index as potential long ideas

C) Ideas that are undervalued on a discounted cash-flow (enterprise valuation) basis and relative valuation basis

D) Ideas that are ranked below 9 on the Valuentum Buying Index as potential long ideas

—

Let’s talk about things that Valuentum maybe didn’t quite get “right” (stocks rated 8 and that are not included in the newsletter portfolios wouldn’t be examples). These 8-rated entities never really were considerations in the newsletter portfolios, nor were they a 9 or 10 on the Valuentum Buying Index. Stocks rated 8 may be ones that we had thought were undervalued, but valuation is one part of our process. The same is true for other stocks that appear undervalued on a discounted cash-flow basis that are not part of the newsletter portfolios, or rated highly on the Valuentum Buying Index. They might turn into value traps! More recently, we have received more questions about companies that are lower on the hierarchy of idea generation (C & D in image above) than on companies that are higher on the hierarchy of idea generation (A & B in image above). We want to make sure that you are focusing on the “right” areas of our service.

—

That said, we do get things wrong at times, but let’s first start with an explanation of our methodology to set the foundation. A stock’s Valuentum Buying Index (VBI) rating is based on our view of the attractiveness of a company’s discounted cash-flow valuation (enterprise valuation), its relative valuation versus peers, and an overall technical/momentum assessment. If our views on any of these three investment pillars change, a company’s Valuentum Buying Index rating will change to reflect this new view. We use our methodologies and our experience and judgment to build and adjust the newsletter portfolios. Achieving the goals of the newsletter portfolios is our primary objective with our regular premium service. If you’re focused only on our report-update cycle (and immaterial interim changes), you’re missing the forest for the trees. We’re considering extending our update cycle to optimize the signal-to-noise ratio.

—

Image — Excerpt Value Trap: Theory of Universal Valuation, page 244.

—

As it relates to the Best Ideas Newsletter portfolio, for example, if a stock registers a 9 or 10 on the Valuentum Buying Index in our coverage universe, we would consider adding it to the newsletter portfolio. When the stock then/eventually registers a 1 or 2 on the Valuentum Buying Index in time, we might then consider removing it from the newsletter portfolio. The changes in the “big middle” of the Valuentum Buying Index (including 8-rated stocks) offer more tactical considerations, but we generally only consider the highest and lowest VBI ratings to be material. During times of market froth, however, as in arguably today’s environment, in the Best Ideas Newsletter portfolio, we may relax some of the VBI criteria and consider undervalued stocks with neutral technical/momentum indicators, or fairly valued stocks with good relative valuation metrics and strong technical/momentum indicators. We may only consider removing ideas from the simulated newsletter portfolios when both their valuation and technical/momentum indicators point in the same direction (good/good or poor/poor), or if we’re making more strategic/tactical moves.

—

The criteria for the Dividend Growth Newsletter is somewhat different. We’re looking for strong dividend growth stocks in the Dividend Growth Newsletter portfolio (something that is not a part of the criteria in the Best Ideas Newsletter portfolio), meaning that in addition to considering the VBI and fair value estimate range, the Dividend Cushion ratio is also very important. We still look to add highly-rated stocks on the VBI and those that are undervalued to this newsletter portfolio, but we may be more open to ideas that have strong dividend growth prospects, on the basis of the forward-looking Dividend Cushion ratio. After adding ideas to the Dividend Growth Newsletter portfolio, we may continue to include them in the portfolio even if they have modest VBI ratings that are trading within our fair value estimate range, as long as they have strong dividend growth prospects. We’d only consider removing a stock from the Dividend Growth Newsletter portfolio when we lose confidence in its intrinsic value support and its dividend growth prospects.

—

The way to think about our process is rather simple. In the Best Ideas Newsletter portfolio, if a company registers a high rating in our coverage universe, we consider adding it (but we won’t consider adding all companies because of portfolio constraints). If we do decide to add the idea, then we watch its fair value estimate and technical/momentum indicators as it navigates the “big middle” of VBI ratings, and only consider removing the idea from the Best Ideas Newsletter portfolio if it registers a 1 or 2 on the Valuentum Buying Index. In the Dividend Growth Newsletter portfolio, we pay attention to the price-versus-fair value estimate range and the company’s Dividend Cushion ratio, as we’re looking for resilient equities with intrinsic-value support that have strong dividend growth prospects. Only when intrinsic-value support and dividend growth strength wane will we consider removing an idea from the Dividend Growth Newsletter portfolio.

—

We talk a lot about our winners (thank goodness we have a lot of them!), from Apple (AAPL) to PayPal (PYPL) to Chipotle and beyond, but how about one that didn’t work out: CVS (CVS) was a rare idea in the newsletter portfolios that didn’t quite live up to our expectations a couple years ago. That’s okay. In the context of 15-20 ideas (or a total of 40 or so in both newsletter portfolios in the premium membership), we’re going to get a few wrong. But we didn’t dwell on our mistake. We removed CVS from the newsletter portfolios February 2018, more than a year ago now, and we didn’t look back (in fact, we added a couple months later what turned into a big winners in Chipotle and Xilinx). Here’s what we said more than 12 months ago about CVS, on

Categories Member Articles

|