Member LoginDividend CushionValue Trap |

Dividend Growth Giant Medtronic Reiterates Expectations

publication date: Sep 1, 2016

|

author/source: Kris Rosemann

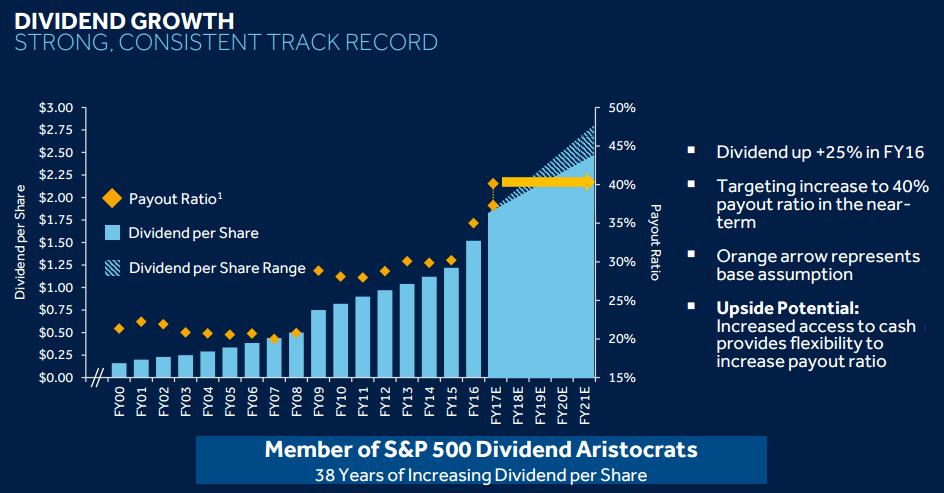

Image source: Medtronic investor presentation By Kris Rosemann As it is a core holding in the Dividend Growth Newsletter portfolio, it is no surprise we are high on Medtronic’s (MDT) free cash flow generating ability. The company remains committed to churning out dozens of billions of dollars in free cash flow generation in coming years, and we like management’s strategy on the allocation of the capital it expects to generate. Medtronic reported a solid first quarter of fiscal 2017 (ended July 29) on August 25. Though revenue fell 1% as-reported, revenue increased more than 5% on a constant-currency, year-over-year basis when ignoring the extra selling week in the comparable period of fiscal 2016. The firm’s ‘Cardiac and Vascular Group,’ ‘Minimally Invasive Therapies Group,’ and ‘Restorative Therapies Group’ all reported worldwide revenue growth in the mid-single digit range on a constant currency basis when ignoring the extra selling week in the first quarter of fiscal 2016, while its ‘Diabetes Group’ turned in worldwide revenue growth in the high-single digits. Medtronic’s bottom line on a GAAP basis performed well in the first quarter of fiscal 2017. Cost management on the a) cost of goods sold and b) selling, general, and administrative lines of the income statement, along with a lower tax rate, helped drive an increase in GAAP earnings per share of 16% from the year-ago period to $0.66. The firm’s cash flow performance was even more impressive in the period, which we have come to expect given management’s recent comments on its forward-looking free cash flow generating capacity, “Medtronic Expects to Generate $40 Billion in Free Cash Flow in Next 5 Years.” Free cash flow came in above $1.2 billion in the first quarter of the fiscal year, more than double from the comparable period in fiscal 2016. Management remains committed to returning at least half of its free cash flow generation to shareholders via share repurchases and dividends, and we like its target of a dividend payout ratio of 40% compared to current levels in the mid-30s. The company has also labeled deleveraging as a focus of its capital deployment, a strategy we view as prudent considering the sizeable amount of debt it added to finance the acquisition of Covidien in late fiscal 2015. However, we have not seen a reduction it Medtronic’s net debt position in since the acquisition was completed. In fact, tis net debt position has risen to ~$19.3 billion at the end of the first quarter of fiscal 2017 from $16.7 billion at the end of fiscal 2015, just after the deal was completed. The firm’s concerning leverage is its largest drawback at this point in time, from our point of view, but deal-making comes with a cost. Medtronic, however, reiterated its guidance for fiscal 2017 of 5%-6% revenue growth on a constant-currency basis when ignoring the additional selling week in its first quarter of fiscal 2016 and non-GAAP earnings per share growth in a range of 12%-16% for the full fiscal year. Such targets are consistent with the company’s long-term expectations for mid-single digit constant currency revenue growth and double digit constant currency earnings per share growth as it remains focused on value over volume in patient outcomes and works to address inefficiencies in healthcare delivery through appropriate application of its medical technology. We will continue to hold Medtronic in the Dividend Growth Newsletter portfolio, but at a weighting that is pushing the 8% mark in the portfolio, we continue to watch shares for the best opportunity to take some profits in the spirit of prudence. Shares have run past our fair value estimate of $76, indicating that there is little valuation opportunity present, but we are more than happy to collect strong and growing dividend checks as we await the optimal time to take a portion of our position off the table. |