Member LoginDividend CushionValue Trap |

Resetting Your Mental Model

publication date: Jan 23, 2020

|

author/source: Brian Nelson, CFA

Image Source: affen ajlfe A version of this article was originally published on our website October 6, 2013. Having the right mental model and using the right information can be the reason why you win or lose in investing. "What is the definition of timeliness? Many believe it is getting information to investors as quickly as possible after an event, or updating something every single day or week for immaterial information. I believe in a different definition of timeliness. I believe timeliness is using all information available in a mosaic approach to accurately predict the event before it even happens. Take Kinder Morgan as the latest example. We were the only ones predicting what was going to happen before it did. To investors, it didn't matter how timely other research was after the fact, after the stock collapsed. What mattered to our members was getting the information to them before it was going to happen. The mosaic method allowed us to deliver. I don't care how quickly someone does something after the fact. I care about predicting the fact before anyone else and preparing for it before everyone else. That's the gold standard definition of timeliness, in my opinion. That's what we're after at Valuentum." -- Brian Nelson, CFA << Nearly 60 Distribution Cuts Later, We Maintain Our View on the Hazards of the MLP Business Model By Brian Nelson, CFA The investing business is a lot different than other lines of work. Most individual investors like to build mental models in investing around frameworks that are familiar to them. For example, the mathematician may love the ratio analysis in our reports, while the finance gal may dig our discounted cash-flow process. The psychologist may go crazy over our Valuentum Buying Index rating system since it captures human tendencies via technical and momentum work, and the electrical engineer and architect may not be able to get enough of our margin of safety work and probability analysis. Having a mental model that works for you is a great thing, but we think one particular mental model can actually become an impediment to investing success. Please take a read of the quote by Tibco’s (TIBX) founder and CEO below, for example:

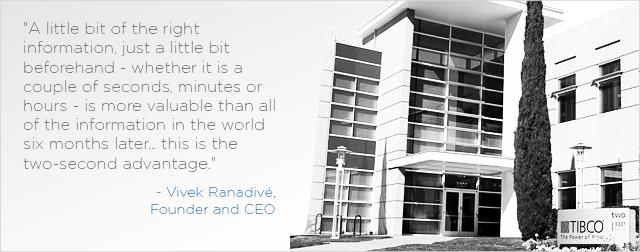

Image Source: http://www.tibco.com/company/default.jsp We had a little chuckle when we found this gem. In investing, if one receives “a little bit of the right information just a little bit beforehand” and uses it for profit, almost all of the time it is against the law. Though the quote may be relevant in Vivek’s line of work, things are quite a bit different in the highly-regulated investing world. You can see here what a controversy receiving market-moving information causes, even just 15 milliseconds beforehand. Significant efforts are made every day by capital market regulators to ensure that there is a level playing ground for all participants, and proper information dissemination is an area that continues to be under great scrutiny. Said differently, Vivek’s corporate insights from his experience at Tibco don’t necessarily apply to the investing world. So what do individual investors that share Vivek’s mental model do – assuming that they aren’t interested in breaking the law? Well, they do the next best thing, of course. If they can’t be early, then it must be that whoever is fastest will win – whoever trades the quickest on new information. Well, unfortunately for many individual investors, it is unreasonable to try to compete with the quantitative and algorithmic trading systems used by many firms on Wall Street. Fifteen milliseconds, for example, is less than the time it takes to blink (400 milliseconds), and typically some trades are completed in less than 1 millisecond…automatically and programmatically. So why then do investors care so much about real-time ratings or up-to-the-millisecond information? Well, in our view, they feel like they are missing out on something -- or if they are not doing something all the time, something must be wrong; they feel they're not getting their money's worth if they're not trading on a new idea every month. It isn’t their fault. This, unfortunately, is what they've been trained to do by the 24/7 media cycle and the pundits championing the excitement of fast-trading, of "getting rich quickly." It has become their mental model, and it is a dangerous one. Our view is that rapid portfolio turnover -- on a weekly, monthly, or quarterly basis -- only results in higher commissions (bid/ask spreads) and taxes and not outsize investment gains over the long haul. Even successful trades of a few months or shorter are often considered by many to be luck. We generally update the information and Valuentum Buying Index ratings in our reports on an as-needed, periodic basis to discourage a fast-trading mindset within the Valuentum community. The reports themselves are already forward-looking, so they target predicting the future, not reacting to events, though the latter certainly influences the former at times. Most importantly, we don’t want our members to lose money! We think the most valuable information in the investing world is information that correctly predicts the future more often than not – for example, a Valuentum Buying Index rating of a 10 that precedes a firm’s doubling in price, or a fair value estimate that reveals a firm’s significant undervaluation before the stock surges. Having a report that gives you this kind of information beforehand more often than not is much more important than a report that simply updates for the news after the fact. There’s tons of information (and some of it free) that investors trade around every day, but we think savvy investors will focus on information that matters, and not concern themselves with real-time ratings and/or up-to-the-millisecond data. Instead, these savvy investors will prefer information that correctly predicts the future more often than not. This information is not the information that provides the “two-second advantage” that Vivek speaks of in the image above. This information is information before it becomes information. It’s information that reveals what a firm is worth—its fair value estimate—before other investors come around to recognizing its value. It’s information that reveals the superb qualities of a stock via its pristine Valuentum Buying Index rating before money managers come around to including it in their portfolios. This is the information we seek to provide in our newsletter products and research reports. We’re not after a “two-second advantage” on widely disseminated market-moving information after the fact. We’re trying to get you the right information on the right stocks before it even becomes information. That’s the Valuentum advantage. That's what we call timeliness. Tickerized for Valuentum's stock and ETF coverage universe. |