Member LoginDividend CushionValue Trap |

Comment: Verint's Traditional Free Cash Flow

publication date: Dec 14, 2017

|

author/source: Kris Rosemann and Brian Nelson, CFA

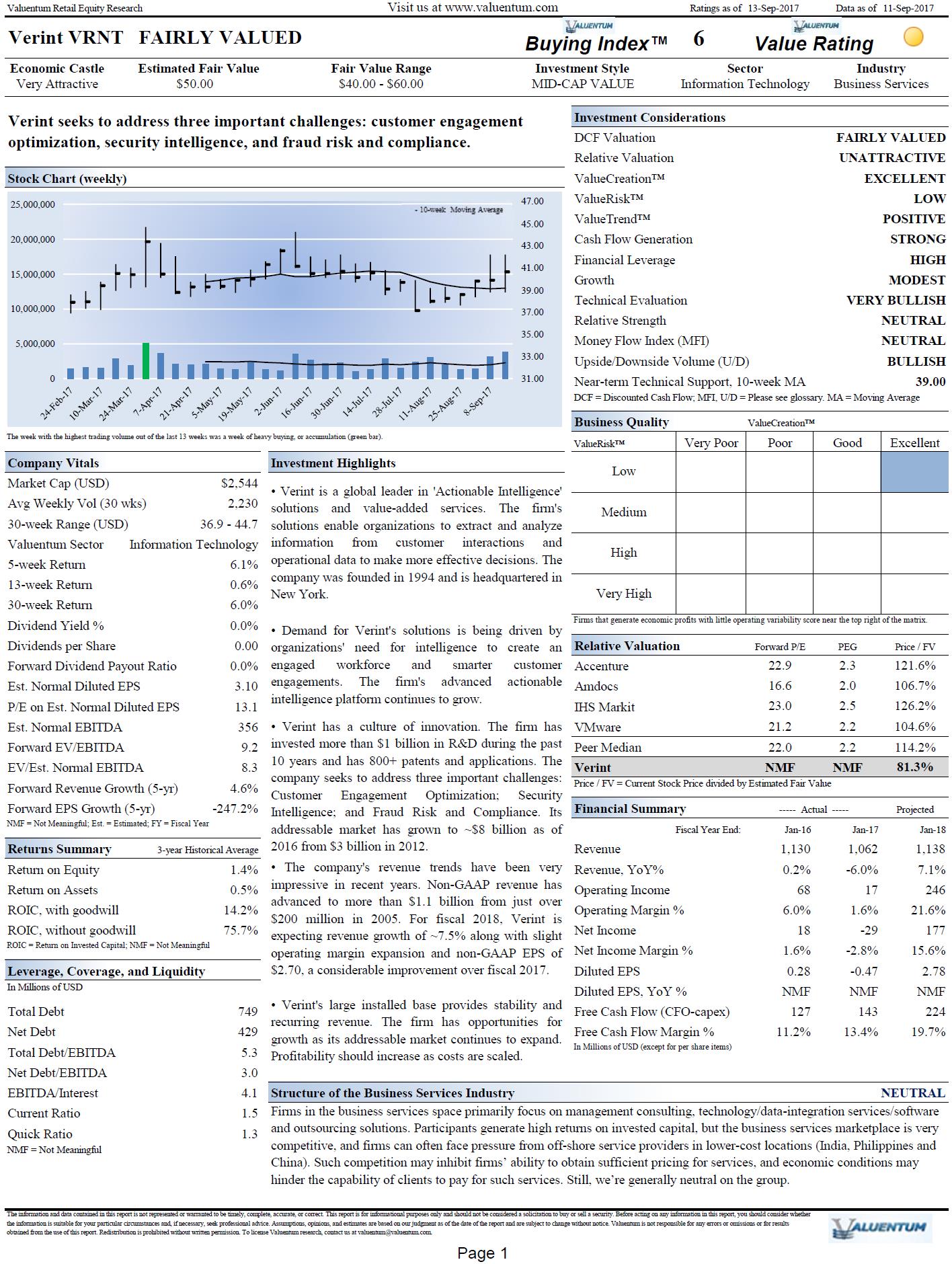

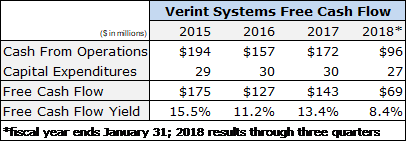

Image shown: Page 1 of 16, Valuentum's 16-page stock report on Verint (VRNT) Verint is free cash flow positive, implying that non-GAAP earnings adjustments are of high quality. By Kris Rosemann and Brian Nelson, CFA Q: What are your thoughts on this bear case for Verint Systems? “Verint's Profits Don't Justify Its High Valuation” A: We're somewhat puzzled by the financial analysis of the write up, perhaps most with the author's calculation of free cash flow, which may not truly reflect the goings-on of the cash flow statement (the author defines free cash flow as NOPAT less the change in invested capital). Adjustments to free cash flow are typically made within the valuation context (as NOPAT less the change in invested capital may do), but such valuation-adjusted metrics are not always as informative in assessing the "true" cash flow characteristics of the business, outside the valuation context. For example, traditional free cash flow is measured as cash flow from operating activities less additions to property plant and equipment (or capital expenditures). Verint is not burning through cash as the article noted. Traditional free cash flow for the company in fiscal 2017, for example, came in at more than $140 million. Though we very much understand the merits of making important adjustments to cash flow items within the valuation context, traditional free cash flow is a rather straightforward concept, and Verint’s is positive.

Source: Verint's regulatory filings Verint's fiscal 2018 non-GAAP earnings per share guidance is $2.75 per share, and management’s early projection for fiscal 2019 non-GAAP EPS is currently $3.00. Consensus estimates for fiscal 2018 and 2019 are $2.75 and $3.03, respectively, implying that shares are trading at ~14 times on a forward basis (a rare bargain, especially for a company that is growing the top line). We think it’s also worth noting that the meaningful adjustments to GAAP net income (aside from stock-based compensation) to arrive at GAAP net income are acquisition related, the largest being amortization of acquired tech and intangibles, as well as restructuring expenses. We generally view these as transient adjustments that warranted the non-GAAP treatment, a notion we feel is supported by relatively stable operating cash flow and free cash flow. Said differently, if Verint didn’t have such strong traditional free cash flow performance, we’d be mighty concerned about the GAAP versus non-GAAP discrepancy, but the company does have strong traditional free cash flow performance, implying that non-GAAP earnings are not low quality. Of course it is important to focus on various measures of free cash flow as it relates to calculating the intrinsic value of a company (within the valuation context), but valuation adjustments are not always clean, and they shouldn’t necessarily be used to explain the core goings-on of the business. We may be “right” or “wrong” with our Verint idea, but it won’t be because of GAAP or non-GAAP reasons, or even cash flow valuation adjustments. We maintain our view that Verint’s shares are underpriced. |