Image Source: Colgate-Palmolive

By Brian Nelson, CFA

Colgate-Palmolive (CL) put together a solid quarter when it reported fourth-quarter results in late January. During its fourth quarter, net sales and organic growth both came in at 7% thanks to strong pricing expansion, with the company’s base business earnings per share up 13%, to $0.87. Impressively, both the company’s GAAP gross margin and base business gross margin advanced 400 basis points, to 59.6%. The firm continues to dominate the toothpaste and manual toothbrush markets, with a global market share of 41.1% and 31.5%, respectively, year-to-date.

Management had a lot to say about the quarterly results and outlook:

We are pleased to have finished the year with another quarter of strong top and bottom line results including 7.0% net and organic sales growth, improved organic volume performance, gross and operating profit margin expansion and double-digit earnings per share growth.

For the full year, we grew both net and organic sales 8.5%, with organic sales growth in every division and in all four of our categories. This was our fifth consecutive year with organic sales growth at or above our 3% to 5% targeted range.

The strong sales growth combined with our commitment to productivity and efficiency drove strong bottom line performance as well, with gross profit, gross profit margin, operating profit, operating profit margin, net income, earnings per share and free cash flow all increasing versus 2022 for both the quarter and the year.

We continued to invest in the capabilities required to deliver robust growth going forward, building strength in areas like innovation, digital, data and analytics, revenue growth management and advertising. We leveraged our strong margin performance to invest behind building our brands, with a 19% increase in advertising spending in 2023, and we expect higher levels of brand investment in 2024.

The quality of our results this year and our strong growth momentum, including improved organic volume performance, add to our confidence that we are well positioned to deliver consistent, compounded earnings per share growth in 2024 and beyond.

ESG Matters

Colgate-Palmolive is big on education and is quite generous. According to its latest Sustainability and Social Impact report: “Since 1991, (it has) reached more than 1.6 billion children and their families in over 80 countries with oral health education – including the importance of brushing twice a day – as well as toothpaste and a toothbrush, dental screenings and treatment referrals.” Further, “since 2002, Hill’s Pet Nutrition has provided more than $300 million worth of food to more than 1,000 shelters and helped more than 13 million shelter pets find forever homes.” The company also developed a first-of-its-kind recyclable toothpaste tube, with an eye towards eliminating plastic waste. Colgate-Palmolive has also “targeted Net Zero carbon emissions across (its) value chain, including (its) own operations, by 2040.”

Concluding Thoughts

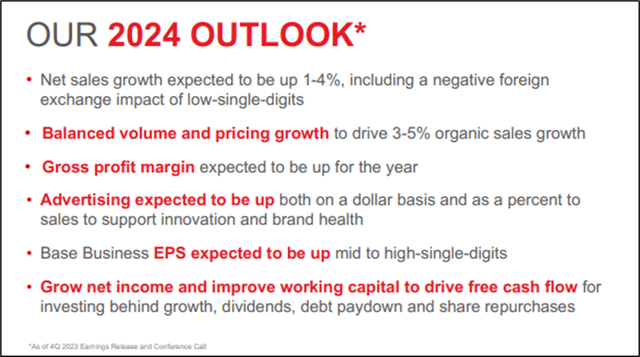

It’s hard not to like this Dividend King that has raised its dividend in each of the past 60+ years. Colgate-Palmolive’s net cash from operations expanded 47% for the full year, to ~$3.7 billion. Looking to the full year 2024, Colgate-Palmolive expects its net sales growth to come in the range of 1%-4%, and that includes a modest headwind from foreign exchange. Organic revenue growth is expected to be in its targeted range of 3%-5% for the year, and management expects gross margin expansion and a double-digit earnings-per-share increase on a GAAP basis. On a base business basis, the company is anticipating a mid- to high-single digit earnings per share increase. All things considered, we liked Colgate-Palmolive’s fourth quarter results, and the firm’s ~2.2% forward estimated dividend yield isn’t too shabby.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.